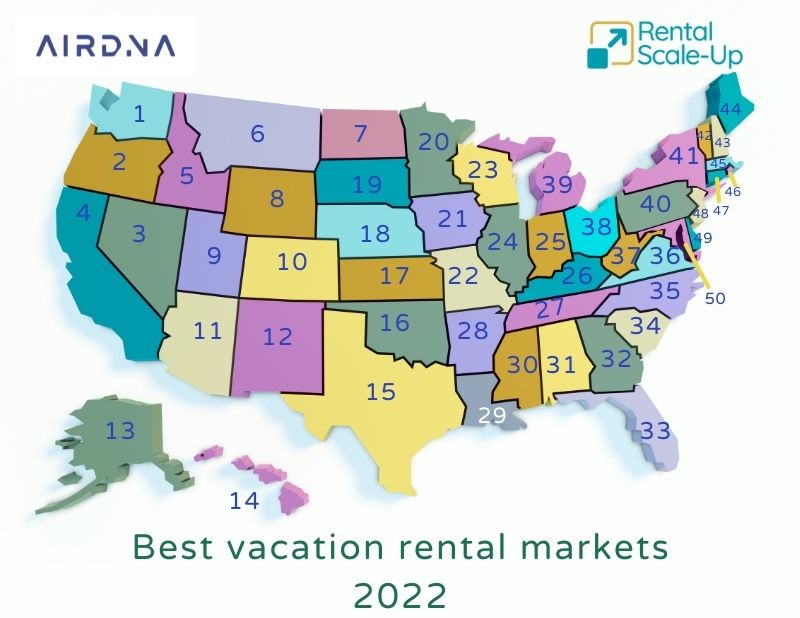

AirDNA has just released its list of the best places to invest in a U.S. vacation rental in 2022, ranging from Hawaii to Alaska and everywhere in between. The complete report can be seen here.

What makes this different from anyone else’s list of the top places to invest? Using the most extensive dataset in the industry and expert analysis, AirDNA offers a clear framework for what makes a great investment in each of these markets, whether that’s down to the neighborhood, property size, or to-die-for amenities. Let’s take a look at AirDNA’s methodology, their top 25 best vacation rentals in 2022, and examine how and why certain trends have changed since 2020.

AirDNA Methodology

AirDNA looks far beyond which cities are currently getting the most traffic. Their methodology is far more extensive and finds the best high-performing short-term rental markets for investors to have the greatest chance of return. To achieve this, they examine the following:

- Rental Demand: AirDNA takes a look at how often rentals are booked throughout the year. They do this by combining the TTM occupancy with listing growth rates.

- Revenue Growth: AirDNA sees if properties earned more money this year than the previous two by looking at the TTM and the yearly changes in revenue per available room.

- Intestibility: AirDNA uses a simple equation to determine the expected income of a property compared to the cost of purchasing it. They take the average revenue of homes in the area, subtract what they believe the average cost of running the property would be, and then divide the sum of that by the values of typical homes of a similar size in the same area.

Combined, these three metrics allow AirDNA to create a much more accurate list of top vacation rentals for investors than most others. Here are AirDNA’s top 25 U.S. vacation rentals in 2022:

Top 25 U.S. Vacation Rental Markets to Invest in 2022:

- Maui, HI

- Kenai Peninsula, AK

- Chattanooga, TN

- Gulfport/Biloxi, MS

- Slidell, LA

- Crystal River, FL

- Joshua Tree, CA

- Charleston, SC

- Galena, IL

- Southwest Harbor, ME

- Three Rivers, CA

- Gainesville, FL

- Buffalo, NY

- Brookings, OR

- Helen, GA

- Townsend, TN

- Broken Bow, OK

- Key West, FL

- Cloudcroft, NM

- Kansas City, MO

- Williamstown, KY

- Memphis, TN

- Black Hills, SD

- St. Louis, MO

- Santa Rosa, CA

A Closer Look at the Top 3

So how did Maui, Hawai’i, Kenai Peninsula, Alaska, and Chattanooga, Tennessee place in the top 3 ahead of the forever-popular Florida? Let’s take a look at each of them.

- Maui

With the return of fly-to travel, Maui takes the top spot on the list. Even though it is expensive to buy anywhere in Hawai’i, with the average property costing $802k, Maui is currently boasting a 73% occupancy rate and a daily rate of $375, making the average yearly revenue $102k. According to current investors, the best places to buy property on the island are in Lahaina and Wailuku, but really you can buy anywhere and still expect to see high revenue. Just about every area of Maui scored high on AirDNA’s list. - Kenai Peninsula

Just like with Maui, the return of fly-to travel has made Alaska a go-to destination for those who want to be close to some of the most beautiful nature in the United States. A much more affordable investment, the average cost for a home on the Kenai Peninsula is $237k and it boasts 67% occupancy and a daily rate of $262, making the average yearly revenue $44k. Even though Kenai is not a year-round destination, the peninsula sees a lot of visitors during the summer months as people try to take advantage of seeing the stunning nature and wildlife. Investors can expect occupancy to be as high as 80% during these peak months, a 20% increase from before the pandemic. Overall, Kenai scored a whopping 94 in Revenue Growth over the last two years. - Chattanooga

A big destination for regional travelers, Chattanooga scored a 98 in Rental Demand. The average home in Chattanooga currently costs $258k, but Zillow predicts it will go up by as much as 17% in 2022, so now is the best time to invest. With occupancy at 70% and average daily rates at $180, investors can expect an average yearly revenue of $47k. Chattanooga will likely rank lower on AirDNA’s list this time next year as housing prices increase, so get in while you can because visitors certainly aren’t going to stop visiting the Appalaichan Mountains anytime soon.

The Current Trends and How They Have Changed

AirDNA’s list shows us that small and mid-sized cities are the best places to be investing in right now, and they have seen a 55% increase in their revenue potential overall. It’s likely that people are still trying to avoid highly populated areas due to the less severe but still ongoing pandemic. However, since people have been stuck inside and at home for so long, they are seeking destinations closer to nature and the outdoors in general. In 2022, we are seeing an increasing number of fly-to destinations making the list as people become more comfortable with flying again.

This is a drastic change from the 2020 and 2021 trends, which saw rural and drive-to markets explode, while urban markets were completely staling along with many hosts and listings dropping off. Obviously, this was due to unforeseen and extreme circumstances as the pandemic controlled the world, but we are now seeing better revenue numbers than we did even before the pandemic. At the beginning of 2021, vacation rental revenues were down 20% from the previous year. Yet, by the end of 2021, revenue was up by 20% from the previous year and AirDNA is seeing those numbers continue to grow.

AirDNA’s methodology for calculating which markets and places to invest in is one of the most comprehensive and accurate you will be able to find. Based on their ranking for 2022, we know that the current trends in travel lean heavily in favor of small and mid-sized cities along with nature destinations and those are the strongest places for investments at this time.