Booking.com’s Q2 2025 earnings reveal strong performance driven by its expanding alternative accommodations segment, home to its short-term rentals, as well as continued investment in its Connected Trip vision. While growth in Europe and Asia fuels momentum, challenges in the U.S. market persist.

For professional short-term rental managers, this report offers a look at how Booking is reshaping its platform, and what it means for your business.

Booking.com’s Short-Term Rental Momentum in Q2 2025

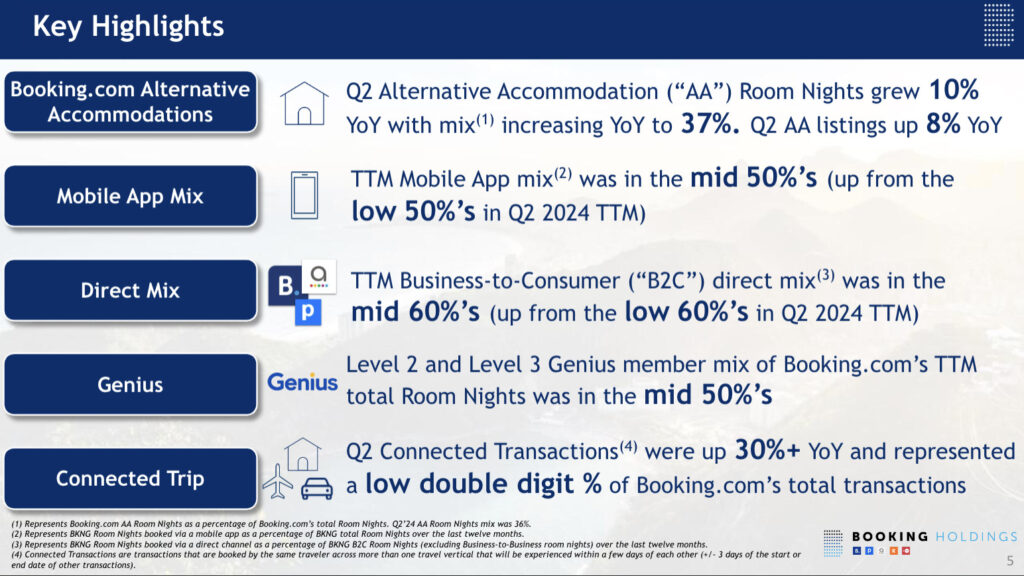

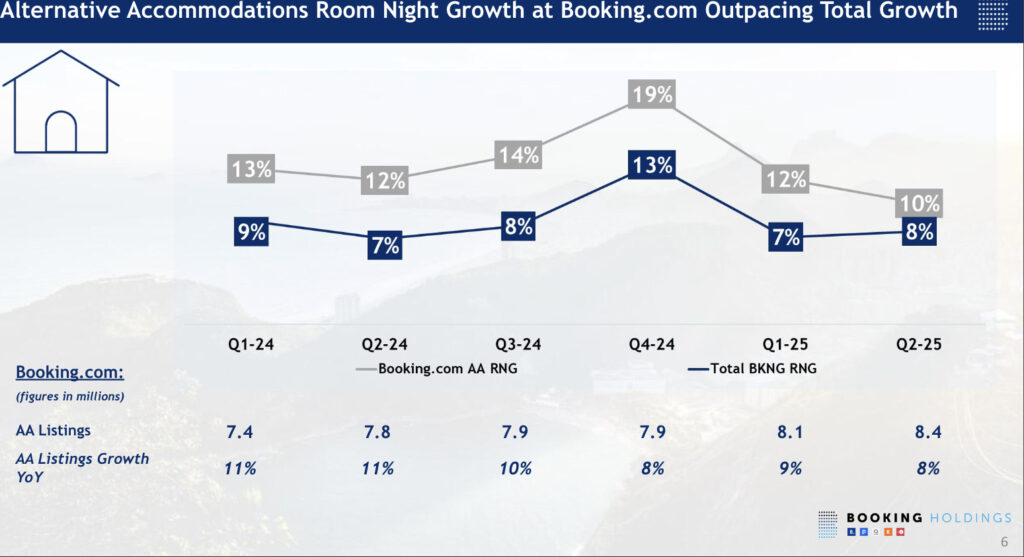

- 10% year-over-year growth in alternative accommodation room nights.

- 35% of total room nights came from alternative accommodations (a slight drop from 37% in Q1).

- 70% of listings are now instantly bookable.

- Expansion of request-to-book functionality via API to onboard more diverse supply.

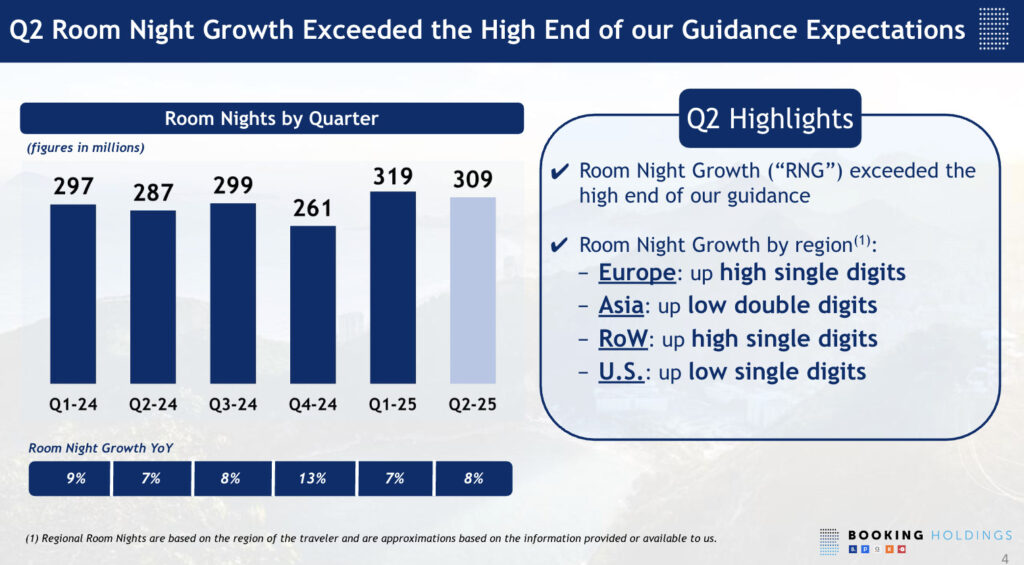

Despite flat overall room night growth and the challenge of comparing results to a strong post-pandemic Q2 in 2024, Booking.com’s short-term rental segment continued to grow—especially outside the U.S. The numbers suggest the company’s focus on onboarding new listings and improving flexibility for professional hosts is paying off.

Key Takeaways for Short-Term Rental Managers

- Short-term rentals on Booking.com keep growing, and the company is now expanding request-to-book via API offering professional managers more flexibility.

- Being global helps Booking weather regional slowdowns, with strong performance in Europe and Asia offsetting softness in the U.S.

- Booking is taking a more active role in managing guest payments and host payouts, especially in regions like Asia, as part of a bigger push to connect flights, stays, and experiences.

- Attractions are gaining momentum, with bookings more than doubling YoY.

- The company is restructuring, reducing staff in expensive markets and investing in lower-cost tech hubs to stay lean and scale faster.

- AI is a major focus, and not just through ChatGPT: Booking is hinting at developing its own in-house travel assistant using its massive pool of data.

Alt-Accom Keeps Growing, And Booking Is Getting More Flexible to Sustain It

Alternative accommodations were one of the few bright spots in an otherwise flat quarter, growing 10% year-over-year. They made up 35% of total room nights (down slightly from 37% in Q1), and 70% of listings are now instantly bookable. That last number is especially important, given Booking’s historical push for Instant Book as its default model.

But here’s what’s new: Booking is expanding request-to-book functionality via API. This is a subtle but important shift. For the first time, Booking is recognizing that professional property managers often need to screen guests, manage risk, or control operational workflows that Instant Book doesn’t accommodate.

“We’re further rolling out request-to-book functionality with pre-booking messaging through an API, providing access to a segment of the alternative accommodation supply that relies on this model,” said Booking Holdings CEO Glenn Fogel.

For pro hosts who have historically preferred platforms with more guest screening options, this is a meaningful development, a sign that the platform is adjusting to better fit the realities of scaled, professionalized short-term rental operations.

Booking’s Global Strength Offsets U.S. Softness

Booking’s global footprint proved its value this quarter. While U.S. bookings were sluggish, with inbound travel from Canada and Europe down, strong performance in Europe and Asia helped the company maintain positive room night momentum.

“So we’re such a large global business. We’re not overly dependent on the U.S.,” Fogel noted.

Even within the U.S., Booking claims it gained share. For STR managers, the takeaway is this: If you’re operating in growth markets like Asia or Europe, Booking’s demand engine may be working harder in your favor. And even in the U.S., aligning with Booking’s strategy could help soften the blow of regional slowdowns.

More Control on Payments to Fuel Connected Trips

Booking.com is streamlining payments to fuel its long-term Connected Trip ambitions. By building its own financial infrastructure, Booking aims to offer seamless, multi-service journeys that integrate stays, flights, and experiences under one roof.

Key developments include:

- Antom partnership: Announced earlier this year, this collaboration localizes payment experiences in Asia, a region Booking is aggressively expanding into.

- More centralized payouts: In Q2, Booking reiterated that controlling how and when hosts are paid is a priority. This enables smoother onboarding and more consistent guest-to-host transaction experiences.

- Bundled payments and upsells: Booking’s growing infrastructure allows it to offer guests add-ons and upgrades (like airport transfers or experiences) directly during checkout, streamlining the path to higher-value bookings.

✅ Why It Matters for Short-Term Rental Managers

Booking.com is positioning itself as a full-service travel ecosystem. For property managers, the upside may include new monetization opportunities through bundled services.

But it also means more platform control over key guest touchpoints, something managers must navigate carefully when deciding how to balance platform tools with their operational preferences.

Attractions: The Next Battleground?

Booking.com reported that its attractions bookings more than doubled year-over-year in Q2 2025, though from what it described as a “modest base.” Still, this spike, paired with multiple signals from the company’s leadership, suggests attractions are a growing area of focus.

The earnings call emphasized the role of attractions in the company’s Connected Trip vision, where Booking aims to be the all-in-one hub for lodging, flights, and in-destination activities. The company noted an increase in attractions inventory, and that more partnerships and product enhancements are on the way.

This comes at a time when other OTAs are also expanding into services:

- Airbnb re-launched Experiences earlier this year, doubling down on local activities and guided services.

- Vrbo and HomeToGo are also making moves toward bundling value-add offerings like insurance, equipment rentals, or curated local perks.

Our take: Attractions may be the next battleground. In a softening demand environment, OTAs are looking for additional revenue streams per guest, and attractions offer a way to drive both monetization and loyalty.

Unlike Airbnb, Booking’s strength has never been in curating one-of-a-kind, bespoke listings. Instead, it dominates through scale and instant availability, a likely blueprint for how it may approach attractions as well. Think easy-to-book tickets for top landmarks, tours, and transport, rather than niche or artisanal activities.

📌 Takeaway for Managers: Attractions may soon become more visible and bundled into bookings on Booking.com. Property managers who offer or partner on local experiences should keep an eye on integration opportunities. As Booking expands this vertical, those already connected to ticketing platforms or local operators may be well-positioned to benefit.

Booking.com Continues Restructuring to Cut Costs

Booking Holdings is in the middle of a multi-year transformation program aimed at making the company more efficient, profitable, and scalable. In Q2 2025, this initiative delivered $450 million in annualized cost savings, as explicitly called out by CEO Glenn Fogel during the earnings call.

“We are already seeing the benefits of our transformation program, which has allowed us to reallocate resources, reduce complexity, and drive meaningful efficiencies across our business,” said Fogel.

These savings stem from operational restructuring, including downsizing in high-cost regions, and investment in “Centers of Excellence”.

Booking.com’s AI Push Hints at a Travel-Specific Assistant

Booking.com is signaling a deeper move into AI not just as a feature, but as a core platform capability. In the Q2 earnings call, CEO Glenn Fogel hinted at building a proprietary, travel-specific model, rather than relying solely on large language models like ChatGPT:

“It may not be a large language model, it may be a very specific travel model that we are creating on our own.”

There’s even speculation of a hardware component, perhaps a kiosk or embedded interface for trip assistance.

This strategy stands apart from other travel players like HomeToGo, which use AI to refine search. Booking appears focused on integrating AI across payments, personalization, bundling, and the entire Connected Trip flow.

For short-term rental managers, this means the guest journey, from discovery to booking to upsells, may increasingly be shaped by Booking’s AI logic. Success could depend not just on search ranking, but on how your property fits into AI-driven trip planning.

So What Should Managers Do Now?

Booking.com is expanding tools and options for hosts while also standardizing key parts of the guest experience. It’s offering pro hosts new tools (API-powered R2B, bundled services, regional growth momentum), while centralizing control over payments, experiences, and guest touchpoints.

In short: Booking.com is no longer just a place to list your property. It’s becoming the operating system of a traveler’s entire journey. Whether you plug into that system, and how, may shape your competitiveness in the years ahead.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.