Our vacation rental data partner AirDNA has shared with us a treasure trove of charts, graphs, and, analytics about the European market, for 2021 (until late October). The demand patterns in Europe have been diverging from those in the US since summer 2020. It looks like the European short-term rental market has gone hyperseasonal, with mediocre winter, spring, and late autumn months, contrasting with a splendid summer peak season that stretches until October. We’ll explore here the dramatic loss of supply and demand in large cities, all across Europe. We’ll contrast the markets that can balance out their demand and supply for short-term rentals, and those that cannot. Can you hear the swan’s song? While October 2021 was, in Europe, the best month ever in terms of recovery from 2019 levels, demand could nose dive again. The rise of new COVID-19 cases, colder weather, and new travel restrictions due to the omicron variant could negatively impact urban destinations and cross-border travel again.

Here is Rental Scale-Up’s take on AirDNA’s report about European short-term trends in 2021 (so far):

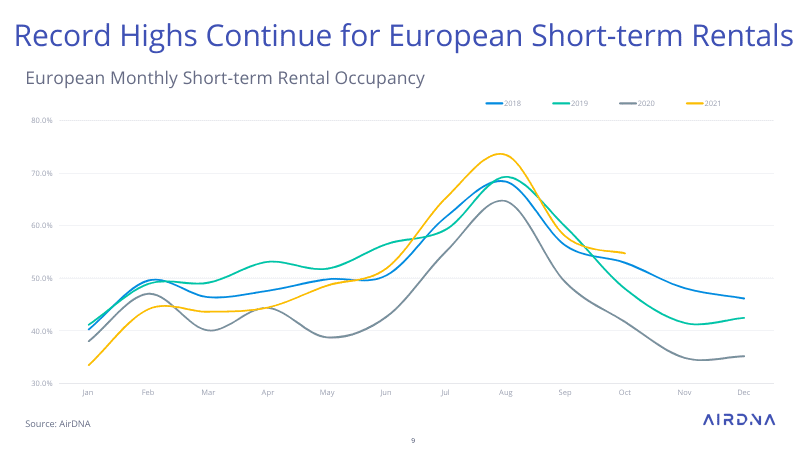

- Hyperseasonality: Just as in 2020, vacation rental data show that demand is even more seasonal than before COVID. In Europe, summer has always been peak season. In 2020 and 2021, the contrast is even stronger, with a longer peak stretching into October.

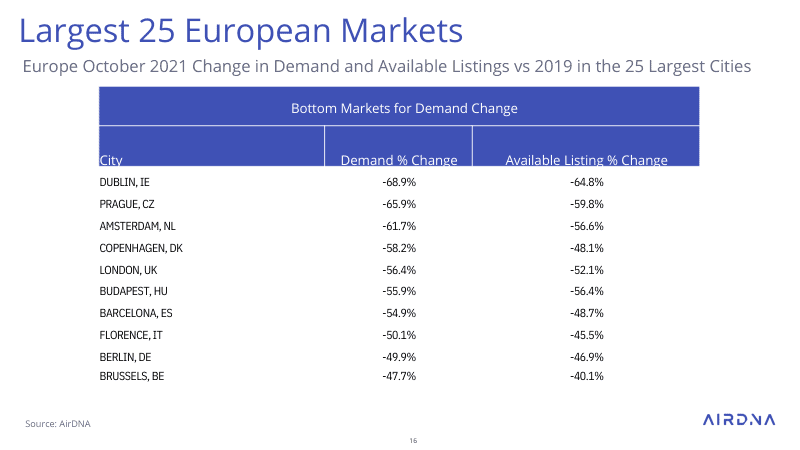

- Throughout Europe, the collapse in demand and supply in large cities is dramatic.

- The average occupancy in Europe was record high in late peak season, but probably because the overall number of listings went down (i.e. drop in supply in cities), and demand was sustained in non-urban markets. So, high occupancy was particulay a sign of health for the market, when considering what was happening in large cities.

- Countries that can balance out their demand and supply do well, as in Russia, France, and the UK. Some countries also benefited from a much stronger preference for domestic stays, such as Germany. Where demand was usually mostly international (95% for Prague and the Czeck Republic), the situation has remained dire.

- As the summer peak turned into a nice Indian Summer (September and October), Europe started recording other positive signs:

- Cross-border travel in Europe has been on the rise (the success of the EU-wide health pass should be noted)

- Demand was slowly coming back to cities

- Christmas bookings were pacing OK, with ski destionations (e.g. Apline countries) doing well

- Yet, the rise of new COVID cases, new lockdown measures, as well as international travel restrictions due to the omicron variant threaten to unwind some of these gains. Hyperseasonality may remain a vacation rental trend in 2022.

- COVID-19 regulations may diverge again among European countries, making the EU-wide health pass harder to use as a sesame to enter neigboring countries. For instance, the French health pass will start requiring a third vaccine shot on January 2015. Will Europeans wait until rules are aligned again to travel in 2022?

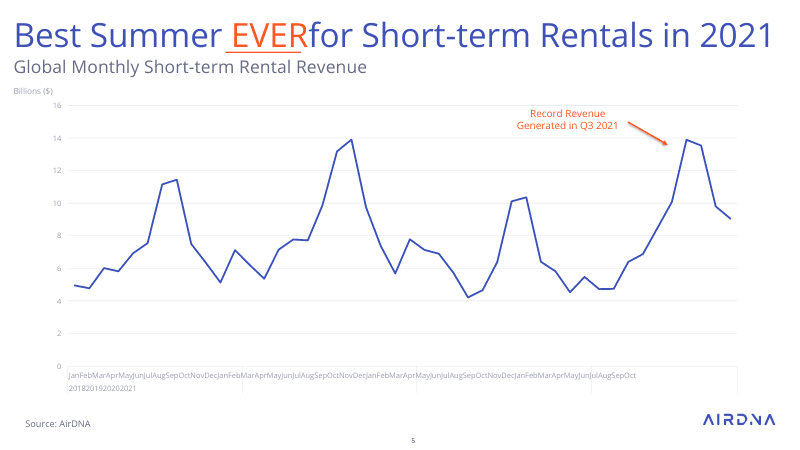

Globally, Summer 2021 = Best Summer ever for short-term rentals

- First, let’s look at the sources for the data we have here. They’re from AirDNA, which uses data from Airbnb and Vrbo. As a result, you can imagine that the data reflects what happens mostly in the Northern Hemisphere, and especiallly in the US and Europe. This is why revenue peaks are usually in Q3 (June, July, and August).

- As, in the US, vacation rentals had an extraordiary year 2021, it

- Note the new “long summer” pattern: Revenue in September and October 2021 were also higher than in 2019, despite low demand in some markets such as large cities.

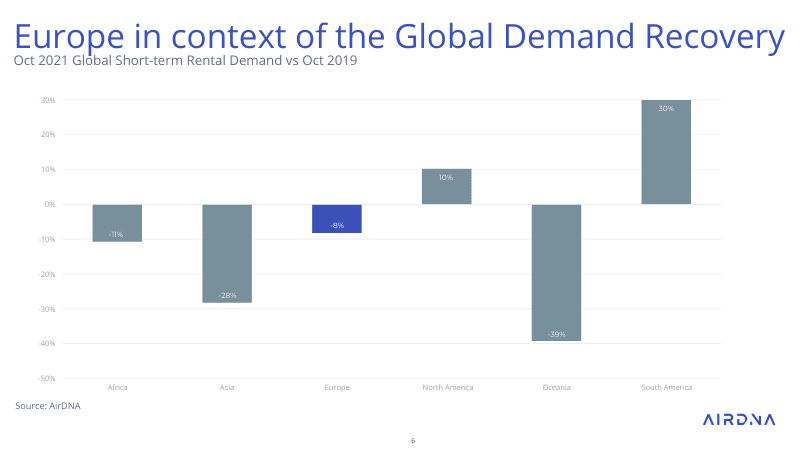

Yet, in Europe:Demand for short-term rentals in Europe is still at 8.3% behind 2019 levels

- We’ve seen that, globally, October 2021 was better than October 2020 and even 2019.

- Especiallly in South America (Spring locally)

- North American market: +10% compared with October 2019 (US: +12.2%, according to this AirDNA report)

- Europe: -8.3% below that of October 2019 (yet, this +48.9% over 2020).

- Is it good or bad?

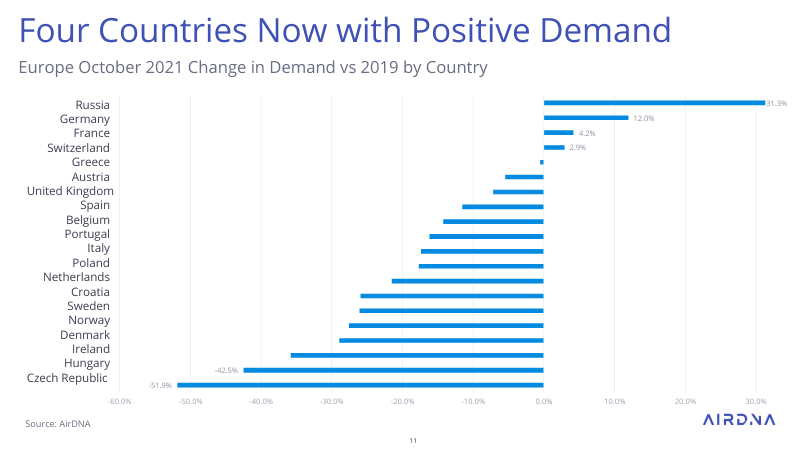

- We’ll see it lower in more detail, but the figures varies across European countries (Russia + 31%, France, +4%, Czech Republic -51% , Ireland -35%) and market types (holiday rentals do better than cities where both supply and demand have collapsed, as in Prague and Londo).

- Lower than the US, right. But Europe from far behind, as the US has been surpassing 2019 levels, months after months, since January 2021.

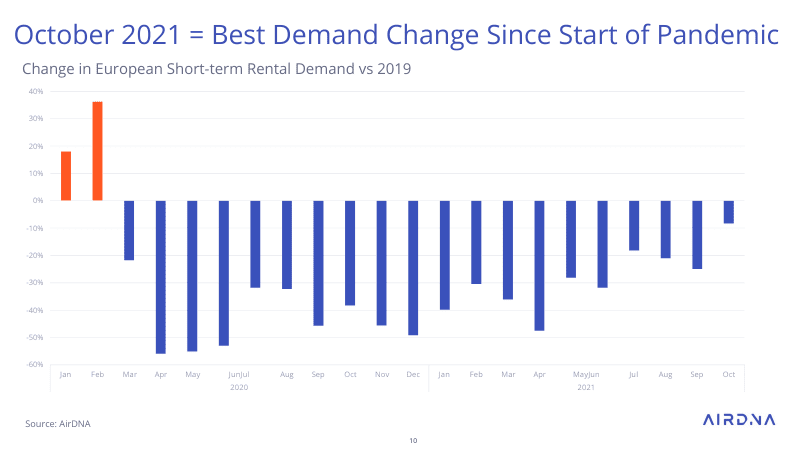

Yet, it was actually an achievement for Europe, as October 2021 was the closest month to 2019 levels since the start of the pandemic

In Winter, Spring, and Summer, overall demand for European short-term rentals was even lower than 2019 levels. For instance, January was at -40% compared with the same month in 2019; April was at -48% and July was still at -19%.

In October 2021, 4 countries recorded MORE demand than in 2019: Russia, Germany, France, and Switzerland

- Russia (+31%), Germany, France, and Switzerland.

- UK at – 5%.

- Worst: Ireland, Hungary, and Cezch Republic (-52%)

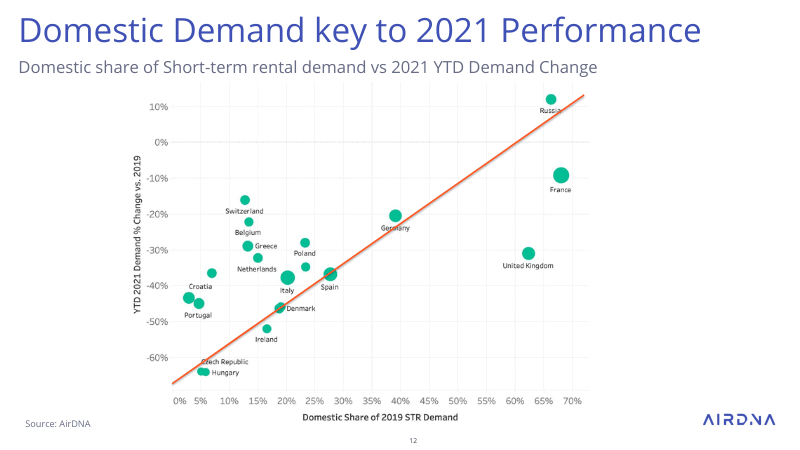

Why are some European countries getting demand, while others see it collapse?

- Domestic Demand key to 2021 Performance

- In 2019, share of domestic was 68% for France, 66% For Russia, 62% for UK, and 39% for Ggermany => Big countries with strong local demand

- Domestic share of short-term rental demand was 39% for Germany in 2019: Big country, where demand used split between domestic and international destinations. Turned to domestic supply in 2021.

- Czech Republic 5% domestic, 95% international => Domestic market too small to support local supply.

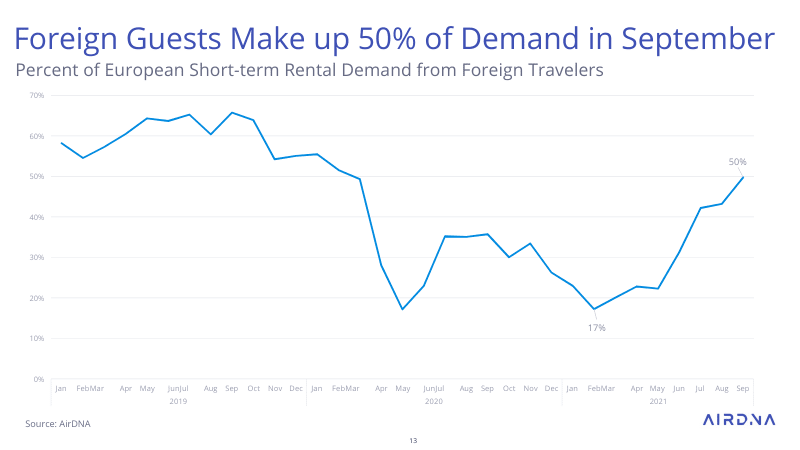

Things were recovering a bit, with more cross-border travel and cities finally getting more demand

Intra-European travel: In September, cross-border demand was returning. Foreign guests made up 50% of demand in September.

Note that Summer 2021 saw a big win for the EU COVID-health pass. EU countries manage to agree on one app format, which allowed the inter-operability of the various QR-Codes delivered across the continent. For instance,a Dutch person could use their Dutch-issued QR code to enter a restaurant in France. It allowed travelers to feel that cross-border travel was possible, with rules more stable and clear.

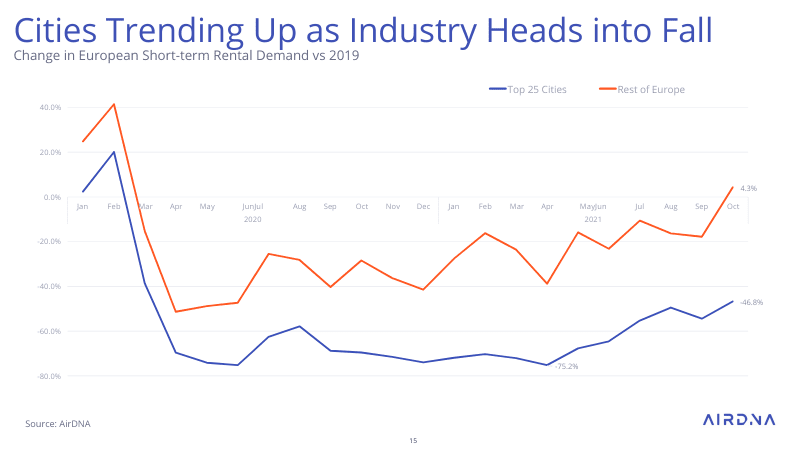

- Demand for urban short-term rental was returning as well. In October 2021, it was still -47% compared with 2019.

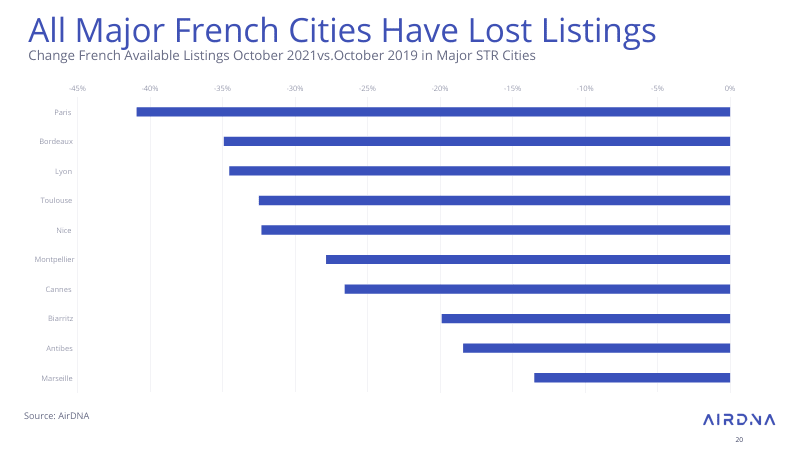

- Lost demand led to retreat in supply, with crazy numbers across Europe.

- International travel restrictions (e.g. few US travelers), a preference for the outdoors, and rolling lockdowns had a negative impact on the demand for short-term rentals in big European cities. Brexit also came into play in some destinations.

- Dublin saw a drop by 69% of demand, while its supply collapsed by 65% of demand in October 2021. This is not March 2020 we are looking at here, but October 2021. With such low demand, no wonder a lot of the stock of apartments has left the short-term rental market in big cities.

Record-high occupancy … helped by a collapse in supply in large cities

Record Highs Continue for European Short-term Rentals

European Monthly Short-term Rental Occupancy: Occupancy higher in July, August, and Oct 2021 than in 2019 (not September) -> Peak season is getting longer

- How can demand be lower than in 2019, but occupancy be the best ever?

- The mystery is solved if you at the collapse of supply in cities and at the high demand for vacation rentals in destination markets.

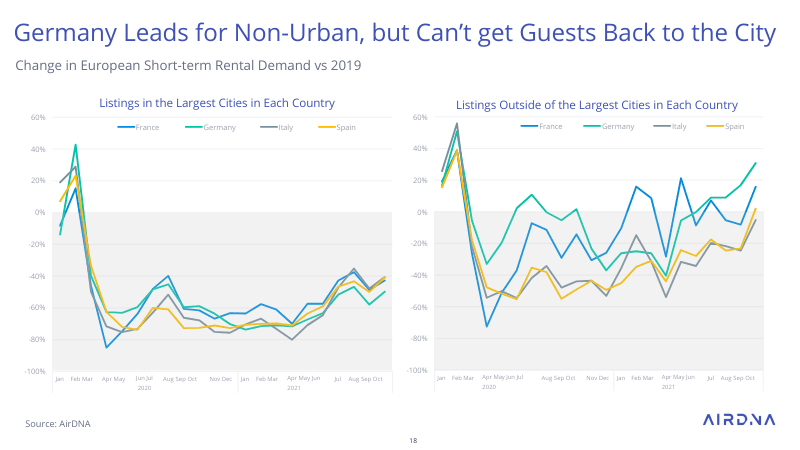

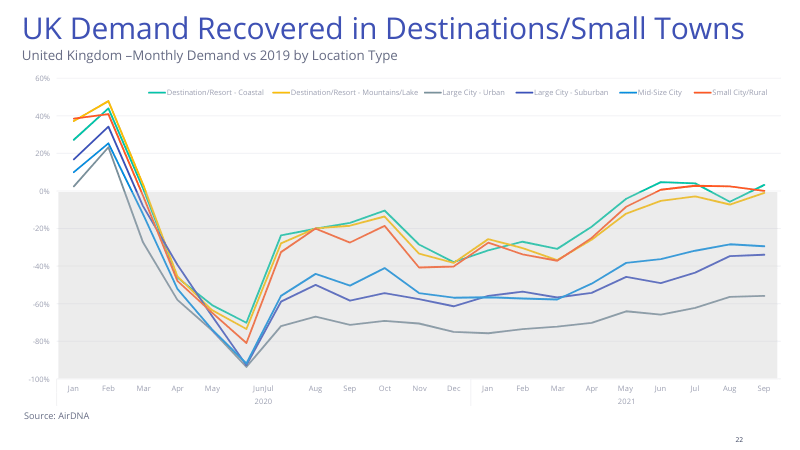

- Demand Cities vs non-cities

- Demand for cities: – 40% in France, Germany, and PSain, – 45% in Germany

- Demand for outside of big cities: + 30% in Germany compared with 2019; +18% in France (Italy= -8%, Spain, +1%)

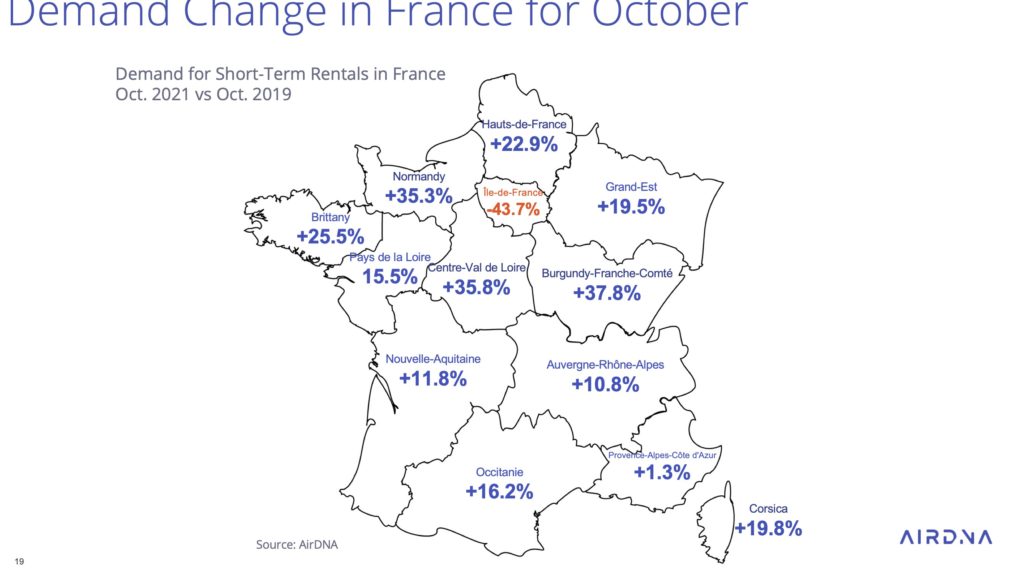

Vacation rental data: France, 2019 vs 2021 (month of October)

Paris still down, Côte d’Azur barely up (negative impact of cities such as Marseille, Cannes, and Nice, with international and business travel (e.g. conventions in Cannes) still down.

UK 2019 to 2021 demand patterns: Destinations have recovered, not cities

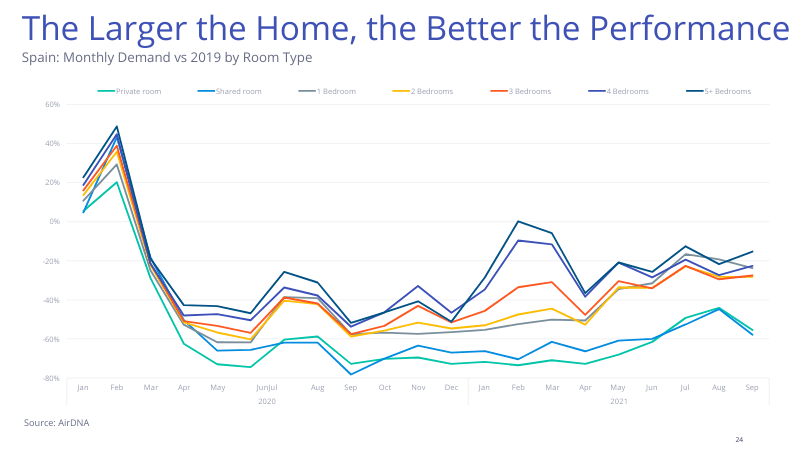

Spain as a example of a market where demand for shared spaces remains low, while bigger places are in demand

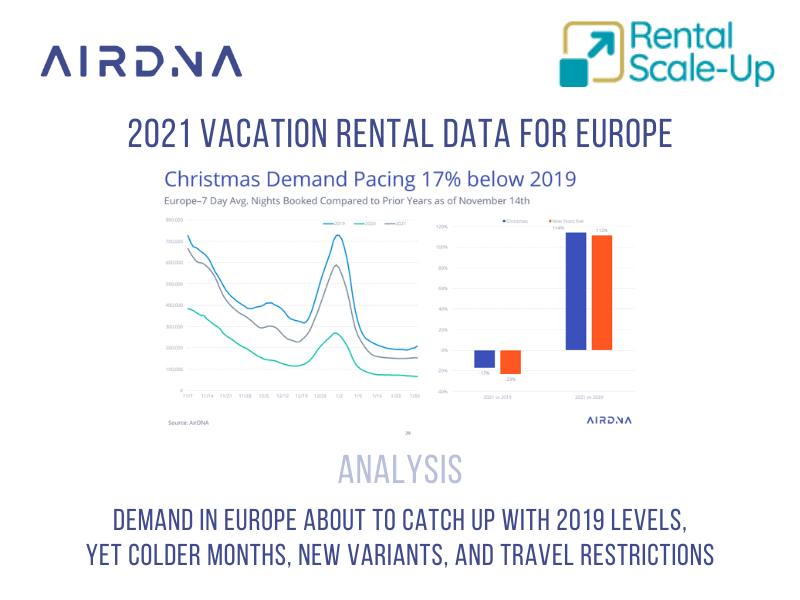

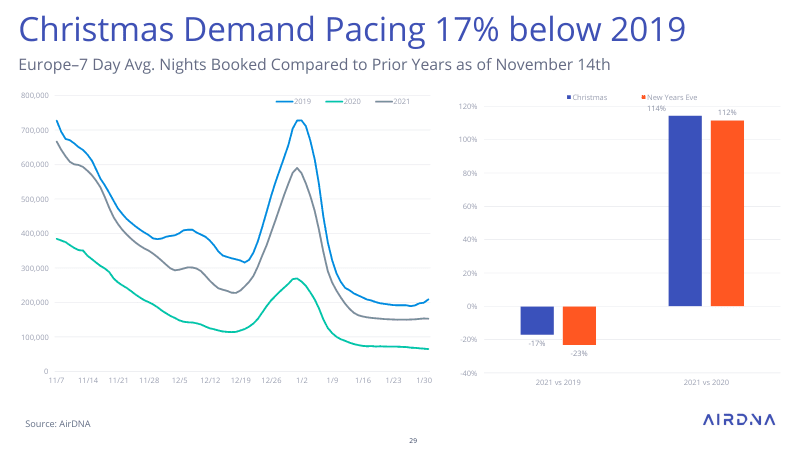

Early 2022 vacation rental trends for Europe

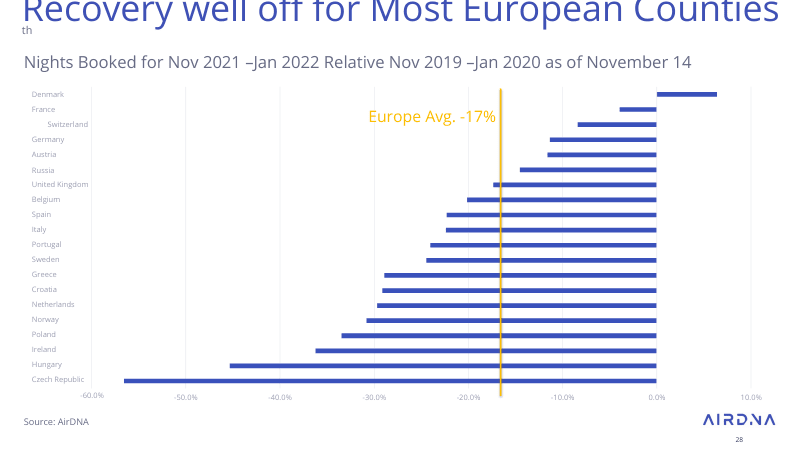

- European average nights booked at -17% for the coming months(November, December, and January)

- Only Denmark is positive

- France is at -4%, CZ at -55%,Germany at -12%, UK at -20%, Italy and Spain at -25%

- Christmas Demand Pacing 17% below 2019 (was pacing at -23% in 2020)

- Ski destinations do pretty well for early 2022.

Conclusion: Swan’s song before colder months, COVID cases, and the Omicron variant pull down demand for shor-term rentals?

The return of International travel is key for an Urban Recovery. Yet, travel restrictions do not want to go away.

Cross-border travel in Europe at the mercy of COVID rules change fatigue. They are ever-changing in your own country, so it is hard to keep up with rules in other countries. Summer 2021, a big win for the EU COVID-health pass. Yet, rules may differ again: Starting January 15, people will need a third shot to get their health pass QR-code in France. The rule will probably be different in other countries.

Maybe travelers will sit out visiting European cities again this Winter, making 2022 the third year in a row where demand is hyperseasonal in Europe.