Each month, I get on a live call with the members of Scalers Network to talk about recent European short-term rental trends to help them plan better for the upcoming months. Network members have the opportunity to attend live and even submit questions of their own, and make business decisions backed by data to improve occupancy and overall profitability. You can find more info about what else membership includes, or apply to become a member here.

This month we were joined by AirDNA Vice President of Research Jamie Lane to dissect European market data for December 2021. Using data, Jamie was able to uncover some fascinating booking trends for December 2021, while also sharing with us his predictions for 2022 based on past data.

Key highlights:

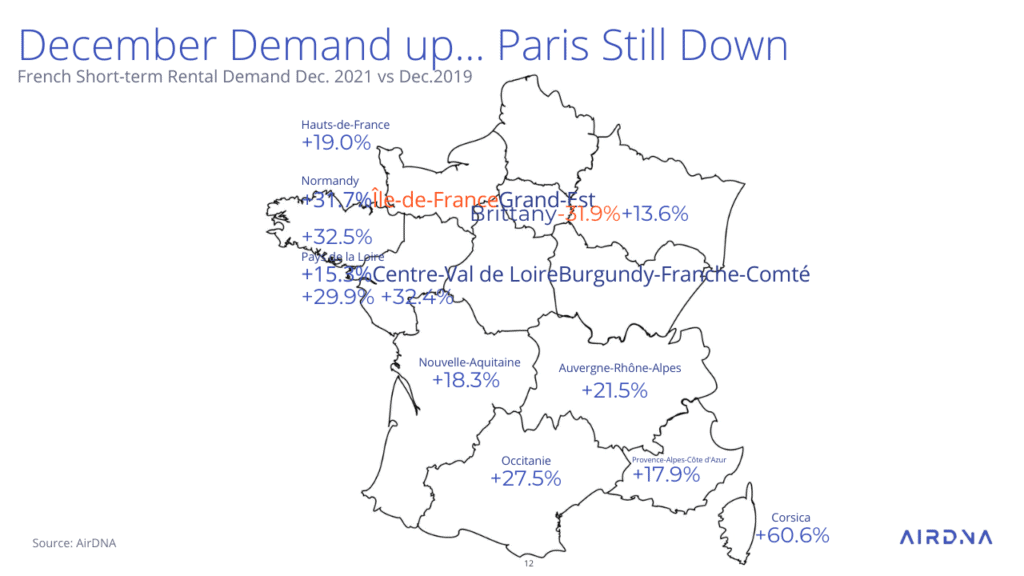

- Demands outside of cities continues to explode, fueling real estate growth in new markets e.g. Brittany, France

- December on a downturn from November due to Omicron, but revenues level with 2019 still

- Vaccination passports aid in recovering cross-border demand

- Countries with strong short-term rental inventory see demand growth e.g. France, Germany, and Russia

- In Denmark, Switzerland, Greece, Austria, UK, and Germany summer demand pacing up

- Struggle markets such as Spain, Italy, Greece, Croatia gain momentum

Thibault Masson:

Dear Rental Scale-Up members and Scalers Network members. Today I am with Jamie Lane. We are going to be discussing European Union Trends for the short-term rental industry. We are going to see data from AirDNA and we’ll be commenting away trends we see, things that happened in December. Also how bookings are pacing for 2022. Without further ado, let me welcome Jamie. Jamie, how are you?

Jamie Lane:

Great, thanks for having me.

Thibault Masson:

I’m excited to have you here and thank you for taking the time. We’ll be commenting on data that AirDNA has compiled for us, and that you guys are sharing on your blog every month, by the way, and with us too. Can you maybe for people who don’t know, introduce what AirDNA is and what you do over there?

Jamie Lane:

Yeah, no problem. We are a short-term rental data analytics company. We collect data on short-term rental performance globally and report on it. We’ve got excellent tools for hosts to understand what the revenue potential is of investments, how to benchmark their performance for selling properties in their market, pricing tools to help understand how they should price into their market given these current demand trends, and all-around business intelligence for short-term rental operators. I’m the VP of research here. I’ve been with AirDNA just over a year now. I come from a decade of experience in the hotel industry as an economist.

Thibault Masson:

So thank you again for taking your time and explaining what AirDNA does. We’ll be commenting through slides and charts, and I think you had a hand in putting them together, creating those. It’s always good to be talking to the person who’s the source of this, because once again, AirDNA is probably the most well-known name in the industry when it comes to data. Whenever you read an article in the press about the industry, quite often, data from AirDNA is quoted. So I’m pretty excited. Jamie, do you want to take us through the slides without further ado?

Jamie Lane:

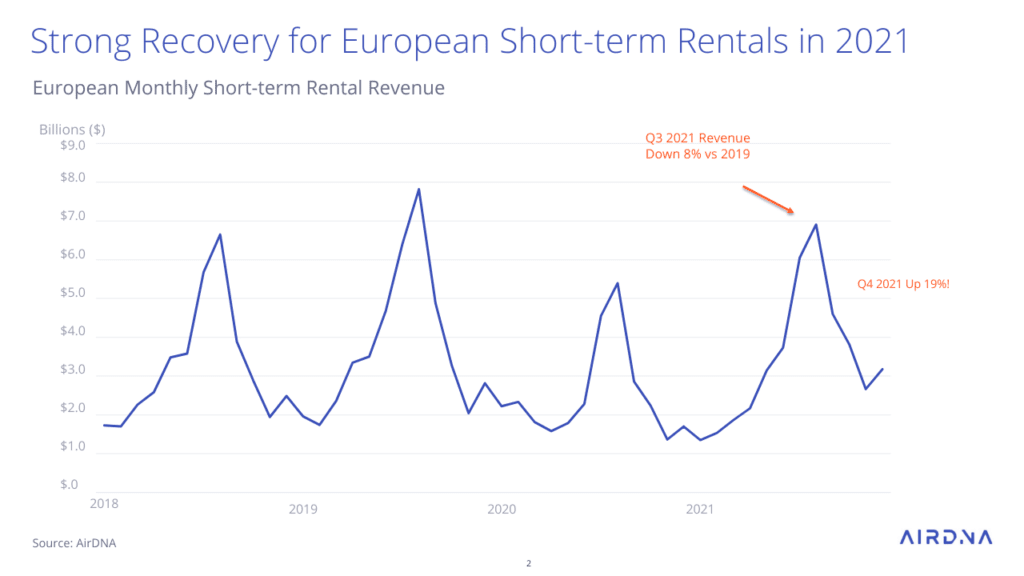

Absolutely. First thing, I want to start off and give everyone a level set of where we’re at. So we’ve got here the past 4-5 years of performance for revenue earned by short-term rental hosts in Europe. Obviously, European short-term rental demand and revenues are very seasonal. Q3, we are still down about 8%, versus 2019. So not fully recovered in terms of revenue, but Q4 is very strong for both demand and revenue. For the first time, Europe exceeded 2019 levels and we were up about 19% versus Q4 2019. Given that I’m Q4 is a pretty low time for European demand, but still very positive momentum as we head into 2022. We exceeded, at least on a revenue basis, 2019 levels.

Thibault Masson:

That’s pretty fascinating because if we quickly compare the situation with the U.S. For the U.S., if I’m not mistaken, 2021 was the best year ever. Especially Q3 was the best Summer ever. Not so in Europe. And yet right before Omicron, things were finally… Omicron hit Europe in Q4, but things were finally getting back and even better than 2019 right before the pandemic. So I’m-

Jamie Lane:

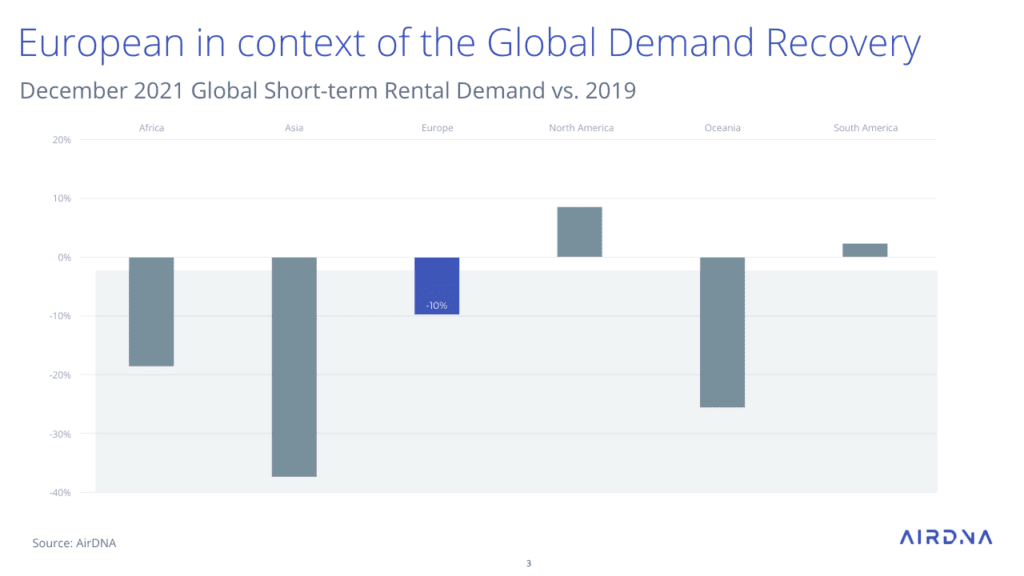

Yeah. And we sort of show that in these next two slides. So one, showing now we’ve switched from revenue to demand. So overall, December demand was down about 10% relative to 2019 in North America. U.S., it was up about 12% relative to 2019.

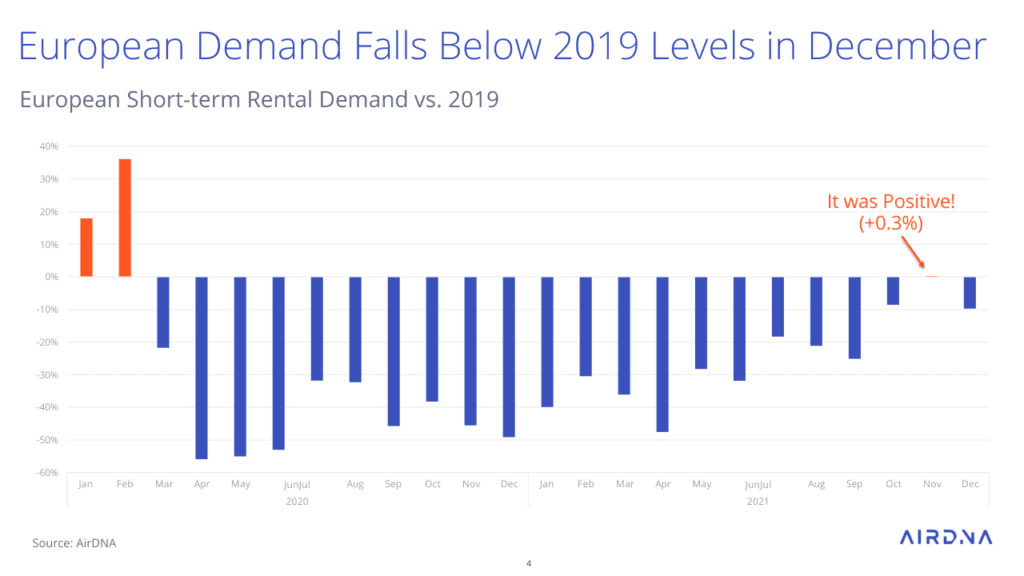

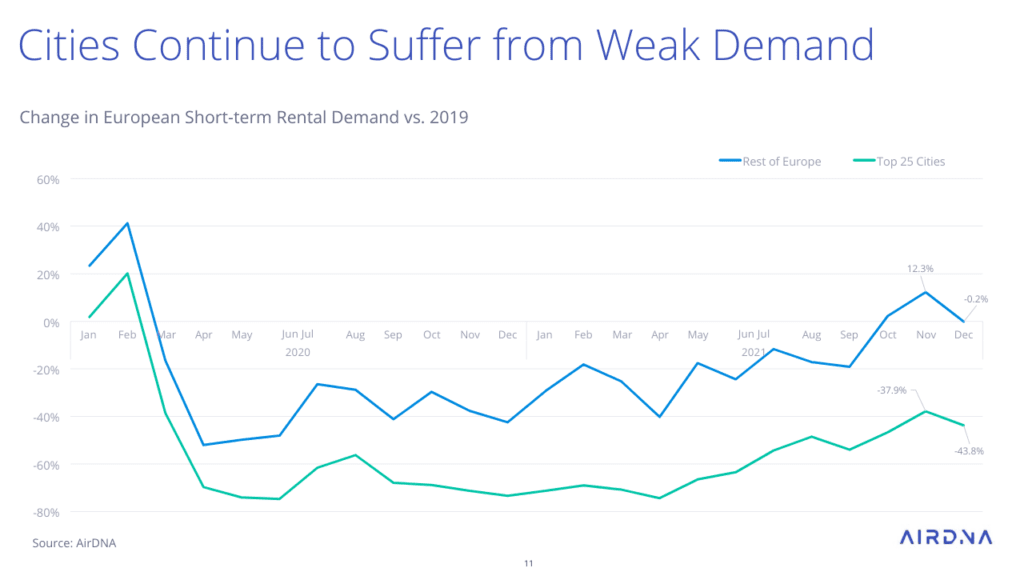

But to your point, we had seen a really strong recovery. In November, we had actually had for all of Europe, positive demand relative to 2019 and sort of tongue and cheek, it was positive, but in a good way. It was a surprise to me how quickly things turned in Europe in the back half of the year. I’ve got a slide sort of later in the deck where we look at it. But we really saw a surge of bookings in October, November. We got through the Delta wave. Things began to look more normal, vaccination rates way up, and really strong booking behavior heading into Winter ski markets, destination markets in Southern Europe, really strong booking demand.

Thibault Masson:

Again, Q3 was not amazing, but it was pretty good. I think we wrote an article using your data from the previous month, I think was from maybe November, when you were showing that in Europe it was not just about domestic markets anymore, that cross-border travel was back. I think, for example, in Europe, there was a big success coming from the EU Digital COVID certificates app. They managed to align 27 countries to have national apps working and interoperating and that was really working. We’ll see this probably in the data when people start traveling again. We’ll see in pacing, whether now that all this is in place, people have this app on their phone, whether it’s positive for Q1 and Q2 this year. That’s sort of a teaser. But again, that’s what we saw, people were traveling. That’s pretty positive.

Jamie Lane:

Yeah. To put some numbers behind that typically in Europe we see, pre-COVID, about 65% of demand is cross-border travel. So people from France traveling the UK or from the UK traveling to Portugal. About 35% of demand being domestic. That dropped enormously throughout 2020. It was only about 15-20% of cross-border demand at the beginning of 2021. But towards the end now it’s increased to over 50%. We are able to get to a really strong Q4 and over 50% of that demand being cross-border travel I think points to the point you just made that the app is working that and borders are opening. Countries feel confident in allowing international travelers again. We know that’s going to be key for a lot of countries to sort of get this recovery back. Because so far, the recovery is really concentrated in just a handful of countries.

Jamie Lane:

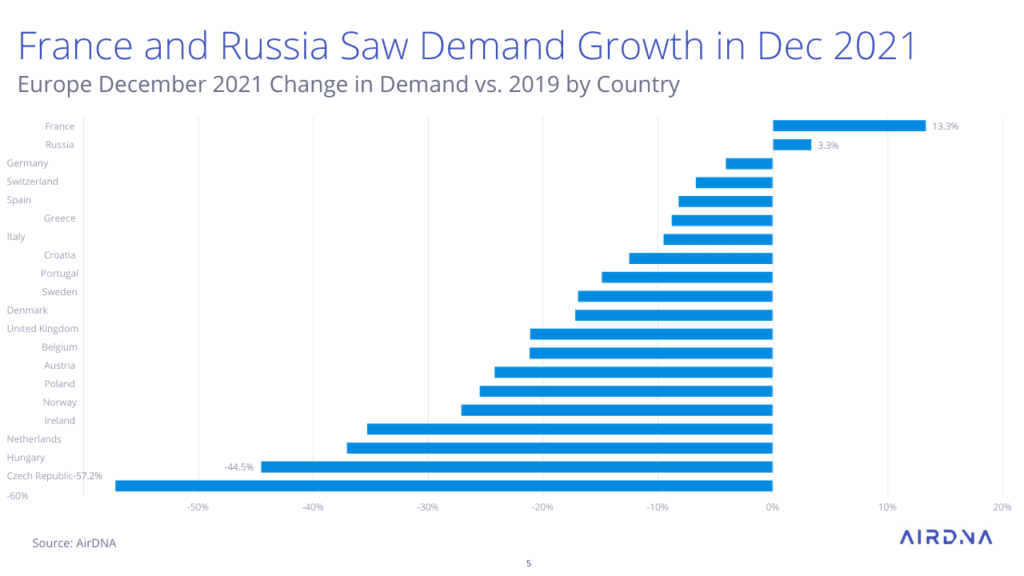

Some of these countries are the biggest in terms of short-term rental inventory. So France, Germany – two of the bigger behemoths that do really well at attracting domestic demand, given their inter-rich culture and in short-term rentals pre any of this online evolution. And we saw in December very strong demand in France. France has had a pretty good 2021. More months than not were above 2019 levels. Germany right there too. Russia has had a strong year, and it is a pretty small market.

Jamie Lane:

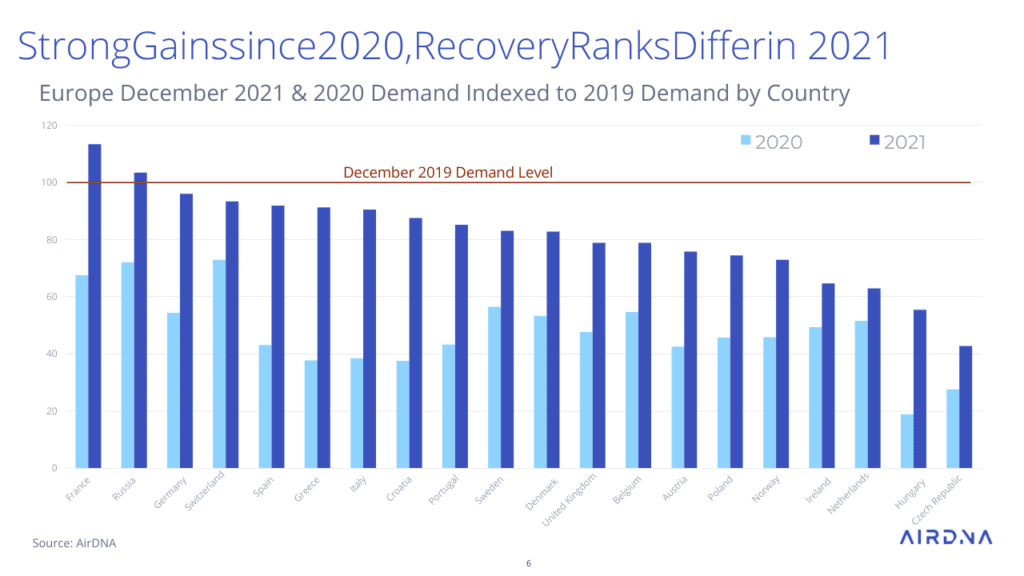

And then some markets like Switzerland, very strong. There are some surprising ones though. One of my favorite slides here that my colleague Blake put together brings together the data on the previous side. So in the dark blue indexing, December ’21 relative to December ’19. But also shows where we were a year ago. So December 2020 relative to December 2019. And we see just how the ranking of markets has changed. So yes, France, Russia, Germany, Switzerland, are some of the best countries today in terms of recovery, but were also some of the best as of last year. But some emerging ones, some markets that were doing really bad last year, Spain, Greece, Italy, Croatia looking much, much healthier this year.

Thibault Masson:

And here is an index level. So 100, I’m guessing… I hope I’m reading, is the December 2019 demand level. So most of the countries are below this 100% mark. And what you’re showing is that there’s a huge jump for Spain, Greece, Italy. They are coming back closer to this 100 point level, right?

Jamie Lane:

Yeah. The difference here would be the year-over-year growth rate. So how much better have they gotten in 2021 relative to 2020. But still, both showing in their index, how much further do they have to go to get back to 2019 levels.

Thibault Masson:

It is interesting as well. Especially Spain and Italy in a way are sort of intermediary into the position in the sense that they do have a domestic market but supply is so vast they can’t balance it like France can, for example. But Croatia like 90%, I think of the demand is normally international. So seeing Croatia and Portugal come back, it is again to prove that cross-border travel at least in demand was back. Very interesting slide, I agree with you, because it’s not just showing that the French, Russia, Germany, domestic markets, they were even stronger, but the ones that usually depend on cross-border travel in Europe, they were back.

Jamie Lane:

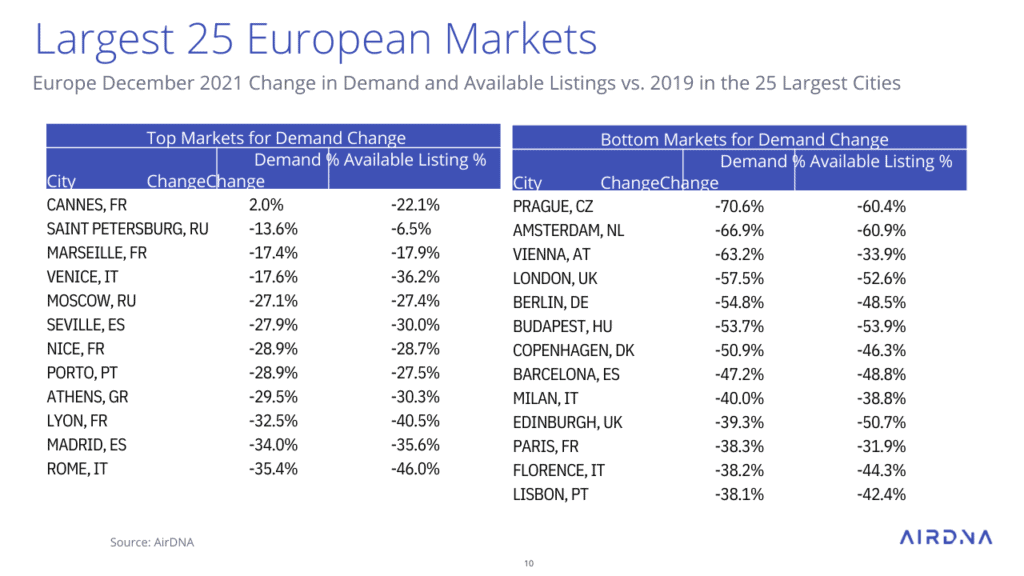

Yeah. Maybe some of the dichotomies between country demands and you still look to the right, Hungary and Czech Republic are very much dependent on urban international travel with their key markets. Budapest, Prague still not anywhere close to sort of recovery. And Croatia, Italy, Spain, Greece, really benefiting from the beaches destination markets that people want to go to. Not so much the cities yet.

Thibault Masson:

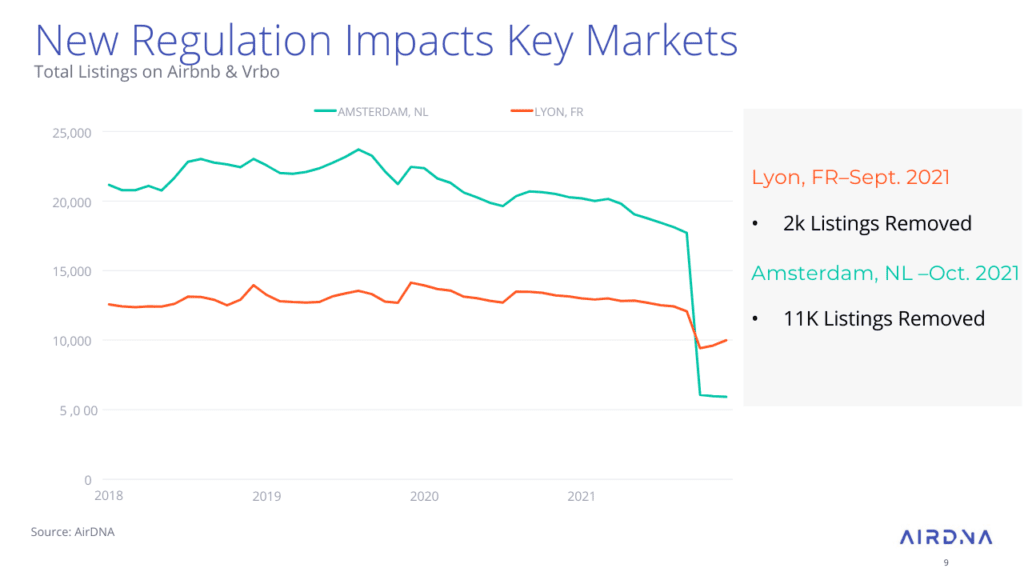

What you’re saying is very interesting. Netherlands, Hungary and Czech Republic, it is not just a matter – as people may know right now I am in the Netherlands – so not just a matter of international demand not being here, it’s also a matter of big cities with very strong new regulations. It’s not that demand collapsed. Actually, if you look at Prague and Amsterdam, it’s very bleak numbers, but we’ll go through that. And again, that’s such a powerful slide where we can talk about the domestic market. We can talk about the recovery of cross-border travel. You can see also the impact of the sanctions, or let’s say new regulations in some countries. Fantastic.

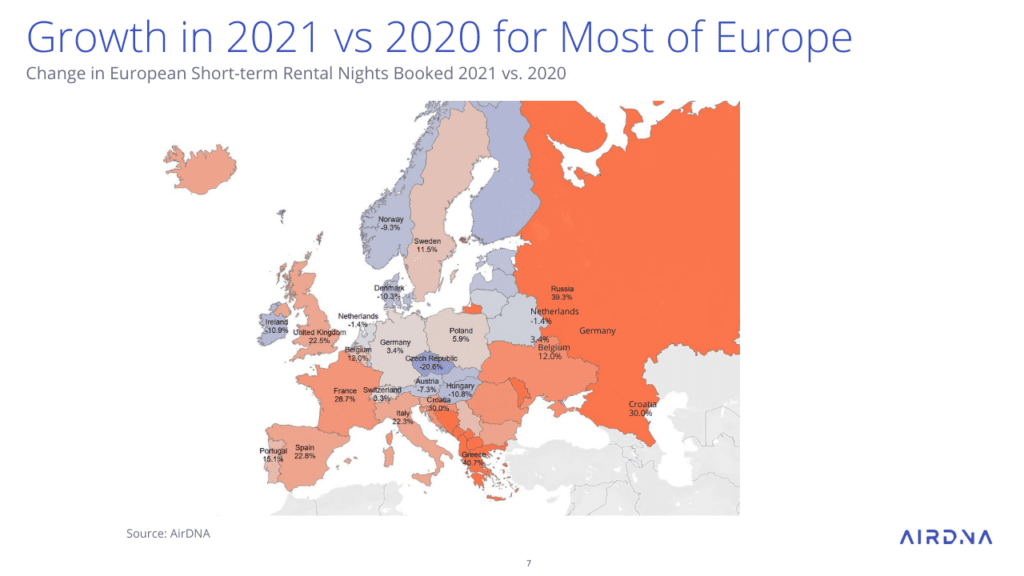

Jamie Lane:

This is just visually how 2021 has grown. So now we’re looking at annual figures in growth and demand. Most of Southern, Western Europe, pretty strong growth for 2021. Still some weakness you see there in mid-Eastern Europe Some actual declines – you see there Hungary, Czech Republic, Austria But shows the year for most countries, 2021 being a much better year than 2020.

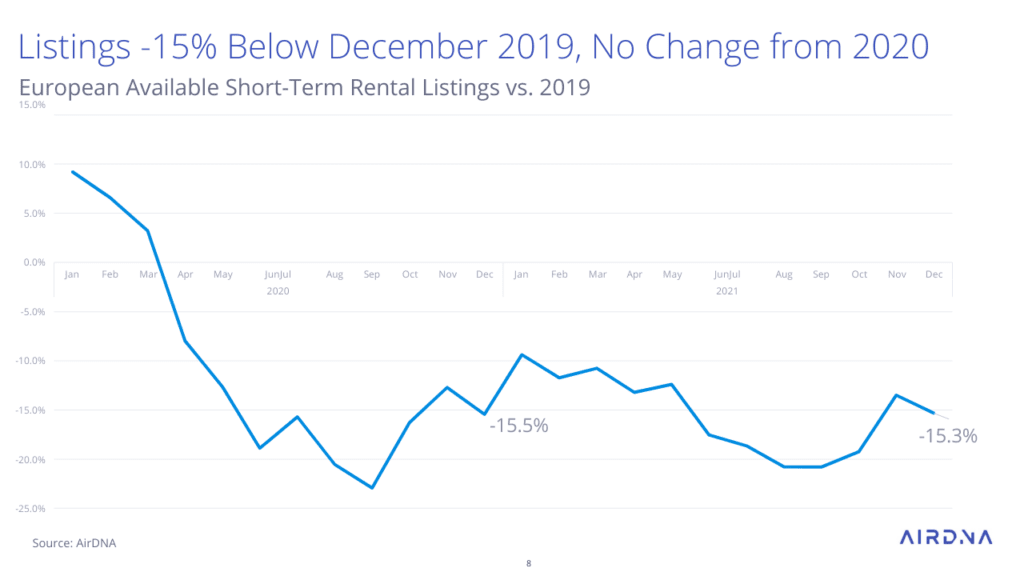

And teeing up some of that discussion on supply, and this looks at overall available listings in Europe, indexed as percent change from the same month in 2019. It shows some of the waves we’ve been going through with the pandemic and how comfortable hosts and investors have felt at bringing supply back online. So initial point of the pandemic, we essentially lost 20% of listings, people bringing those offline.

Pretty bleak Summer in 2020. Again, in 2021, not nearly the supply we’ve seen in previous years. We had been seeing a pretty good recovery again, heading into this fall, and then a slight pullback again in December with Omicron. But I also thought that was interesting here is, and in terms of the total level supply this year versus last year, there’s essentially no change. Around 2.5 million listings, and we were essentially pegged to that figure December 2020, December 2021. So really interesting going forward, as demand comes back, as cross-border travel accelerates into 2022, do we see more supply coming back, especially in the urban areas.

Jamie Lane:

And teeing up into this slide, we will talk through the largest 25 cities. But I just wanted to point out that when I first saw it, I was wondering if it was an error in our data, but we have seen new regulations brought into some markets. In Amsterdam, new registration requirements have led to 11,000 listings being removed on both Airbnb and VRBO. We’ve been seeing this in quite a few other countries globally. So Beijing has lost a significant number of listings, I think over 6,000, and then Sydney as well, new regulation leading to some pretty big removals.

Thibault Masson:

All throughout the year you guys share so many good charts that I just love re-sharing. For example, I think Amsterdam and Prague had something like 75-80% fewer listings. In the U.S., how different is it? I think I was reading something on your website that for example, New Orleans was still 30% down compared with 2019. So how’s the situation in the U.S. big cities? How different is it?

Jamie Lane:

It really varies across the type of city, in similar ways to Europe. So really global destinations, I like to think of them as the gateway cities to the U.S., if you were flying in, those markets that you’d visit first. So New York, Boston, San Francisco, LA, supply and demand is down 40-50%. So not as bad as some of the markets in Europe, but pretty significantly down. We’ve seen similar removals of supply that we’ve seen in some of the European cities. There are pockets of big cities that are doing great though. And these are some of the cities you may have seen in the news that sort of lifted their COVID restrictions early.

Jamie Lane:

They removed their mask mandates and travel has come back pretty strong. So markets like Phoenix, Atlanta, Dallas, Houston demand is – and these are big cities, 6 million-plus population centers – and demand is 10-20% higher than in 2019. We’re seeing large amounts of new supply being brought into these markets. I’m here based in Atlanta, Georgia, and it was the number two market for new investment in the U.S. with over 2,500 new listings added. About 30% increase in supply just this past year. So pretty big difference in some of the major U.S. cities.

Thibault Masson:

Thank you. Thank you.

Jamie Lane:

And sort of teeing that up perfectly here are the top 25 largest cities in Europe and what we’re seeing in both supply and demand. So both demand and supply are relative to December 2019. On the left here, we’ve got sort of the top markets. You see one market, Cannes, with positive demand playing into the strong growth that we’ve seen in domestic travel markets in France. And you see that contrasted to Paris where demand’s still down about 40%. And then some of these really struggling markets, Prague, Amsterdam, Vienna, London, Berlin, Budapest, that we had talked about earlier.

Thibault Masson:

December was also for London for example was tricky. I was talking to property managers in London and people had started booking again. Brits staying in London for Christmas, for Christmas shopping, and they had started booking again and they canceled because Omicron was there. The peak of the wave was in December in the UK, which it’s only coming now in continental Europe. So there’s also that, that didn’t really help London probably in terms of-

Jamie Lane:

Yeah. And it was also some of the new travel restrictions of quarantine requirements, even for vaccinated travelers, to get PCR tests once they got into the country. There was actually an article in the Telegraph that we provided data for yesterday that showed the cancellation rate for the UK. It was really the lead-up, the week or two before the sort of Christmas, New Year holiday, big uptick in cancellations as people sort of made alternative plans for their holidays. And that cancellation rate, we looked at it in the major cities, London, Edinburgh, Glasgow, Birmingham, and then outside. And the cancellation rate was much more pronounced in the cities and where the international travel is most. So most people doing their domestic trips actually kept doing those, and overall demand wasn’t terrible in the UK. We saw it earlier, but not as good as it could have been.

Thibault Masson:

Yeah. Thanks.

Jamie Lane:

And this has been a trend, and I think we’ve shared quite a few of these type of slides with your members. Over the past year there have really been two Europes. One of the cities, and one of the destination areas that attract domestic travelers. You see Europe outside of those 25 major cities, essentially positive demand in Q4. And when we look at specific areas, specific countries, and Germany’s been the poster child for this, when you essentially get outside of the four major cities in that country, demand’s been on fire. New investment in those areas, and we’ve seen more supply added than really any time in near history.

Jamie Lane:

So it’s really been interesting to see, and sort of mirrors a lot of what we’ve seen in the U.S., those areas that are able to attract domestic travelers looking to get out of the city. They’ve seen demand trends, seen seasonality trends that are just unprecedented, of people wanting to travel really for the first time outside of that July, August period. And where we see the shoulder seasons really pick up. People finally have pricing power outside of the peak season and really interesting, we’ll see whether those trends hold. Or we go back to sort of normal, typical seasonality patterns in those areas.

Thibault Masson:

Mm-hmm (affirmative).

Jamie Lane:

And the other clear example is France. So essentially, showing the major regions in France in December. All of them doing really well. You see Corsica down there at the bottom 60% growth. Brittany, probably not a lot of people going to Brittany in December. But this shows the changing seasonality. If you’re going to be working from home anyway, there are some beautiful places to be able to do that from. And people are seeing demand in times when they’re just not used to seeing bookings, and really strong demand in the French Alps, you can see that there.

Thibault Masson:

Yeah, it is interesting. And obviously, reading the French news as well, you can really areas like Brittany. Brittany is amazing because real estate prices are just increasing. I think it’s probably the region in France where real estate prices are rising the highest, just also because of that pressure, people realizing they can live there or you should have a secondary home there. It’s not that far from Paris. You kinda see that you know what? In this climate change, you will still be cooler and it’s really the winning region for the pandemic. This is really amazing. It’s really interesting to see in Corsica as well. Well, I think another factor to add in here is that a lot of people in December in France would go overseas to French departments, like the Guadeloupe and Martinique where COVID is raging right now, was raging already in December. So warmer destinations like Corsica, well, relatively and warmer closer are probably also winners this year for French people.

Jamie Lane:

Yeah. And then you look down to the Côte d’Azur, and we had seen earlier some of the specific cities down there. And yes, Cannes was positive, but Nice was still pretty far negative. You get outside of the bigger cities and demand is very strong, and averages out to that 18% growth.

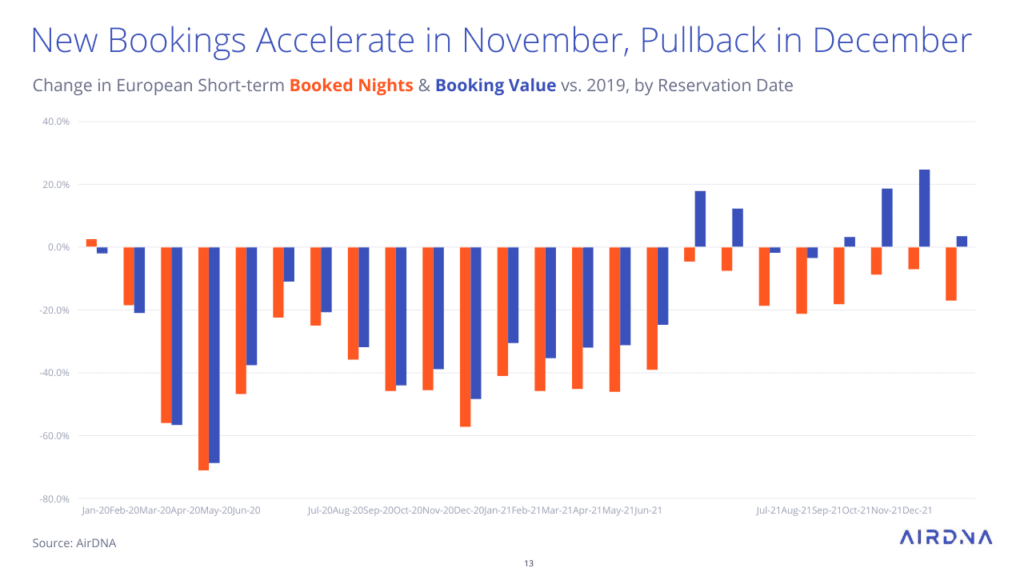

So where previously we’d been talking about demand and revenue on a stayed basis. This is now looking at bookings based on the reservation date. So how many reservations were made this month relative to the same in December? And this is where I wanted to show the surge in bookings that we had seen last Spring. So May, June sort of leading up to Summer travel. People realizing that last Summer was going to be a more normal travel season.

Jamie Lane:

So we saw that surge coming out of lockdowns and earlier in the year. And then again, once we got past the Delta variant in August and September, a really strong surge in bookings, almost 30% more book nights made in November 2021 than in November 2019. And what I think was our booking value. And then what I think is one of the really positive things, even with how Omicron ravaged Europe, we’ve still seen more revenue booked in December 2021 than in December 2019 though obviously a pullback from November. I can tell you looking at the January data so far, it’s been a really strong January. We’ll look at that at some of the forward pacing as we get there. But it’s shaping up. And that bookings are at least on a much stronger foot as we start the year than we were in 2020.

Thibault Masson:

And also something to add here. I’m curious to see that, but we just talked about January is that we saw Austria doing not so well. But Austria has been hit in 2021 twice. Basically, most of Europe in early 2021 ski stations were closed except in Switzerland. So Austria depends a lot on ski tourism and they were hit. And in December they also had locked lockdown again unlike other countries. So that may explain why Austria was doing so low. But there’s also clearly in the other countries that are open this rage of being able to ski again. So that’s maybe why we’re seeing some very good numbers in other areas in France or Switzerland, maybe as well, probably for December and January. Because you see that’s what you see in the data. But that could be an explanation this whole like, “Wow, we can finally ski again” thing happening.

Jamie Lane:

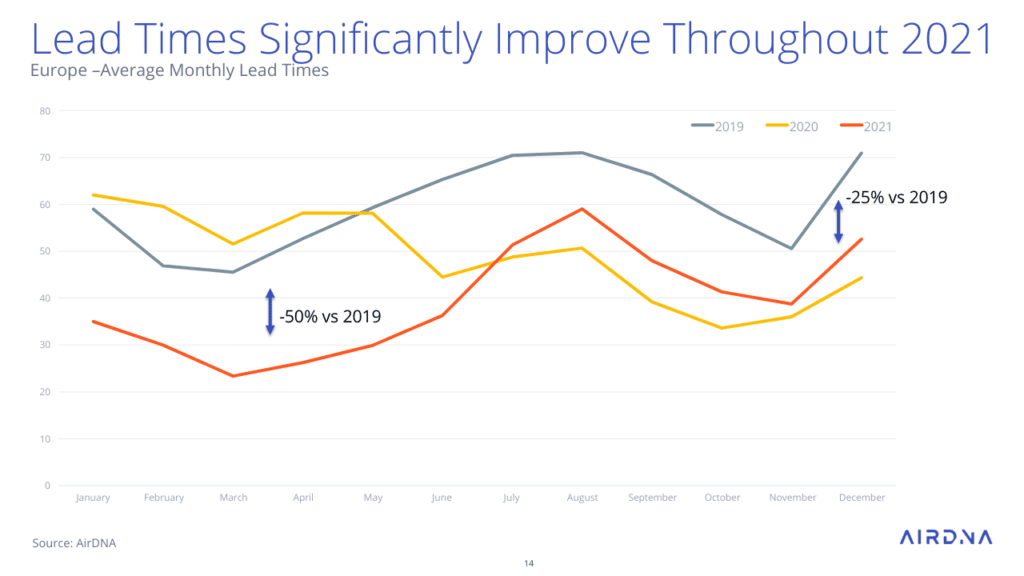

Yeah. And we will definitely show where we’re pacing for Q1 broadly with the recovery. We’ve seen not as strong as a recovery lead time as I would’ve hoped, but definitely getting there. And this may be something we have to live with for a bit is, a reduction in the lead time that people are willing to plan ahead with all the uncertainty that comes with and what new variant is going to be next. And there’s an understandable hesitation for people to book vacations really far out in advance, outside of this sort of July, August period. So where we were typically 2019 in Q1 about 40-50 day lead time in this past year, people only planning out about two or three or four weeks in advance. So 20 to 30 days, that’s definitely recovered. People planning now about 40 or 50 days in advance. As of Q4 still down about 25%.

Jamie Lane:

But I suspect this will even get better throughout 2022, but I doubt we get back to the lead times that we saw in 2019, 2018, with people booking two, three months in advance. We weren’t talking about Omicron two months ago, and now we’re sort of living through it and the cancellations that come with it. So definitely some hesitancy there from guests on booking really far in advance.

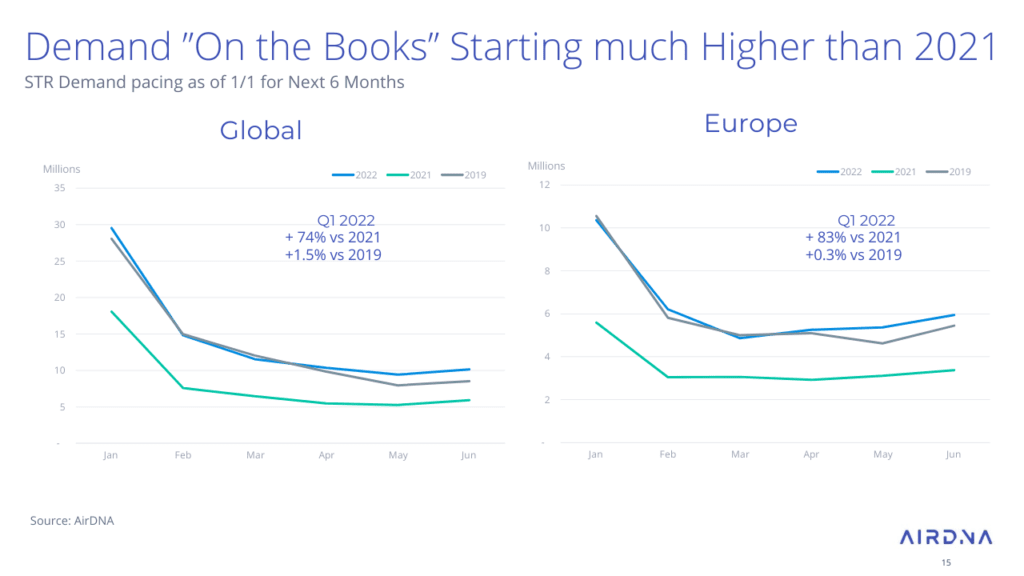

And then where are we at for Q1, so what we’re showing here is sort of on the books reservations looking out. The blue line is for the first six months of 2022. The gray line really nearing now 2022 is as of the same time at the sitting at the beginning of 2019. How much demand was on the books for 2019. And then the same for the green line for 2021.

Jamie Lane:

So if we were sitting here last year at the same time, how much demand was there. And what this first points to me is one, we’re looking way better than we were the same time last year, right? 80% more demand on the books, essentially in Europe. 74% more globally, and almost exactly what we were at, at the beginning of 2019. A lot of that is, and as you said, strong growth in ski markets. It’s areas outside of the major cities. What we saw in Brittany, a really strong demand for what is usually a pretty weak season in most areas of Europe. So great to see there.

Jamie Lane:

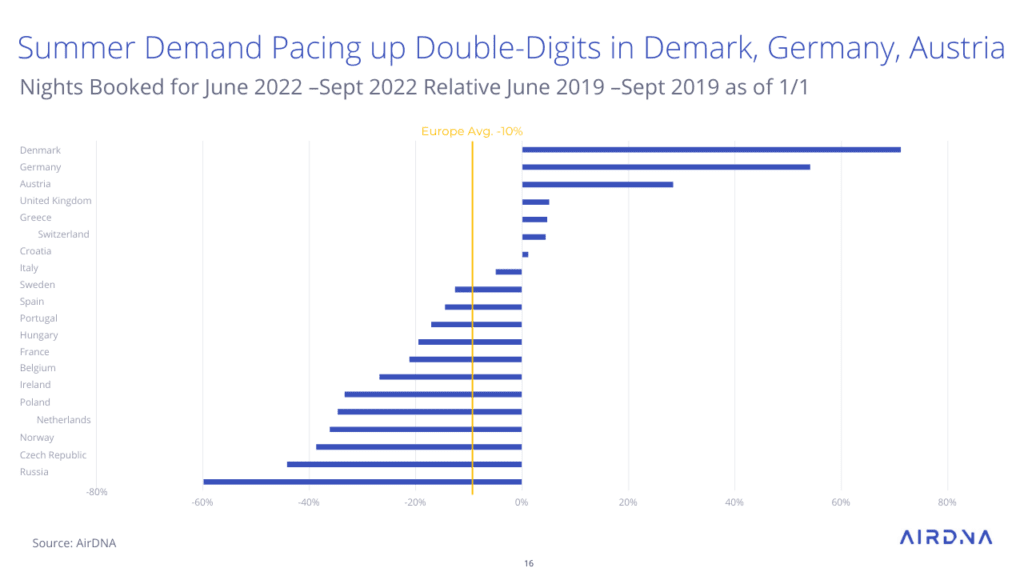

And all-important is, what does next Summer look like with over half of the demand for the year coming in just two months? So here it’s June through September, demand for 2022, relative to June through September 2019. That’s data as of the beginning of the year. So, that is seven countries where demand is pacing higher than in 2019. Denmark, Germany, Austria, UK, Greece, Switzerland. So people not only planning their winter vacations, but already getting a head start on their Summer vacations in those destinations, and overall Europe down about 10%. And remember that compares to the last Summer, where we were down about 20%. So we’re already looking to be pacing well ahead of where 2021 ended up coming in.

Thibault Masson:

And Jamie, we’ve seen that France and Russia had a good 2021. But they’re sort of lagging behind sort of bookings for the Summer. Right?

Jamie Lane:

Yeah. And that could be, one for Russia, we see very tight lead times. So people booking trips in Russia and they’re doing it two, three weeks in advance. Admittedly, this is off of very low figures. So, if we look at how much demand was even booked for June out here. It’s pretty low of what June ends up at it, like 20 million bookings. So some of these countries having pretty short lead times. France, there’s a lot of bookings that still need to be made in that country. But it is interesting to see in two markets that have played out pretty similar, where Germany is doing so well and France is a bit lagging behind.

Thibault Masson:

My only question here for you is that I was talking with Graham Donoghue from Sykes Cottages in the UK. What he was saying is that the UK is a supply-constrained market. So people got burned last year. Couldn’t book on time, or had to pay crazy prices. Maybe, talks as well, about the market where people have to book ahead because they might be afraid of… I don’t know, whether Germany is supply-constrained. I don’t know if it talks to that, or people are a bit organized in the rest of Europe to talk through a cliche. But that could be maybe some kind of patterns we see, I don’t know.

Jamie Lane:

That’s definitely a point on why some markets might take a really long time to recover peak season demand, is because so much supply has been lost. It’s easy to grow demand during shoulder seasons because occupancy was so weak, most listings are going unbooked anyway. But when you look at peak season in peak areas or in really high demand areas, those areas are getting fully booked out during peak season anyway. So the fact that there 10, 20, 30%, fewer listings just means that there’s a ceiling on how far recovery can go. Total occupancy might be a better measure of what the recovery is in those areas.

Thibault Masson:

Very interesting point.

Jamie Lane:

So that’s all I got for you.

Thibault Masson:

Fantastic. So we’ve seen that things are recovering in Europe in Q4 finally then Omicron struck. And if you look at the news right in Europe, people are like, “Yeah, well, it’s peaking and we can start booking.” And hopefully the patterns we saw happening in Europe starting in June last year when things were not so soft anymore, that should hopefully happen earlier in the year and having a really good year. Sorry, for the crystal ball thing but do you think this year in Europe will be like the U.S. last year. Will it be the best year ever in Europe?

Jamie Lane:

I do see that 2022 is going to, in my opinion, look pretty similar to 2021 in the U.S. We’re going to start a little bit weak. And in the U.S., demand started 10-20% down. And then throughout the year we saw a huge of surge and bookings in March, April sort of once. And people got through the Winter doldrums, started to think about Summer travel and bookings and essentially pegged throughout the year.

One thing that I think really plays into a really strong Summer for Europe is international coming back from the U.S. So the U.S. is, across all major European countries, I think the number one inbound country for guests pre-COVID and getting those travelers coming back will be a really big boost. The flexibility that workers have today to sort of live and work remote, I think really plays into long-term travel. Where if someone would’ve maybe just taken a one or two-week trip, now they can go take a three or four-week trip at work while they’re traveling. And I think this is really going to play into the long-term strength of the European short-term rental market.

Thibault Masson:

That’s great to hear. And hopefully, well, maybe you can see you and your family over in Europe this Summer, who knows?

Jamie Lane:

Absolutely. Yeah.

Thibault Masson:

Jamie again, you are the VP of Research at AirDNA. Thank you so much. If you are watching this want to know more about AirDNA what should they do?

Jamie Lane:

Visit our website, airdna.co. If you like what you’ve heard, we have a blog. Click on the blog on the website. You’ll see a whole host of research that we’ve done. We’ve put out monthly updates. We put out regular blogs on interesting things that we are seeing in the industry. What are the new trends. And follow me on LinkedIn or Twitter.

Thibault Masson:

Sounds good. I encourage people to just do that. Once again Jamie, thank you so much so for time today and take care.

Jamie Lane:

Thank you.