FIFA World Cup 2026 hasn’t started yet, but its impact on travel markets is already unmistakable.

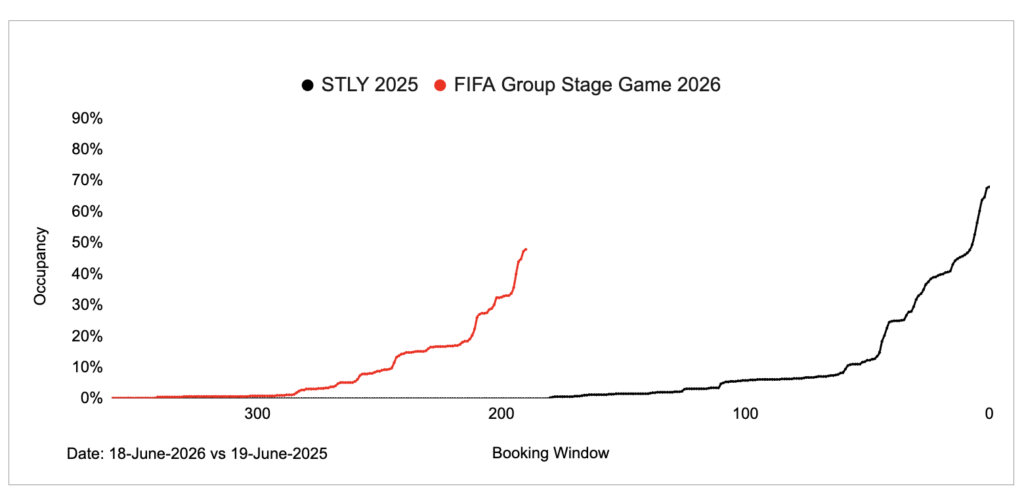

On December 5, when the official World Cup draw confirmed who would play where and on which dates, booking activity surged across host cities. In some markets, short-term rental occupancy jumped to more than 40 times higher than the same point last year within days.

But the response hasn’t been uniform. Despite the tournament’s global pull, and at a time when international travel to the U.S. has softened, some cities are seeing explosive early demand, while others are moving more slowly, shaped by domestic travel habits, regulation, pricing power, and supply constraints.

Using booking-curve data from PriceLabs across seven key host cities, we looked at how World Cup demand is actually unfolding, and why tracking your market closely matters more than reacting to headlines.

Looking at Seven Key FIFA World Cup 2026 Host Cities

To make sense of how FIFA World Cup 2026 demand is taking shape, we focused on seven host cities chosen for their different roles within the World Cup ecosystem: opening and closing matches, stadium scale, domestic versus international travel patterns, and cross-border dynamics.

Together, these seven cities show why there is no single “World Cup effect,” only local responses to a global event.

Mexico City: Opening Match City with a Massive Domestic Football Base

FIFA World Cup 2026 Venue: Estadio Azteca Mexico City (commonly known as Estadio Banorte)

Mexico City was always going to move differently, and earlier, than most other host cities.

As the opening match host, Mexico City had certainty long before the December draw. Add to that a huge population of domestic football fans, easy internal travel, and fewer visa barriers for international travelers, and you get a market where demand didn’t need a trigger to wake up.

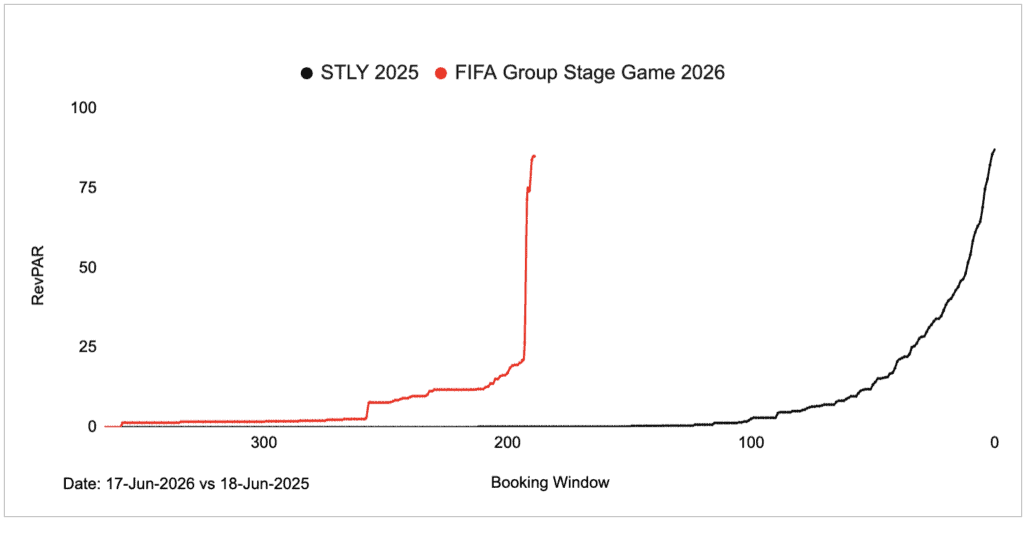

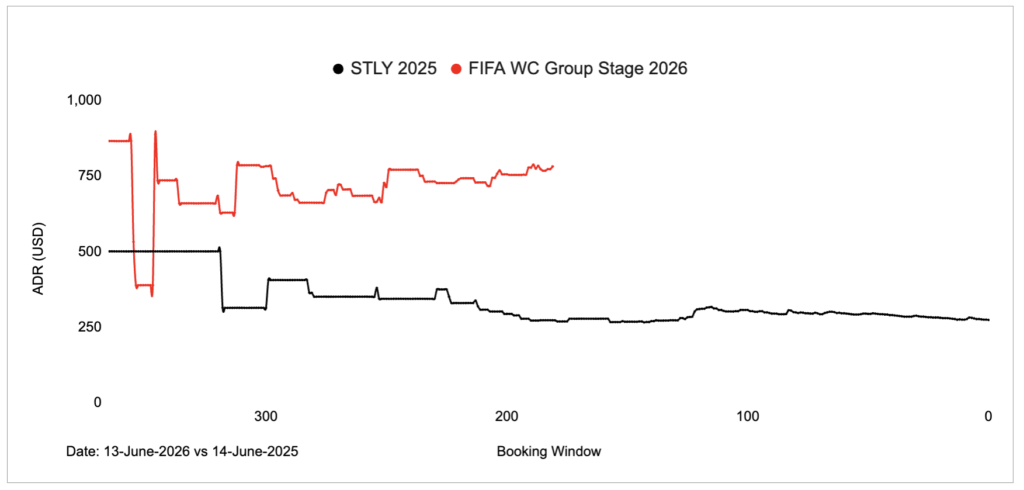

PriceLabs data shows that pricing was already elevated months in advance, with bookings accumulating steadily rather than spiking abruptly. For many fans, attending the opening match was never in question. The only decision left was where to stay.

There is also broader affordability at play. Compared with U.S. host cities, accommodation prices in Mexico City remain materially lower, making it a viable alternative for international fans who may be priced out of U.S. markets or discouraged by visa complexity. That pricing gap could further reinforce Mexico City’s role as a pressure valve for global World Cup demand.

Here, World Cup demand feels calm, confident, and culturally anchored; less speculative, and more assured.

New York–New Jersey: Global Gateway, High Prices, Slower Burn

FIFA World Cup 2026 Venue: New York New Jersey Stadium (commonly known as MetLife Stadium, located in East Rutherford, New Jersey)

The World Cup final will be played here, but demand behaves very differently than people might expect.

This is one of the world’s busiest gateway markets, with international tourism, corporate travel, and year-round demand already baked in. New York City’s strict short-term rental rules don’t constrain supply in New Jersey itself, but they do shape where visitors stay: many fans will default to hotels in Manhattan or spread out across New Jersey rather than rely heavily on short-term rentals near the stadium.

There is pricing power, but less room for explosive early growth. Instead, demand builds carefully. After the draw, bookings and prices did rise, but in a measured way, as fans began locking in plans while leaving room for flexibility.

Here, the World Cup doesn’t upend the market. It tightens an already busy one, pushing demand outward and forward rather than triggering a sudden surge.

Atlanta: Drive-To Market with Heavy Summer Travel Already in Place

FIFA World Cup 2026 Venue: Atlanta Stadium (commonly known as Mercedes-Benz Stadium)

Atlanta doesn’t need a World Cup to fill rooms in summer, and that matters.

Between June and August, the city consistently ranks among the most popular summer travel destinations in the U.S., driven by festivals, concerts, sporting events, and a steady stream of domestic leisure travel. It’s easy to reach, relatively affordable to fly into, and well-suited to short trips, weekend stays, and drive-to travel from across the Southeast.

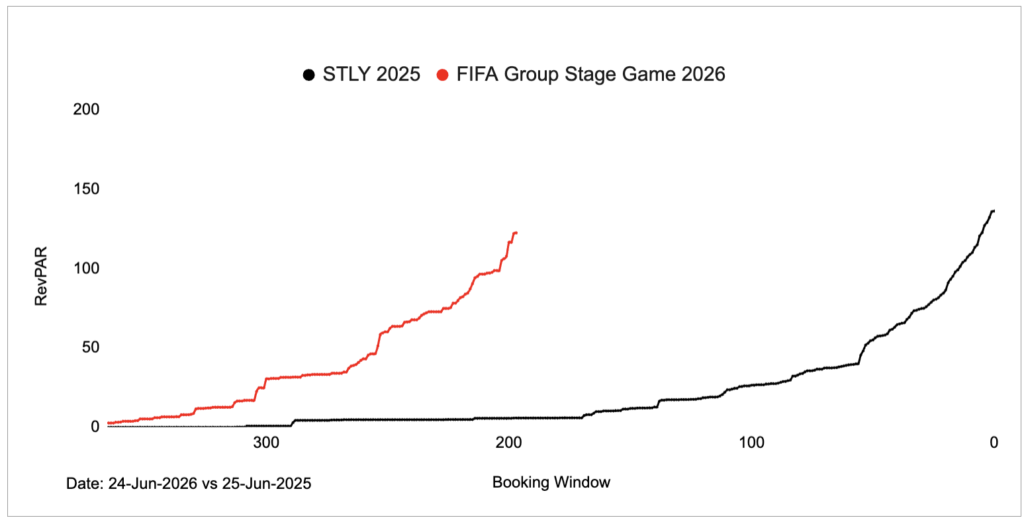

When multiple World Cup matches are added to that mix, demand doesn’t suddenly appear, it simply starts earlier and builds faster. Occupancy has been climbing well ahead of the draw, reflecting how familiar Atlanta already is as a summer destination. Pricing, by contrast, has been slower to react, suggesting there may still be room for rates to rise as inventory tightens closer to kickoff.

This is a market where the World Cup layers onto existing travel habits rather than creating new ones.

Dallas: One of the Tournament’s Biggest Stages With Supply Still in Question

FIFA World Cup 2026 venue: Dallas Stadium (commonly known as AT&T Stadium)

Dallas is a classic example of a market where confidence showed up early, but certainty is still evolving.

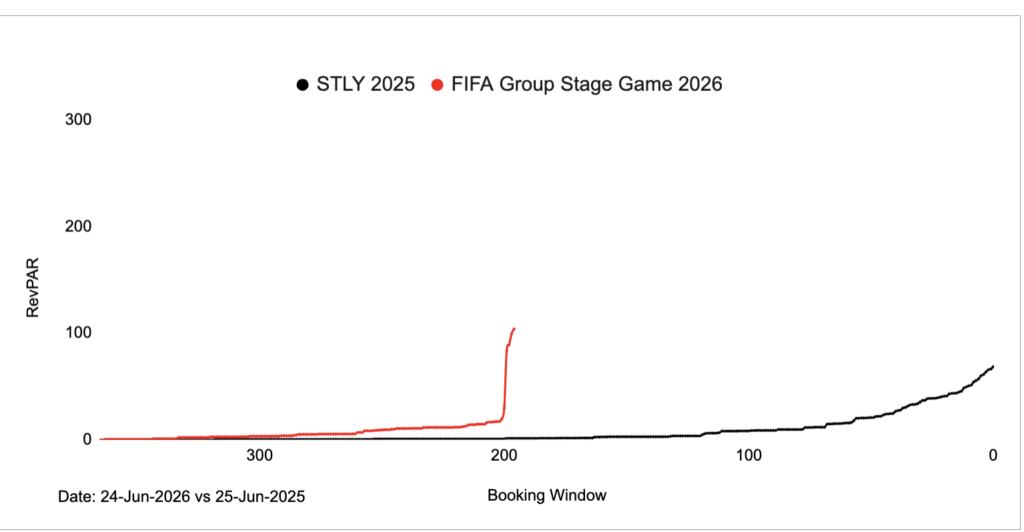

Home to one of the largest stadiums in the tournament and long accustomed to hosting major global events, Dallas saw pricing jump well ahead of last year even before bookings fully followed. Hosts clearly expected demand to arrive. Once the December draw confirmed matchups and dates, occupancy began to catch up, validating those early assumptions.

At the same time, Dallas carries a layer of regulatory uncertainty that could still reshape the market. The city has asked the Texas Supreme Court to lift an injunction currently blocking enforcement of its short-term rental ban. If that injunction is lifted, Dallas would be able to restrict unregulated short-term rentals, limiting how much new, often part-time supply can come online ahead of the tournament.

If supply tightens while demand continues to build, pricing pressure could increase further. If not, additional inventory may still temper rates. Either way, Dallas remains a market where early signals look strong, but outcomes are still very much in motion.

At 189 days before kickoff, RevPAR was nearly 500 times higher than at the same point last year. While revenue had begun rising well ahead of the tournament, a pronounced step-up followed the December 5 draw.

Kansas City: Sports-Savvy, Mostly Domestic, Calm and Methodical

FIFA World Cup 2026 Venue: Kansas City Stadium (commonly known as GEHA Field at Arrowhead Stadium)

Kansas City looks like a market that already understands how big sports weekends work.

Demand has been building steadily rather than explosively, reflecting a fan base that is largely domestic and deeply accustomed to traveling for major sporting events. Much like NFL weekends at Arrowhead, many World Cup visitors are expected to drive in from nearby states, plan trips with confidence, and book practical accommodations without waiting for last-minute certainty.

Because these travelers don’t face visa logistics or international travel friction, there is less pressure to book all at once. Pricing has remained disciplined as a result, even as revenue continues to climb.

What sets Kansas City apart is that this calm demand curve is happening alongside deliberate regulatory coordination. Local leaders approved a temporary pause on short-term rental tax reclassifications that would have significantly increased property taxes for STR operators; a move that could have sharply reduced available supply ahead of the World Cup. That pause is in place through the tournament, helping stabilize inventory for now, though a pause is only a pause.

At the same time, the Missouri Vacation Home Alliance (MOVHA) has been actively working with local stakeholders to prepare hosts for the event, including developing World Cup–specific hosting guidance and education. The result is a market that is not just reacting to demand, but actively planning for it.

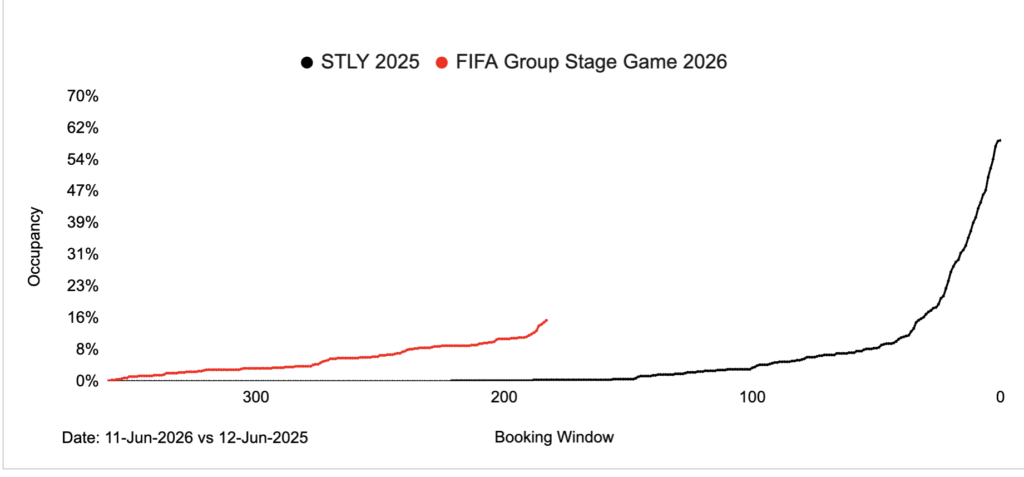

Miami: International Leisure Hub Where Demand Moves Fast

FIFA World Cup 2026 Venue: Miami Stadium (commonly known as Hard Rock Stadium)

Miami reacted to the draw loudly, and for clear reasons.

As one of the most internationally connected leisure markets in the U.S., Miami was always likely to respond quickly once teams and dates were confirmed. The city’s group-stage schedule includes Saudi Arabia vs. Uruguay, Uruguay vs. Cape Verde, Scotland vs. Brazil, and Colombia vs. Portugal – matchups that strongly appeal to fans traveling from Latin America, Europe, and the Middle East.

For many of these visitors, attending the World Cup involves long-haul flights, visa planning, and multi-day itineraries. That kind of travel doesn’t happen casually. Once the draw provided certainty around who was playing in Miami, demand accelerated quickly as international fans moved to lock in accommodation alongside flights and match tickets.

Miami’s baseline leisure demand is already high, but the World Cup adds a distinctly global layer. That also makes the market more sensitive than most U.S. cities to changes in visa costs, entry requirements, or broader international travel sentiment, factors that could still influence how demand evolves closer to kickoff.

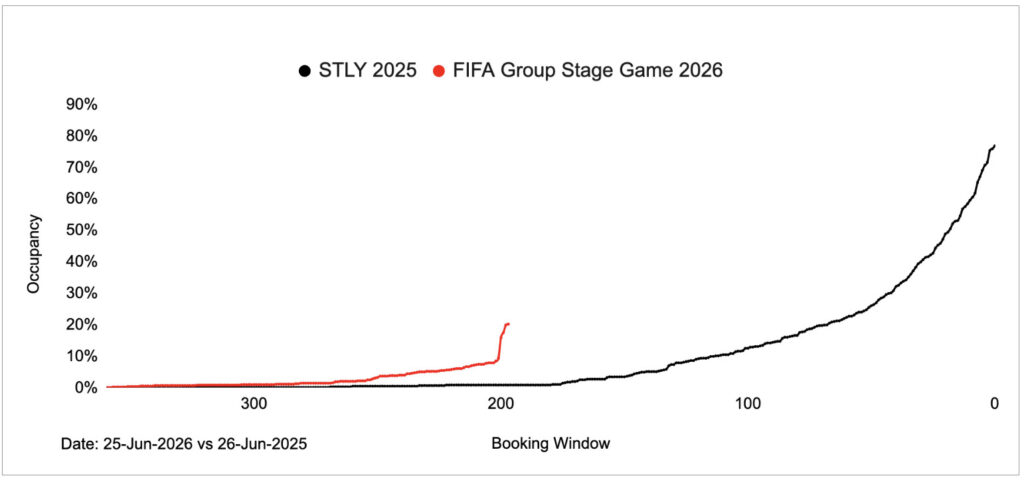

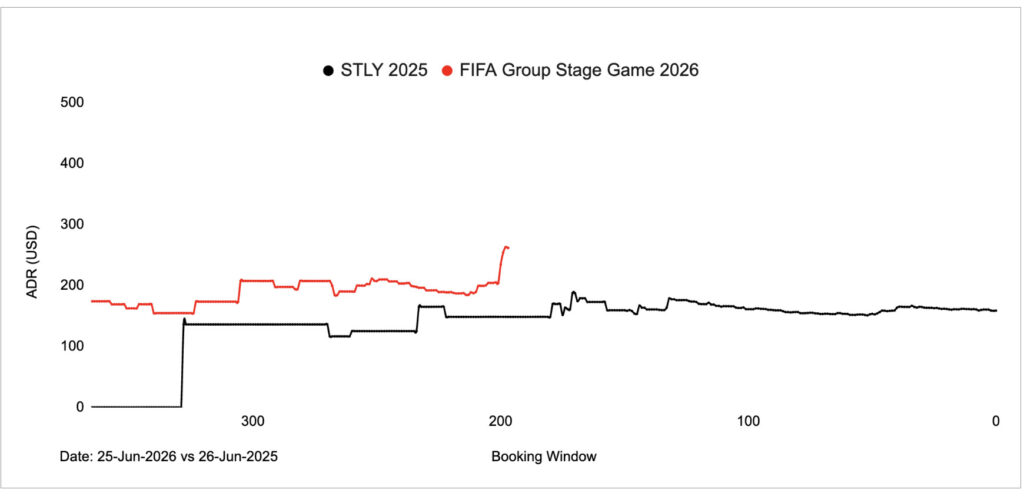

Vancouver: Supply-Constrained, Price-First, and Shaped by Who Stays Home

FIFA World Cup 2026 venue: BC Place Vancouver (commonly known as BC Place)

Vancouver’s World Cup story isn’t about whether demand will arrive. It’s about how little room there is to absorb it.

Strict short-term rental rules and zoning limitations restrict where and how STRs can operate, capping the amount of inventory that can come online even as the tournament approaches. Hotels are already among the most expensive in Canada, and accommodation prices in the city have been climbing for years. The result is a market where prices move first, long before bookings have a chance to surge.

That pricing pressure is also shaped by broader travel behavior. Throughout 2025, Canadian travel to the U.S. declined, while trips to Mexico accelerated. For some Canadian fans, World Cup matches in Vancouver may replace trips they might previously have taken south of the border. Supporting the national team at home, without navigating U.S. entry requirements, becomes the simpler option.

If regulatory conditions remain unchanged, Vancouver’s accommodation supply will stay tight, and prices will continue to carry the weight of demand. If rules shift, the curve could still change. Either way, this is a market where policy and travel sentiment are shaping outcomes as much as football itself.

What the City-by-City Data Makes Clear

Across these seven host cities, World Cup demand is already taking very different shapes. Some markets are being driven largely by domestic, drive-to travel. Others depend heavily on international visitors. In some places, prices surged long before bookings followed. In others, demand built steadily without dramatic spikes. Regulation, supply limits, and travel culture matter just as much as the matches themselves.

This is why simply knowing that the World Cup is “driving demand” isn’t enough. What matters is how demand shows up in your market, and how that behavior continues to evolve over time.

And the forces shaping that evolution don’t stop with the draw.

Why World Cup Demand Will Keep Shifting

Even with the schedule now set, several factors, many of them still unresolved, will continue to influence how bookings, pricing, and availability unfold between now and kickoff.

Ticket access: demand exists, attendance is still fluid

The December draw gave fans certainty about match locations and dates. It did not guarantee access.

Ticket pricing for World Cup 2026 has already been controversial, with many fans describing prices as “exorbitant” and availability uneven. While FIFA later introduced lower-cost supporter tickets, access remains constrained, and not everyone who wants to attend will be able to.

That matters because:

- early bookings tend to skew toward higher-income travelers

- host-country fans (notably in Mexico and Canada) benefit from allocation advantages

- later ticket releases or resale activity can still trigger new booking waves

Layer on top the structure of the tournament itself – group stages, knockout rounds, and the possibility that popular teams advance – and demand remains inherently flexible. Some fans will wait. Others will book refundable stays. Many will decide only once performance expectations become clearer.

In other words, booking curves are still forming.

Regulation and supply: when demand meets hard limits

Demand doesn’t rise in a vacuum. It collides with supply.

Vancouver offers the clearest example. Strict short-term rental rules sharply limit how much inventory can come online, even as the World Cup approaches. Prices have risen steadily as a result, well ahead of major booking surges.

In parts of the U.S., the picture is more unsettled. Markets like Dallas and Kansas City have seen regulatory debates, court challenges, or temporary pauses that could still affect how much supply is available closer to the tournament.

The takeaway is simple: changes in regulation, or even the expectation of change, can reshape markets faster than demand alone.

International travel friction: visas, sentiment, and uncertainty

For markets that rely heavily on international visitors, demand is also shaped by forces well beyond football.

Overseas travel to the U.S. declined throughout much of 2025, reflecting a mix of factors: higher costs, shifting entry requirements, and broader traveler sentiment. Some travelers have cited growing frustration with the complexity of entering the U.S., while others point to a more general cooling of enthusiasm, including, in some cases, anti-Trump sentiment.

Policy proposals add another layer of uncertainty:

- a potential Visa Integrity Fee increase of a whopping $250

- expanded data requirements for ESTA travelers, including biometrics, social media history, and family members’ personal information.

None of these measures are fully in place yet. But even proposals can affect confidence.

FIFA’s introduction of the FIFA Pass, offering priority visa appointments for ticket holders, may help smooth the process, but it is not a guarantee of approval, nor a silver bullet for demand.

For cities like Miami and New York–New Jersey, where international travel plays an outsized role, these dynamics matter.

The Bottom Line

FIFA World Cup 2026 is already reshaping travel markets, but not in a single, predictable way.

What the data shows so far is not a uniform surge, but a patchwork of local responses shaped by who can travel, how easily, and under what constraints. Some markets moved early. Others are still finding their footing. And many will continue to change right up until kickoff.

For hosts and managers, the lesson isn’t just to recognize that demand is coming. It’s to keep watching how it evolves in your market through concrete data, and to revisit assumptions as conditions change.

Because for now, FIFA World Cup 2026 demand is a moving target.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.