A 682% ADR surge. $18,000 Airbnb listings. 250,000 visitors expected. Green Bay’s short-term rental (STR) market is seeing record-breaking pricing—but why aren’t bookings following suit?

With a severe hotel shortage, STR operators have set sky-high rates, betting on high-spending VIPs and last-minute demand. But with just 19% occupancy and slow booking pickup, some may be holding out too long—risking last-minute price cuts and lost revenue instead of windfall profits.

Let’s break down the data, explore why bookings are lagging, and uncover strategies that could help professional short-term rental managers maximize revenue—not just in Green Bay, but in any major event-driven market.

What Is the NFL Draft and Why Does It Matter?

The NFL Draft is one of the biggest sporting events in the U.S., where professional teams select top college football players to join their rosters. This annual event draws hundreds of thousands of attendees, millions of TV viewers, and massive economic activity in the host city.

For 2025, Green Bay, Wisconsin, home of the Green Bay Packers, will host the NFL Draft for the first time in its history. The event, scheduled for April 24-26, 2025, is expected to bring 250,000+ visitors to the city, injecting tens of millions of dollars into the local economy.

Why Does This Create a Huge Short-Term Rental Opportunity?

- Hotel rooms are extremely limited in Green Bay, a smaller market compared to past host cities like Las Vegas (2022) and Detroit (2024).

- NFL Draft fans are known to spend big, making it a prime opportunity for STR operators to maximize bookings and revenue.

- The event is free to attend, attracting both high-end travelers and middle-class fans who may drive in from nearby states.

In theory, this combination of demand and limited supply should make Green Bay a jackpot for STR operators. However, as we’ll explore next, pricing dynamics and guest behavior are making this market more complex than expected.

The Data: Record-High Pricing, But Where Are the Bookings?

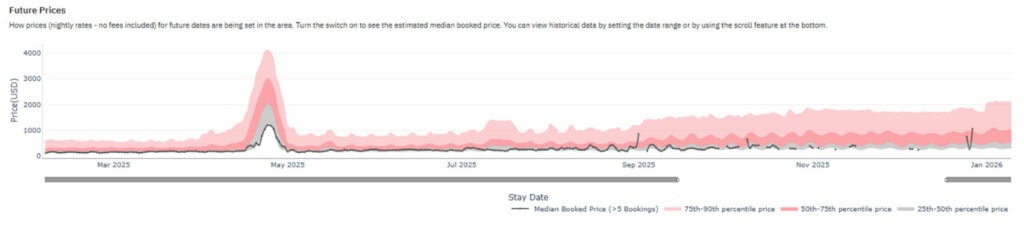

According to PriceLabs data as of February 2, 2025, the NFL Draft has pushed Green Bay STR rates into uncharted territory:

- ADR is up 682% compared to the same time last year in Green Bay.

- RevPAR has increased by a staggering 1800%.

- Booked nights have surged by 166%.

- Some Airbnb listings near Lambeau Field are priced as high as $18,000.

Even compared to Detroit, which hosted the NFL Draft in 2024, Green Bay is seeing massive pricing increases. Current ADR is 573% higher than what Detroit hosts charged for the 2024 Draft.

This suggests two things:

- Green Bay’s limited inventory is driving far more aggressive pricing than in larger cities.

- STR operators are expecting to cash in on elite, high-spending guests—but that bet hasn’t fully paid off yet.

While rates hit record-highs, occupancy remains surprisingly low. And that leads us to the central mystery—why haven’t bookings caught up to these sky-high prices?

The Pickup Is Slow—What’s Going On?

Occupancy is Lagging

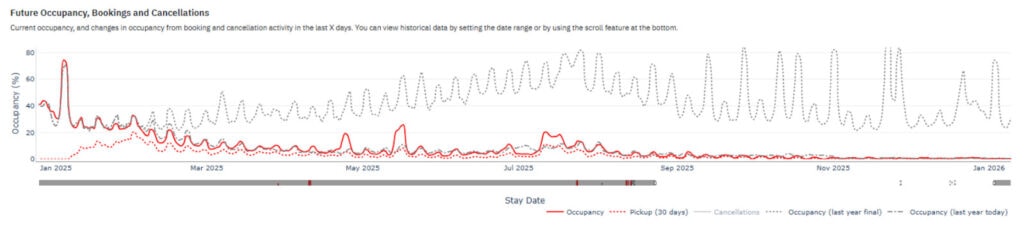

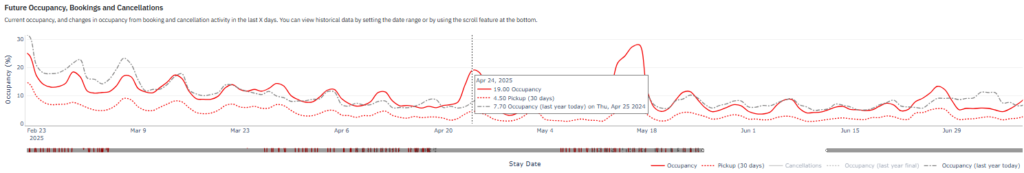

🔹 Occupancy for April 24, 2025, currently sits at just 19%—meaning more than 80% of short-term rentals remain unbooked for the most in-demand week of the year.

🔹 Only 4.5% of properties have been booked in the past 30 days, suggesting a slower-than-expected pickup rate.

🔹 For comparison, at this same time last year, occupancy for the 2024 NFL Draft in Detroit was at just 7.7%—showing that Draft bookings often come late, but still leaving questions about why Green Bay’s pace isn’t faster despite extreme pricing.

Despite massive rate increases, booking momentum is not keeping up—and this isn’t just normal last-minute demand behavior.

Unlike past host cities, Green Bay’s small size and lack of hotel alternatives should, in theory, drive STR bookings earlier. Yet, occupancy is pacing slower than expected, raising the question: What makes this market different?

Why Green Bay is Different From Past NFL Draft Markets

Historically, NFL Draft bookings have skewed late, with many fans securing accommodations closer to the event. However, Green Bay is an unusual case—its small size and limited hotel supply should, in theory, be driving STR bookings earlier than usual. Yet, current occupancy remains lower than expected, and the anticipated surge of bookings has yet to materialize.

The Risk of Holding Out for High-Paying Guests

Many STR managers are holding out for premium, long-stay bookings at ultra-high rates, banking on last-minute demand from VIPs, media, and affluent fans. But if that demand doesn’t arrive as expected, they could be forced into drastic price cuts in April—potentially leaving money on the table.

Why Are Bookings Moving Slower Than Expected?

Several key factors are likely contributing to the unusually slow pickup:

1. Prices May Be Too High—At Least for Now

With ADR exceeding $1,100 per night, many potential guests may be holding off, hoping for price drops closer to the event.

STR managers are betting on securing big-money bookings from NFL execs, VIPs, and affluent fans—but if that demand doesn’t materialize fast enough, they could be left scrambling to adjust rates.

2. Travel Costs Are High, But That’s Not the Whole Story

- Flights to Green Bay are expensive, which could be discouraging out-of-state travelers.

- But key fanbases—like the Tennessee Titans and Cleveland Browns—don’t need flights.

- The draft order was finalized only weeks ago, so their fans only recently learned they have top picks.

- These teams have highly engaged, traveling fanbases, but many of their supporters are middle-class fans who may be waiting for prices to drop.

3. Fans Might Be Booking Later Than Expected

Unlike the Super Bowl or Formula 1, where fans know they need to book early, the NFL Draft has a different type of audience. Many attendees—especially middle-class fans—may feel less urgency to secure accommodations far in advance.

This could mean a rush of last-minute bookings in March and April, but it also introduces risk: What if property managers wait too long to adjust pricing and lose momentum?

We’ve seen similar late-stage booking trends with events where attendees aren’t locked into purchasing expensive tickets months in advance. Since the NFL Draft is a free-to-attend event, many fans may still be deciding if they will attend at all.

4. The Market Is Overly Focused on High-End Guests

Many STR operators are holding rates high in hopes of attracting media professionals, wealthy fans, and corporate guests.

But here’s the issue:

- Affluent guests typically book early. If high-end properties aren’t filling up now, it suggests demand may not be as strong as expected.

- Most NFL Draft fans are middle-class travelers. If pricing remains out of reach for them, they might delay bookings or stay farther outside Green Bay.

This leads us to an alternative strategy—one that could help operators capture demand without slashing rates too soon.

A Smarter Way to Capture Demand

With high-priced multi-night stays still sitting empty, STR managers may need to rethink their approach. Kyle Driskell, a Solutions Consultant at PriceLabs specializing in revenue optimization, offers a different playbook:

“Everyone is chasing long bookings, but I’d go the other way. Most first-round draft picks will leave Green Bay immediately after being drafted, and many high-spending fans will too. The real opportunity could be in making one-night availability a premium offering until around Spring Break, when booking behavior shifts.”

Instead of waiting for multi-night bookings at ultra-premium prices, STR operators should consider:

- Offering single-night stays at extremely high rates to capture short-stay VIPs and media.

- Turning off auto-booking to allow for direct negotiation with high-value guests.

- Monitoring demand through Spring Break before adjusting rates for late-stage bookers.

Given the current slow pickup, Driskell’s strategy could help STR managers capture high-spending guests while keeping flexibility open. Instead of waiting for multi-night bookings that may or may not come, pricing premium one-night stays at extremely high rates allows hosts to secure revenue now while keeping availability open for last-minute shifts in demand.

Could Supply Suddenly Drop? Homeowners May Pull Listings

Some Green Bay homeowners only listed their properties hoping for a massive payday. But what happens if those sky-high prices don’t hold?

If prices fall too much, many casual hosts may simply delist and attend the Draft themselves.

Why this matters:

- If enough homeowners pull listings, STR supply could tighten unexpectedly in March and April.

- A sudden reduction in available rentals could drive last-minute price rebounds, benefiting professional operators who stay in the market.

- Fans who wait too long to book may find fewer options, increasing demand for well-positioned STRs.

What STR Managers Should Do Now

- Track active listings. If casual hosts start exiting, remaining properties could become more valuable.

- Avoid premature rate cuts. If supply shrinks unexpectedly, you don’t want to be locked into unnecessary discounts.

- Consider flexible booking policies. Guests may be willing to pay more for premium last-minute stays.

Key takeaways for any event-heavy market

✅ Watch Booking Pickup Closely. If demand isn’t rising fast enough 8-6 weeks before a major event, reassess pricing and availability.

✅ Don’t Assume Demand Will Fill at the Last Minute. Past trends suggest NFL Draft bookings skew late, but every market is different—adjust based on your real-time data.

✅ Experiment with Short-Stay Pricing. If multi-night bookings aren’t coming in, test ultra-premium single-night rates to maximize revenue without locking into long stays.

Will Green Bay STR Operators Win Big or Misplay the Market?

Green Bay STR managers are facing one of the biggest pricing tests in event-driven rental history. With bookings still slow, the real winners will be those who read the market, adjust early, and stay ahead of demand shifts.

So the real question isn’t just when to adjust pricing—it’s who will move fast enough to seize the best opportunities before the market turns?