Airbnb, Booking, and Vrbo are busy finding ways to take the thunder away from each other. Vrbo wants Airbnb’s supply. Airbnb wants Vrbo’s large vacation rentals and Booking.com’s low prices. Meanwhile, Booking.com automatically imports Airbnb and Vrbo listings to bypass its own lengthy registration process and attract the individual hosts that its platform is missing. For the moment, Airbnb, Booking.com, and Vrbo look like differentiated players in the short-term rental industry, but how strong and defensible are their differentiators? If Airbnb has a large supply and low prices, what is left of Booking.com’s competitive advantages? If Airbnb manages to attract the family-friendly supply that is core to Vrbo, how long can Vrbo stand alone?

Airbnb vs Booking.com vs Vrbo: Still not overlapping

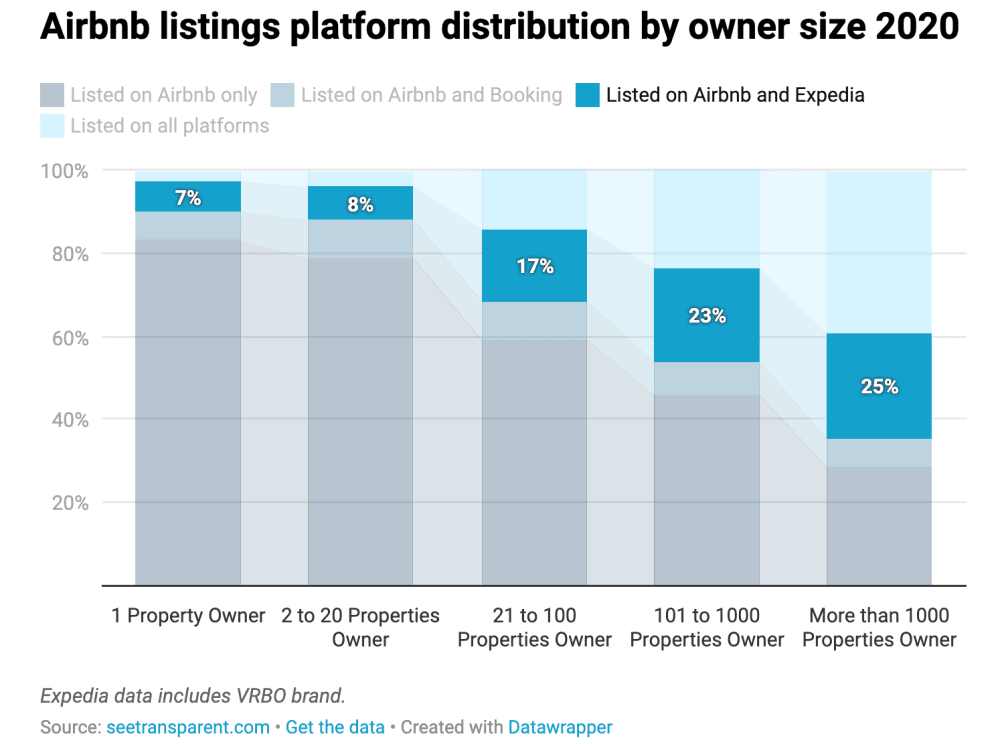

Airbnb, Booking, and Vrbo may be competing against each other, the gap between each company is still large. For instance, a lot of small Airbnb hosts are not listed on Vrbo. When Airbnb was getting ready for its December 2020 IPO, Transparent released a study on Airbnb hosts’ loyalty. The short-term rental data company looked at listings across Airbnb, Booking.com, and Expedia/Vrbo. According to their findings, 83% of Airbnb hosts with 1 property were listed on Airbnb only. Only 7% of them were listed on both Airbnb and Expedia/Vrbo, 7% on both Airbnb and Booking.com, and a tiny 3% on all of these platforms.

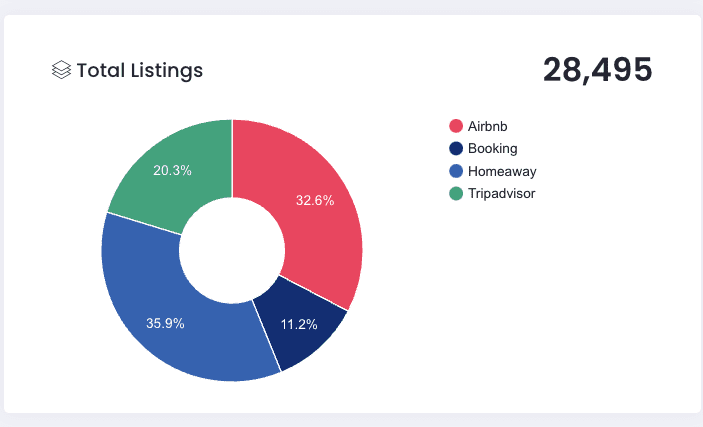

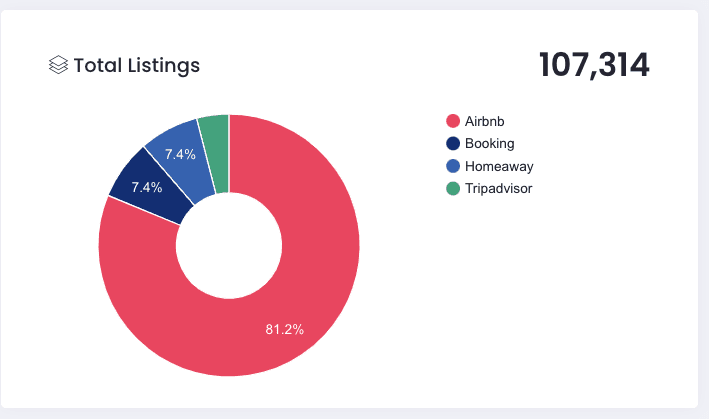

Using data from Transparent Intelligence again, let’s have a look at how the platforms are faring in two markets. As you can see, from one continent to another, from an urban market to a rural district, the overlap still varies:

Gatlingburg, Tennessee, USA: HomeAway/Vrno still strong, but Airbnb is growing

Paris, France: An Airbnb city in a historic Booking.com stronghold

Let’s have a look at the tactics used by the big short-term rental listing platform to steal some thunder from one another.

Vrbo: Capture Airbnb’s best hosts that offer entire homes

In 2021, Vrbo has been on the offensive and has started naming Airbnb directly in its press releases and commercials. It is a challenger tactic, which can be surprising from a company that’s been around for 20 years. Yet, a lot of newer hosts know about Airbnb but may have not tried Vrbo yet.

Vrbo: Direct claim that hosts make more on Vrbo than on Airbnb

In 2021, Vrbo was afraid to mention Airbnb’s brand when talking money:

Individual property owners who joined Vrbo in 2020 made an average of almost US$6,000 per property or 50 percent more than other travel sites.

Vrbo US’s commercials names Airbnb and uses the following claims:

- Vrbo is better at getting large properties booked (“bigger places like yours” and “luxury homes like yours” )

- Vrbo can attract families “

- Vrbo’s guests are more affluent (“spend over twice as much more”)

- The length of stay (LOS) is bigger on Vrbo (“Vrbo families who stay longer”)

Video audio: If you only list your vacation home on Airbnb, you might attract someone looking for a quaint little studio, but if you list it on Vrbo, you’ll attract families looking for a bit more and who spend over twice as much more. Your dream guests await. Become a Vrbo host today.

Video copy:

Vrbo guests spend over 2x on average and stay significantly longer. And they love luxury homes like yours.

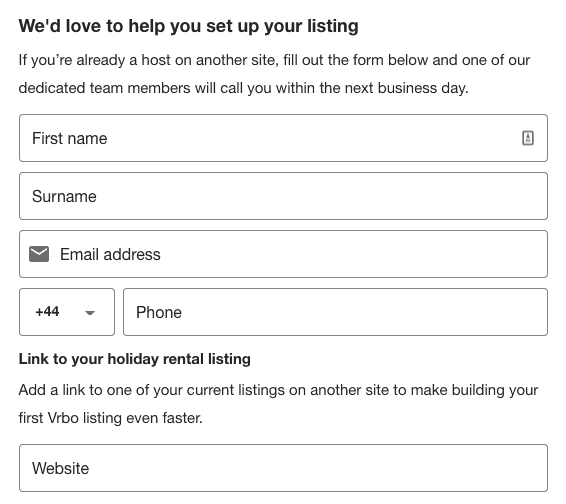

Vrbo Fast Start expanded to more countries

On September 15, 20221, Vrbo announced today that it was extending Fast Start program to Canada (Vrbo Canada), France (Abritel), and the UK (Vrbo UK). Vrbo’s goal is to attract successful Airbnb hosts who make decent revenue and want to diversify their booking sources.

Who can qualify for the Vrbo Fast Start program?

- Any Superhost or Airbnb host with a 4.5+ review rating

- who has earned more than £2,000 / €2,300in the last year

What do Airbnb hosts get on Vrbo?

- A ‘New to Vrbo’ / “Nouveau sur Abritel” badge displayed for 90 days -> More visibility in search results and an additional trust factor on the list page

- A review score based on reviews from other travel sites -> No need to wait to get bookings and reviews to get a public score

- An elevated position in sort -> Upranking in search results

- New hosts will receive dedicated, personal support. => We guess from Vrbo employees, a bit like what Airbnb Ambassadors provide to their new hosts they refer

- No exclusivity: The host can stay on Airbnb. This is about getting hosts to try out Vrbo.

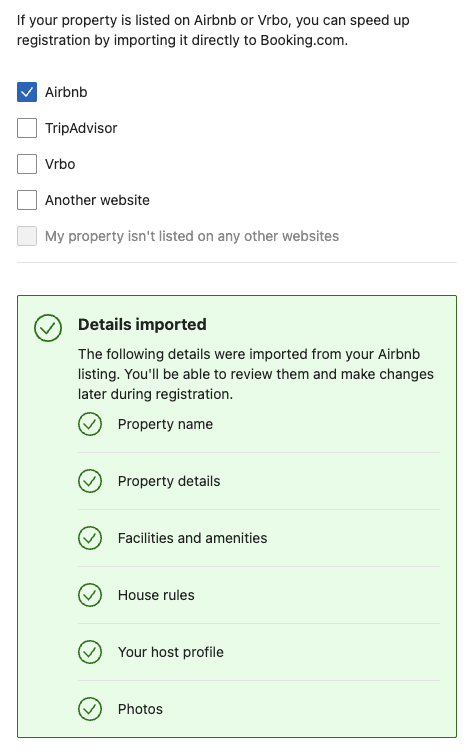

Booking.com: Make it easy for individual hosts to import their Airbnb and Vrbo settings

Vrbo’s Fast Start program looks to be a bit manual. Booking.com is traditionally keener on only doing things that are scalable. It may make it move slower and less boldly than others, but it can also result in interesting innovation.

Listing a property on Booking.com can be cumbersome. Yet, for people who want to know how to advertise their airbnb on Booking.com, here comes a solution: When a user registers a new property on Booking.com, they can important listing details such as property name, photos, details, facilities, amenities, house rules and host profile straight from Airbnb or Vrbo.

Airbnb: Capture Vrbo’s group and family-friendly positioning?

In a recent interview, Airbnb CEO Brian Chesky said the next opportunity for his company, in the coming 10 years, will be group and family travel. At the same conference, HomeAway (now Vrbo)’s founder Carl Sheperd noticed that this is what everyone else in the vacation rental industry had known for 40 years: Vacation rentals are mostly used by families and groups.

We at Rental Scale-Up could add that when Chesky is excited about multi-generational families and groups of friends traveling together to reconnect, he’s merely pointing out Vrbo’s core user group and business case.

During the pandemic, Airbnb’s marketing has shifted away from shared spaces to entire homes. This was visible in their TV commercials, where people were shown staying at cabins, vacation rentals, and apartments. Yet, what is striking in these Airbnb commercials is that families shown were most often made up of 3 people: 2 parents and 1 baby, 1 Mom and 2 daughters, for instance.

This was a sharp contrast with Vrbo’s commercials, which feature large families and groups of friends counting at least 5 people.

As we’ve seen above, Vrbo says that it can help hosts make more money, as it attracts larger groups than Airbnb.

This is obviously interesting to Airbnb too, as Airbnb makes money on bookings whose value is high.

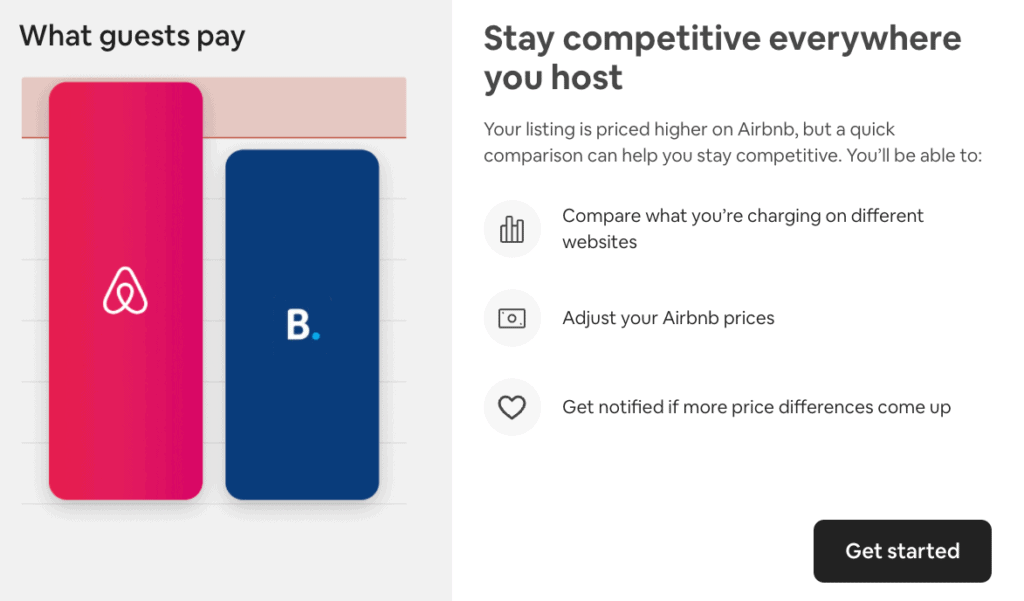

Price parity, a weapon that Airbnb can use to lower Booking.com’s price advantage

What is one of Booking.com’s main competitive advantages? Itss focus on getting the lowest price for its customers.

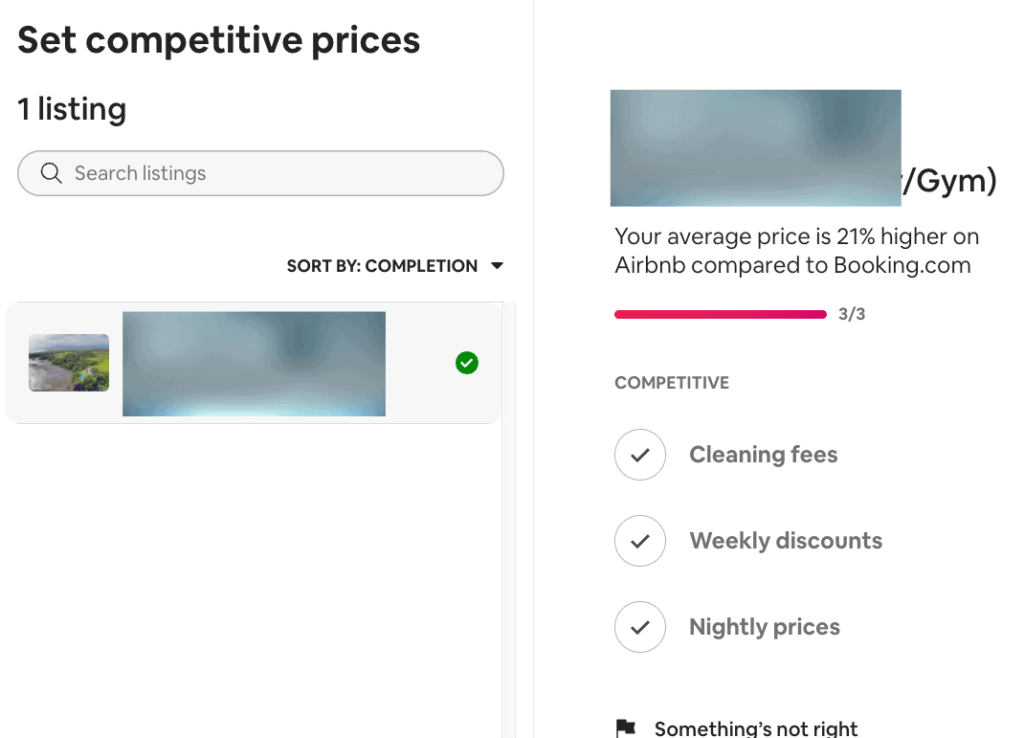

Airbnb hosts can now see, in the Insights report of their Hosting Dashboard, whether the listing is more expensive on Booking.com. If so, hosts are shown the following messages:

Compare how you’re priced on different websites

Check your Airbnb and Booking.com prices side-by-side to find out where you’re priced differently. Then adjust your prices to stay competitive everywhere you host.

The next screen gives a bit more explanation about what this is about. Airbnb is not afraid to show Booking.com’s logo and colors.

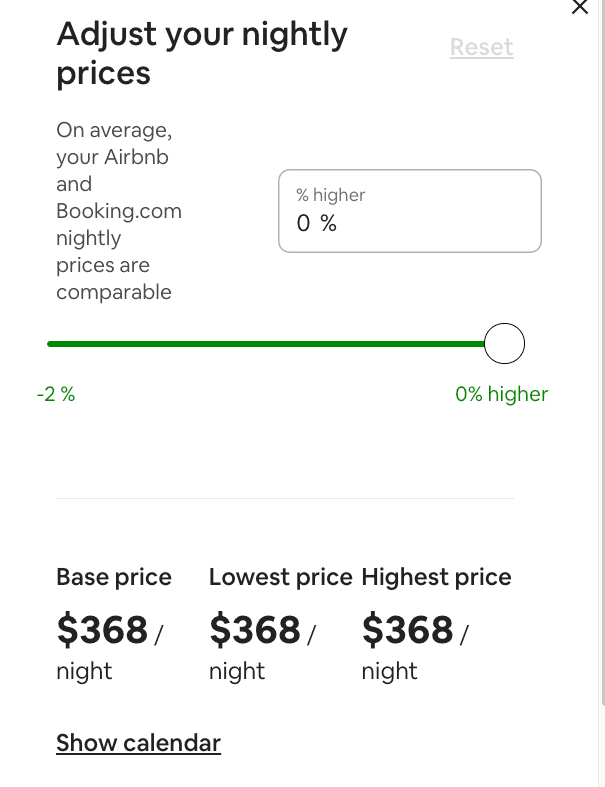

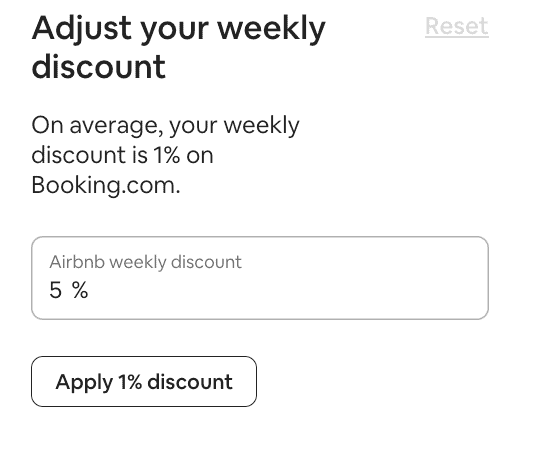

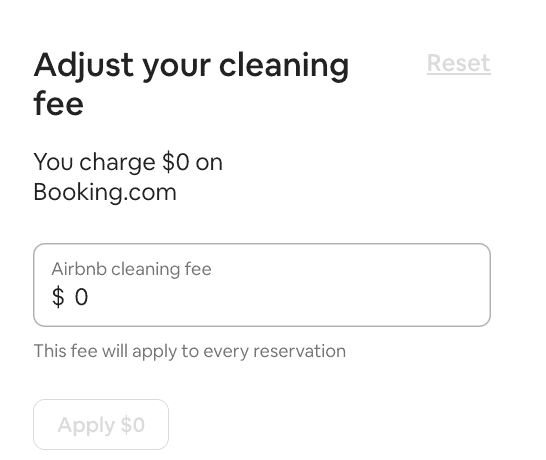

For the listings whose overall pricing Airbnb finds higher than on Booking.com, hosts can revise three price components:

1 – Nighty prices

2 – Weekly discount

3 – Cleaning fee

For the moment, Airbnb, Booking.com, and Vrbo’s brands clearly stand apart. Airbnb’s host base is supposed to be rather unique, especial among individual hosts. Vrbo wants to attract the best of them, while Booking.com is simply making ready for Airbnb (and Vrbo) hosts to onboard.

Property managers in Europe are usually already active on all three platforms. In the US, the overlap is more between Airbnb and Vrbo. Can Airbnb manage to take family travelers and family-friendly properties away from Vrbo? We will just end up with most large properties being available on both channels in the US?