Vrbo’s Q2 2025 results confirm a clear shift: the U.S. market is growing, but just barely, and the brand is leaning hard into promotions, flexible trip types, and bundled services to keep bookings flowing. For professional short-term rental managers, these moves signal where Vrbo is betting its chips, and where they might need to follow.

The Short Version: Vrbo’s Four Big Moves in Q2 2025

- Soft U.S. growth sets the tone: Q2 growth stayed in the low single digits, mirroring broader U.S. market pressures like softer demand, price sensitivity, and shorter stays.

- Discounts take the spotlight: 10% of bookings now use Vrbo’s new promotional rates, with last-minute deals leading the push.

- The week-long trip is no longer king: Expanded urban inventory and product updates target demand for shorter, more varied trips.

- Bundled value as a differentiator: Partnerships like BabyQuip and Rentable bring added convenience and keep guests inside the Vrbo ecosystem.

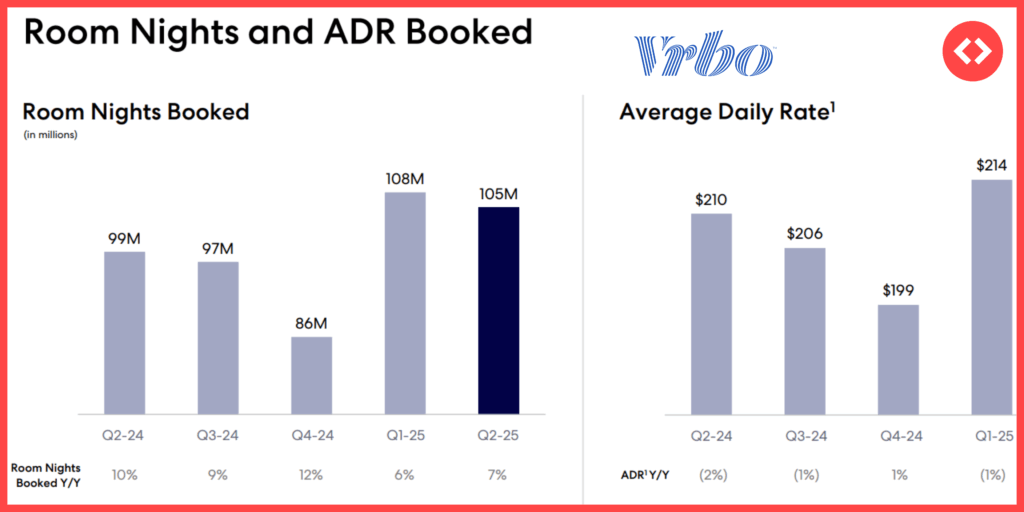

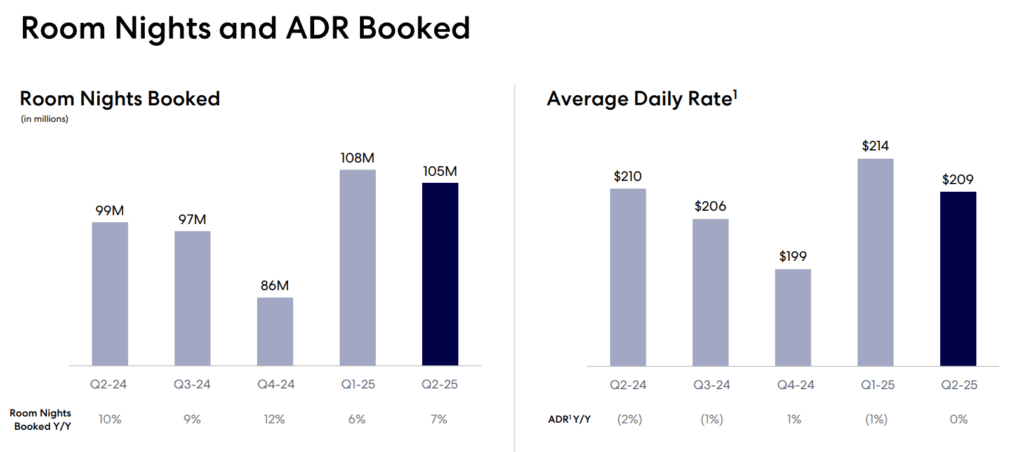

Q1 vs Q2 2025: What’s Changed, What’s Confirmed

U.S. growth still capped

In Q1, Vrbo was treading water in a slowing U.S. market. Q2 brought a slight improvement, but growth stayed in the low single digits, still roughly in line with the market. Beneath that: lower ADRs, shorter lengths of stay, and higher cancellations all weighed on results.

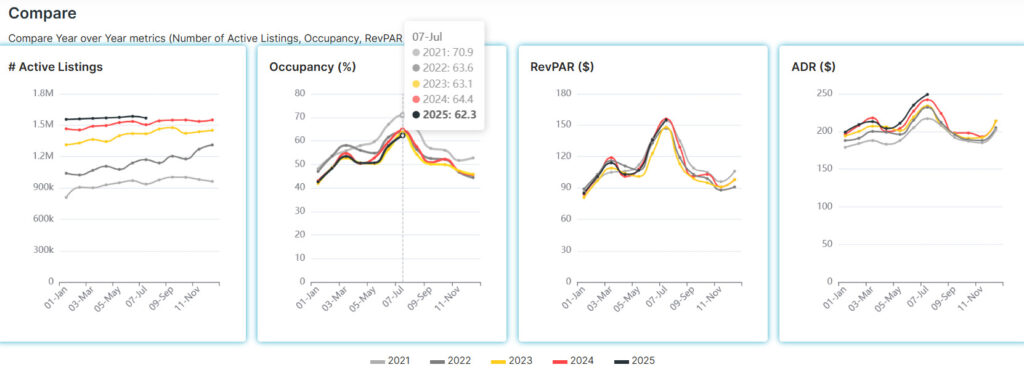

Market context: PriceLabs data

These drivers aren’t unique to Vrbo. PriceLabs’ STR Index – a free short-term rental market data resource for operators, journalists, and suppliers – shows a more competitive, not collapsing market:

- Occupancy: 62.3% (July 7, 2025) vs. 64.4% in 2024

- ADR: Still climbing year-over-year

- RevPAR: $155 in 2025 vs. $156 in 2024

Occupancy is down largely because supply keeps growing and ADRs have risen, but RevPAR holding steady suggests operators are still extracting similar revenue per night. For property managers, it’s a reminder: in a market where demand isn’t shrinking but competition is rising, conversion is king.

Promotions and Merchandising Take Center Stage

When guests are more price-sensitive, promotions are one of the fastest levers to pull. Vrbo is leaning in hard:

- 10% of bookings now use promotional rates since the May launch of its Promotion Suite.

- Discount types include early-booking, last-minute, mobile-only, and members-only rates (some still to come).

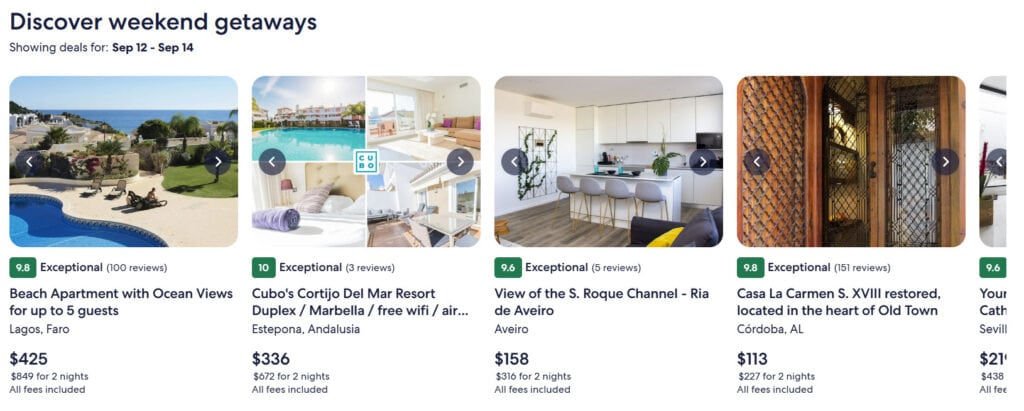

Last-minute offers are the current hero. In June, Vrbo launched a TV spot, “Last-Minute Getaway”, paired with:

- In-app last-minute booking filter

- Prompts like “This host offers a reduced rate for bookings within 30 days”

- Social media pushes for visibility

Given shortening booking windows in the U.S., last-minute promotions will likely remain a priority, but members-only rates could be the next big play.

Manager takeaway: Vrbo is edging closer to Booking.com-style merchandising. Expect better visibility for listings that opt into these promos.

Vrbo Targets More Trip Types

This isn’t a new pivot, in Q1 we noted Vrbo’s move beyond week-long, leisure-oriented stays, fueled by the addition of significant urban inventory last year. Q2 confirms the follow-through.

- Why: U.S. traveler behavior in 2025 = shorter lead times, more varied trip lengths.

- How: Product updates like last-minute deals, new filtering options, and multi-unit urban inventory.

The goal: capture demand from audiences who might otherwise book hotels or other OTAs, and keep them inside Vrbo’s booking funnel.

Bundling Value and Convenience

In today’s short-term rental market, price isn’t the only battleground. Travelers increasingly expect to book more of their trip within a single platform:

- Airbnb: stays + experiences

- Booking.com: flights + hotels + car rentals

Vrbo is moving in the same direction, leveraging Expedia’s ecosystem:

- BabyQuip partnership: lets families book baby gear (cribs, strollers, essentials) alongside stays.

- Rentable partnership: adds enhanced accessibility filters and features for guests with mobility needs.

These integrations let Vrbo unlock new pockets of demand without expanding to new geographies, while deepening value for core audiences like families and accessibility-conscious travelers.

Why This Matters for Property Managers

Vrbo’s Q2 2025 performance isn’t just a snapshot of one OTA. It’s a blueprint for competing in a tighter U.S. market:

- Promotions drive visibility in a price-sensitive environment.

- Shorter stays and varied trip types require a more flexible inventory strategy.

- Bundled services can differentiate listings without slashing rates.

Whether or not you list on Vrbo, these trends are shaping traveler expectations across platforms.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.