At the recent Scale Show Barcelona, an industry-defining conference for rental professionals, RSU had the privilege of curating and hosting the Knowledge Stage. This stage was unique, featuring only property managers as speakers—a first in the industry. The focus was on sharing real-world tactics, with many fresh faces and first-time speakers. One of the standout sessions, highly attended and well-received, was “Diversity Is The Key: How to Go From 25 to 2500 Units,” presented by Mahwushh Alam, Founder of One Perfect Stay.

One Perfect Stay: A Success Story

Founded in 2016, One Perfect Stay has become a leading player in the UAE’s short-term rental market, with over 200 curated homes in prime Dubai locations. Their success is built on rigorous selection for quality, location, and ambiance, and a commitment to digital hospitality, making luxury approachable. The results speak for themselves:

- 400 Rooms Under Management

- 200% Annual Growth Rate

- $3M Gross Annual Sales

- $100M Assets Under Management

- 85% Occupancy Rate

- 200 Units Under Management

Why is Diversification Imperative for Short-term Rentals?

Understanding Diversification

Diversification in the context of short-term rentals means expanding your property portfolio and revenue streams across various types of assets, locations, and business models. The goal is to spread risk and increase potential returns by not relying on a single type of property or income source. By diversifying, property managers can mitigate risks associated with market downturns, changing traveler preferences, and economic fluctuations.

Hospitality Variants within Diversification:

- Rental Arbitrage:

- This model involves leasing properties from landlords and then subleasing them on short-term rental platforms like Airbnb or Booking.com.

- How it works: The property manager profits from the difference between the long-term lease cost and the short-term rental income.

- Master Lease Model:

- This model entails leasing multiple properties under a single agreement.

- How it works: The property manager is responsible for managing and marketing the units, subleasing them to short-term guests, and keeping the profits after paying the lease.

- Revenue Sharing:

- This involves a partnership between short-term rental operators and property owners.

- How it works: Rental income is divided based on a predetermined percentage, often including property management services in exchange for a share of the revenue.

Pros and Cons of Diversification in Short-Term Rentals

Pros:

1. Risk Mitigation

Diversification spreads investment risk across different assets, meaning if one investment underperforms, the negative impact is cushioned by other investments. For example, if you own apartments in an urban area and beach houses in a tourist destination, a downturn in tourism might affect the beach houses but not the urban apartments. This helps balance your portfolio, reducing the impact of localized economic downturns or seasonal fluctuations.

2. Capital Preservation:

By investing in various asset types, you reduce exposure to any single asset’s failure or market downturn. For instance, owning a mix of short-term rentals (vacation homes) and long-term rentals (residential leases) ensures that if short-term rental demand drops, the steady income from long-term rentals can preserve your capital.

3. Steady Returns:

Diversified portfolios often experience smoother returns because the volatility of one investment can be offset by the stability of another. For instance, while vacation rentals might have seasonal peaks and troughs, urban rental properties may provide more consistent income year-round.

4. Opportunity for Growth:

Diversifying across different markets allows you to capture growth potential in various conditions. For example, investing in emerging markets like Riyadh, where the hospitality sector is expanding, alongside established markets like Rome or Barcelona, positions your portfolio to benefit from growth in both new and mature markets.

Cons:

1. Potential for Diluted Returns:

While spreading investments can mitigate risks, it may also mean missing out on high returns from a single, high-performing investment. For example, if a particular city experiences a real estate boom and you’ve only allocated a small portion of your portfolio there, your overall returns may be lower than if you had concentrated your investments in that booming market.

2. Complexity and Monitoring:

Managing a diversified portfolio increases administrative burdens and requires more time and resources. For instance, owning properties in different countries involves understanding and complying with various local regulations, tax laws, and market dynamics, which can be complex and time-consuming.

3. Correlation Risk:

During market stress, assets that seemed uncorrelated might move together, limiting risk reduction. For example, an economic crisis affecting global tourism can simultaneously impact your vacation rentals in multiple countries, reducing the effectiveness of diversification.

4. Overdiversification:

Spreading investments too thin can diminish the benefits of diversification, leading to lower returns and higher costs. If you own too many different types of properties in too many locations, you might face challenges in effectively managing and optimizing each property, resulting in higher operational costs and diluted profits.

The Kingdom of Saudi Arabia (KSA): Opportunities and Gaps

According to the data shared by Mahwushh Alam, there is a considerable gap between the projected demand and supply of luxury accommodations, highlighting the lucrative potential for expansion in this region.

Key Findings

1. Luxury Market Dominance:

By 2030, it is anticipated that 77% of the new supply will cater to the luxury and upscale segments, totaling approximately 138,985 units out of an upcoming supply of 180,500 units. This trend underscores a clear market preference and an investment focus on high-end properties.

2. Supply and Demand Dynamics:

The demand for luxury accommodations in KSA is projected to reach 315,000 units by 2030. However, the current supply pipeline falls short, with only 134,500 units expected to be available. This leaves a substantial gap of 180,500 units that needs to be filled to meet market demand.

3. Investment Models:

The report highlights the viability of both “Master Lease” and “Management” models in the KSA market. These models offer flexible and scalable options for investors and property managers to engage with and capitalize on the growing market.

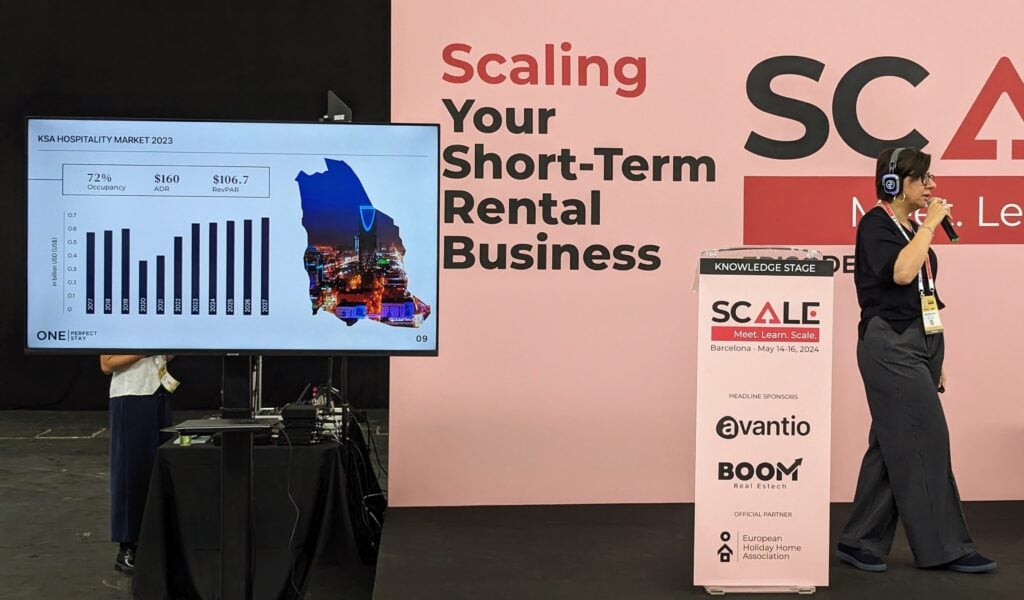

2023 KSA hospitality market

1. Occupancy Rate:

The occupancy rate in KSA for 2023 stands at a healthy 72%. This high rate indicates a strong demand for accommodation, reflecting the country’s growing appeal as a travel destination and the effectiveness of its tourism initiatives.

2. Average Daily Rate (ADR):

The ADR for 2023 is recorded at $160. This figure is crucial for property managers as it represents the average rental income per occupied room, offering a benchmark for pricing strategies and revenue management.

3. Revenue per Available Room (RevPAR):

RevPAR, a key performance metric in the hospitality industry, is reported at $106.7. This metric combines occupancy and ADR, providing a comprehensive view of a property’s ability to generate revenue.

4. Historical and Projected Revenue:

The visual also includes a bar chart depicting the revenue in billion USD from 2017 to 2027. It shows a noticeable dip in 2020, likely due to the pandemic, followed by a strong recovery and steady growth projections through 2027. This trend underscores the resilience and potential of the KSA hospitality market.

One Perfect Stay Expansion Strategy

One Perfect Stay has outlined a comprehensive strategy plan aimed at expanding its footprint and enhancing its service offerings in the UAE and KSA markets. This includes a hybrid approach that integrates various operational models and service enhancements to achieve a target of managing 1000 rooms across these regions.

Multi-Pronged Strategy

The central focus of the strategy revolves around creating a hybrid model that combines several key components:

- Authentic Guest Experience: Prioritizing unique and memorable experiences for guests to differentiate their properties from competitors.

- Outstanding Spaces: Ensuring that properties are well-designed, functional, and aesthetically pleasing to attract and retain guests.

- Dynamic Pricing: Implementing flexible pricing strategies that adjust based on demand, seasonality, and market trends to optimize revenue.

- Branded Properties: Developing and managing properties under a recognizable brand to build trust and loyalty among guests.

Mixed Operational Model

The strategy incorporates two primary operational models to manage and expand the room portfolio:

- Master Lease: Securing properties through long-term leases, allowing for consistent control over the property and stability in operations.

- Management Model: Offering property management services to owners, providing an additional revenue stream and expanding the brand’s reach without owning the properties outright.

- Build to Rent: Investing in the development of new properties specifically designed for the rental market. This approach ensures that properties meet the high standards and specific needs of short-term rental guests from the ground up.

One Perfect Stay’s insights at Scale Show Barcelona highlight the importance of diversification and strategic expansion. By leveraging hybrid models, operational flexibility, and focusing on guest experiences, property managers can effectively scale their businesses and capitalize on the booming short-term rental market.