If you listened to Expedia Group’s earnings call for Q1 2025, hoping for updates about Vrbo, you probably came away with questions. The brand was barely mentioned, and no real performance numbers were shared. But here’s the thing: that silence tells us a lot.

In this article, we’ll help you read between the lines. Whether you list on Vrbo, Airbnb, Booking.com, or are still deciding where to focus your energy, here’s what you should know as a professional short-term rental manager, and how you can respond.

Vrbo Q1 2025: Modest Growth Driven by Shorter Stays, Not the Brand It Sells

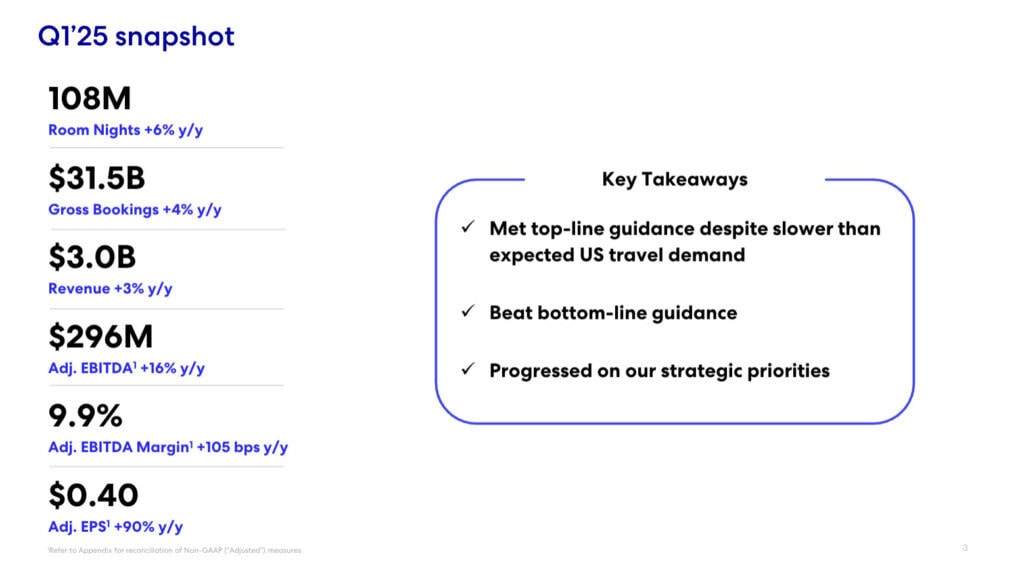

Vrbo recorded modest growth in Q1 2025. That’s the one (non)data point we got from Expedia Group’s earnings call. The platform’s bookings were up, but only just, and, as CFO Scott Forbes put it, they “grew in line with the market in the U.S.”

Notably , the growth Vrbo did see didn’t come from the brand image it promotes. According to Expedia’s leadership, nearly a third of that growth came from multi-unit inventory added in 2024. Vrbo is also leaning more into shorter stays, another shift that runs counter to its traditional family-getaway positioning.

Vrbo Is Deeply U.S.-Focused, And the U.S. Was Slow This Quarter

| Platform | Q1 2025 Booked Nights | YoY Growth | Notes |

| Booking.com | Not disclosed total, but Alternative Accommodations made up 37% of all room nights (up from 36%) | +12% (Alt. Accom. only) | Consistent, growing base; strong in EU/ROW |

| Airbnb | 143.1 million nights and experiences | +8% | Platform-wide; mostly STRs |

| Expedia (Expedia.com, Vrbo, Hotels.com) | 107.7 million room nights (all lodging brands) | +6% | Vrbo’s growth = “modest,” not broken out |

Expedia said clearly: “Two-thirds of our bookings come from the U.S. point of sale.” And Vrbo is especially exposed to the U.S. market.

Here’s what happened in Q1:

- Demand from U.S. travelers was soft.

- Inbound international travel to the U.S. dropped 7%.

- Bookings from Canada to the U.S. dropped nearly 30%.

This hits Vrbo especially hard because it relies on high-ticket, longer-stay bookings, exactly the type most affected by these trends.

Meanwhile:

- Airbnb’s U.S. business is mostly domestic (only 2–3% international).

- Booking.com’s strength is in Europe, which remained more stable.

“Vrbo bookings remained positive in the quarter and grew in line with the market in the US,” said CFO Scott Forbes. That line, while technically accurate, reveals that Vrbo wasn’t outperforming—it was treading water in a shrinking pool.

Takeaway: If your Vrbo listings rely on inbound U.S. travel, especially from Canada or Europe, diversify your guest base. Target domestic traffic. Use other channels if needed.

Vrbo’s Disappearing Act Wasn’t an Accident

Vrbo effectively vanished from Expedia’s Q1 earnings spotlight. No performance slides, no product updates. That kind of omission usually means one of three things:

- Underwhelming performance not worth spotlighting.

- A desire to hide another brand’s worse quarter (Hotels.com).

- A push to fold brand narratives into a unified “Lodging” category.

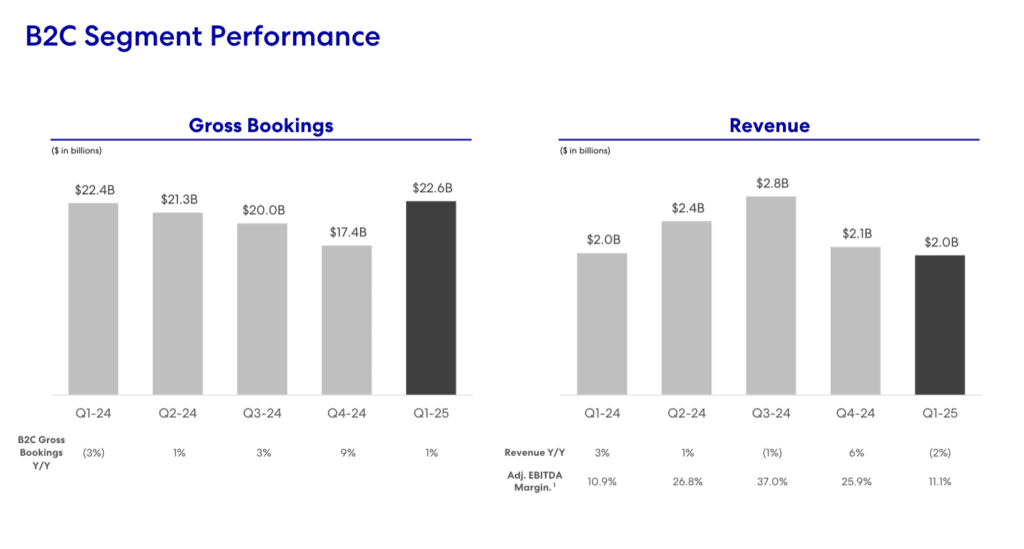

Expedia said all lodging brands are now grouped under B2C Lodging.

Rather than draw attention to soft numbers or loyalty growing pains, Expedia chose to stay vague.

Takeaway: Vrbo didn’t have the numbers or the momentum to anchor a breakout story, and Expedia may be strategically deprioritizing brand-level commentary ahead of EXPLORE 25.

Vrbo’s Silence Might Not Be About Vrbo Alone

Vrbo may have had a relatively quiet (or modest) quarter, but Hotels.com may have had a rougher one, and Expedia likely didn’t want to draw attention to it.

Bundling all B2C brands under one “lodging” umbrella, Vrbo, Expedia.com, Hotels.com may be a calculated move to:

- Avoid calling attention to poor performance at Hotels.com;

- Downplay underwhelming U.S. demand, which disproportionately affects Vrbo;

- Smooth over brand-level inconsistencies in the One Key loyalty rollout, which sparked value dilution complaints (especially for Hotels.com) and led to cuts on Vrbo’s end.

As CEO Ariane Gorin put it:

“We are tuning the loyalty program by brand and geography… Loyalty was a differentiator for Hotels.com, and once you took it away, it diluted the value a lot.”

That candid admission suggests Expedia is learning that a one-size-fits-all strategy doesn’t land equally well across brands. And rather than spotlight those growing pains, the company chose to keep messaging tight and aggregate performance under the safer umbrella of “B2C Lodging.”

Takeaway: For property managers, this means Vrbo is no longer getting standalone treatment, at least for now. Its story is being blended into a larger platform narrative focused on scale, efficiency, and margin optimization. The question is whether it will eventually re-emerge as a clearly defined brand or continue being folded deeper into Expedia’s machinery.

Vrbo Loyalty Devaluation: What the Cuts Really Tell Us

If you’re a property manager who’s had success bringing in repeat guests on Vrbo, this next part might give you pause.

In April 2025, Expedia changed One Key rewards for Vrbo:

- Blue-tier members: no more OneKeyCash.

- Silver-tier members: only 1% back.

- Expedia/Hotels.com users: still get 2% back across all tiers.

Ariane Gorin: “Blue members did not drive sufficient repeats to justify the cost and resulting pressure on Vrbo’s revenue.”

Expedia sees Vrbo as attracting infrequent, high-AOV (Average Order Value) guests. Loyalty incentives for those guests aren’t profitable. Frequent hotel/travel bookers, on the other hand, are more predictable.

Why it matters for managers:

- Vrbo-only listings may see lower conversion among rewards-savvy guests.

- Bookings could shift toward Expedia.com or Hotels.com.

- Guest questions about rewards or cancellation policies may increase.

What you can do:

- Audit your listings on Expedia and Hotels.com.

- Offer your own repeat-stay incentives to direct bookers.

Vrbo Talks About Homes, But Grows Through Apartments

If you’ve seen Vrbo’s latest billboard or commercials, you’ve probably noticed a familiar message: peaceful, full-home vacation rentals with no awkward host interactions. In short, host-free, whole-home, private stays.

This kind of marketing appeals to Vrbo’s long-standing brand identity: a platform for family reunions, holiday escapes, beach houses, and mountain cabins—the kinds of bookings that feel personal, exclusive, and memorable.

But here’s the disconnect.

“Nearly a third of Vrbo growth came from the multi-unit inventory we added last year,” Ariane Gorin said on the Q1 call.

That’s right. Vrbo’s growth isn’t being driven by remote lake houses or luxury villas. It’s coming from multi-unit buildings: serviced apartments, urban condos, and potentially even hotel-like inventory managed by professional operators.

On top of that, Expedia pointed to shorter stays as another driver of Vrbo’s performance.

This is where the brand identity and the business model start to clash.

What’s the problem?

- Vrbo is still telling the story of classic vacation rentals, but its growth is coming from more transactional, high-turnover supply—a model that looks a lot more like Booking.com.

- The emotional appeal of “your family’s summer home” is being used to attract guests… but the underlying inventory increasingly consists of two-night urban stays in multi-unit buildings.

This isn’t inherently bad. It may even make the platform more competitive with Airbnb and Booking.com in dense markets. But for property managers, it raises key questions about positioning, visibility, and fit.

What this means for different types of hosts:

If you manage standalone homes:

- You may still be featured in marketing campaigns, but you’re no longer the main revenue driver.

- Vrbo’s product development and supply focus may increasingly favor higher volume, repeatable inventory types.

- It might get harder to rank high in search results unless you align with platform priorities (like flexible stays, pricing tools, etc.).

If you manage urban or multi-unit listings:

- You may find Vrbo more receptive to your supply than in years past.

- Vrbo’s guest messaging still speaks to “host-free” privacy, which aligns well with professionally managed, keyless entry setups.

Strategic mismatch, or evolving identity?

It’s possible that Vrbo is in a transition phase: trying to retain its legacy guest loyalty while quietly shifting toward a model that fits Expedia’s larger lodging platform.

But if that tension isn’t resolved, if messaging and marketplace mechanics continue to diverge, property managers may start seeing performance inconsistency, with some listings thriving and others falling behind despite quality.

Will Vrbo Announce New Features at EXPLORE 25?

So far in 2025, Vrbo hasn’t launched any new host tools or platform updates. That may change soon. Expedia’s partner event, EXPLORE 25, is next week. If Vrbo is going to make a splash, this would be the moment.

What could they announce?

- Trip matching powered by AI. Expedia teased a tool that turns Instagram Reels into bookable trips. Vrbo could benefit from a version tailored to vacation rentals.

- Improved content tools (AI-powered listing descriptions, photo tagging, etc.)

- Updated onboarding and pricing support for new hosts

- Expansion into LATAM to meet guest demand shifts

If Vrbo doesn’t appear meaningfully at EXPLORE 25, it could signal the brand is being absorbed deeper into the Expedia platform with fewer standalone innovations.

Takeaway: Watch EXPLORE 25 carefully. This could be Vrbo’s chance to clarify its future, or quietly fade into platform uniformity.

Vrbo Isn’t Gone, But It Is Evolving

Vrbo is still part of the Expedia ecosystem, but seemingly it’s no longer the strategic darling it once was. Its bookings are stable, but growth is coming from shorter stays and multi-unit supply. Loyalty has been pared back. And Expedia is tuning its messaging to match where it wants the platform to go.

The good news? Vrbo still has visibility and value, especially for the right type of supply. The key is to stay flexible, keep your listings competitive across platforms, and be ready to pivot as the landscape shifts.

The next signals will come at EXPLORE 25. Let’s see if Vrbo is ready to step forward, or step further into Expedia’s shadow.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.