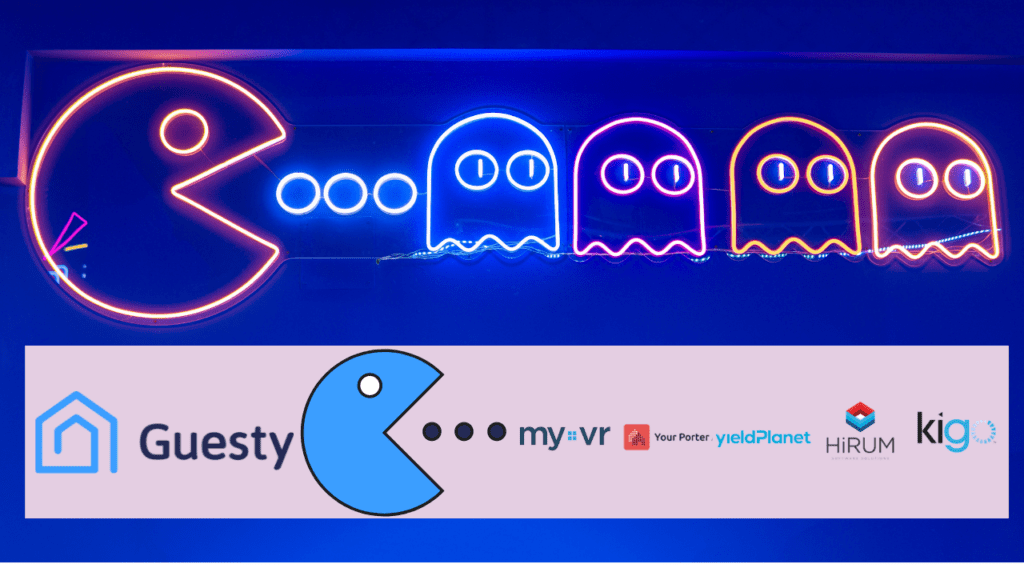

In just 15 months, Guesty has acquired five smaller rivals: MyVR and YourPorter App in April 2021, and YieldPlanet, HiRUM, and Kigo in September 2022. Is Guesty the new Pac-Man of the short-term rental industry, gobbling up software solutions left and right, thanks to the $170 million treasure chest it raised in August 2022? Why should property managers and hosts care?

First, some of them may be current users of smaller solutions bought up by Guesty. What could happen? We’ll look at why large software companies buy smaller competitors and what difficult choices customers sometimes have to make. The article’s goal is to talk about strategy and options and not take a position in favor or against Guesty’s recent moves.

For instance, a larger company may want to enter a new market. Guesty has rebranded and relaunched YourPorter as “Guesty for Hosts” to answer the needs of people with fewer than 10 listings, while Guesty is now for “Pros” with 10 listings and up.

From fears of product stagnation to increased prices, we’ll examine a few common issues whenever a larger software company acquires a smaller one. In the tech world, acquisitions may be a way to gain market share and even build a monopoly. Yet, building a monopoly is out of the question with hundreds of large, small, and medium PMSs around. So, using Guest’s acquisitions, we’ll see that they can help the company enter new markets (e.g. hotels with YiedlPanet)) and reinforce a geographic foothold (e.g. Australia with HiRUM).

Why do larger software companies acquire smaller ones?

First, let’s start with a general approach to understand why such acquisitions happen. Then, we’ll see how we can apply it to Guesty’s shopping spree.

Here are fa ew reasons for acquiring smaller software companies

- Enter new businesses and markets (e.g. the hotel industry)

- Add specific features that are faster to buy and than to build in-house (e.g. a guest messaging tool)

- Add a new list of clients to migrate to the existing main software solutions (e.g. acquire the company for its customer base, not for its tech)

- Use the acquisition as a way to add more qualified employees to the main company

- Increase market share

- Consolidate and monopolize the market

- Use the money raised from investors to speed up sales and product growth through acquisitions

- Create some more profits and revenues by creating synergies in terms of technology, sales teams, support capability, or economies of scale (roll-up)

- Create a large portfolio of related solutions that look so compelling that it can go public and make a nice return for investors,

- A mix of all the reasons above

Why should property managers and owners care? What are the risks for them?

Imagine that one of the key tech solutions that you use to run your business is acquired by a larger company. What could go through your mind?

The good:

- The smaller software can improve, as it can now benefit from a larger pool of tech talents and more recent technology

- For property managers, choosing the right PMS is important. Their whole business runs on it. Several small and medium PMSs are not in the best financial shape at the moment. So, customers of an acquired solution may feel safer knowing that their “small” solution has access to the financial resources of a larger partner.

The bad:

- The smaller solution may stagnate and later cease to exist as the larger company tries to move the current customers to the main product

- The acquirer may introduce a new business model (e.g. higher prices) to increase the profitability of the solution.

Guesty, the new Pac-Man of the short-term rental tech industry?

First, let’s return to Guesty’s announcements to see how it plays out with the approach we mentioned earlier.

What is Guesty?

Here’s how the company describes itself:

Guesty is the world’s leading property management platform for the short-term, vacation rental and hospitality industry. Serving everyone from hosts to hotel brands, customers utilize Guesty’s platform and solutions to centralize their reservations, guest communication, operational tasks, cleaning management and more across all the major booking OTA channels, including Airbnb, Vrbo, Booking.com, Tripadvisor, Expedia, Agoda, direct booking websites and more. With 15 offices serving customers worldwide, Guesty empowers hospitality operators to save time and resources so that they can focus on maximizing occupancy, ensuring a great guest experience, and growing their business.

With these acquisitions, Guesty wants to position itself as the #1 PMS in the world

- Granted, there are hundreds of property management (PMS) and channel management solutions available across the world. The industry is so atomized that adding a couple of medium and small PMSs (e.g. Kigo) to a large one (Guesty) could create a leader pretty fast.

- How is being #1 here measured here? By the number of clients, the number of listings, or software sales?

- To be fair, we should note that Inhabit IQ could also be a contender for the title: Over the years, the fund has bought companies such as Streamline, LiveRez, Virtual Resort Manager (VRM), Bluetent, Lynnbrook, Rental Guardian, LSI Tools, and Bizcor.

- If you are a fund manager, it is great to be able to tell your investors that you’ve invested in the #1 company in one industry.

Guesty is not just a property management software (PMS) solution, but a platform

- Guesty wants to offer as many features as possible to serve the needs of its customers. It may build some of these features, buy them by acquiring companies, or partner with third-party companies to make them available to customers.

- It also offers solutions: Guesty has acquired 3rd-party software companies that are more or less integrated with its main platform. Some run alongside Guesty, such as the newly acquired PMSs. Guesty also offers services such as 24/7 guest messaging, which can also be a kind of solution

Guesty is not only targeting short-term rental and vacation rental operators:

- The company is going after “everyone from hosts to hotel brands”

- Guesty started by serving the needs of the short-term rental industry and then moved to serviced apartments. To penetrate markets such as the hotel industry deeper, it can build features, acquire existing hotel-focused software solutions, or partner with independent third parties.

How do the acquisitions of myVR, YourPorter, YieldPlanet, HiRUM, and Kigo fit in?

Here’s a quick overview of each acquired company:

- myVR was a vacation rental PMS active in the US

- YourPorter App was a PMS that targeted hosts and individual owners

- YieldPlanet was a hotel-focused revenue & distribution management platform

- Kigo was a vacation rental PMS particularly active in Europe

- HiRUM Software Solutions was an Australian PMS for hotel and accommodations managers

Let’s now the framework we created above:

- Enter new businesses and markets

- Guesty going after a stronger slice of the hotel tech sector thanks to YieldPlanet and HiRUM (thanks to their tech, custom base, and sales team)

- Guesty rebranded YourPorter into “Guesty for Hosts” to serve the 1-10 property market with a simpler and cheaper product than the original Guesty solution

- Add specific features that are faster to buy and than to build in-house (e.g. a guest messaging tool)

- Guesty could leverage YieldPlanet’s dynamic pricing and revenue management capabilities to add them to the main Guesty solution. This way, Guesty could offer a more complete solution to property managers.

- Add a new list of clients to migrate to the existing main software solutions (e.g. acquire the company for its customer base, not for its tech)

- Could be the case with Kigo as its positioning as a PMS for medium to large companies was the closest to Guesty’s

- Use the acquisition as a way to add more qualified employees to the main company

- Guesty can add more tech, sales, and support employees who can work on all kinds of products for the company

- Increase market share

- Guesty growing its market share in Europe (Kigo), Australia (HiRUM), and US (myVR)

- Consolidate and monopolize the market

- As the PMS industry is heavily fragmented, the risk of creating a monopoly remaints low

- Use the money raised from investors to speed up sales and product growth through acquisitions + Create some more profits and revenues by creating synergies in terms of technology, sales teams, support capability, or economies of scale + Create a large portfolio of related solutions that look so compelling that it can go public and make a nice return for investors,

- A roll-up is a process used by private equity firms where multiple small companies in the same market are acquired and merged. While Guesty is acquiring smaller competitors under its name, the $170 million recently raised can help fuel the roll-up ambitions of the investors behind the money poured in.

Guesty’s moves are very impressive: With these recent acquisitions, the company seems to be executing the growth plan it presented to its shareholders and new investors. Acquiring a company to get a hold of a customer base can be tricky. If the customers of the acquired solution are asked to migrate to the acquiring platform, they may think twice.

If the tech platform were stagnating, being offered a sweet deal and tech help to migrate to a more recent solution may be appealing.

For instance, picking a PMS is usually a long process in the short-term rental industry. If a property manager is asked to migrate from a PMS they chose to another they did not choose, they may think that they should also consider other options. It is not a given that customers will stick around if they are forced to migrate or if the software costs of a platform suddenly rise under new ownership.

This is where strategic change management comes into play, and Guesty has plenty of smart people to execute it.