Few industries are as routinely scrutinized, and misunderstood, as short-term rentals. Media coverage doesn’t just inform the public; it often sets the tone for how regulators view the sector and whether communities welcome or reject it.

The latest example is a recent report from CORRECTIV.Europe, an investigative journalism network known for data-driven, collaborative storytelling. Their article, Where Travel Platforms Like Airbnb Have Transformed Europe’s Tourism, has been widely quoted across European outlets and is gaining traction in large Reddit threads. It offers a timely contribution to the ongoing conversation about tourism’s footprint, but also illustrates how even data-rich journalism can reinforce misleading narratives.

CORRECTIV is credible, transparent, and mission-driven. But professional short-term rental managers, especially those working at scale, should pay attention to how this story frames STRs. These narratives influence public opinion, shape regulation, and ultimately, impact your license to operate.

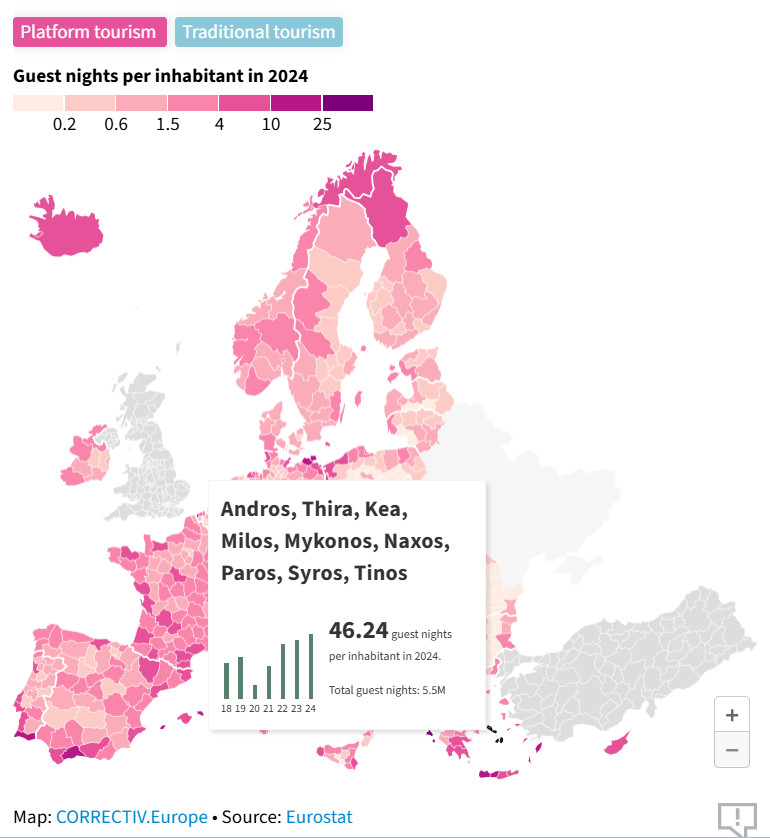

1. That Viral “46 Guest Nights per Resident” Stat: Powerful, But Misleading

One of the most cited numbers in CORRECTIV’s article is this: In 2024, the Cyclades saw 46 guest nights per island resident, a figure meant to highlight the intensity of tourism in fragile destinations like Santorini and Mykonos.

But as with all data points, the how matters just as much as the what.

Total Capacity Tells a Different Story

We turned to 2024 data from INSETE, the Greek tourism intelligence agency. INSETE’s hotel data is sourced from the Hellenic Chamber of Hotels, while its short-term rental (STR) data is compiled from Airbnb, Vrbo, Booking.com, and Tripadvisor listings.

Here’s what we found:

- Hotel guest beds in the Cyclades (2024): 239,047

- Short-term rental guest beds in the Cyclades (2024): 151,196

That STR number required a bit of work to extract. INSETE didn’t provide a single annual total for STR guest beds in the Cyclades. Instead, they listed monthly STR bed capacity per island, a dataset that reflects how supply fluctuates with seasonality.

To get a realistic annual average:

- We calculated the average monthly bed supply for each island by taking the mean of the 12 monthly figures from January through December 2024.

- We then added the average bed counts across all Cycladic islands to arrive at a regional total.

This methodology offers a more accurate, seasonally adjusted view of average STR supply, one that smooths out peak summer spikes and winter troughs.

The result? STRs do not surpass hotel capacity, even during high season. Hotels still account for the bulk of guest accommodations in the Cyclades.

Why the Ratio Can Mislead

The “46 guest nights per resident” stat is compelling, but potentially misleading when detached from context:

- It excludes the accommodation mix: hotels, second homes, cruise ship visitors, boutique stays.

- It doesn’t reflect the economic role tourism plays in these island economies.

- It ignores visitor type, length of stay, and the nuance of destination management planning.

In fact, CORRECTIV’s own data visualization reveals this tension clearly.

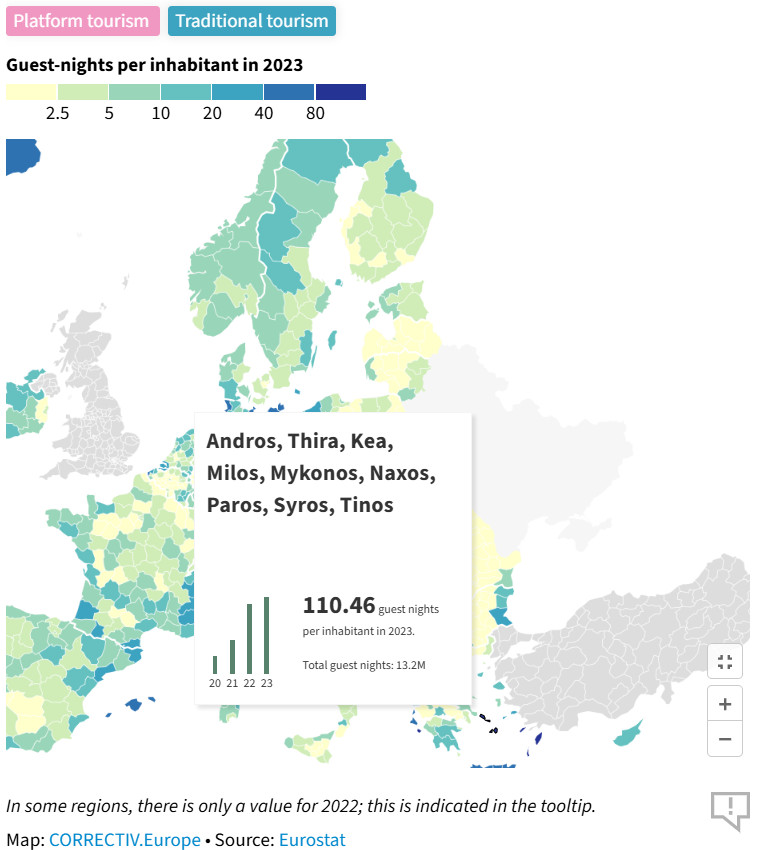

Same Region, Different Lenses: In CORRECTIV’s own data, the Cyclades record over 110 guest nights per resident in 2023 from traditional tourism, more than double the 46.24 guest nights from platform tourism in 2024.

In their interactive maps, CORRECTIV highlights that Andros, Thira (Santorini), Kea, Milos, Mykonos, Naxos, Paros, Syros, and Tinos recorded 46.24 guest nights per resident in 2024 from platform tourism (i.e., Airbnb, Vrbo, Booking.com, Tripadvisor), the very figure cited in headlines.

But when you click the traditional tourism view for the same island group, the number rises to 110.46 guest nights per resident in 2023, more than double. These traditional tourism numbers include hotels, campgrounds, and other commercial accommodation.

In other words: platform-based guest nights make up a minority share of total tourism activity in the region.

To be clear, this doesn’t invalidate concerns about overtourism, it strengthens them. But it also shows that platform-based short-term rentals are just one part of the broader tourism footprint, not the sole or even dominant driver.

This difference is quietly embedded in the visual, but rarely acknowledged in how the story is told.

High guest-to-resident ratios don’t automatically signal failure or overreach, especially in places where tourism is the primary economic engine. What they do signal is the need for smart, balanced infrastructure planning—not scapegoating one lodging category.

2. “Platform Tourism” vs. Reality: A Misleading Binary

CORRECTIV draws a sharp distinction between “platform tourism” (Airbnb, Booking, Expedia, Tripadvisor) and “traditional tourism” (hotels, campgrounds, commercial holiday providers). It’s a tidy headline device—but it oversimplifies a highly complex ecosystem.

- Platforms aren’t silos. Booking.com and Expedia serve both hotels and STRs. Tripadvisor lists hotels, villas, and experiences. Even Airbnb now includes hotel inventory in some cities.

- Vacation rentals predate platforms. French gîtes, agriturismos in Italy, Spanish villas, all long-standing, legal categories, don’t neatly fit the idea of “platform tourism.”

- Professional operators are erased. A property manager running 300 legal apartments in Lisbon is nothing like a casual subletter in Barcelona, but both are lumped into the same category.

This binary may make for clean visuals, but it fails to acknowledge that the short-term rental world spans from family-owned countryside retreats to fully staffed, ESG-certified urban operations.

3. The Blame Game: Sustainability and Housing Are Bigger Than STRs

The report opens with a vivid picture of Santorini: water scarcity, overcrowded infrastructure, and housing pressures. In the next breath, it points to a rise in Airbnb bookings. The implication is obvious: STRs are the problem.

But that’s a partial diagnosis at best.

Tourism at Large Drives Water Stress

Santorini’s resource issues stem from overlapping forces: cruise tourism, hotels, second homes, seasonality, drought, and outdated infrastructure. Short-term rentals play a role, yes, but singling them out overlooks the broader systemic pressures.

Housing Pressure Is Multifactorial

Yes, STRs affect local housing supply in hot markets. But housing affordability is also impacted by:

- Second-home investment

- Stagnant local wages

- Lack of new construction

- Weak primary residence protections

Blaming STRs alone lets governments and real estate interests off the hook.

STR Professionals Are Already Acting

Many property managers are investing in sustainability, retrofitting older buildings, and aligning with ESG frameworks. Initiatives like EnviroRental, QALIA, and Sustonica are supporting the industry’s push for more responsible operations.

Framing STRs as the villain may be rhetorically powerful, but it obscures the real opportunity: cross-sector collaboration between policymakers, professional managers, platforms, and destination marketing organizations.

4. A One-Size-Fits-All Approach to Regulation Doesn’t Work

Cities and rural areas experience STR impacts differently. Yet, narratives like CORRECTIV’s often treat them as interchangeable, paving the way for blanket regulations that ignore context.

Lisbon: Targeted Controls, Not a Ban

Lisbon has paused issuing new Alojamento Local (AL) licenses and created containment zones in high-density neighborhoods like Alfama and Bairro Alto. This targeted approach uses spatial data to balance tourism demand with residential stability.

Rural France: STRs as Lifelines

In contrast, as seen in this report on the EU Tourism Platform from March 2025, parts of rural France have embraced STRs as tools for economic revitalization. Rentals support local farmers, preserve historic homes, and bring foot traffic to under-visited towns in France and elsewhere in Europe.

The Problem with Blanket Bans

- False equivalence: Treating Lisbon, Paris, and Provence as the same.

- Punishing the responsible: Penalizing compliant operators who contribute positively.

- Lost economic opportunity: Especially in fragile rural economies.

- Inefficient targeting: Ignoring core issues like housing supply, wage stagnation, or tourism policy.

What works? Data-driven, adaptive regulation, not blunt instruments.

5. Why This Narrative Matters for STR Managers

If you’re a professional manager, you already know your business is more than a line in a dataset. But your audience, lawmakers, neighbors, even journalists, may not.

Reports like CORRECTIV’s help shape the cultural and political lens through which STRs are viewed. So, what can you do?

✅ Understand the media narrative: Read critically and share context.

✅ Make your sustainability efforts visible: Don’t assume good deeds speak for themselves.

✅ Engage in policymaking: Join local conversations, participate in working groups.

✅ Push for nuance: Support policies that distinguish between casual subletting and professional operations.

Being part of the solution means being part of the conversation.

Final Thought

CORRECTIV’s report raises important issues and deserves engagement. But viral statistics, especially those detached from context, can become shorthand for blame. If you’re a short-term rental professional, your business is more than a data point in a heatmap.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.