In the high-stakes opening week of the 2026 Winter Olympics, professional rental markets in Val di Fiemme saw occupancy rates “plummet” by 24%—yet daily revenue (RevPAR) actually grew by 28%. This highlights the defining trend of the Milano Cortina Games: a massive surge in local supply that makes markets appear softer on paper, even as total revenue reaches record highs.

Market Intelligence Context: The following analysis is based on PriceLabs short-term rental (STR) performance data. The study focuses specifically on the Opening Days window (February 4–9, 2026), comparing performance against the Same Time Last Year (STLY) period of February 5–10, 2025.

Fans Aren’t Coming for One Night. They’re Planning Full Olympic Itineraries

Unlike traditional seasonal tourism, the Winter Olympics draws a specific type of “experience seeker.” These travelers view the event not just as a sports match, but as a multi-day cultural holiday. This behavior is evident in the current data, which shows demand peaking well before the official February 6th Opening Ceremony.

In Cortina, early-start sports like Curling (which began February 4) acted as an early revenue engine. This illustrates a shift in traveler trends where fans are willing to lock in premium stays nearly a year in advance to secure proximity to “mission-critical” venues—those specific stadiums or slopes where their favorite events take place.

Supply Grew Up to 56% in Some Olympic Markets

The 2026 Games have triggered what some call a “regional revaluation.” This refers to the process where once-quiet mountain towns are suddenly transformed into high-capacity professional rental markets. The sheer volume of new inventory entering the market is staggering:

- Valtellina (Bormio/Livigno): Leads the region with a 56% explosion in available nights.

- Val di Fiemme: Has seen a 47% increase in inventory to accommodate Nordic skiing fans.

- Milan: The primary hub for ice sports and ceremonies has seen a 35% surge in listings.

While this influx of opportunistic “event-only” hosts creates more competition, the data suggests that established professional managers are maintaining a performance edge through higher service standards and better listing visibility.

Booked Nights Are Up, So Why Is Occupancy Down?

The data reveals a striking discrepancy: while total Booked Nights are up in almost every major market, Occupancy Percentages are down. This is the “Occupancy Paradox” of the 2026 Games.

In Milan, booked nights are pacing 25% higher than the same period last year. However, because the number of available homes grew even faster (+35%), the occupancy rate dropped from 72% down to 60%. Similarly, Cortina saw its occupancy drop from 67% to 55%. This does not indicate a lack of demand, but rather a market that has expanded its capacity faster than the immediate influx of travelers can fill it.

Hosts Chose Higher Rates Over Higher Occupancy, And It Paid Off

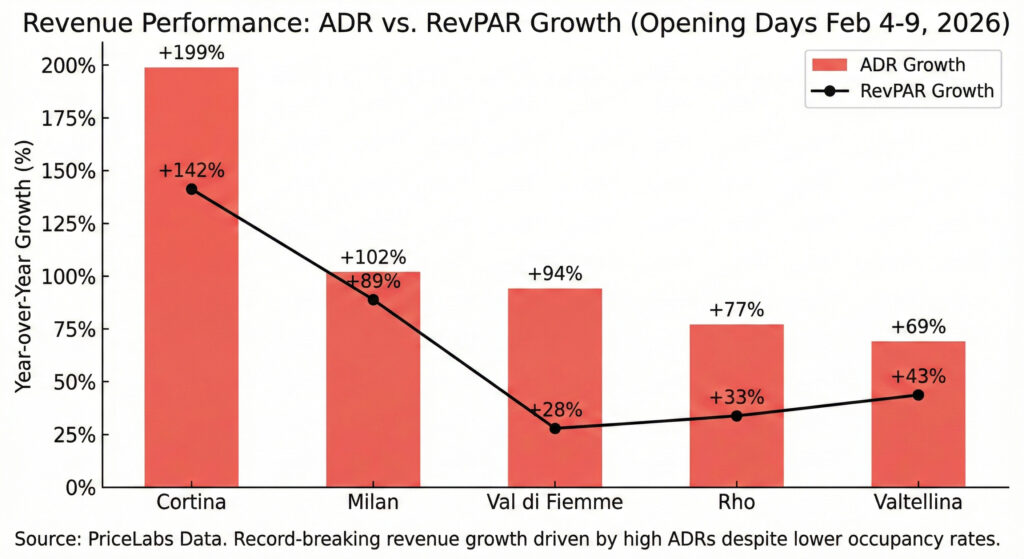

The most significant trend for the opening week is the survival of Pricing Discipline. Despite the increased competition, Average Daily Rates (ADR) have remained remarkably high, proving that Olympic travelers are relatively price-insensitive when it comes to location.

- The Cortina Premium: ADR in Cortina skyrocketed to €1,043, a 199% increase over last year’s €349.

- The Milan Surge: Milan’s ADR doubled (+102%) to €443, resulting in an 89% jump in RevPAR.

- The Transit Halo: Areas like Rho (up 77% in ADR) and Val di Fiemme (up 94%) demonstrate how even secondary markets are benefiting from the supply-and-demand tension of the opening days.

Market Summary: Opening Days (Feb 4–9, 2026)

| Market | Supply Growth | ADR Growth | RevPAR Growth |

| Cortina | +21% | +199% | +142% |

| Milan | +35% | +102% | +89% |

| Val di Fiemme | +47% | +94% | +28% |

| Rho | +36% | +77% | +33% |

| Valtellina | +56% | +69% | +43% |

The Bottom Line

The Milano Cortina Games prove that mega-events can fundamentally alter a region’s hospitality landscape in a matter of days. While the surge in supply may create the illusion of a softer market through lower occupancy percentages, the record-breaking RevPAR and ADR growth confirm that Northern Italy’s rental market is operating at a historic premium.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.