For the past year, vacation rental managers have watched Airbnb dominate the “flexibility” conversation with its 2025 rollout of $0-down bookings. But in early 2026, the tables turned: Vrbo finally closed the gap by making Buy Now, Pay Later (BNPL) a core, exclusive part of its checkout experience through an expanded partnership with Affirm. While this news signals that flexible payments are now the industry standard, it also marks a critical shift in who carries the financial risk.

For professional short-term rental managers, the insight is clear: Vrbo has chosen a “FinTech” path that protects your payout, while Airbnb’s model remains an “operational” one that could leave your calendar vulnerable.

The Big News: Vrbo Goes All-In on “Buy Now, Pay Later” with Affirm

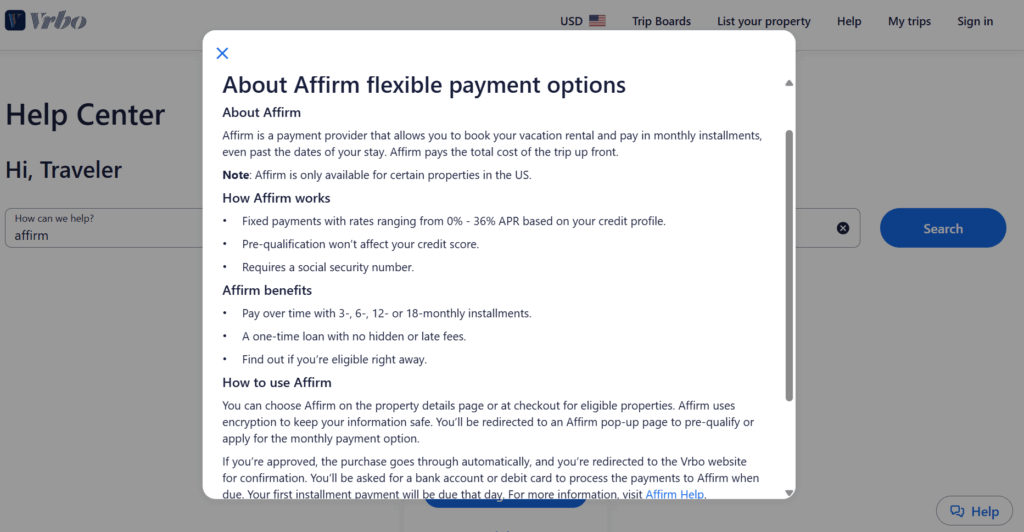

Earlier in 2026, Expedia Group, the powerhouse behind travel giants like Vrbo and Expedia.com, significantly deepened and expanded its collaboration with Affirm. Affirm is a leading “Buy Now, Pay Later” (BNPL) provider, a type of financial service that allows consumers to split purchases into smaller, manageable installments over time, often with little to no interest. The key takeaway here is exclusivity and scale: Affirm has become the primary, deeply integrated BNPL partner across all of Expedia Group’s platforms, including Vrbo.

What this means for Vrbo bookings:

- Who: Guests booking vacation rentals on Vrbo.

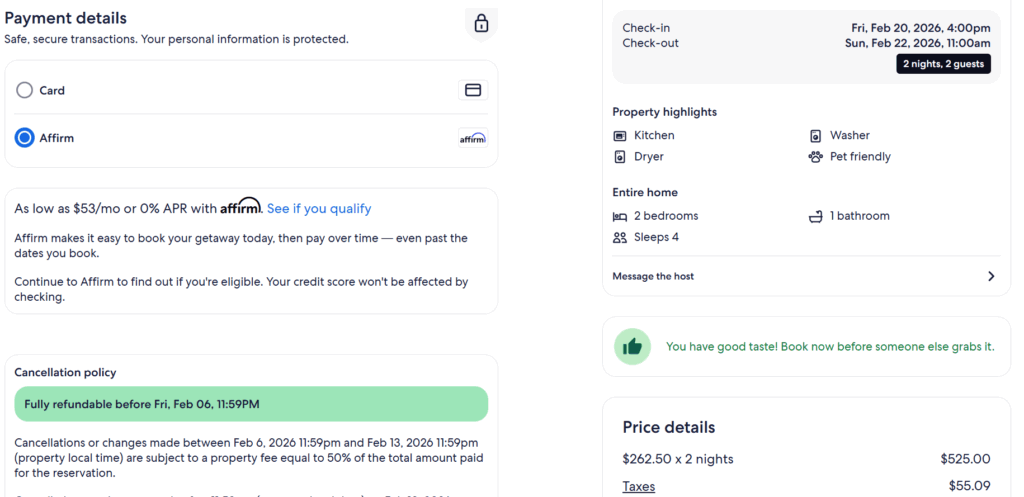

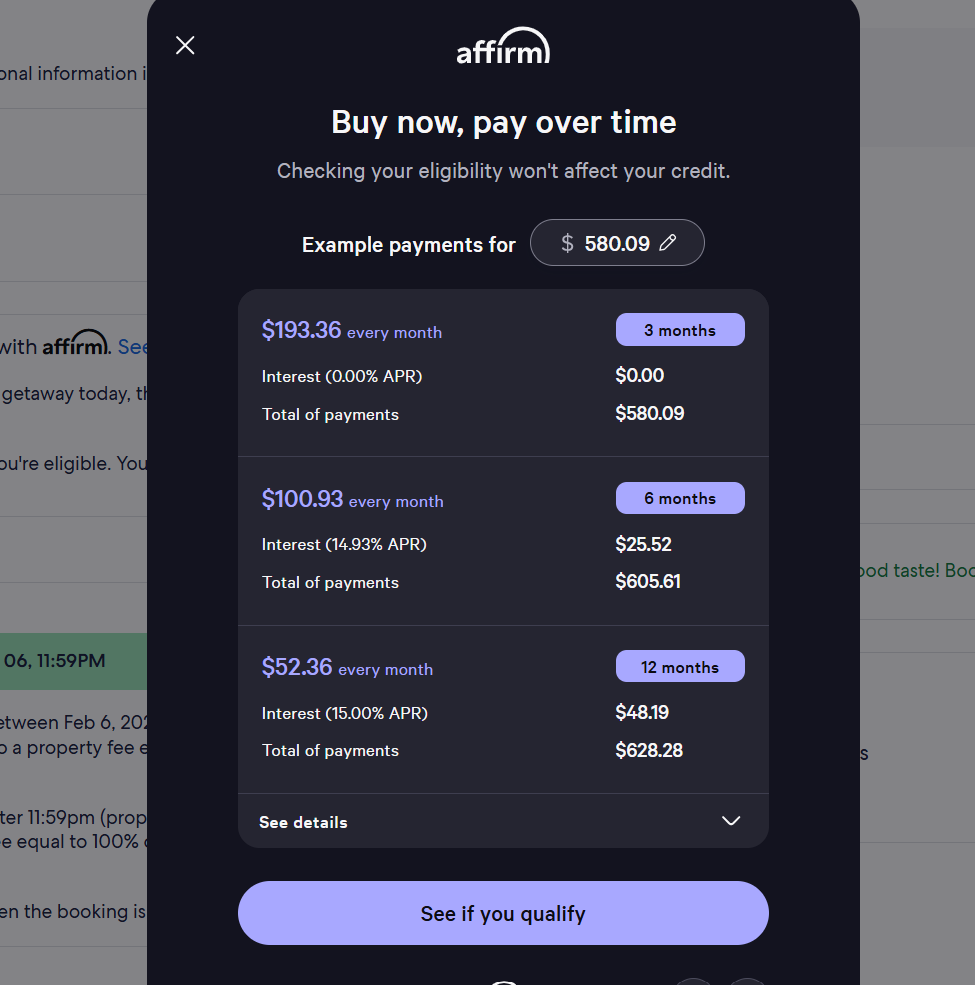

- What: They can now opt to pay for their entire trip in installments over periods ranging from 3, 6, 12, or even up to 24 months.

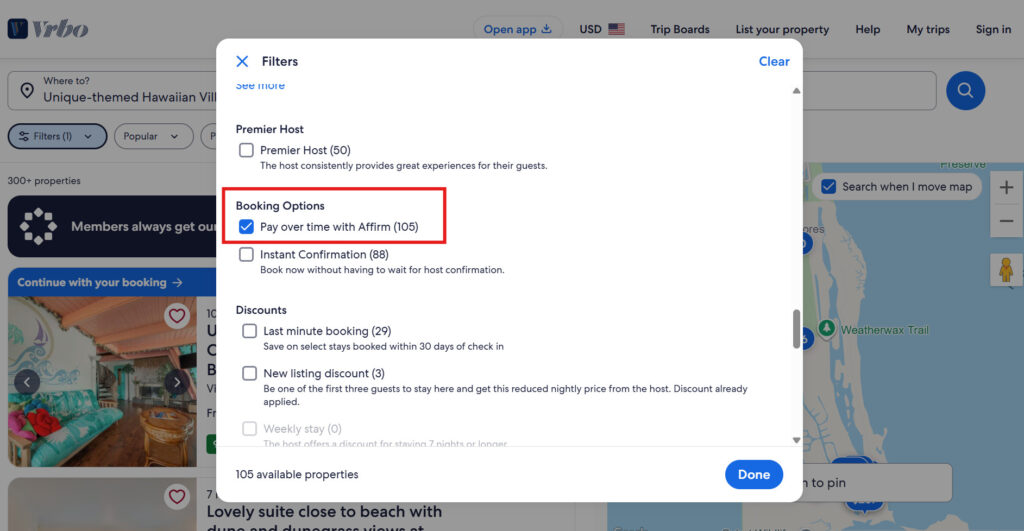

- Where: This service is available on select properties (typically those with a total cost of at least $250) across both the United States and Canada.

- When: The expanded partnership solidified in early 2026.

- Why: For guests, it makes high-value vacation rentals more affordable by spreading the cost. For Vrbo, it’s about increasing booking conversion rates and attracting a broader demographic who might otherwise be priced out of longer or more luxurious stays.

Not Just a Payment Option: How Vrbo’s BNPL Evolved

Understanding the current landscape requires a look back. Before this exclusive partnership, Vrbo’s approach to deferred payments was a patchwork, creating a less consistent experience for guests.

The “Before”: A Fragmented Payment Landscape

Previously, if a guest wanted to spread out their payments on Vrbo, their options were limited and less cohesive:

- Host-Controlled Installments: Many hosts offered the ability to split payments into two or three chunks (e.g., 50% at booking, 50% 30-60 days before arrival). This was a direct arrangement with the host through Vrbo’s system, not a loan. The full balance was always due before check-in.

- Limited Affirm Pilots: Vrbo had experimented with Affirm in earlier years (dating back to 2021), but it wasn’t universally available, and the payment terms were often shorter, usually capping at 12 months.

- Third-Party BNPL Workarounds: Guests could manually use external BNPL apps like Klarna or Zip. They would open the BNPL app, create a “one-time virtual card” for the amount of their Vrbo booking, and then input those virtual card details at Vrbo’s checkout. This was cumbersome and not a seamless part of Vrbo’s native experience.

The “Now”: Deep Integration and Expanded Access

The 2026 exclusive partnership with Affirm fundamentally changed this, offering a streamlined, powerful solution:

- Exclusivity & Full Integration: Affirm is no longer just “an option”; it’s the dedicated, preferred BNPL provider, seamlessly woven into the Vrbo checkout process. This means a consistent user experience for guests.

- Extended Loan Terms: The ability to finance a trip for up to 24 months is a game-changer. This dramatically lowers the monthly payment burden, especially for high-value bookings.

- 0% APR Opportunities: While interest rates can range up to 36% based on a guest’s credit, Affirm frequently offers 0% Annual Percentage Rate (APR) plans for shorter terms (e.g., 3 or 6 months). This means guests can pay in installments without any additional cost.

- Geographic Expansion: The service expanded beyond the US to include the Canadian market, broadening its reach.

This evolution from a fragmented system to a single, integrated, and expansive solution is crucial for understanding its impact on the STR industry.

The Airbnb Comparison: Different Strokes for Different Folks

While Vrbo has gone deep with Affirm, Airbnb has adopted a dual strategy, focusing on both a BNPL partner and a powerful, native booking flexibility feature.

| Feature | Vrbo (via Affirm) | Airbnb (via Klarna & Native Tools) |

| Primary BNPL Partner | Affirm (Exclusive) | Klarna |

| Installment Logic | Monthly payments, often a longer-term loan | Primarily “Pay-in-4” (split over 6 weeks) or monthly for long stays |

| Loan Length | Up to 24 months (significant for high-value trips) | Typically short-term, with monthly for 28+ day stays |

| Upfront Cost | Can be $0 (after credit approval) | $0 with “Reserve Now, Pay Later” (RNPL) |

| Credit Impact | Soft check; monthly plans may affect credit score | Soft check for Pay-in-4; RNPL has no credit impact |

| Risk Profile | Guests take out a loan with Affirm | Airbnb handles installment risk for RNPL |

| Best Suited For… | Large, expensive family vacations; long-term planning | Shorter, mid-range stays; immediate booking with delayed payment |

Airbnb’s “Reserve Now, Pay Later” (RNPL): The Key Differentiator

Unlike Affirm, which is a loan, Airbnb’s RNPL is a native platform feature that allows guests to book a stay with $0 down at the time of booking. The guest is only charged when the free cancellation period ends (often 3–14 days before check-in). This has some distinct characteristics:

- No Credit Check: Since it’s a platform feature, not a loan, there’s no credit check involved.

- Flexibility: It’s incredibly appealing for guests who want to lock in dates but need a few weeks to collect funds.

- Cancellation Policy Dependent: It’s typically available only for properties with “Flexible” or “Moderate” cancellation policies.

Airbnb’s Klarna Integration:

For guests who want a more traditional BNPL experience, Airbnb partners with Klarna, primarily offering “Pay-in-4” options where the total cost is split into four payments over six weeks. This is a shorter-term solution compared to Affirm’s extended plans on Vrbo.

In essence, Vrbo’s strategy allows guests to finance a significant portion of their vacation well in advance, making dream trips more accessible over a longer financial horizon. Airbnb, conversely, emphasizes immediate reservation with a shorter delay before the first payment, catering more to booking convenience and smaller groups.

The Manager’s Dilemma: Increased Conversion vs. Calendar Uncertainty

For STR managers, these shifts influence booking volume, cancellation rates, and ultimately, their revenue strategy.

1. Payouts are (Mostly) Safe: The BNPL Shield

This is excellent news for managers. For bookings made through integrated BNPL services (Affirm on Vrbo, Klarna on Airbnb):

- Instant Funding: The BNPL provider (Affirm or Klarna) pays the platform (Vrbo or Airbnb) the full booking amount upfront.

- Standard Payout Schedule: You, the manager, receive your payout from the platform according to your regular schedule (e.g., 24 hours after guest check-in).

- No Guest Credit Risk: If the guest defaults on their payments to Affirm or Klarna months later, it does not impact your earnings. The BNPL provider absorbs that financial risk, not you. This offers significant peace of mind.

2. The “Phantom Booking” Threat: Airbnb’s RNPL Risk

While BNPL offers a payment shield, Airbnb’s “Reserve Now, Pay Later” (RNPL) introduces a new layer of risk that managers must actively monitor:

- Lower Commitment Threshold: Because RNPL allows guests to book with $0 down, it dramatically lowers the “barrier to commitment.” Guests can quickly reserve dates without any financial outlay, leading to a higher likelihood of speculative bookings.

- Increased Last-Minute Cancellations: The biggest risk is the “phantom booking,”a reservation that looks solid but never materializes because the guest’s card fails when the payment is finally due (just before the free cancellation window closes). This can leave you with an unexpected vacant slot just days or weeks before check-in, making it difficult to re-book.

- Monitoring is Key: Regularly review your upcoming Airbnb bookings, especially those made far in advance with an RNPL option. Keep an eye on the payment due dates and be prepared to activate your re-booking strategies if a payment fails and leads to an automatic cancellation.

As we navigate 2026, the arrival of native “Pay Later” options across both Vrbo and Airbnb marks the end of the “full payment at booking” era. But for property managers, the “fintech-y” convenience of these tools shouldn’t obscure the operational reality: increased conversion at the top of the funnel often creates volatility at the bottom.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.