For years, Airbnb has been the public face of overtourism, blamed for housing shortages, neighborhood erosion, and transforming city centers into tourist playgrounds. While the hotel industry quietly expanded, Airbnb took the heat.

That dynamic is changing.

Now, Airbnb is borrowing directly from the hotel lobby’s playbook: funding political campaigns, commissioning economic impact studies, and reframing the public narrative. The goal? To cast hotels as the true culprits of overcrowding and rising travel costs, and to position short-term rentals as the more equitable, flexible, and community-anchored alternative.

This isn’t a soft rebrand. It’s an aggressive posture shift, and it’s being deployed globally.

The European Front: Data Battles and Street-Level Protests

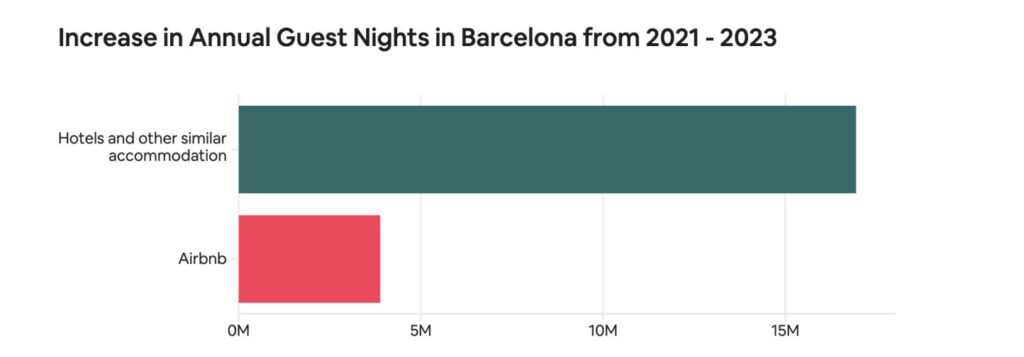

In Europe, tensions around overtourism have hit a boiling point. In Barcelona, the city has pledged to revoke all short-term rental licenses by 2028 and has already ordered over 66,000 listings to be delisted. Athens extended its STR ban in central districts through 2026. And across Spain and Italy in June 2025, thousands protested overtourism with smoke bombs, chants, and confrontational tactics aimed at tourists.

In response, Airbnb is attempting to counter the backlash with data. CEO Brian Chesky told German outlet WELT that STRs are being unfairly scapegoated. Shortly after, Airbnb released a 35-page report, “Overtourism in the EU,“ arguing that:

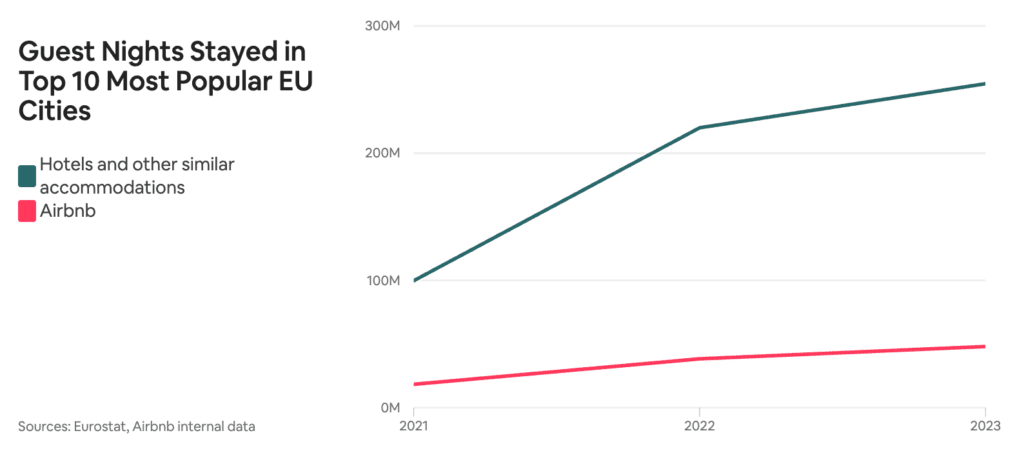

- Hotels account for 75%+ of tourist nights in the EU’s top cities.

- Cities like Barcelona and Amsterdam have seen tourist volumes grow despite STR crackdowns.

- Cruise ships and low-cost airlines, not Airbnb, are the real engines of mass tourism.

In the top 10 EU cities, including Barcelona, Rome, and Paris, hotels represent more than 75% of tourist nights, significantly outweighing Airbnb stays

But the report, produced by Airbnb and aligned with its strategic interests, hasn’t shifted the public mood. Critics like TUI’s Alexander Panczuk have dismissed Airbnb’s findings outright, claiming that STRs are driving overtourism in iconic cities like Venice and Santorini.

What Airbnb is offering is a logical argument. What protestors are responding to is symbolic: STRs represent cultural disruption, investor-led gentrification, and a loss of local life. That’s a harder story to rebut with charts.

The U.S. Play: PAC Money and Policy Messaging

Airbnb’s U.S. approach goes a step further. In early 2025, it launched a Super PAC called Affordable New York, pledging $5 million to influence local elections in the country’s most regulated STR market. Its first target: mayoral candidates seen as hostile to STRs.

Alongside this, Airbnb released an economic impact study pegging its contribution to the U.S. economy at $90 billion. This time, the framing wasn’t just about boosting local hosts. It explicitly positioned hotels as the winners when STRs are restricted, signaling that Airbnb is ready to name enemies.

But how effective is this pivot, really?

Airbnb has long maintained a brand that empowers everyday people, generates local wealth, and supports tourism in underserved neighborhoods. Those claims can be harder to sustain when the company is also engaging in direct political advocacy and participating in high-profile government advisory roles, including through Joe Gebbia’s appointment to Donald Trump’s DoGE council.

Which leads to the deeper tension at the heart of Airbnb’s identity shift.

Airbnb’s Evolving Identity: Between Community and Corporate Strategy

Airbnb’s strength has long been its emotional brand centered on local hosts, personal stories, and a sense of belonging. That image helped it stand apart from traditional hospitality and earned it goodwill from residents and regulators alike.

Yet as the company scales, its tactics are beginning to mirror those of the hotel lobby it once disrupted: investing in political campaigns, lobbying, and aligning with powerful figures in government. All pragmatic moves, especially in an increasingly regulated environment, yet they may create new questions about what Airbnb stands for.

The company’s leadership may see no contradiction in combining grassroots branding with strategic influence. But for some residents and stakeholders, the dual identity can feel jarring, especially when political affiliations or corporate-style lobbying enter the picture.

Airbnb’s evolving strategy may still resonate if paired with transparency, accountability, and a renewed focus on host and community benefits. But it will need to navigate this balance carefully to avoid alienating the very audiences it seeks to reassure.

What This Means for Property Managers

Airbnb’s strategic pivot isn’t just about reputation. It’s about regulation, market access, and who gets to tell the story of short-term rentals. For professional property managers, this moment offers both tools and warnings.

1. Leverage Airbnb’s Data, But Add Local Context The Overtourism in the EU report provides talking points you can use with local regulators and stakeholders. Pair the data with your own local case studies to add credibility.

2. Monitor Airbnb’s Political Footprint Locally If the Super PAC playbook works in New York, Airbnb may replicate it elsewhere. Understand how it could affect your city’s politics.

3. Reassess Alignment with Airbnb’s Brand As Airbnb embraces a more assertive posture, decide where your business sits:

- Do you benefit from Airbnb’s grassroots storytelling, or are you operating at a scale that demands a different narrative?

- Do your values align with Airbnb’s current direction?

4. Prepare for Greater Polarization This strategy could win Airbnb influence, but also deepen public distrust. Property managers should be ready to clarify how they differ from platform politics, especially when talking to owners, city officials, or local media.

The Real Question: Can Airbnb Tell Two Stories at Once?

Airbnb wants to be seen as both a community platform and a corporate force. It wants to invoke emotion and wield economic clout. But can those two stories co-exist?

Professional managers may find opportunity in this split, leveraging Airbnb’s resources while defining their own voice. But they should do so with eyes wide open.

Because Airbnb isn’t just flipping the script. It’s rewriting the playbook. And not everyone will want to play along.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.