Airbnb in 2018 felt like a quirky travel startup; Airbnb in 2025 feels like a global OTA.

What once defined Airbnb, host-led stays, loose rules, and a sense of informality, is now giving way to a playbook that looks increasingly similar to Booking.com. And based on Airbnb’s own 2025 communication, the company has now formalised four strategic pillars that will guide its direction into 2026:

- Make the service better for hosts and guests

- Bring Airbnb to more parts of the world

- Expand what Airbnb offers beyond stays

- Integrate AI across Airbnb to make the experience smarter, more personal, and easier to use

Thibault Masson and Uvika Wahi walked through everything Airbnb threw at operators this year: the cancellation rule changes, new payout terms, the host-only fee shift, the return of Experiences, the launch of Services, Hotels, and Airbnb’s renewed enthusiasm for AI and connected all the dots for property managers.

Below are the key takeaways from the session.

1. Expect Higher Cancellation Rates in 2026

Thibault opened the webinar by addressing the single biggest shift property managers feel most directly: Airbnb removed the Strict cancellation policy.

- Strict is no longer offered to new listings.

- Existing listings were allowed to “grandfather” it only if they opted in earlier this year.

- Even for grandfathered listings, Airbnb has added 24-hour free cancellation on top.

This showed up in our live polls as well: a strong share of attendees said they’d prefer fewer, more reliable bookings instead of chasing volume that ends up cancelling later.

As Thibault put it: “Airbnb is clearly making the platform more guest-friendly around cancellations.”

He explained why this is happening through the lens of his Booking.com experience:

At Booking.com, the data has always shown:

- More flexible cancellation = more conversions

- More conversions = higher total bookings across the platform

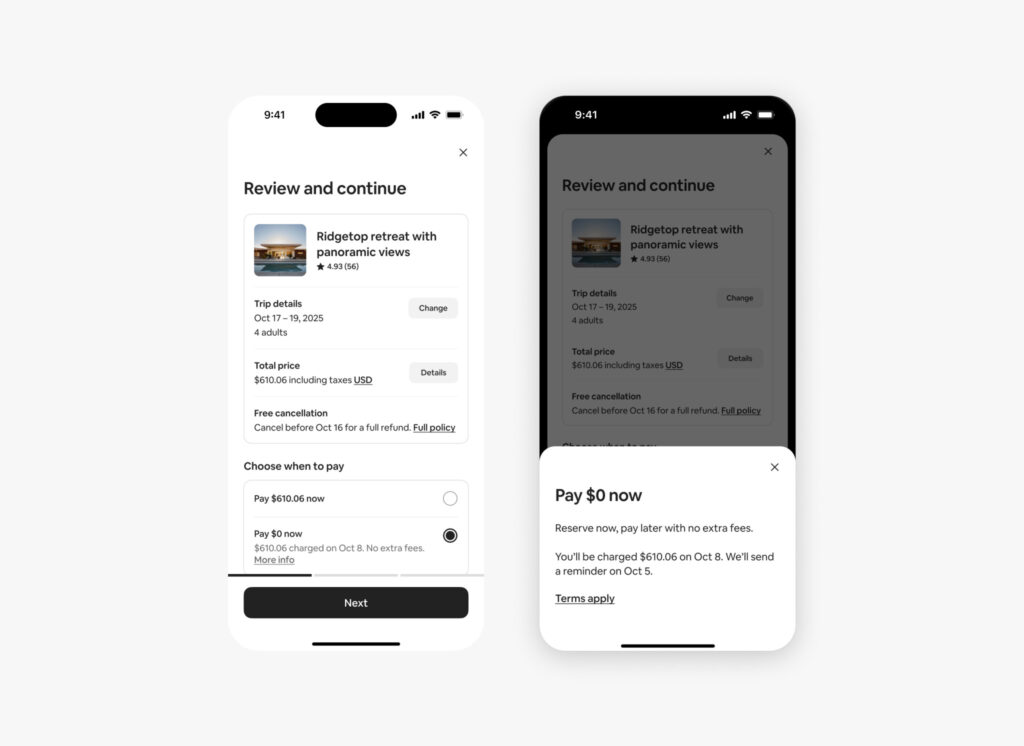

What’s coming next: Dynamic cancellation policies (2026)

Airbnb will soon let hosts assign different cancellation policies to different dates, for example, Firm in peak season, Flexible in low season, and Moderate during shoulder season.

Takeaway for managers:

With strict cancellations gone, 24-hour free cancellations now universal, Reserve Now Pay Later adding uncertainty, and dynamic cancellation policies encouraging flexibility, managers should expect more churn in 2026. Protect your revenue by tightening minimum stays, adjusting advance notice rules, and using dynamic pricing to absorb volatility.

2. Airbnb’s Becoming Booking.com… But Only in the Ways that Suit the Brand Ethos

A clear pattern in 2025 was Airbnb adopting several proven OTA mechanics, ones Booking.com has had on its platform for years, to improve conversion, widen search flexibility, and support marketplace reliability.

| Where Airbnb is following Booking.com | Where Airbnb refuses to copy Booking.com |

| Host-Fee only | Airbnb as lifestyle brand vs. travel website |

| Cancellation flexibility | HIgher price points |

| Flexible search results: showing stays outside filters | No loyalty programs |

| Hotels as a new supply source | Marketing focused on “belonging”/design |

| Connected trips / experiences |

Uvika noted that after viewing a hotel once, her Airbnb homepage began showing hotel carousels, a clear sign of how deeply personalisation is shaping the experience. It’s not a push, but a nudge, and we can expect more of these as Airbnb shows guests that hotels are now part of the platform.

The takeaway:

Airbnb is adopting OTA mechanics that affect how guests browse and book, but it isn’t abandoning its core identity. For managers, this means competing under OTA-style rules while still meeting Airbnb’s higher standards for distinctiveness and guest experience.

3. Airbnb’s Bigger Bet: Becoming a Lifestyle Platform With Two New Businesses a Year

Airbnb had promised two new businesses a year; in 2025 delivered three. But “new businesses” doesn’t necessarily mean brand-new launches. In Airbnb’s model, it also includes relaunches of older verticals, rebuilt and rolled out using its new pilot-first strategy.

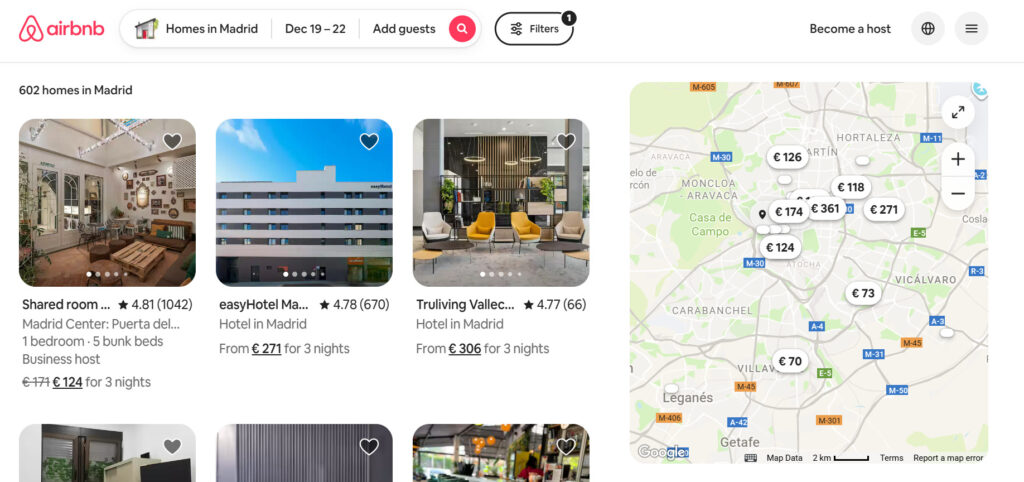

1. Hotels: The Most Booking. com-Like Move

- Hotel listing pages (multiple room types, hotel-style UI)

- A dedicated hotel search experience

- Pilots in NYC, LA, and Madrid, chosen for: heavy regulation, low STR supply

- Personalised nudges: Once you click a hotel, Airbnb starts showing hotel carousels on the homepage.

- The listing description isn’t AI-generated, only the short synopsis at the top is. Airbnb uses AI to pull out key themes from reviews and amenities, but the main description still comes from the hotel.

Thibault’s take: Hotels aren’t replacing STRs; they’re a plug for supply gaps in cities where Airbnb lost inventory or needs more reliability.

🔮Our Airbnb Predictions for 2026: Airbnb Luxe Relaunch

A relaunch could include:

- Concierge

- Pre-arrival services

- Private chefs

- Premium cleaning

- Enhanced guest vetting

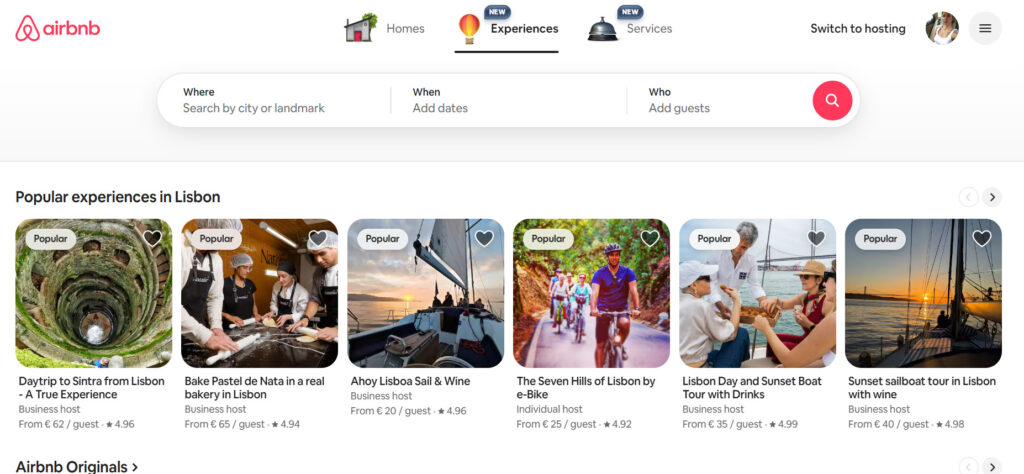

2. Experiences: Reinvented, and Now “Core” to Airbnb

Airbnb brought the Experiences back, and they rebuilt them to fit into the Connected Trip strategy. What changed?

- Experiences now surface on the homepage through personalised carousels, especially after you’ve interacted with them or searched in a city where they’re being actively piloted.

- Not new to locals, but now more heavily booked by locals than before

Uvika highlighted a key stat Airbnb shared: A huge portion of Experience bookings come from locals who aren’t booking a stay.

🔮Our Airbnb Predictions for 2026: The “Host Services Marketplace”

Airbnb has been teasing this for years, and it is now the closest it’s ever been. The marketplace would allow hosts to hire Cleaners, maintenance, and turnover teams all inside Airbnb. Airbnb controls demand, workflow, identity verification, and payment, and collects a fee.

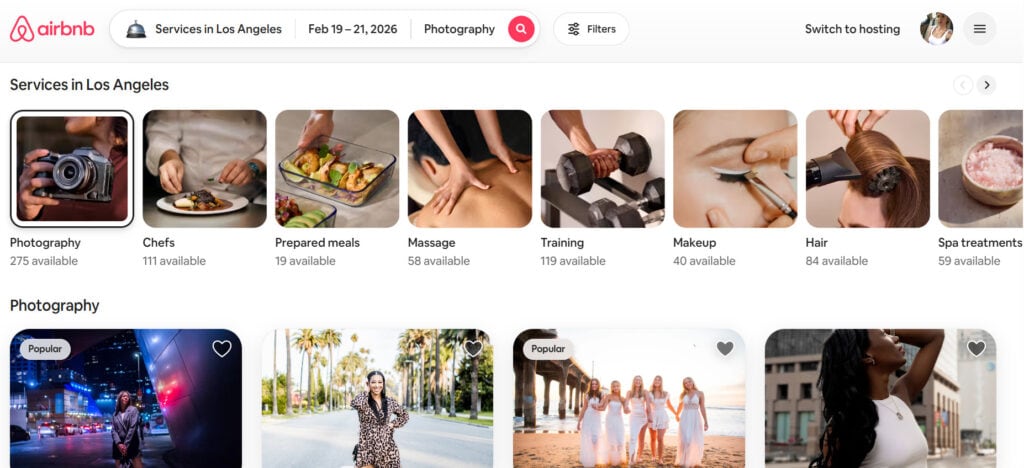

3. Airbnb Services: The New “Lifestyle Marketplace”

- Guests can now book add-on services, some delivered inside your property (like private chefs, yoga sessions, or massages), and others that can happen independently of a stay booking.

- Hosts currently have little to no control over these services: They happen in your property, they use your asset, and in most cases, you don’t get a cut.

Thibault noted this mirrors the criticism PMs had with Vrbo’s BabyQuip partnership, platforms monetising upsells that hosts already provide.

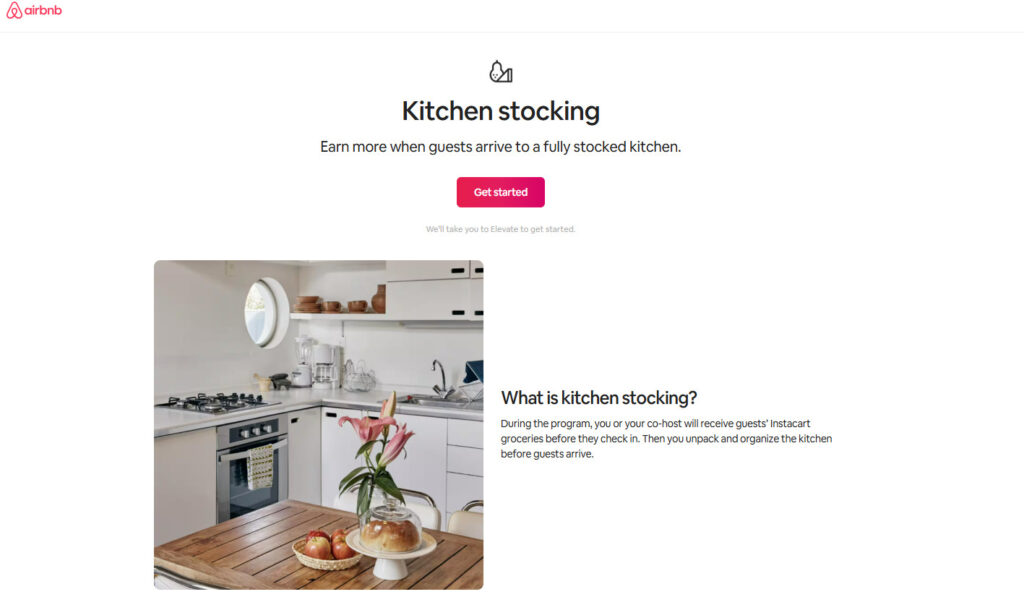

🔮 Our Airbnb Predictions for 2026: Delivery & Kitchen-Stocking

Airbnb has already piloted:

- Grocery delivery with Instacart

- Fridge stocking

- Local goods delivery

It’s a new business line. Bigger basket sizes, more touchpoints, and new revenue streams (all controlled by Airbnb).

4. AI Became Airbnb’s Fourth Strategic Pillar

Airbnb went from shrugging at AI to making it its fourth strategic pillar in 2025, a huge reversal that sets the tone for everything coming in 2026.

Where you can already see AI on Airbnb

- AI-generated hotel descriptions

- Smart summaries of “why guests love this place”

- Dynamic highlights based on your country/behaviour

- Homepage carousels that shift as you browse

- Search results that feel increasingly personalised

Thibault put it in context:

“Airbnb isn’t just competing with Booking.com anymore, it’s competing with ChatGPT-style search.”

Where AI is heading next?

- Natural language search (“Find me a cabin with a hot tub for 4 in March”)

- More personalised ranking for every user

- More interpretation of guest intent

- Faster AI-driven customer support

- Deeper profile-based matching across Stays, Hotels, and Experiences

Takeaway for managers:

AI will play a much bigger role in 2026, from ranking to personalisation, to how Airbnb decides what to surface for each guest. Airbnb has already confirmed that over 800 factors influence visibility, and AI will only make those signals more dynamic. With natural-language search and deeper behavioural targeting likely rolling out, managers need to make their listings “AI-ready”: clear amenities, fast replies, strong reviews, accurate details, and pricing that converts.

Airbnb is scaling up, branching out, and doubling down on AI. For property managers, the message is simple: sharpen your fundamentals, stay flexible, and get ready for a platform that behaves less like a niche marketplace and more like a full-scale travel engine. The hosts who prepare now will be the ones who win in 2026.

For more information, you can download the deck we used during the webinar here.

Snigdha Parghan is a Content Marketer at RSU by PriceLabs, where she creates articles, manages daily social media, and repurposes news and analysis into podcasts and video content for short-term rental professionals. With a focus on technology, operations, and marketing, Snigdha helps property managers stay informed and adapt to industry shifts.