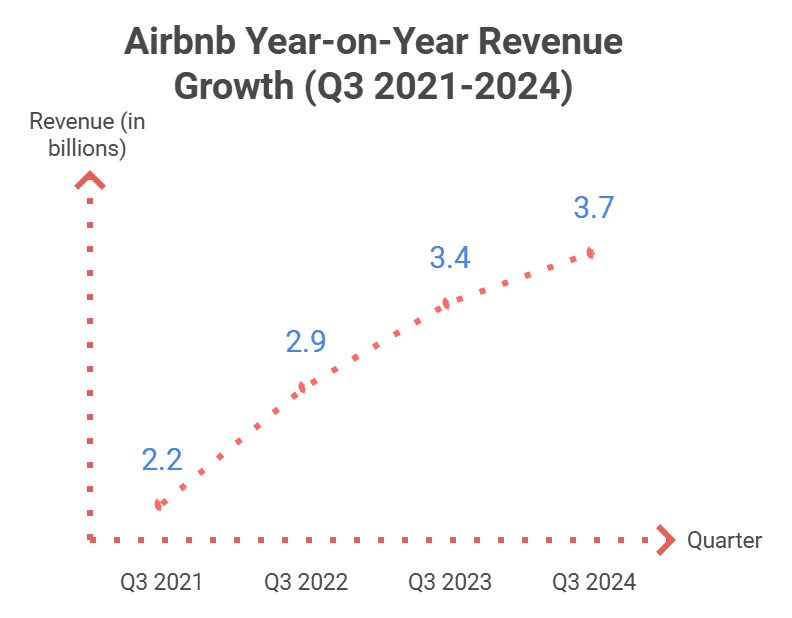

With revenue reaching $3.7 billion (up 10% year-over-year) and a surge in key metrics like total bookings, Airbnb is leveraging its strong position to improve quality standards, expand in emerging markets, and launch new services like the Co-Host Network.

For short-term rental managers, these changes offer both new opportunities and competitive pressures. Here’s a breakdown of key highlights from Airbnb’s Q3 2024 financials and the steps you can take to respond effectively.

Financial Performance: Solid Revenue and Cash Flow Keep Airbnb Primed for Growth

Airbnb reported strong financial results for Q3 2024, demonstrating continued growth and profitability. Here are the key highlights:

Financial Performance:

- Revenue: $3.7 billion, up 10% year-over-year

- Net Income: $1.4 billion, representing a 37% net income margin

- Adjusted EBITDA: $2.0 billion, up 7% year-over-year with a 52% margin

- Free Cash Flow: $1.1 billion generated in Q3, with $4.1 billion over the trailing twelve months

Operational Metrics:

- Nights and Experiences Booked: 123 million, an 8% increase year-over-year

- Active Listings: Over 8 million

- App Bookings: Increased 18% year-over-year, now accounting for 58% of total nights booked

- Guest Arrivals: Surpassed 2 billion all-time

Strategic Highlights:

- Bookings growth accelerated throughout Q3 and into Q4

- Strong performance in expansion markets, with average growth rate more than double that of core markets

- Improved supply quality, with host cancellations reduced by almost 30% compared to the previous year

- Introduction of the co-host network, attracting over 20,000 potential new co-hosts shortly after launch

Future Outlook:

- CEO Brian Chesky expressed optimism for the upcoming holiday travel season

- The company plans to launch 1-2 new businesses with $1B+ revenue potential annually, starting next year

- Airbnb is focusing on expanding beyond accommodations, with more details expected in the coming year

Quality Over Quantity: Airbnb is Raising Its Standards

Airbnb now has over 8 million active listings, but rather than just growing inventory, it’s focused on quality. Over the past year, Airbnb removed 300,000 underperforming listings. These removals have reduced customer service issues and increased guest satisfaction. Host cancellations have also dropped nearly 30%, further improving reliability.

Guest Favorites Drive Increase in Bookings

One of Airbnb’s key initiatives supporting this quality-first approach, Guest Favorites, highlights top-rated listings based on guest feedback. The program has proven effective, driving a 21% increase in bookings with Superhosts and high-ranking properties since its launch.

Also, by spotlighting properties in the top 1%, 5%, and 10% in listings, Airbnb is encouraging travelers to book with high-performing hosts, reinforcing the value of quality service.

What This Means for You: Airbnb’s quality-driven approach rewards hosts who maintain high guest satisfaction and reliable service. Managers should focus on quality control, as well-rated, dependable listings are likely to gain greater visibility and booking preference on the platform.

Co-Host Network: New Opportunities and Potential Competition

Airbnb’s Co-Host Network aims to attract hosts who want to list their properties but lack the time to manage them, connecting them with experienced co-hosts who handle bookings, communication, and setup. The program quickly gained traction, with over 20,000 interested co-hosts joining in just a few weeks.

What This Means for You:

- Tap Into New Revenue: Established managers can join the Co-Host Network to increase income by managing additional properties.

- Prepare for More Competition: New co-hosts may bring higher standards to the market, competing directly with professional managers. Differentiate your services by emphasizing expertise, quality, and reliable guest experiences.

Global Expansion: Airbnb Targets High-Growth Regions

Airbnb’s growth strategy includes significant investments in regions with high potential, such as Japan, Latin America, and Asia-Pacific. These areas are now experiencing faster growth than Airbnb’s core markets. Initiatives like targeted ad campaigns and local payment options aim to increase Airbnb’s appeal and usability in these regions.

What This Means for You:

- Position for Growth in Emerging Markets: Managers with listings in these regions may see rising demand and new traffic as Airbnb invests locally.

- Understand Local Preferences: Embrace local payment options and cultural preferences to maximize appeal to a growing pool of travelers in these areas.

New Revenue Streams: Airbnb Ventures Beyond Traditional Accommodations

Airbnb is preparing to launch “one or two new billion-dollar businesses each year”, starting with a relaunch of its Experiences platform in 2025. Experiences will be tailored for both locals and travelers, allowing Airbnb to increase engagement and build new revenue channels.

What This Means for You:

- Diversify Your Offerings: Managers can consider adding experiences or unique local activities as Airbnb introduces these services, positioning themselves to capture additional revenue from Airbnb’s broader user base.

- Stay Flexible: As Airbnb expands its service offerings, managers should keep a close eye on new opportunities that could integrate with or complement their current operations.

Shifting Market: More Last-Minute Bookings and Regulatory Pressures

Airbnb reported that guests are booking closer to their travel dates than in previous years, impacting revenue planning and availability strategies. Meanwhile, regulatory challenges, especially in markets like New York, continue to impact Airbnb’s ability to grow, while in others, such as Paris, more collaborative approaches are helping Airbnb manage large events like the Olympics.

What This Means for You:

- Optimize for Last-Minute Bookings: Adjust your pricing and availability strategies to attract last-minute travelers. Flexible settings and shorter minimum stays could increase bookings.

- Stay Informed on Local Rules: For managers in high-regulation areas, it’s essential to stay up-to-date on local laws and consider expanding into neighboring areas with fewer restrictions if necessary.

Bottom Line

Airbnb’s Q3 report signals a future of higher standards, global growth, and new business possibilities. For short-term rental managers, now is the time to align with Airbnb’s focus on quality, leverage the Co-Host Network, and prepare for expanded guest engagement as Airbnb introduces new services. By proactively adapting to these changes, managers can turn Airbnb’s growth into a pathway for their own success.