The luxury rental market is soaring. With the global sector expected to be valued at a staggering $82 billion by 2031, the opportunities are vast and exciting. In 2024, stable occupancy rates and growing demand for unique properties are forecasted for the short-term rental market. But how do you tap into the $201 billion capacity of the global luxury travel market?

Through a revealing interview with Wolf Worster, the CEO and Founder of Sirreti – a luxury vacation rental community of property managers, property owners, hosts, and other industry professionals – and exclusive findings from the Sirreti Insights Report 2024, we offer an insider’s look into the lucrative world of luxury short-term rentals. Learn what truly defines luxury in private accommodations and gain deep insights into the spending behaviors and expectations of affluent travelers.

A Community to Support Luxury Short-Term Rental Operators

The luxury vacation rental market is a specialized field with its unique set of challenges and opportunities. Recognizing this, Wolf Worster founded Sirreti, a platform designed specifically for professionals operating within this niche.

Sirreti’s global community encompasses travel agents, concierge companies, celebrity managers, and family offices serving high net worth (HNW), very high net worth (VHNW), and ultra-high net worth (UHNW) clients. It also includes property owners, managers, and villa agencies.

This diverse community allows members to network, gain industry insights, and increase their market presence. Through regular webinars, access to luxury travel agents, and networking opportunities, Sirreti provides the resources needed to succeed in this complex field.

Under Wolf’s leadership, Sirreti is helping its community navigate the complexities of catering to high net worth guests, ensuring they are well-equipped to deliver exceptional experiences consistently.

Understanding the Methodology Behind Sirreti’s Report

To ensure a robust understanding of affluent guests’ travel patterns, Sirreti collaborated with Private Accommodations Marketing Ltd and other partners on a unique study initiated in May 2022.

The research utilized a comprehensive approach involving 27 online surveys, capturing quantitative data on luxury travel and vacation trends, as well as information about global ultra-high net worth (UHNW) individuals.

Key to the success of this study was Sirreti’s network of over 1,400 luxury travel professionals, whose inputs enriched the research. Additionally, two specific surveys were conducted among 1,124 very high net worth (VHNW) and UHNW leisure travelers, providing further valuable insights.

The report presents only the key findings, ensuring that the information is concise and relevant. The determinant used for an individual’s location was their residency, providing a consistent basis for geographical analysis.

What Makes Luxury, well, Luxury?

The Luxury Private Accommodation (LPA) industry uses the term ‘luxury’ to describe properties that significantly surpass average private accommodations in three key aspects: Location, Standards of Operation, and Physical Characteristics.

Location

The value of a location is determined by several factors such as the neighborhood’s safety, cleanliness, and privacy. Properties with great views typically earn higher Average Daily Rates (ADR). Further, luxury properties are expected to offer enhanced safety and security measures.

Standards of Operation

These encompass everything from the booking process to on-site service levels and value inclusions. High net worth (HNW), very high net worth (VHNW), and ultra-high net worth (UHNW) guests often prefer booking through trusted third parties due to privacy concerns. Other expectations include 24/7 accessibility of a house manager, daily housekeeping, basic stocking of refrigerators and pantries, and availability of additional services like a private chef or personal trainer.

Physical Characteristics

Wealthy guests prioritize space, with expectations extending to high-quality finishes throughout the property, luxurious indoor and outdoor furniture, and attention to detail in all aspects. Additional desired features often include a private outdoor space, amenities like a private pool or gym, and updated in-home automation.

While these definitions provide a general framework, the interpretation of ‘luxury’ can be subjective and vary among individuals. It’s crucial for rental managers to understand their clients’ unique preferences and expectations to truly deliver a luxurious experience.

What Makes Certain Destinations Stand Out Over Others for HNW and UHNW Travelers?

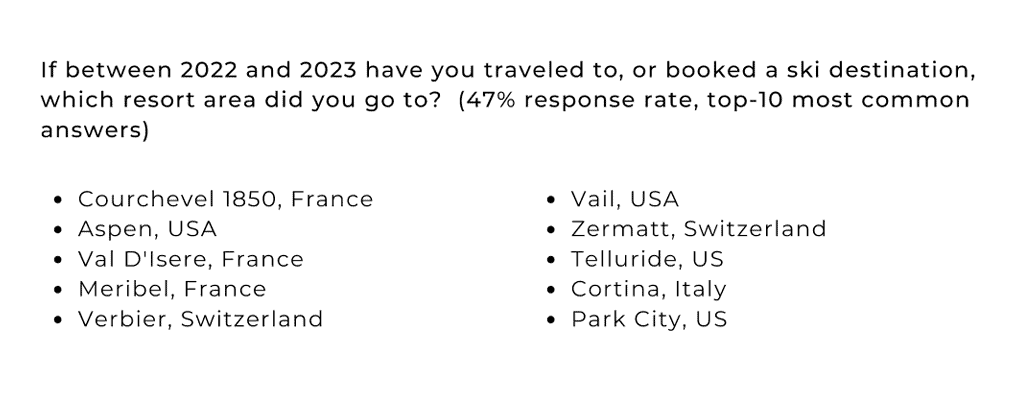

In analyzing why certain destinations in general appeal more to high-net-worth (HNW) and ultra-high-net-worth (UHNW) travelers over others, several key factors emerge from Wolf Worcester’s insights during the interview The factors that influence these preferences are not limited to ski destinations but apply to travel destinations in general.

- Brand and Reputation: Well-established destinations with a strong reputation for luxury, exclusivity, and high-quality services tend to attract wealthy travelers. They often value the assurance of a consistent, top-tier experience that these destinations provide.

- Infrastructure: Destinations with robust infrastructure, including well-maintained roads, airports with capacity for private jets, and high-end accommodations, are more likely to appeal to HNW and UHNW travelers. These individuals often have specific expectations for comfort and convenience that such infrastructure can meet.

- High-End Amenities and Services: Luxury travelers appreciate destinations that offer a range of high-end amenities and services. This could include anything from fine dining restaurants and world-class spas to private beaches and golf courses. Destinations like St. Bart’s in beach resorts or Courchevel 1850 in ski resorts have built reputations for offering upscale amenities, fine dining options, and high-quality accommodations. These factors enhance the overall experience for affluent travelers, who prioritize luxury and sophistication in their travel choices.

- Exclusivity and Privacy: Many HNW and UHNW individuals seek out destinations that offer a degree of exclusivity and privacy. This might mean choosing a secluded island resort over a crowded city, or a private villa over a hotel.

- Quality of Experience: The overall quality of the experience is crucial. This includes not just the physical aspects of the destination, but also intangible factors like the level of service, the local culture, and the sense of peace and relaxation the destination provides. Luxury destinations often offer unique and exclusive experiences that set them apart from mainstream tourist destinations. Whether it’s access to pristine natural landscapes, cultural immersion opportunities, or bespoke recreational activities, affluent travelers seek destinations that offer memorable and extraordinary experiences tailored to their interests and preferences.

- History and Expectations: Destinations with a rich history and a legacy of luxury tend to attract HNW and UHNW travelers seeking exclusive experiences. For example, destinations like Aspen and Vail in the USA or Zermatt in Switzerland have long been associated with high-end tourism, offering a blend of luxury amenities, upscale properties, and world-class recreational activities. The presence of historical significance and established expectations contributes to the allure of these destinations among affluent travelers.

- Safety and Security: Safety and security are also important considerations for HNW and UHNW travelers. Destinations with low crime rates and strong security measures in place are more likely to be attractive to this demographic.

The Emergence of Younger High Net Worth Individuals

The interview with Wolf sheds light on a significant trend in the luxury travel market—the emergence of a younger demographic with substantial wealth. This cohort, often in their twenties, represents a new wave of affluent travelers, driven by a combination of entrepreneurial success, technological advancements, and intergenerational wealth transfer.

- Young and Wealthy: There is an emerging category of younger multimillionaires, particularly from the United States. This demographic, often in their mid-20s, represents a considerable amount of wealth. Factors contributing to this trend include entrepreneurial ventures, tech industry success, and inherited wealth.

- Shifting Preferences: While younger high net worth individuals (HNWIs) may still desire luxury accommodations akin to their predecessors, their priorities and preferences differ. For instance, while they may enjoy upscale amenities and breathtaking views, their focus lies more on experiential aspects such as adventure activities like surfing and socializing with friends.

- Social Media Impact: The interview suggests a changing dynamic in the decision-making process, with younger individuals increasingly involved in booking travel arrangements. Traditionally, such tasks were handled by older generations or administrative personnel. However, with the rise of younger HNWIs, there’s a notable shift towards a more digitally savvy approach, with social media playing a pivotal role in research and marketing. Platforms like Instagram are becoming increasingly popular among luxury travelers and those who book on their behalf.

Increased Reliance on Luxury Travel Agents

The Sirreti Insights Report 2024 brings to fore another interesting trend in the luxury travel market: an increased reliance on third-party bookers or luxury travel agents. The trend is attributed to various factors:

- Growth of Third-Party Bookers: Sirreti reports an estimated 1,600 new professionals have entered this field since 2020, with 78% based in North America. These bookers, which include luxury travel designers, celebrity managers, family offices, and private concierge or lifestyle companies, have become increasingly involved in arranging luxury travel. The surge in agency registrations is seen as a reflection of increasing demand for professional assistance in navigating complex travel arrangements, particularly among affluent travelers.

- Value of Expertise: As factors like health, safety, and cancellation policies have become more prominent in travelers’ decisions, travel experts have seen a resurgence in popularity. Wealthy travelers are placing their trust in these agents to provide high-end experiences and ease concerns related to luxury travel in a post-COVID world.

- Influence on Spending: The use of a travel agent or third-party booker significantly influences spending, with Sirreti’s research indicating an 83% increase. Very High Net Worth (VHNW) and Ultra High Net Worth (UHNW) clients who use an agent are reported to spend more on their private accommodation, suggesting that to these clients, travel agents have become indispensable.

- Covid’s Impact: The pandemic has played a significant role in this trend. Many individuals have turned to managing properties or becoming travel agents as a response to job loss or lifestyle changes induced by Covid.

- Correlation with Wealth Growth: The growth in the number of travel agents is consistent with the growth in wealth, particularly in the United States, suggests Worster. This suggests a parallel trend: as wealth increases, so does the demand for personalized, high-end travel experiences managed by professionals.

Continual Growth Projected in Luxury Travel Spending

The Sirreti Insights Report 2024 underscores a continued trend of growth in luxury travel spending among affluent travelers, despite the uncertainties associated with inflection years. According to the report, a survey question regarding spending intentions for 2023 compared to 2022 garnered an 88% response rate.

Projected spending trends

Among respondents, a little over 40% indicated their intention to spend “a bit more” on luxury travel in 2023, while approximately 35% stated they were likely to spend “about the same.” Additionally, around 15% expressed their intention to spend “a lot more,” while slightly over 15% indicated they planned to spend “a bit less.”

The American Market

The interview with Wolf further supports these findings, particularly emphasizing the resilience of the American market in driving luxury travel spending. Despite concerns surrounding inflection years and potential economic fluctuations, affluent travelers remain committed to their travel plans, with spending levels expected to increase across various categories. While there may be slight fluctuations in spending patterns compared to previous years, the overall trajectory indicates a continued upward trend in luxury travel expenditure.

Conclusion

The luxury short-term rental market is an intriguing space full of potential. With these select findings from the Sirreti Insights Report 2024 and the expertise shared by Wolf Worster, we’ve only scratched the surface of understanding the nuances of the luxury vacation rental market.

The report uncovers further insights about the luxury vacation rental market and provides a thorough analysis of the behaviors, destinations, and experiences popular among HNW and UHNW individuals. It also highlights important trade shows for the luxury market, and offers other valuable resources. You can unlock these and gain access to more resources by purchasing the full report.