Super Bowl LX is more than just a 60th-anniversary milestone for the NFL; it is a live laboratory for how mega-events revalue local short-term rental markets. For professional property managers, the 2026 data reveals a surprising shift in traveler behavior that flips the traditional Bay Area hierarchy on its head.

Last year, during our analysis of Super Bowl LIX in New Orleans, we saw a market defined by regulatory scarcity and a staggering 826% spike in RevPAR. In the Bay Area for 2026, the story is different: it is a battle between “Utility” and “Experience,” where the stadium’s backyard is currently outpricing the city center.

1. Beyond the Gridiron: How Bad Bunny and Global Stars are Driving a Multi-Day Holiday

To interpret the data, we must first understand the traveler. The Super Bowl is no longer just a single-day game; it is a multi-day “cultural pilgrimage” that blends sports with high-stakes entertainment.

- Destination Performers: Entertainment remains a massive draw for visitors who view the Super Bowl as a holiday. This year’s headline act, Bad Bunny, is making history as the first Latino solo artist to lead the halftime show entirely on his own.

- The “Experience” Crowd: Fans are also drawn to a star-studded pre-game lineup featuring Charlie Puth for the National Anthem, Brandi Carlile for “America the Beautiful,” and Coco Jones for “Lift Every Voice and Sing”.

- Local Identity: The opening ceremony at the San Jose Convention Center features Green Day, a legendary Bay Area trio, adding a “hometown” energy that further boosts regional appeal.

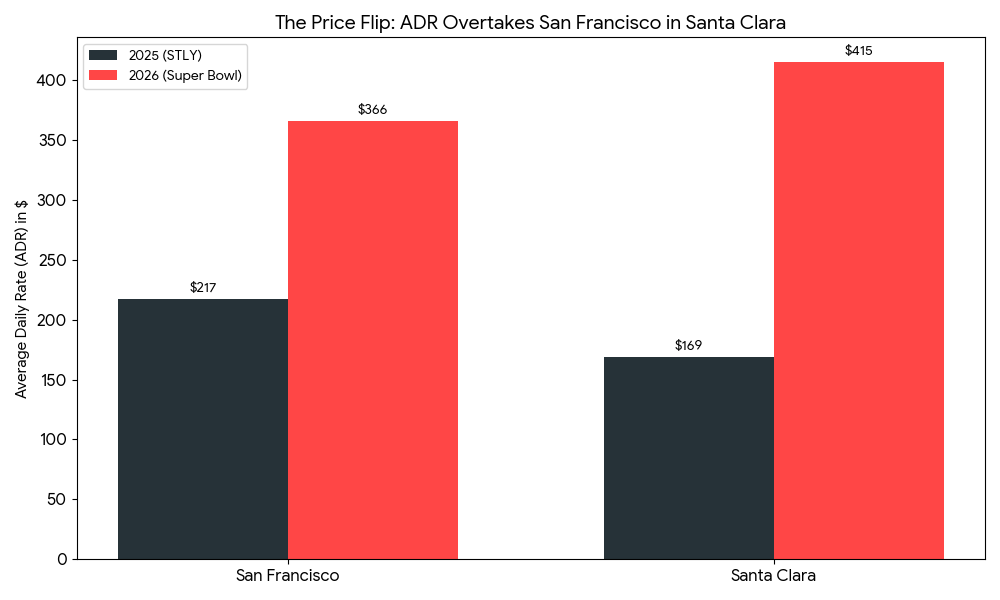

2. The Geographic Flip: Proximity Outpaces the City Center

In previous years, San Francisco (SF) has typically been the premium market in Northern California. However, for Super Bowl weekend (February 6–9, 2026), the traditional hierarchy has reversed. While both cities have seen significant growth compared to the same weekend last year, the stadium city is seeing the more aggressive surge.

- Santa Clara (The Epicenter): Average Daily Rates (ADR) have surged to $415, a massive 146% increase over last year’s pacing.

- San Francisco (The Experience): Rates have climbed to $366, representing a strong 69% increase over the same period last year.

The Insight: For a singular marquee event, the convenience of being within “stadium-adjacent” distance currently commands a $49 per night premium over staying in the cultural city center.

3. The Volume Game: Why SF Captures 70% of Economic Impact

While Santa Clara holds the pricing crown, San Francisco remains the volume workhorse of the region. Despite being 40 miles from the stadium, San Francisco properties are projected to capture nearly 70% of the total regional economic impact.

- The “Anchor” City: San Francisco is hosting 8x more booked nights than Santa Clara (8,864 vs. 1,069). This is driven by its robust infrastructure, including the Super Bowl Experience at the Moscone Center and the Fan Zone at Yerba Buena Gardens.

- The Transit Corridor Advantage: High-value demand is spilling over into the “Transit Corridor”: cities like Palo Alto and Mountain View that sit along the Caltrain line. These areas are not merely budget alternatives; they are high-value niches for guests who prioritize a 2-minute walk to VTA or Caltrain stations to avoid the massive road closures surrounding Levi’s Stadium.

4. Supply vs. Demand: The 5:1 Growth Ratio

A common fear during these events is “supply dilution,” the idea that an influx of new hosts will crash the market. The 2026 data shows that demand is absorbing new supply at a rapid pace.

- Supply Growth: Listings increased by 10% in Santa Clara and 8% in SF as opportunistic hosts entered the market.

- Demand Explosion: Actual booked nights have outpaced supply growth by roughly 5-to-1, increasing by 52% in Santa Clara and 57% in SF.

5. Potential Scenarios for the Epicenter vs. the Experience Hubs

The following observations illustrate how different market positions might play out for professional managers during this period:

| If you are in… | Possible Market Dynamics | Potential Guest Expectations |

| Santa Clara | Market data indicates that proximity is the primary value lever; properties near the stadium may continue to command the highest premiums. | High-intent fans often look for “mission-critical” amenities: parking, quiet rooms, and easy stadium access. |

| San Francisco | In high-occupancy environments like SF (already at 64%), managers are frequently observed utilizing length-of-stay (LOS) restrictions to capture the full week of festivities. | Experience-led tourists, drawn by festivals like BAHC Live!, may prefer longer stays to explore local nightlife. |

| Transit Corridor | Properties near Caltrain or VTA stations are seeing value spikes comparable to stadium-adjacent homes due to ease of connectivity. | Guests often prioritize walkability to public transit to bypass game-day traffic and detour routes. |

The Bottom Line

Super Bowl LX proves that even in markets with growing supply, the sheer scale of fan demand, fueled by global superstars and a well-connected regional transit network, can trigger a fundamental revaluation of local geography. Whether guests choose the “Utility” of Santa Clara or the “Experience” of San Francisco, the data indicates a clear willingness to pay a premium to be part of the moment.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.