The short-term rental industry has recently been tested by layoffs and demand uncertainty. December 2022 and January 2023 saw the introduction of further events that may present even greater disruptions.

But forward-thinking property managers can use the potential turbulence to their advantage, by creating contingency plans that are both adaptive and agile, allowing them to take full advantage of emerging opportunities as they arise. These strategies were discussed at our first free virtual conference of the year, titled ‘5 Factors That May Derail Your 2023 Planning and How To Avert Them’ which brought together experts in the field to share advice on how short-term rental managers can best face the future with confidence.

In this article, we share key takeaways from this conference of the year uncovering recent trends and news, worrying and otherwise, and practical measures for reacting appropriately.

Meet our speakers:

- François Gouelo, CEO & Co-Founder, Enso Connect

- Neal Cyr, CEO, Quibble RM

- Pierre-Camille Hamana, CEO & Founder, Hospitable

- (HOSTED BY) Thibault Masson, Founder, Rental Scale-Up, and Head of Product Marketing at PriceLabs Inc

1. Inflation, recession, price-sensitivity – is short-term rental demand about to nosedive?

Many managers are probably looking at January and planning for a bad year. The data available to revenue management experts at Quibble, as shared by its CEO Neal Cyr during our online conference, is showing that January occupancy is substantially down. Conversely, February and March are still holding at or above last year’s occupancy numbers. The hard question is should short-term rental managers preemptively reduce pricing or follow the real-time data.

Tightening the Purse Strings: Consumer Concerns Can Impact Spending During Economic Uncertainty

Despite the fact that a recession has yet to hit the US and other Western nations, shares Hospitable CEO & Founder Pierre-Camille Hamana, anxiety around continued layoffs and industry disruptions caused by the current crisis can lead consumers to become more conservative with their spending on non-essential items. This could mean that plans for future trips are not booked as early compared to pre-crisis times, but they may be planned in due course.

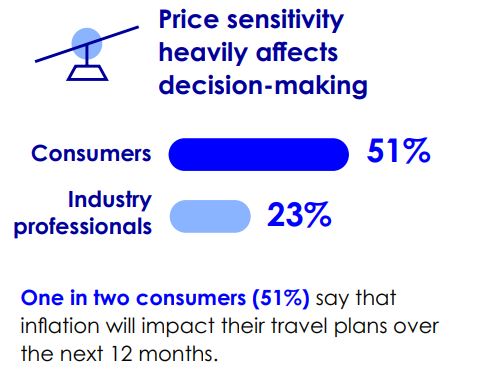

Flexible Bookings and Price-Sensitivity: Post-Pandemic Guest Expectations Are Evolving

In Expedia’s research of Traveler Value Index 2023, points out Enso Connect CEO and Founder François Gouelo, the main findings are that inflation-related concerns are replacing post-pandemic health and safety expectations. Price sensitivity, flexible policies, and refundable rates are at the center of guest values. However, it doesn’t mean that the travelers are hunting down the cheapest deals, it’s more about getting their “money’s worth”. This is why guest experience is more important than ever.

2. How Resilient Will Short-Term Rental Markets Be in Face of Bloating Supply

The continued increase in market supply is our biggest concern, states Neal Cyr. He explains that this bloating supply puts downward pressure on the price by spreading demand over more inventory and making marketing more expensive to capture a customer.

Short-Term Rentals in Prime Real Estate Markets Will Continue to Attract Interest

Pierre-Camille Hamana suggests that real estate may not face uniform effects in top US travel destinations. Properties in prime markets are likely to still have more buyers than needed, while some others may remain on short-term rentals until they find a suitable sale. This has happened before in certain markets where property prices were dropping, and inflation is likely to encourage more owners to opt for short-term rentals.

3. Online Privacy Regulations Could Create an Extra Hurdle

The rise of digital interactions between hospitality operators and guests raises questions about laws regulating the Internet and digital environments, expresses François Gouelo.

An example is the European Data Protection Regulation, GDPR. This regulation is the answer to a real demand of users wanting to have greater control of their data, together with greater security and privacy. And if implemented proactively and transparently, can generate a greater level of trust in guests. However, many companies are unclear on how to maintain GDPR compliance.

4. Wild Currency Exchange Fluctuations Could Deter Guests From Booking Internationally

As the global travel industry starts to recover and rebound, Pierre-Camille Hamana warns that any large currency fluctuations in 2023 could affect the re-globalization process. The addition of more EU-US and Chinese travelers may be thrown off balance should the EUR/USD rate swing 17%, as different customers may become more or less attracted to international destinations depending on which way it moves.

This will be particularly important for larger-scale operators doing their own payment processing.

Doom and gloom scenario! With continued inflation, regulators (likely starting from the European Union!) could demand more pricing transparency across industries perceived as performing price-gouging. Online booking platforms want to show goodwill and spontaneously introduce capped increases in nightly rates!

We have already seen the European Union’s push to make Airbnb more consumer-friendly, especially when it comes to price transparency.

5. Will Recent Layoffs at Large Operators Like Vacasa Affect Local Operators

Pierre-Camille Hamana suggests that the recent layoffs in technology companies such as Vacasa could create new prospects for local operators while raising questions about the future of remote work. These layoffs are sure to affect demand in the company’s key markets.

Conversely, larger property management companies may follow in their footsteps and push for profitability faster, and venture capital funds may be attracted to invest in the opportunity.

Wild Card: The Impact of ChatGPT on Short-Term Rental Property Managers

The opportunities of large language AI models (like Chat GPT) and their use in hospitality will only increase guest experience and boost performance, offers François Gouelo. The cultural impact of ChatGPT is yet to come, but the seed has already been planted in popular opinion. This will accelerate the drive of technological transition toward Artificial Intelligence for every industry. This will be the great equalizer of the decade, he predicts.

Google just called a “Code Red” to defend its business against ChatGPT, reports Pierre-Camille Hamana, which will be licensed by Microsoft. The ability to use this technology, and its subsequent iterations, is perceived as the biggest threat to established companies everywhere, including in travel & hospitality.

How Can Property Managers Respond To These Challenges?

Property managers must develop strategies to manage their resources effectively, respond rapidly to market trends, and make well-informed decisions to stay ahead of the competition. With a clear vision, good planning, and the right technology, property managers can create innovative solutions to overcome any obstacle on their path to success. Here is what our speakers had to suggest on the subject:

How to track major events in a local market that may affect demand in an area, and how to plan your resources around these changes?

Using own booking data and competitor data to make better decisions

The starting point to answer this question is in your historical data, points out Neal Cyr. Many events happening this year happened last year.

Next is to use future-looking market data. In this data, you are looking for both spikes in occupancy and in pricing. If it is an event, you have not identified yet, it is possible your neighbors have. What is also possible is many of your neighbors have already sold out, and you still have a chance to raise your prices.

For effective tracking of relevant metrics, Pierre-Camille Hamana recommends creating a “stagger chart” – a forecast covering the next 12 months month by month. It is important to take note of past forecasts as a way to learn and reflect on future predictions. Remember that people who spend 50 hours a week analyzing the economy do not know the answer!

Learn to glean by context based on guest requests patterns

Perform context analysis of all interactions in your business, advises François Gouelo. You may not know about any big events going on, but if you notice an increase in requests focused on health and safety, questions about outdoor spaces, for example, it signals that people are concerned about spreading diseases. Questions about high-speed internet might signal an increase in workations or a wave of digital nomads coming to your area, etc. Monitor these trends and use this to make data-driven business decisions.

He also suggests that you track guest sentiment and collect feedback to take care of edge cases, increase guest satisfaction and receive only 5-star reviews.

How can tech help plan and execute a contingency plan?

Consider how investing in technology will pay off for you

Spending on tech is all about increasing the velocity of the business to seize more opportunities or doing more with fewer resources, emphasizes Pierre-Camille Hamana.

2023 is uncertain, there may be more opportunity for some, and more attention to profitability for others. He implores you to ask yourselves: Could your software stack allow you to face 100x of your scale, with a 10th of the resources? Would your software stack help you react to market changes with more agility?

Think about ‘Connections’ that work with what you already have

Technology allows operators to streamline processes, eliminate human error and implement protocols for any predefined scenario, comments François Gouelo. Having the needed tech in place can help ensure that all necessary steps are taken in the event of an emergency or other unexpected event. Operators can be ready with an immediate response that solves the problem or gives them time to solve the issue.

He expresses that there will be even more fragmentation as more and more vendors offer newer, more specialized tech solutions, but short-term rental managers will benefit from being able to ‘connect’ – finding technology that connects to other systems will allow you to follow new trends without upending existing processes.

Improve your reaction time to changing market

Neal voices that the right tech can help you react quicker to changes in the market. It is easy to look backward and see where we underperformed. It is harder to constantly react to changes in the market. Tech helps you do that.

Short-term rental management is a complex and ever-changing landscape. To stay ahead of the competition, property managers must be aware of the local market and develop strategies that are agile and adaptive to any changes in their environment. Preparedness is key; by anticipating new developments and implementing contingency plans, property managers can ensure success for their businesses even in uncertain times.