Airbnb has officially updated its strategic playbook. As revealed in the Q2 2025 Shareholder Letter and reiterated during the earnings call, the company is now organizing its focus around three new strategic pillars:

- Perfect our core service

- Grow through new offerings

- Accelerate our international expansion

This marks a shift away from the earlier trio, which had been used since early 2023:

- Make hosting mainstream,

- Perfect the core service,

- Expand beyond the core.

Notably, “Make hosting mainstream” has been retired as a standalone goal, and “international expansion”—previously just a subset of broader plans—has now earned top-line status as its own pillar.

In essence, Airbnb Strategy 2025 reflects not just a change in language, but a shift in mindset. Airbnb is moving from an aspirational tone to a more grounded, execution-driven strategy. The emphasis is now on measurable results, scalable platforms, and operational efficiency—rather than on storytelling or movement-building.

That said, hosting remains central. Even though it’s no longer its own pillar, Airbnb is doubling down on host supply strategically—especially where it intersects with growth priorities. For instance:

- International growth requires onboarding hosts in new markets like Germany, Brazil, and Japan.

- Major global events (e.g. concerts, sporting events) are prompting Airbnb to recruit occasional and part-time hosts in high-demand zones.

- Operational upgrades include co-hosting tools and faster onboarding processes, crucial to supporting this more targeted host expansion.

Let’s take a closer look at each new pillar and what it means for your business.

1. Perfect Our Core Service

Airbnb’s first strategic priority remains the foundation: make the booking and hosting experience smoother, faster, and more reliable—for both guests and hosts.

But what’s changed is how they’re doing it. Instead of focusing broadly on delighting users, Airbnb is targeting efficiency, automation, and measurable performance gains. Improvements are increasingly tied to clear business metrics like increased conversion, reduced support tickets, or margin improvement.

Key examples from Q2:

- AI-powered support agents now resolve 94% of English-language guest inquiries automatically—a big step toward scaling support without growing costs.

- Streamlined checkout and flexible payment options are being optimized to drive higher bookings and reduce abandonment.

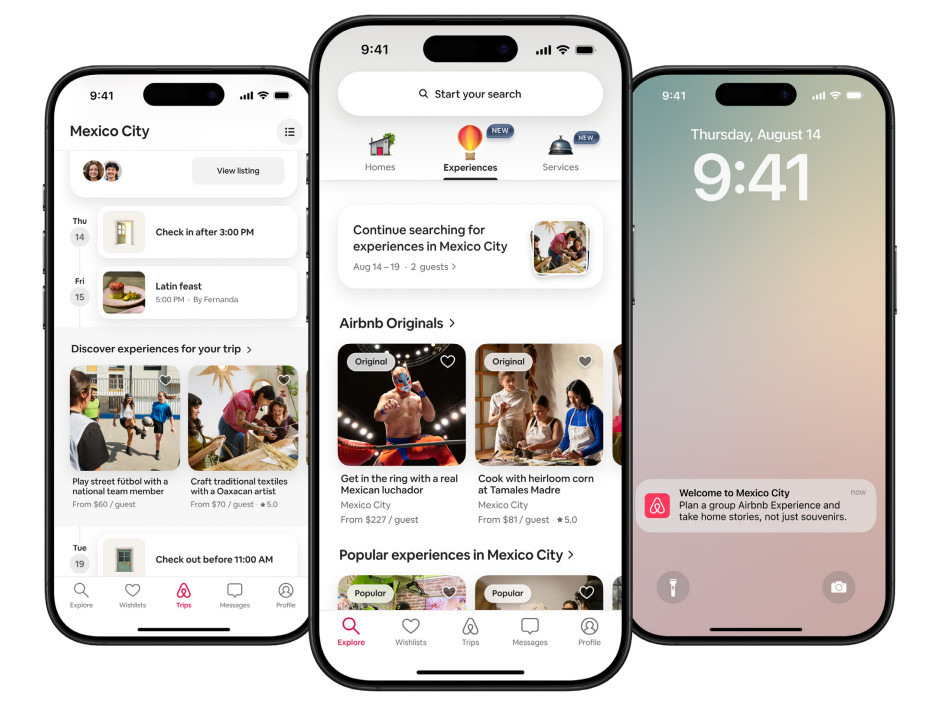

- Mobile app redesign now allows guests to book stays, experiences, and services from a unified platform, creating a more seamless path to purchase.

What it means for vacation rental managers:

Expect Airbnb to push harder on tools that improve guest satisfaction and drive booking conversion, especially in mobile. For hosts, this may lead to more pressure to adopt Airbnb’s suggested settings (e.g. Instant Book, Smart Pricing) in the name of guest trust and platform consistency.

What to watch out for:

- Airbnb’s UX choices may prioritize guest simplicity over host customization.

- AI-driven support could miss context on complex host-side issues.

- Conversion-focused updates may come with little advance notice or optionality.

2. Grow Through New Offerings

This second pillar is about turning Airbnb into more than a place to book a stay. The company is betting that Experiences and the newly launched Services (think mid-trip upgrades like early check-in or airport rides) can become major sources of revenue.

Airbnb is no longer treating these as side projects. With $200 million allocated to new offerings in 2025, they’re building the infrastructure—teams, supply, and vetting tools—to scale these categories. And while current volume remains “immaterial,” Airbnb says these verticals could one day rival the core business in size.

Key details:

- Airbnb Services were quietly rolled out and are being expanded based on host/guest demand and app integration.

- Experiences are now more tightly integrated into the booking flow, which Airbnb believes will drive a higher attach rate than before.

- Importantly, 40% of Airbnb Originals and 10% of Services are being booked by locals—not just travelers—highlighting an opportunity for local demand.

What it means for vacation rental managers:

If you’re in a high-traffic area or event-based market, Airbnb may nudge you to offer upgrades or partner with service providers. There’s also a potential opportunity to monetize more touchpoints across the guest journey—before, during, and after a stay.

What to watch out for:

- These offerings are still experimental—returns may take time.

- The company’s $200M investment will weigh on margins, possibly prompting cost control elsewhere.

- Scaling these services without diluting quality or brand trust remains a major challenge.

3. Accelerate Our International Expansion

This is the newest of the three pillars—but not a new idea. Airbnb has long talked about growing beyond the U.S., but now it’s elevating international markets as a core driver of growth, not just a supporting role.

In markets like Japan, Germany, Brazil, and Mexico, Airbnb is pursuing tailored growth strategies—including local marketing, product customization, and host acquisition—to drive bookings from first-time guests and expand awareness.

Key highlights:

- Japan saw the highest year-over-year bookings growth of any major country in Q2 2025.

- Airbnb is investing in localized app features, payment options, and even customer service to meet regional needs.

- The company is emphasizing co-hosting tools and streamlined onboarding to quickly scale host supply in target geographies.

What it means for vacation rental managers:

If you’re managing listings outside North America—or plan to expand—Airbnb may offer new demand levers and localized tools. Increased platform visibility and marketing support could help raise occupancy in emerging or seasonal markets.

What to watch out for:

- Market-specific regulation remains a wild card and could limit growth.

- Regional competition (e.g. Booking.com in Europe, local OTAs in Asia) is fierce.

- Platform features may evolve unevenly across markets, creating friction for cross-border operators.

📊 From “Experiences Booked” to “Seats Booked”: Why It Matters

What changed:

In Q2 2025, Airbnb replaced its “Nights and Experiences Booked” metric with “Nights and Seats Booked.” Each “seat” now reflects one person attending an experience or service, instead of counting bookings at the event level.

Why it aligns with the industry:

This brings Airbnb in line with standard practice in ticketing and attractions, where performance is measured by tickets sold — one event with 20 attendees equals 20 seats. Platforms like Spektrix and Eventbrite use this model.

What it implies:

As part of Airbnb Strategy 2025, counting “seats” rather than “experiences” may help Airbnb show stronger growth as it scales its reimagined verticals. A single popular experience with 10 guests now shows up as 10 seats, not one booking — potentially boosting the optics of traction, especially in early stages

Thibault Masson is a leading expert in vacation rental revenue management and dynamic pricing strategies. As Head of Product Marketing at PriceLabs and founder of Rental Scale-Up, Thibault empowers hosts and property managers with actionable insights and data-driven solutions. With over a decade managing luxury rentals in Bali and St. Barths, he is a sought-after industry speaker and prolific content creator, making complex topics simple for global audiences.