The French Open 2025 offers the clearest view yet of Paris short-term rental market trends in 2025, and a rare chance to assess real performance after the turbulence of last year’s Olympic season. Each May, Roland-Garros becomes the center of the tennis world and a reliable bellwether for short-term rental demand in Paris.

But this year, it’s more than a sporting spectacle. It’s a test case for how well the city’s rental market has rebounded from the Olympics 2024 Paris rental oversupply, where a flood of new listings and inflated expectations left many hosts disappointed. With fewer listings, new guest behaviors, and a more stable pricing environment, the French Open gives us a snapshot of a post-glut market finding its footing again.

Let’s break down what changed, what stayed steady, and what the data from PriceLabs tells us about where Paris’ rental market is heading.

Why the French Open 2025 Matters for Paris Short-Term Rental Demand

The French Open is one of Paris’s most commercially reliable recurring events, and a cornerstone of its spring tourism season. Held annually at Stade Roland-Garros, the tournament draws hundreds of thousands of international travelers, including high-spending tennis fans, media teams, corporate sponsors, and leisure tourists.

This year, the 2025 French Open (May 20 – June 9) is especially telling for the short-term rental market because:

- It’s the first major recurring event in Paris following the 2024 Summer Olympics.

- It reflects a new normal in Paris’s STR market, post-regulatory tightening and post-hype supply corrections.

- Unlike the Olympics, the French Open is localized to one main venue and predictable in demand and geography, making it ideal for testing sustainable pricing and operational strategies.

In other words: The French Open offers a stable stress test—without the chaos of the Olympics. That’s why analyzing this event with PriceLabs data gives us insight into what’s really working in the Paris market.

What’s New in 2025: A Raffle, a Sunday Start, and a Fan Zone

This year’s French Open saw three significant updates that may have subtly but meaningfully influenced traveler behavior:

- Ticketing by Raffle

In a departure from previous years, fans had to enter a draw to purchase tickets. This introduced uncertainty and likely delayed bookings, as many travelers waited for confirmation before locking in their accommodation. This could partially explain the longer average booking window of 93 days, up from 86 last year, as those with tickets may have secured their stays far in advance, while others hesitated until confirmation. - Sunday Start

The tournament now begins on Sunday instead of Monday. This minor change can have ripple effects on traveler behavior, nudging guests to arrive earlier or extend their stays slightly. Data supports this, with a small increase in 5–6 day bookings and a decrease in 1–2 day bookings, suggesting a modest shift toward longer stays.

- A New Free Fan Zone

For the first time, the French Open offered a large free-access fan zone, attracting not just ticket-holders but also casual visitors and locals. This kind of democratized access may have helped sustain interest and bookings across a broader slice of travelers, especially those seeking to combine tennis fandom with general tourism.

STR Market Rebound: Data from the 2025 French Open

The headline numbers from PriceLabs are deceptively simple:

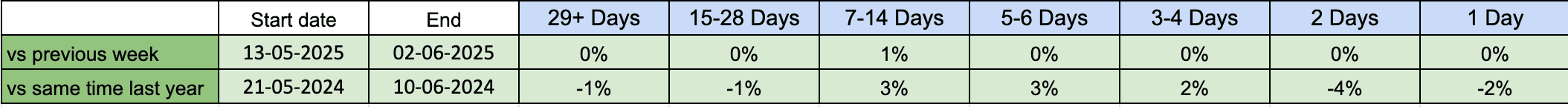

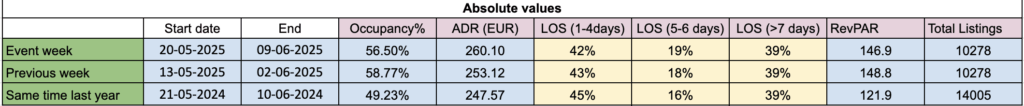

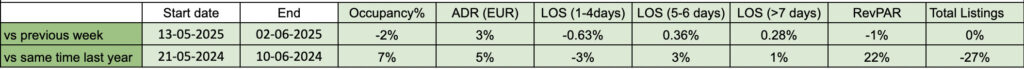

- Occupancy: Up 7 percentage points YoY (from 49.2% in 2024 to 56.5% in 2025)

- ADR: Up 5% YoY (from €247.57 to €260.10)

- RevPAR: Up 22% YoY (from €121.90 to €146.90)

Initially, this looks like a market roaring back. But the twist comes in the listing count: there were 27% fewer listings active during the French Open period this year compared to last. That massive drop in supply contextualizes the improved performance across all other metrics.

In 2024, the Olympics distorted the market. Hosts flooded the platform with new listings, some opportunistic, others short-lived. This supply glut drove down occupancy and diluted pricing power, even as Average Daily Rates stayed high. The result? Soft RevPAR performance and inflated market expectations.

The market, oversaturated and heavily regulated, didn’t reward everyone equally. Many of these new listings underperformed, faced compliance pressure, or simply weren’t designed for long-term STR viability. This year, with many of those listings offline, the Paris short-term rental market is functioning more efficiently. The leaner inventory allowed actual demand to be captured more cleanly, boosting RevPAR and keeping ADRs steady.

Was Last Year Overpriced? Not Quite. But It Was Overstuffed.

One of the lingering questions is whether last year’s prices were simply too high. The data suggests: not exactly.

ADRs in 2024 were already elevated, but demand didn’t meet expectations because supply overwhelmed it. So while the prices may not have been outrageous, the market misjudged how much demand the French Open alone could generate in an Olympics-adjacent year. This year’s modest 5% ADR increase tells us that the 2024 prices were already nearing guest tolerance.

That’s why the 2025 performance is more about correction than explosion. Supply shrank, bookings stabilized, and prices found their footing. This is not a market on fire, it’s a market getting smarter.

What This Means for Revenue Managers and Hosts

For hosts in seasonal or high-profile event markets, the French Open provides a reference point for refining event-based pricing strategy for vacation rentals—balancing anticipation, calendar flexibility, and minimum stay thresholds based on real booking behavior.

- Normalize Your Comps After a Mega-Event

Year-over-year comparisons are tricky when you’re coming off a once-in-a-generation event like the Olympics. Supply distortion lingers, and demand may return to baseline more slowly than you expect. - Watch Booking Behavior, Not Just Pricing Trends

This year’s changes, from a ticketing lottery to new fan zones, show that how guests book matters as much as how much they pay. Understand guest psychology around event types: whether they’re planning around ticket uncertainty, traveling for experience vs. attendance, or combining business and leisure. - Don’t Chase Headline Occupancy

A higher occupancy rate doesn’t always mean demand has surged. Sometimes, it just means there are fewer listings to fill. Make sure you’re tracking booked nights, not just occupancy percentage, to get a true read on demand.

Conclusion: A Calmer, Clearer Picture

The French Open 2025 is shaping up not as a blockbuster, but as a well-balanced return to form. For property managers, this is a welcome change. After a chaotic 2024 where more listings didn’t equal more revenue, the market has shed its excess and is back in equilibrium.

It’s a reminder that smart supply, steady pricing, and responsive guest engagement matter more than headline hype. And that sometimes, the best indicator of a healthy market isn’t a dramatic spike, it’s a quiet correction.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.