If you’re a vacation rental property manager, you may have heard about the recent news regarding Vacasa and Sonder potentially facing delisting from the NASDAQ Stock Market due to non-compliance with the minimum bid price requirement. Both companies have received notices from the NASDAQ Stock Market as the closing bid price of their common stocks has been below $1.00 per share for 30 consecutive business days. This news has understandably raised concerns among industry professionals, as these are two of the biggest names in the vacation rental management industry.

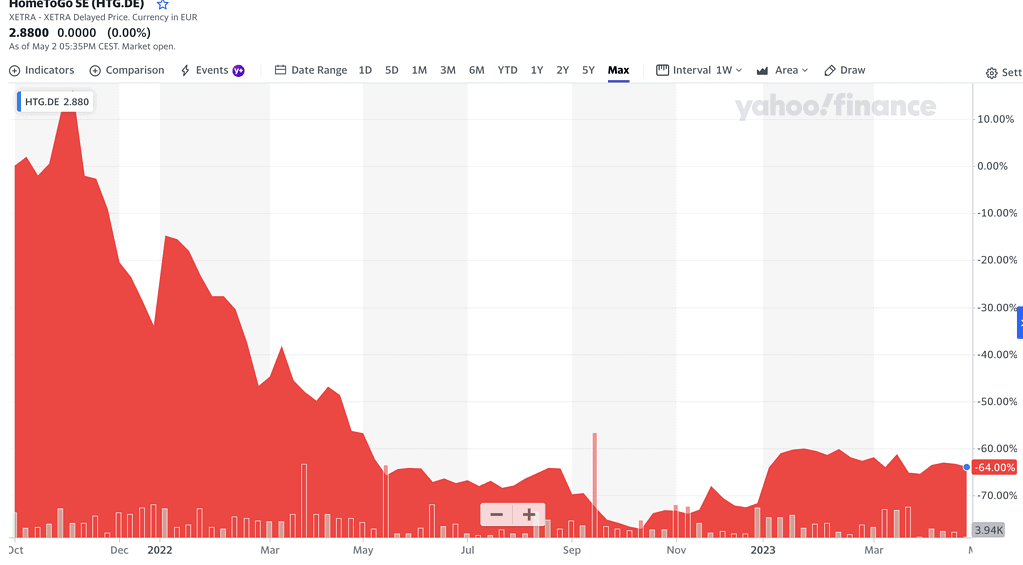

It’s worth noting that another company in the vacation rental space, HomeToGo, has been performing relatively well since going public in 2021. HomeToGo, being an asset-light booking platform, operates more like a tech company such as Airbnb. This business model differentiates it from property management companies like Vacasa and Sonder, which, despite also being asset-light, have a higher number of employees in operations and sales roles.

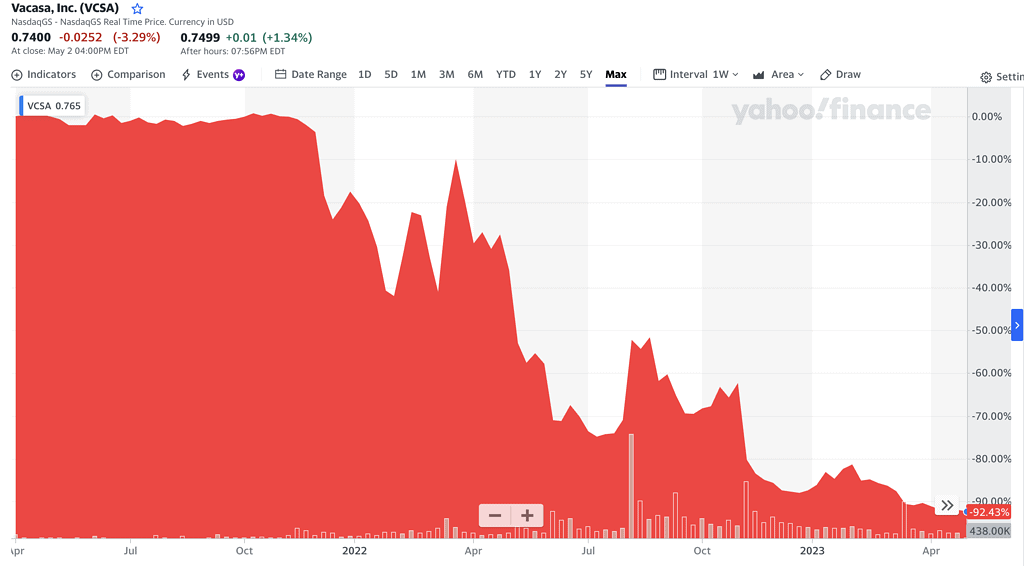

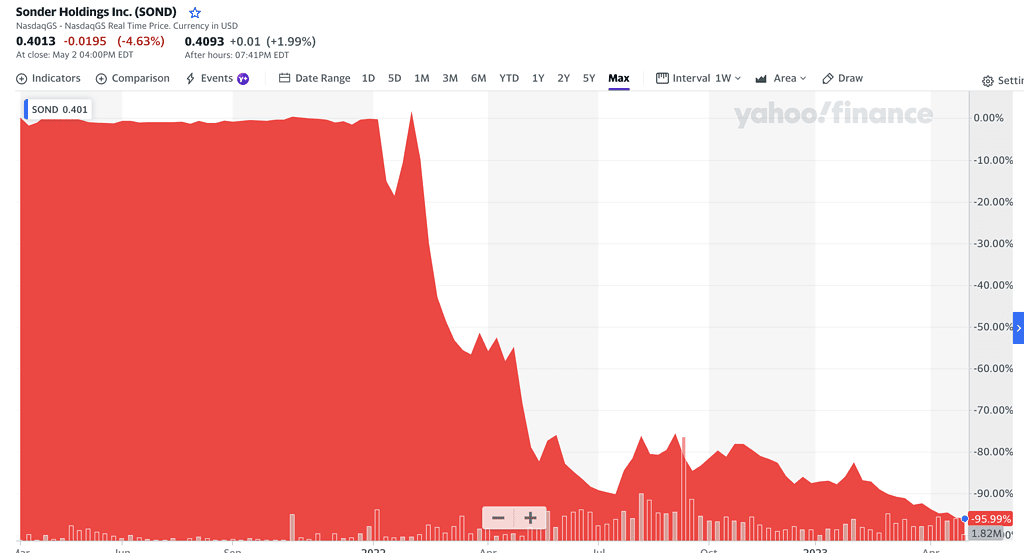

To gain a better understanding of the market’s perception of these companies, let’s take a look at the share price performance of Vacasa, Sonder, and HomeToGo since their respective public listings:

- Vacasa: -92%

- Sonder: -96%

- HomeToGo: -64%

As you can see, both Vacasa and Sonder have experienced significant declines in their share prices, while HomeToGo’s share price has seen a decline as well, but to a lesser extent. It’s worth noting that HomeToGo’s share price has experienced a rebound since January 2023.

As a vacation rental property manager, it’s important to stay informed about industry trends and news that may impact your business. The recent news about Vacasa and Sonder facing delisting from the NASDAQ Stock Market serves as a reminder of the potential risks associated with going public through SPAC mergers. While the SPAC route can offer benefits to companies and investors, it’s essential to evaluate each deal on its merits and consider the risks involved.

At the same time, it’s important to recognize that the vacation rental market is still growing, and there are opportunities for companies that are able to adapt and innovate.

What’s happening with Vacasa and Sonder?

Both Vacasa and Sonder have received notices from the NASDAQ Stock Market regarding non-compliance with the minimum bid price requirement, as the closing bid price of their common stocks has been below $1.00 per share for 30 consecutive business days. Both companies have been given a 180-day compliance period to regain compliance, and if they fail to do so, they may be eligible for an additional 180-day compliance period if they apply to transfer the listing of their common stocks to the Nasdaq Capital Market.

Both companies plan to monitor the closing bid price of their stocks and assess potential actions to regain compliance with NASDAQ’s Listing Rules, including the possibility of implementing a reverse stock split. The situations faced by both companies are quite similar in terms of the nature of the non-compliance and the steps they plan to take to address the issue.

Possible Outcomes of Delisting

When a company is delisted, it signifies that its shares are removed from the stock exchange, rendering it unable to trade publicly. While the delisted company might still continue its operations, it loses the advantages of being a public company, such as the ability to raise capital through stock offerings. Shareholders are often faced with considerable losses, as the value of their investments is likely to diminish. In some instances, shareholders may have the option to sell their shares, but the value would be substantially lower.

Despite the drawbacks, there are potential benefits for delisted companies. These include increased flexibility and reduced regulatory requirements, which could aid them in restructuring and enhancing their financial performance. The overall impact of delisting varies, depending on the specific situation of the company and its shareholders

Share Price Performance: HomeToGo, Vacasa, and Sonder

To understand the situation, let’s look at the share price valuation. Let’s also compare and contrast with HomeToGo, another vacation rental industry business that went public through a SPAC.

Since their respective public listings, the share prices of these three companies have exhibited varying degrees of decline:

- Vacasa: -92%

- Sonder: -96%

- HomeToGo: -64%

It’s worth noting that, contrary to Vacasa and Sonder, HomeToGo’s share price has experienced a rebound since January 2023.

Vacasa’s Rocky Journey: From SPAC Merger to Financial Challenges and Nasdaq Compliance Struggles

Vacasa, a vacation rental management company, went public through a merger with a special purpose acquisition company (SPAC) called TPG Pace Solutions Corp in October 2021. The combined company began trading on the Nasdaq Stock Market under the ticker symbol “VCSA” for its Class A common stock.

Vacasa, Inc. SPAC Timeline:

- October 19, 2021: Vacasa announced the completion of its merger with TPG Pace Solutions, a SPAC.

- October 21, 2021: Vacasa started trading on Nasdaq under the ticker symbol VCSA.

- April 27, 2023: Vacasa received a notice from Nasdaq due to not meeting the minimum bid price requirement.

- May 9, 2023: Vacasa’s first quarter 2023 earnings conference call is scheduled for 05:00 PM ET.

- October 24, 2023: Deadline for Vacasa to regain compliance with Nasdaq’s minimum bid price requirement.

Vacasa’s 2022 financial results and 2023 guidance reveal several concerning signs regarding the company’s profitability. Here are some key facts and data points that indicate the challenges Vacasa faced in achieving profitability:

- Net Loss: In 2022, Vacasa reported a significant net loss of $332,149,000, more than double the net loss of $154,591,000 in 2021. This indicates that despite experiencing sales growth, the company failed to manage its expenses effectively.

- Adjusted EBITDA: Vacasa’s adjusted EBITDA for 2022 remained negative, showing that the company struggled to generate positive earnings before interest, taxes, depreciation, and amortization.

- Workforce Reduction: In an effort to streamline operations and prioritize profitability, Vacasa undertook a significant workforce reduction in January, cutting approximately 1,300 employees or 17% of its workforce. This move reflects the company’s need to address inefficiencies and control costs.

- Homeowner Churn: Vacasa experienced an increase in homeowner churn during the fourth quarter of 2022, which continued into 2023. The rise in churn is partially attributed to homeowners witnessing a normalization of their revenue following two years of unprecedented highs in the industry. This heightened level of homeowner churn presents challenges for Vacasa in retaining properties on its platform and sustaining revenue growth

- 2023 Guidance: For 2023, Vacasa expects full-year revenue to decline by a low double-digit to high single-digit percentage year-over-year. This decrease in revenue is mainly due to the assumed reduction in gross booking value per home, reduced investment in portfolio programs, the wind-down of real estate brokerage services, and lapping the recognition of future stay credits in 2022.

Sonder’s SPAC Odyssey: From High Valuation to Nasdaq Compliance Challenges”

Sonder, a hospitality company that operates short-term rentals, announced in June 2021 that it would go public through a merger with a special purpose acquisition company (SPAC) called Gores Metropoulos II, Inc. The combined company was expected to have an implied valuation of approximately $2.2 billion. After the merger, the company began trading on the Nasdaq Stock Market under the ticker symbols “SOND” for its common stock and “SONDW” for its warrants.

Sonder Holdings Inc. SPAC Timeline:

- August 2021: Sonder announced the completion of its merger with Gores Metropoulos II, a SPAC.

- January 19, 2022: Sonder became a publicly traded company on Nasdaq under the ticker symbol SOND.

- April 17, 2023: Sonder received a notice from Nasdaq due to not meeting the minimum bid price requirement.

- May 10, 2023: Sonder will report its first quarter 2023 financial results.

- October 14, 2023: Deadline for Sonder to regain compliance with Nasdaq’s minimum bid price requirement

HomeToGo’s SPAC Journey: From Lakestar Merger to Promising Financial Performance”

HomeToGo SPAC timeline

February 2021: Lakestar SPAC I was launched by venture capitalist Klaus Hommels on the Frankfurt Stock Exchange, raising 275 million euros ($333 million).

- June 2021: Lakestar SPAC announced plans to acquire travel portal HomeToGo in a deal that would be the first of its kind to bring a company to the Frankfurt Stock Exchange. A letter of intent was signed, confirming that Lakestar SPAC I would merge with the startup HomeToGo. The merger would value HomeToGo at €1.2 billion.

- September 2021: Shareholders unanimously backed the merger between Lakestar SPAC I and German travel tech startup HomeToGo. Berlin-based HomeToGo received a 250 million euro ($295 million) cash injection from the SPAC. HomeToGo went public after merging with Lakestar SPAC I, subject to shareholder confirmation.

- May 16, 2023: HomeToGo SE will announce its first quarter 2023 results.

HomeToGo’s 2022 Financial Performance and 2023 Outlook

HomeToGo, a leading vacation rental platform, has reported promising results for 2022, with several key indicators suggesting a bright outlook for the company in 2023. The company’s ability to narrow its losses and achieve a positive adjusted EBITDA demonstrates its focus on cost control and operational efficiency.

In 2022, HomeToGo generated a gross booking value of $1.5 billion, showcasing strong demand for its vacation rental offerings. The company’s net revenue for the year reached $95 million, indicating steady growth compared to previous years. With a positive adjusted EBITDA of $8 million, HomeToGo has managed to turn a corner in terms of profitability, outperforming its competitor Vacasa in this regard.

Looking ahead to 2023, HomeToGo aims to continue its growth trajectory by expanding its property listings and strengthening relationships with homeowners. The company’s guidance for the upcoming year projects a further increase in gross booking value and net revenue, reflecting the management’s confidence in its growth strategy.

In conclusion, HomeToGo’s 2022 financial results and guidance for 2023 provide a cautiously optimistic outlook for the company’s future performance. The positive adjusted EBITDA and projected growth in key metrics signal a strong foundation for continued success in the competitive vacation rental market.

Beyond Vacation Rentals: Other Industries Threatened by SPAC Volatility and Delisting Woes

The challenges faced by Vacasa and Sonder due to the volatile SPAC market also affect companies in other industries that are similarly threatened with potential delisting. Satellite operators Momentus and Spire Global have both received delisting warnings as their stock prices fell below $1 a share. They have 180 days to regain compliance with exchange standards or face delisting. Launch provider Astra Space is also at risk of being delisted from NASDAQ if it fails to meet the required average closing share price within the given time frame. Moreover, esports organization Faze Clan is in jeopardy of being delisted by the Nasdaq stock exchange just six months after going public through a merger with a SPAC. The company has seen its stock price fall significantly since its public debut, putting it in violation of Nasdaq rules that require a stock to close above the $1 mark for 30 consecutive days. These cases highlight that the uncertainties surrounding SPACs and the threat of delisting are not limited to travel-related companies but extend to various other sectors as well.

Why did Sonder, Vacasa, and HomeToGo use SPACs to go public?

The wave of SPAC-fueled public offerings can be attributed to several factors:

- Faster and more efficient process: Going public through a SPAC merger is generally faster and more efficient than a traditional initial public offering (IPO). The process involves less regulatory scrutiny and fewer complexities, allowing companies to focus on their core business instead of navigating the IPO process.

- Certainty of funding: In a SPAC merger, companies have more certainty about the amount of capital they will receive. The SPAC typically has a pool of capital raised from investors, which is then used to fund the merger. This reduces the risk of price fluctuations that can occur in a traditional IPO, where the amount of capital raised depends on market conditions.

- Attractive valuations: Companies going public through a SPAC can negotiate better valuations with the SPAC sponsor, which can potentially result in a higher valuation than what they might achieve in a traditional IPO.

Travel companies, like Sonder, Vacasa, and HomeToGo, used SPACs to go public for similar reasons:

- Speed and efficiency: The travel industry has been significantly impacted by the COVID-19 pandemic, and companies may have wanted to go public quickly to raise capital and take advantage of market opportunities as the industry recovers.

- Expertise and partnerships: SPAC sponsors often have experience and connections in the industry, which can help the company grow and scale more effectively post-merger.

- Market conditions: As travel companies recover from the pandemic, they may have found the SPAC route more attractive due to the ability to negotiate better valuations and certainty of funding.

SPACs can be seen as a sign of over-buoyant investment markets for several reasons:

- Excess liquidity: Low-interest rates and central bank stimulus have led to an abundance of capital-seeking investment opportunities. This excess liquidity has fueled the growth of SPACs, as investors look for alternative ways to deploy their capital.

- FOMO (Fear of Missing Out): As SPACs gained popularity and produced some high-profile success stories, more investors and sponsors jumped on the bandwagon, fearing they would miss out on potential gains.

- Speculation and risk-taking: In an overbuoyant market, investors may be more willing to take on higher risk, leading to the formation of more speculative ventures like SPACs. Some companies that have gone public through SPAC mergers may not have been ready for a traditional IPO, leading to concerns about the quality and long-term prospects of these companies.

While SPACs can offer benefits to companies and investors, they can also be an indicator of excessive risk-taking and speculation in the market. As with any investment, it’s essential to evaluate each SPAC deal on its merits and consider the risks involved.

In conclusion, the recent news about Vacasa and Sonder potentially facing delisting from the NASDAQ Stock Market serves as a reminder of the potential risks associated with going public through SPAC mergers. While the SPAC route can offer benefits to companies and investors, it’s essential to evaluate each deal on its merits and consider the risks involved. The decline in share prices of these companies highlights the volatility of the market and the importance of staying informed about industry trends and news that may impact your business. However, it’s important to recognize that the vacation rental market is still growing, and there are opportunities for companies that are able to adapt and innovate. The success of HomeToGo, with its asset-light booking platform, is proof that there are viable alternatives to the property management model adopted by Vacasa and Sonder. As the industry recovers from the COVID-19 pandemic, it’s important for vacation rental property managers to carefully evaluate their options and strategies for growth and profitability.