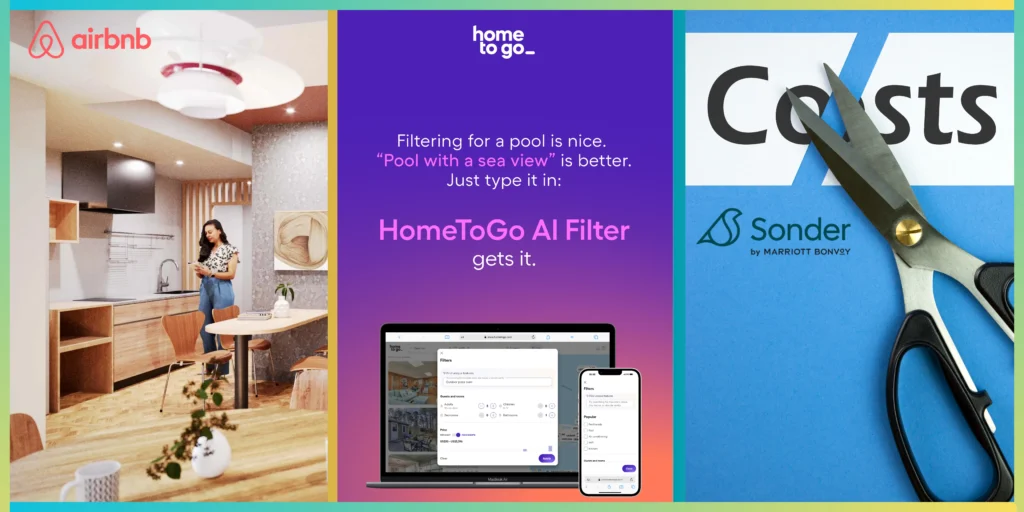

HomeToGo Rolls Out AI Filter to Improve Vacation Rental Search Accuracy

- HomeToGo has launched an AI Filter that lets travelers search for vacation rentals using natural language terms like “outdoor shower” or “game room.”

- Before launching the new AI Filter, HomeToGo relied on traditional search filters, such as checkboxes for amenities (e.g., “pet-friendly,” “wifi,” “pool”) and structured drop-down menus.

- Currently in beta across the U.S. and Germany, the tool surfaces listings that match the exact amenities guests search for. Specific timelines or details regarding expansion to additional markets have not been disclosed yet

- The feature aims to improve search accuracy and make it easier for guests to find homes with highly specific features.

- AI Filter is part of HomeToGo’s broader push to build a fully AI-powered marketplace, alongside tools like AI Sunny (an AI-powered travel assistant), AI Mode (an AI-driven trip planner), and Smart AI Reviews, which condense guest feedback into easy-to-read summaries.

About HomeToGo:

HomeToGo is a SaaS-enabled vacation rental marketplace that connects travelers with stays while providing property managers with software tools to manage listings, optimize pricing, and streamline operations.

Snigdha’s Views:

- Homes with standout amenities often get buried in search results because platforms rely on broad filters like “luxury” or “family-friendly.” These generic categories miss the nuance.

- While AI-powered filters can boost visibility, they’re only as smart as your listing. If you don’t mention features in your listing descriptions, the AI won’t pick them up, and your property could be skipped.

- For operators who can’t afford to outspend competitors on ads, this type of AI-based discovery tool could become a low-cost lever for exposure.

- Features that were once “nice to have” (like a sauna, outdoor shower, or game room) now become searchable differentiators—especially as AI filters attract more decisive travelers who know exactly what they want.

- These guests are more likely to book when they find matching amenities, meaning better visibility could also lead to better conversion.

- Platforms like Landfolk in Europe are also experimenting with similar tools. Its “Daisy” feature lets users find listings based on emotional themes or vibes, like “cozy cabin by the lake”.

Airbnb Partners with Daiwa House to Build Rentals in Tokyo, Blending Travel and Daily Living

- Airbnb has taken its first direct step into real estate development in Asia through a new partnership with Japan’s largest homebuilder, Daiwa House Group.

- Airbnb and Daiwa House are co-developing a branded property specifically designed for the Airbnb platform, under the new “Sumu powered by Airbnb Partners” brand.

- The aim is to blend longer stays, flexible living (e.g., workations or multi-base lifestyles), and deep local immersion—essentially real estate tailored for Airbnb-style hosting from the ground up.

- In parallel, the platform also released a new ad campaign promoting local Japanese-style stays on its platform.

Snigdha’s Views:

- Airbnb’s latest Japan partnership shows it’s doubling down on shaping supply, not just relying on hosts, but co-developing purpose-built spaces.

- In highly regulated markets like Japan, where zoning and permitting restrict casual hosting, this gives Airbnb more control over quality, pricing, and compliance, without needing to own or operate the assets directly.

- This “powered by Airbnb” label could be the start of a soft-brand strategy, echoing what Marriott and Hilton have done with Autograph Collection or Curio.

- This move aligns with Airbnb’s 2025 vision to evolve into a full travel and living brand. From Airbnb-friendly apartments to purpose-built developments like the “Sumu” project in Tokyo, the company is expanding into hybrid formats that go beyond short-term leisure.

- These new stay formats—longer stays, workations, and multi-base living are likely to receive stronger algorithmic support and visibility, creating new competition for traditional property managers.

- From its new domestic travel ad to the launch of the Co-Host Marketplace and now this real estate partnership, Airbnb is making a series of calculated moves to gain a stronger foothold in Japan.

Sonder Cuts $50M Ahead of Marriott Integration; Layoffs and Restructuring Underway

- Sonder, the hybrid hotel and short-term rental brand, is cutting $50 million in annual costs through layoffs, software savings, and operational efficiencies.

- The move comes just months before its properties are expected to be integrated into Marriott’s digital channels by June 2025.

- While Sonder didn’t specify the number of layoffs, the cuts are part of a broader push to stabilize its finances.

- The company also raised $18 million through Series A preferred shares and received $7.5 million in key money from Marriott, tied to their 20-year licensing agreement. Under this deal, Sonder listings will be marketed as “Sonder by Marriott.”

- CEO Francis Davidson framed the changes as progress toward a company transformation, with the Marriott integration expected to enhance RevPar and profitability over time.

Snigdha’s Views:

- Sonder’s $50 million cuts, new funding, and layoffs show it’s trying to stay afloat until the Marriott partnership takes effect—another step in a longer struggle.

- The company is under significant financial pressure. Sonder reported $179 million in losses in Q3 2024 and had negative free cash flow of $17.3 million.

- Sonder has always operated in a different category from traditional vacation rental managers. Its model resembles a tech-enabled, asset-light hotel chain. It leases urban buildings, not standalone vacation homes, and works directly with real estate operators.

- That model, while streamlined, exposed Sonder to high fixed costs and tight margins, especially during downturns. And we’ve seen the result: drastic restructuring, delayed financial filings, and a stock that’s plummeted more than 80% in recent years.

- The Marriott deal looks like a lifeline—and it might be. Being listed on Marriott.com and included in the Bonvoy loyalty program gives Sonder access to 210 million potential guests, a global sales network, and built-in credibility with business travelers.

- For property managers, it’s a reminder that business models can look sleek and scalable until market conditions shift. Long-term success still depends on fundamentals: sustainable growth, operational resilience, and financial discipline.

Snigdha Parghan is a Content Marketer at RSU by PriceLabs, where she creates articles, manages daily social media, and repurposes news and analysis into podcasts and video content for short-term rental professionals. With a focus on technology, operations, and marketing, Snigdha helps property managers stay informed and adapt to industry shifts.