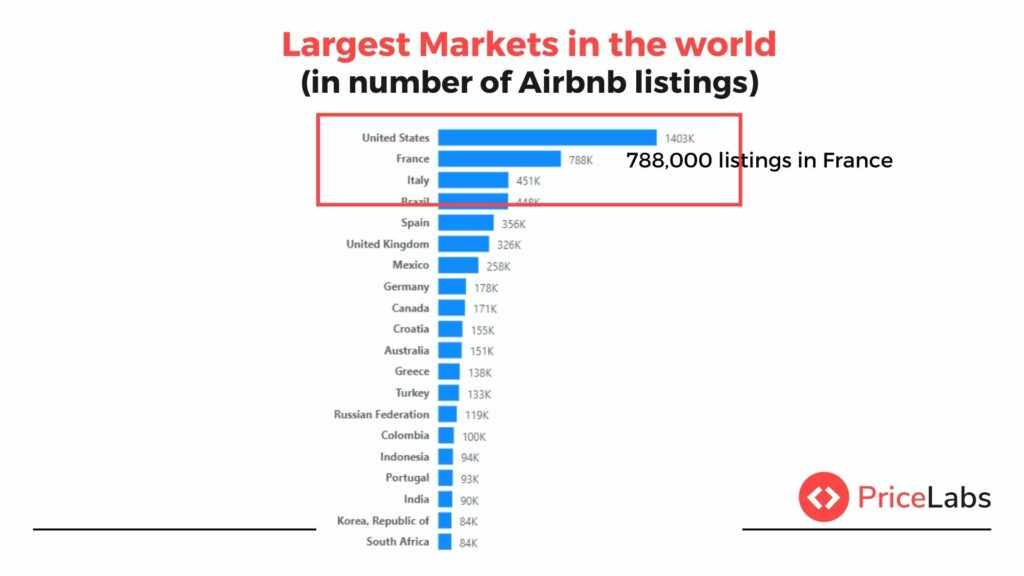

As the global community sets its sights on the Paris 2024 Summer Olympics, a significant shift is taking shape in the French short-term rental market. France, already the second-largest market for Airbnb, with 788,000 listings, stands poised at the brink of a transformative year. The impending sporting event presents a remarkable opportunity for the platform and its hosts to capitalize on a surge in demand. The Airbnb effect – the way in which the platform reshapes local housing markets – is anticipated to be felt more than ever in the French cities hosting the Olympic events. The outcome, however, is a delicate balance of market growth, evolving customer preferences, regulatory challenges, and the potential long-term effects on France’s housing landscape. Using data from Airbnb and PriceLabs, let’s dive into the French short-term rental market.

France’s Position as a Major Airbnb Market

As a renowned tourist destination, France has long held a significant role in Airbnb’s global operations. The country’s rich culture, history, and picturesque landscapes make it a magnet for tourists and, by extension, a lucrative market for Airbnb.

Even before the establishment of Airbnb, the concept of vacation rentals was well-embedded in the French culture. The short-term rental market in France is as diverse and enchanting as the country’s varied landscapes and rich history. Examples of these accommodations paint a vivid picture of the multitude of options available to travelers.

In France, the short-term rental market is fueled by international tourists and a robust domestic travel scene. French citizens, who typically enjoy five weeks of paid vacation, often choose to explore their diverse and scenic country. As such, tourism is more than a leisure activity in France; it’s a significant industry with a substantial economic footprint.

From the sun-drenched villas nestled amidst the glamour of Cannes to the iconic Haussmannian apartments lining the boulevards of Paris, the offerings are as chic as they are diverse. Travelers with a penchant for rustic charm can find solace in rural ‘gites‘, traditional holiday homes that offer a slice of the idyllic French countryside.

Venturing towards the snowy peaks of the French Alps, the warm glow of ski chalets beckons, providing cozy retreats after thrilling days on the slopes. The market also caters efficiently to the business traveler, with a range of ‘aparthotels‘.

Volume and Density of Vacation Rentals

In terms of vacation rentals’ volume and density, France outpaces many of its global counterparts. According to PriceLabs, a leading short-term rental market data firm, France boasts a striking density of vacation rentals that’s ten times higher than that of the United States. On a per square kilometer basis, France’s density stands at 1.4 listings, starkly overshadowing the 0.14 listings in the U.S. The French market, with its 788,000 listings, exemplifies the substantial appeal of short-term rentals in the country.

Regional Breakdown of Airbnb Listings

Drilling down into the regional distribution of listings in France, interesting patterns emerge. Contrary to what one might expect, Paris, or more accurately, the Île-de-France region, is not the region with the highest number of listings. In April 2023, the top three regions for Airbnb listings were:

- Provence-Alpes-Côte d’Azur (PACA): 138,000 listings

- Rhône-Alpes: 102,000 listings

- Île-de-France: 83,000 listings

This data suggests that Airbnb’s reach extends far beyond the confines of France’s capital, deeply penetrating other touristic regions.

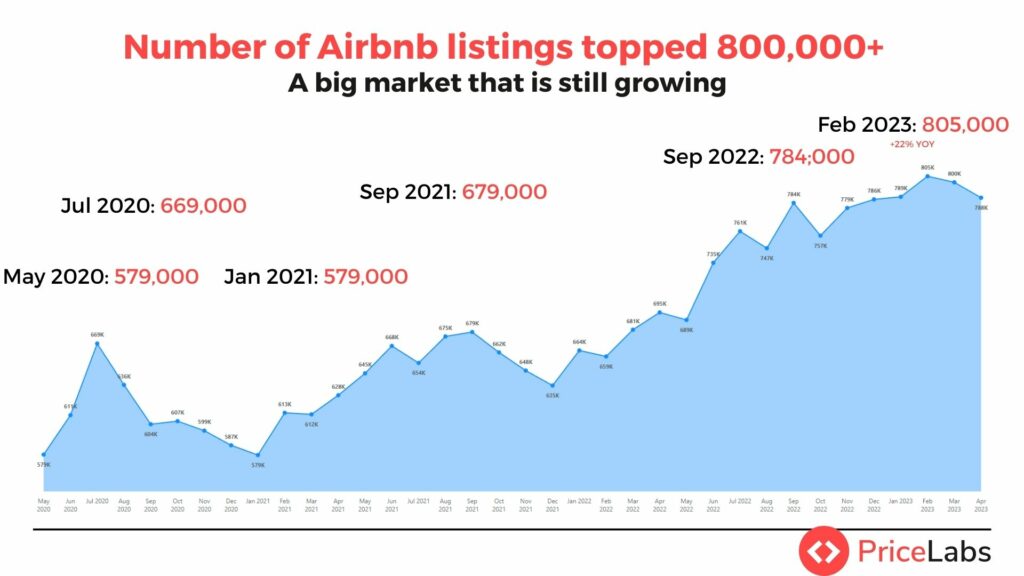

Growth of Airbnb Listings in France

The French market for Airbnb listings has demonstrated a notable upward trajectory. The following table illustrates the significant growth of listings in the country over a span of three years:

| Month & Year | Number of Airbnb Listings in France |

| May 2020 | 579,000 |

| July 2020 | 669,000 |

| January 2021 | 579,000 |

| September 2021 | 679,000 |

| September 2022 | 784,000 |

| February 2023 | 805,000 |

Comparison with Airbnb’s Largest Market – The U.S.

Even when juxtaposed with the United States—Airbnb’s largest market—France’s substantial standing doesn’t waver. While the U.S. hosts 1,403,000 listings, the gap in density illustrates how concentrated the French market is. This, in part, underscores the distinctive nature of France as a major player in Airbnb’s global strategy.

Undoubtedly, the unique characteristics of the French market, coupled with the forthcoming Paris 2024 Summer Olympics, have set the stage for a potential reshaping of the short-term rental landscape in the country. However, along with these opportunities come challenges that Airbnb must navigate wisely.

The Anticipated Impact of the 2024 Paris Olympics on the French Airbnb Market

As the world looks forward to the Paris 2024 Summer Olympics, an undercurrent of excitement is sweeping through the French short-term rental market, most notably on Airbnb, which has a robust presence in the country.

Influence on Demand and Supply Dynamics

The Olympic Games, a revered global event, consistently draw a massive international audience. The expected influx of visitors to France for the event naturally elevates demand for accommodation, providing a ripe opportunity for Airbnb. In response, hosts are expected to increase the supply of listings, with existing hosts likely to make additional properties available and new hosts joining the platform. Airbnb data shows that searches for stays during the Olympic Games surged six times higher during the first phase of ticket sales and increased nine-fold following the second phase, underlining the event’s potential impact.

Geographical Spread of the Olympics: Stimulating Nationwide Short-Term Rental Activity

The Paris 2024 Summer Olympics will not be confined to Paris but will extend to various French cities, amplifying the impact on the short-term rental market across the nation. Alongside Paris, the most searched-for cities on Airbnb include Marseille, Boulogne-Billancourt, and Clichy, among others, suggesting increased short-term rental activity beyond the French capital. This wider geographical impact can stimulate Airbnb activity in locations with typically less tourist traffic, fostering a dynamic short-term rental market across France.

As we draw closer to the Paris 2024 Summer Olympics, its influence on Airbnb’s market in France grows more tangible. With significant opportunities at hand, Airbnb’s response will undeniably play a crucial role in shaping its trajectory in the French market.

Airbnb’s Strategy: Increasing the Supply

Airbnb’s continued success hinges significantly on its ability to increase the supply of listings on its platform to meet surging demand. Amidst the excitement of the upcoming Olympics, Airbnb has undertaken strategic initiatives aimed at ramping up the supply of both short-term rentals and individual rooms.

Attracting New Hosts: Airbnb’s Campaign

Key to Airbnb’s strategy of expanding its supply is the attraction of new hosts to the platform. Airbnb has been actively campaigning to recruit more hosts, promoting the financial benefits of hosting, the opportunity to meet people from diverse cultures, and the sense of community the platform offers. The surge in demand, catalyzed by the Olympics, presents a potential windfall for new hosts, making this an opportune time to join Airbnb’s growing host community.

Introduction of Airbnb Rooms: A Strategic Move

Adding another dimension to its supply-enhancing strategy, Airbnb has introduced Airbnb Rooms, a feature that allows hosts to rent out individual rooms in their homes. This move is strategic on multiple fronts.

Firstly, Airbnb Rooms enables Airbnb to offer more affordable accommodation options to guests. In recent times, Airbnb has sometimes been perceived as a pricier alternative in the accommodation market. By facilitating the hosting of individual rooms, which are typically cheaper than full properties, Airbnb can attract a broader customer base that includes budget-conscious travelers.

Secondly, Airbnb Rooms provides a solution to potential hosts in cities with strict regulations on short-term rentals. In many cities, laws are less restrictive for renting out individual rooms compared to entire properties. Therefore, Airbnb Rooms can enable would-be hosts in these areas to join the platform and contribute to the supply of listings.

With these strategies, Airbnb aims to bolster its accommodation offerings, catering to a wide range of preferences and price points. As the Paris 2024 Summer Olympics draw closer, these initiatives could play a pivotal role in determining Airbnb’s performance in its second-largest market.

The Escalating Debate Around Regulatory Measures

Current Regulatory Landscape

The short-term rental market in France, dominated by platforms like Airbnb, Booking.com, and Abritel (Vrbo’s local brand name), is already under a set of stringent regulations. These rules primarily aim to balance the economic benefits of tourism with the protection of the long-term housing market. Various restrictions apply, ranging from rental duration limits to compulsory registration of rentals in certain cities.

Mounting Concerns and Debates

Despite the existing regulatory framework, there is a growing concern that the short-term rental market, particularly Airbnb, is disrupting the housing market. Critics argue that Airbnb’s model, by converting long-term rentals into short-term lodgings, exacerbates the housing crisis, especially in tourist-heavy zones.

These concerns have stirred lively debates among the public, policymakers, and the housing sector. They argue that while Airbnb offers economic opportunities, there needs to be a balance to ensure it doesn’t lead to a shortage of affordable housing.

Pressure from Citizen Groups and Politicians

The increasing prominence of Airbnb, amplified by the forthcoming Paris 2024 Olympics, has sparked increasing calls for more stringent regulations. Citizen groups and politicians are intensifying their pressure on regulatory bodies for stricter control measures.

Recently, the deputies of the Socialist Party, led by Inaki Echaniz, have presented a legislative proposal. The proposal seeks to combat the tax advantages enjoyed by Airbnb, citing it as a contributing factor to the housing crisis in tourist areas. This initiative is significant as it indicates a political will to further tighten the regulatory reins around short-term rentals.

Potential Changes to Tax Laws

The legislative proposal includes key changes to the tax laws for furnished tourist accommodations. Under the proposed law, these accommodations would be partially excluded from the tax reduction scheme currently available for non-professional micro industrial and commercial benefits.

Additionally, the proposal aims to clamp down on fraudulent practices and introduces more stringent rental conditions. It also suggests a reduction in the number of nights allowed for main residences from 120 to 60.

While this proposal is yet to be debated or approved, it underscores the escalating debate around Airbnb’s impact and the need for further regulation in the French short-term rental market. The direction these debates take will undoubtedly shape Airbnb’s operations, the hosting community, and the wider housing market in the country.