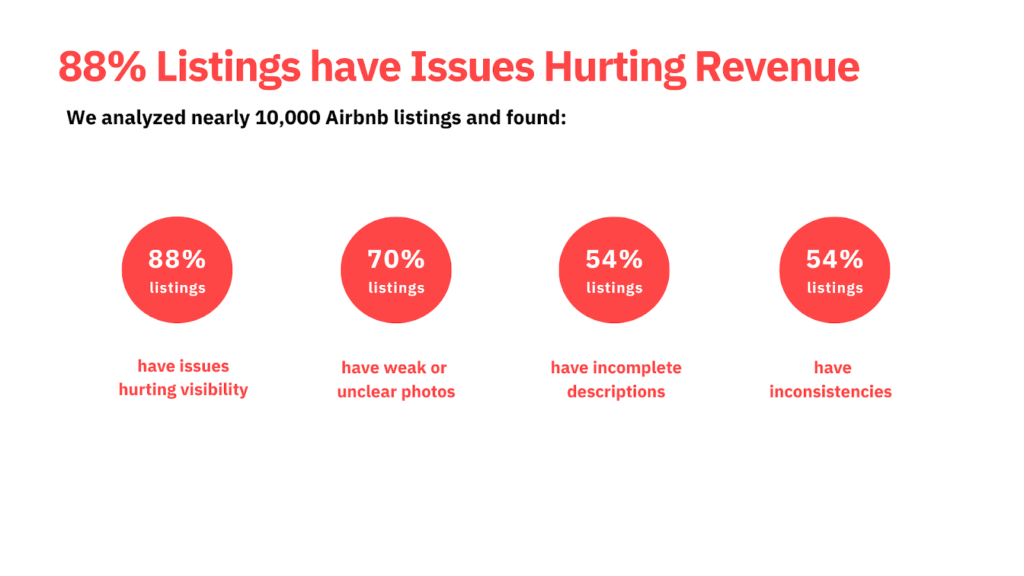

When PriceLabs analyzed more than 10,000 active Airbnb listings, one result stood out immediately: 88% of listings showed content issues that directly hurt visibility, guest trust, or conversion.

This wasn’t a surface-level audit. The study reviewed publicly available Airbnb listing content and guest reviews across 9 diverse markets, spanning urban, leisure, and mixed-demand destinations. That data was then enriched with PriceLabs’ historical performance benchmarks, built from millions of listings worldwide.

The goal was simple: understand what consistently separates listings that outperform their local market from those that don’t.

What emerged was not a pricing story.

It was a visibility and conversion story.

In many cases, listings weren’t underperforming because they were priced incorrectly; they were underperforming because guests weren’t finding them, clicking on them, or trusting what they saw once they did.

What “Poor Listing Quality” Actually Looks Like in Practice

One of the most surprising findings was that most underperforming listings didn’t look “bad” at first glance.

They were professionally managed.

They had decent photos.

They had acceptable descriptions.

But when the data was reviewed at scale, recurring issues appeared again and again:

- Photos that didn’t clearly explain the space or layout

- Descriptions that skipped details guests consistently care about

- Amenities listed but not shown, or shown but not listed

- Titles that failed to communicate why the listing was worth clicking

Individually, these issues feel minor. Across a portfolio, they quietly compound.

Only 12% of listings showed consistently strong, aligned, revenue-driving content across photos, titles, descriptions, and amenities. Those listings were 35% more likely to outperform their market.

Why This Often Gets Misdiagnosed as a Pricing Problem

For property managers, the first visible symptom of underperformance is usually slower bookings. Naturally, pricing becomes the focus.

But the data revealed a different sequence:

- Guests don’t fully understand the listing

Guests hesitate or filter it out - Click-through rate drops

Booking pace slows - Prices get lowered, without fixing the real issue

Even perfect pricing cannot compensate for a listing that guests never choose.

This explains why many professional portfolios experience diminishing returns from repeated price adjustments, especially in competitive markets where content quality differences decide which listings even get considered.

Why Listing Quality Is Harder for Large Portfolios

Listing quality has always mattered, but why has it become so critical today?

Two platform shifts help explain this:

- Airbnb has stated it evaluates 800+ signals when ranking listings, many of which relate to clarity, consistency, guest behavior, and trust.

- Vrbo has recently tightened its visibility and performance milestones, making content quality and consistency harder to ignore.

As artificial intelligence increasingly shapes search and ranking logic, small quality gaps now carry outsized consequences. What once felt like a “nice-to-have” has become a gating factor for visibility. This is the moment when listing quality moved from a hygiene factor to a measurable revenue lever.

Why Manual Fixes Break at Portfolio Scale

This challenge disproportionately affects professional operators managing 100, 500, or 1,000+ listings.

Not because teams don’t care, but because of how operations scale:

- Multiple teams touch the listing over time

- Owners upload or replace photos independently

- Amenities change faster than content gets updated

- Guest feedback is scattered across hundreds of reviews

No single listing looks broken. But across a portfolio, performance leaks quietly.

The cost here isn’t just quality; it’s time, coordination, and opportunity cost. Manual audits that work for five listings collapse under the weight of five hundred.

Ratings and Badges Are No Longer Enough

Another insight from the analysis: traditional quality signals are no longer differentiators.

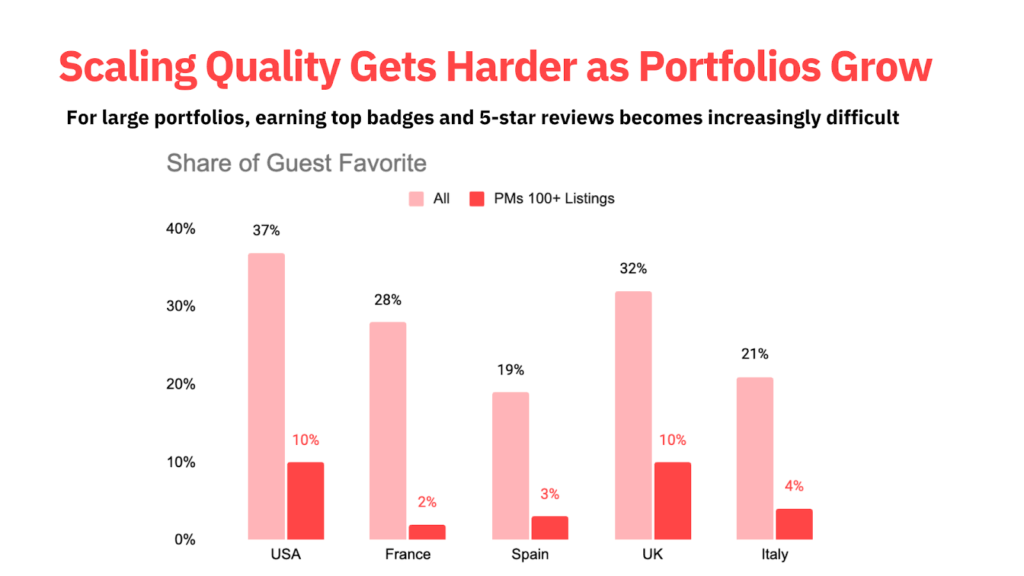

In the United States, roughly 30% of listings now carry Guest Favorite badges. Among large property managers, that share drops closer to 10%.

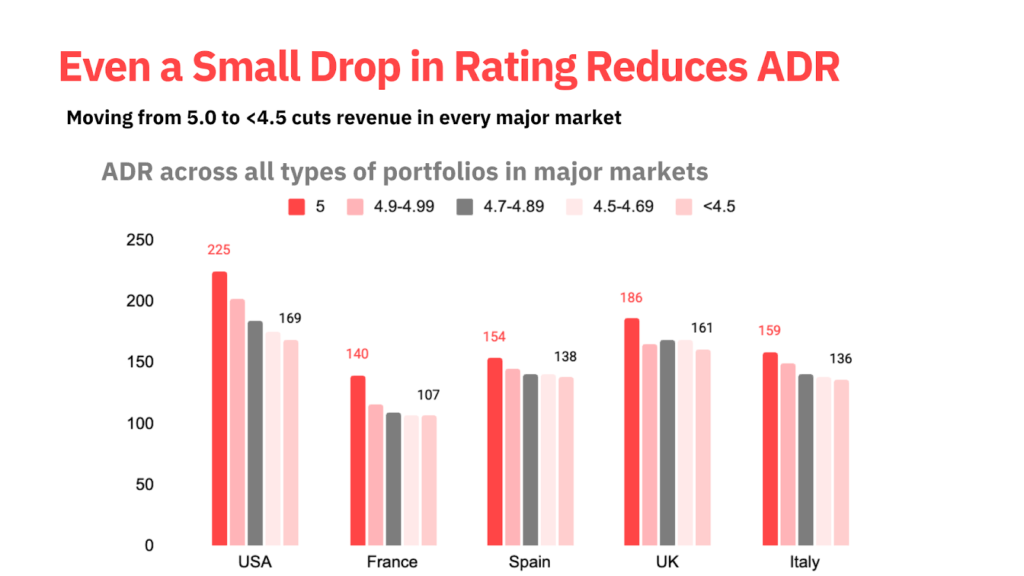

At the same time, even small rating differences matter financially. Listings rated 5.0 consistently command meaningfully higher Average Daily Rate (ADR) than those in the high-4 range.

The takeaway isn’t “chase badges.” It’s that clarity, consistency, and expectation-setting now drive both ranking and pricing power.

Guest Favorite badges are harder to earn at scale. In every market shown — including the US, UK, France, Spain, and Italy, large property managers (100+ listings) earn these top quality signals far less often than the market average.

Why Manual Listing Reviews Can’t Keep Up at Scale

As the analysis deepened, one pattern became clear: Inconsistency was the biggest silent performance killer.

Not pricing. Not availability. Inconsistency between what guests read, see, and experience.

At the portfolio scale, identifying these gaps requires:

- Structured comparison, not spot checks

- Aggregated review signals, not anecdotal feedback

- Clear prioritization, not blanket “improve everything” tasks

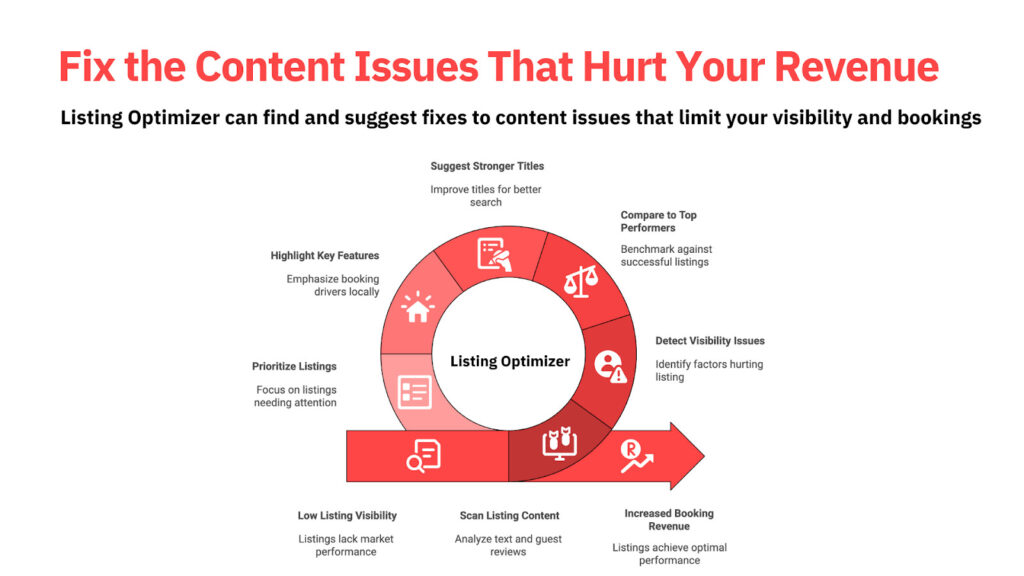

This gap, between knowing quality matters and knowing where it breaks down, is what led PriceLabs to build Listing Optimizer.

Where Listing Optimizer Fits (and What It’s Actually Designed to Do)

Listing Optimizer isn’t a marketing tool or a generic AI writer. It’s a PriceLabs-built system designed to surface performance issues that manual workflows miss.

It evaluates listings the way guests — and ranking systems — effectively do, but in a structured, repeatable way:

- Photos: clarity, relevance, order, and whether key spaces are actually shown

- Titles: whether they surface features guests value in that specific market

- Descriptions: completeness, clarity, and alignment with expectations

- Amenities: whether what’s listed matches what’s shown and described

- Reviews: recurring themes that signal confusion or unmet expectations

Crucially, it looks for misalignment across these elements, because that’s where trust breaks.

Generic AI tools can rewrite text. They cannot explain why a listing is being skipped or why similar properties nearby convert better. Listing Optimizer is trained on short-term rental–specific data and performance patterns, not language alone.

It also works independently of pricing. Whether managers price manually, use another tool, or mix approaches, content gaps can still be identified and addressed.

Final Thoughts

The research conclusion is clear: listing quality now has a direct, measurable impact on revenue.

As AI ranking systems get sharper, solutions like Listing Optimizer are promising, yet outcomes will still depend on execution: better photos, tighter amenity mapping, clearer descriptions, and operational follow-through.

The real shift for professional property managers is mindset. Listing quality now deserves the same rigor as pricing received a decade ago: measured, monitored, and prioritized.

Not because it’s new, but because the cost of getting it wrong has never been higher.

Snigdha Parghan is a Content Marketer at RSU by PriceLabs, where she creates articles, manages daily social media, and repurposes news and analysis into podcasts and video content for short-term rental professionals. With a focus on technology, operations, and marketing, Snigdha helps property managers stay informed and adapt to industry shifts.