This is the most significant post I’ve done to date. It has far reaching insights into Airbnb and its explosive growth into the vacation rental industry. As this post grew longer and richer in content, I realised I had to write an eBook with more detail.

But first, this is the story of how I discovered what was happening.

Strange Airbnb valuation

Alarms first started ringing on 21 March 2014 when I read a small item in the business press about Airbnb, the couch surfing website.

A capital raising gave an apparent $10 billion valuation to Airbnb. Far more than the $4 billion valuation of Homeaway, the largest and longest established vacation rental listing company. The big Gorilla of our industry.

What??

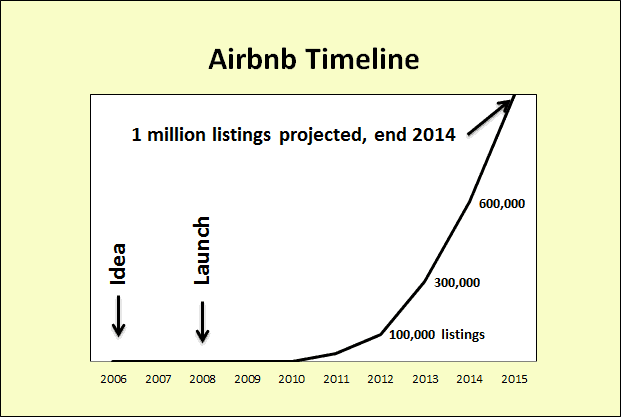

How could a small new player be valued much higher than the proven star performer? This graph provides part of the explanation.

Since launching in 2008, the numbers have been quietly building from zero base, but at a high growth rate. For many years the total numbers were small but in the last year, exponential growth propelled Airbnb into global prominence.

In the latter half of this year, Airbnb will grow larger than Homeaway. There is a new big hairy Gorilla in the vacation rental industry.

Many Australians will not have heard of Homeaway apart from it acquiring the local Stayz holiday rental website at the end of 2013. But now even Homeaway is being eclipsed.

Is Airbnb having any impact locally?

There had been local whispers in my Richmond Melbourne area that the market had suddenly dropped off.

I did a thorough check in my market and I was astonished at the growth of Airbnb. In less than a year it has gone from nothing to more than double the listings of the local Stayz provider in my market. Operators on the ground confirm that it is happening.

But isn’t Airbnb just sharing a couch?

No. That is the popular story in the press. In fact Airbnb is far more. It is a sophisticated platform for renting a full house, a full apartment or a private room. These days, the few couches for rent are insignificant compared to the hundreds of thousands of full houses and apartments for rent. Oops!

Why is it growing so fast?

The owners of Airbnb have grown a platform to make it easy for owners to rent out an apartment, and for guests to rent that apartment.

Not only can guests leave reviews of the apartment, in a new twist owners can leave reviews about the guests. The guests can see the reviews so they can trust what they are getting. The owners can see the reviews about the guests, so they can trust who is staying. It is a model based on trust, layers of it. I kept counting the trust layers till I stopped at 8! I have to admit I’m impressed.

My ‘Airbnb 8 Layers of Trust’ model

In my free eBook I give details of what I call the ‘Airbnb 8 Layers of Trust’: guest reviews; owner reviews; free photography; tiny fee; enquiry help; easy payment; flexible security deposit; insurance. It explains why guests and owners like the model.

Why it is growing

Airbnb is growing virally. In the eBook I show why this is happening, with new twists in social media. I tell how a friend in Melbourne operates a rental solely on Airbnb and the 6 things she raves about.

Will Airbnb affect your vacation rental? You better believe it!

The Airbnb model has already morphed into a conventional rental platform. In my local sample only 37% of listings were for a Private room. The other 63% were for an entire house or an entire apartment. There were no couches for rent.

The concentration of listings is still in the urban areas, where folks are thinking ‘room sharing plus more’. The penetration in traditional summer holiday places in the regions is still small, but it will come as the platform is more widely known.

A real threat is that Airbnb will create a lot of competition and lower prices for commodity short term rentals.

Opportunities and limitations

Airbnb brings opportunities for those who can find ways of standing out on the new platform, and to list early in areas that still have limited Airbnb presence.

There are also challenges for owners as Airbnb takes tight control of guest information and limits telephone communication.

It is not for everyone. For example, the open public identity requirements of the Airbnb model will discourage those with privacy concerns from using it.

There is a lot to learn about Airbnb. As I uncovered more and more, I realised that it is too much for one web post and so I wrote the eBook:

“How the astonishing growth of Airbnb is changing vacation rentals.”

It is free to Holiday Rental Mastery readers. The eBook is the definitive guide to the emergence of Airbnb:

How Airbnb has grown

- How Guests, Bookings and Listings grew in 2012 before exploding in 2013.

- Why Australia is the 2nd biggest Airbnb market after the USA

- How I dug deep into the data to see exactly what happened in my local market and the astonishing result.

- The amazing growth in just the last 6 months.

- How my findings were validated by owners on the ground who are using Airbnb

- The (scary) impact on prices

Why Airbnb has grown

- Full description of the ‘Airbnb 8 Layers of Trust’

- The social model driving Airbnb growth

- Advantages and limitations

- Links to 7 stories describing Airbnb’s emergence including interviews with the global CEO and Homeaway’s naïve dismissal of Airbnb

The future

- My prediction of the future impact of Airbnb

- What you can do about Airbnb in your market

Has Airbnb penetrated your market already?

All vacation rental owners should check. The eBook contains a Toolkit for finding Airbnb numbers and its growth rate in your market. It uses my ‘5 Step Growth Measurement Method.’ It takes you step by step with a worked example.

Get your free eBook now: ‘How the astonishing growth in Airbnb is changing vacation rentals’.

What is your experience with Airbnb?

Tell me about your experience with Airbnb. Do you list with it? How is it working? Are there more competitors in your market now than a year ago?

Please leave a comment below.

Posted 28 Apr 2014

My first experience with AirBNB was through my husbands business associate, who uses it regularly. I checked it out and found that the fees would be astronomically high for us compared to Homeaway. 3% of each booking – Although that sounds like a deal initially, when you are a successful vacation homeowner renting over 43 weeks per year at a luxury rental rate, it isn’t. We would have to pay over $3,000 annually on each of our homes. We currently pay the Homeaway Group $650 for the US Bundle Package.

Also, we were turned off by their less than stellar owner authentication process, when a criminal had posted a listing with one of our home’s details and photos. It took me a month of constant e-mailing to get them to remove the fraudulent posting.

Not Impressed for our business profile!!!

Thank you Mary. Useful to know the Airbnb response was slow to remove the problem posting, I gather they are very fast locally here and will vary from country to country, given they are in 192 countries.

The 3% fees sound a lot, but they are tiny in comparison to many competitor listing sites. Fees of 8%- 12% are common, depending on the market and the competition in other listing sites. My fees average 8% for the local Stayz (Homeaway subsidiary) site which (used to) dominate my local market. Your $650 Homeaway package is an absolute bargain, and if you are getting occupancies in the 80%+ range, you would be crazy to use anything else. I gather many folks are paying quite a bit extra for Homeaway platinum listings.

I’d be interested in what other people’s experiences are – let me know in the comments 🙂

PS I’m not an advocate for Airbnb, just what works best locally. The thing that astonished me was the incredible rate of growth in Airbnb in my local market. One day no Airbnb, six months later they dominate.

Rex,

I have found that 40% of my bookings come from my own website, Stayz was out in front as number 2 but in only six months since I listed with Airbnb it has jumped over all the also rans to be almost equal number 2. I will not be surprised if it passes Stayz by next year. I need listing sites such as Stayz and Airbnb for off season, most peak season (3 months of the year) I can fill via my website, although a little slower if I do not use listing sites. In the off season (7 months of year) Stayz is costing me 18% in nightly fee plus annual fee. There are a lot of things I do not like about Airbnb due to their couch surfing origin, no weekly rate, no mid-week special by number of nights etc, and I am having to change some very successful well established practices I have been using for 15 years to use Airbnb effectively. However the guest pays the fee and the 3% I pay is offset by the saving in credit card merchant fee. ( There is the gain or loss on exchange rate between when the guest books and when they arrive which can be 6 months). However I am getting more bookings and saving 18% compared to Stayz, so the day may come when I can drop Stayz. Also Stayz guests tend to send out inquiries to at least 6 properties at once without studying which best meets their requirements. Ring them 10 minutes after they inquired and the typical Stayz user cannot remenber the names of the accommodation houses and sometimes which towns. Stayz users sometimes send you inquiries from other sites within half an hour of the Stayz inquiry. A fair percentage will send a second inquiry even after you have responded to the first. Their evaluation seems to be made after they have the prices. Airbnb users seem to read your listing more closely, more often than not decide they prefer your accommodation before they inquire (Rather than after you respond with Stayz) and are generally less price sensitive ( probably because they are not asking for bids from 6 providers). Maybe as more owners in my area sign to Airbnb it may not be so successful for me.

Thanks David, you are quite insightful about the differences between Stayz and Airbnb.

These two big players will evolve over time. As you say, as Airbnb has more rental competition, their performance will drop for the few early adopters. Time will tell how the market will react to Airbnb, the lack of privacy, the control over guest identity, reputation. re the latter reputation is bouncing around due to sudden transformation of markets – loathed in New York, blessed in San Francisco, and recorded churn of 30% in a year in some places.

Stayz will also evolve, as parent Homeaway experiments with pay per booking and pay for listing simultaneously. It is also experimenting with the Gogobot app for an insider guide to local experience.

It will be a wild ride for the next 2-5 years