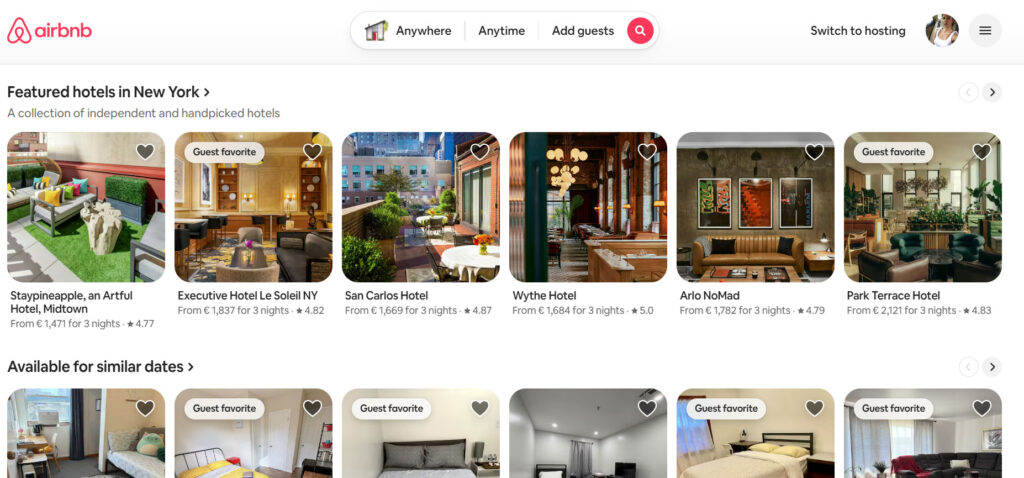

Airbnb is testing a new frontier, one that looks surprisingly traditional: hotels.

In 2025, the company quietly began piloting a new hotel product in Los Angeles, New York, and Madrid.

It’s not just a new category in search results. It’s an experiment in redefining how hotels are presented, discovered, and booked on Airbnb, and part of a much larger strategy to make the platform more complete.

This is not about becoming Booking.com overnight. It’s about learning how hotels can fill key gaps in Airbnb’s ecosystem.

🔍 What the Hotel Pilot Is

Airbnb hotels pilot, first mentioned in the Q3 2025 earnings call, is being rolled out in a handful of cities where demand exceeds available supply, or where regulations have sharply reduced home listings (for example, New York City).

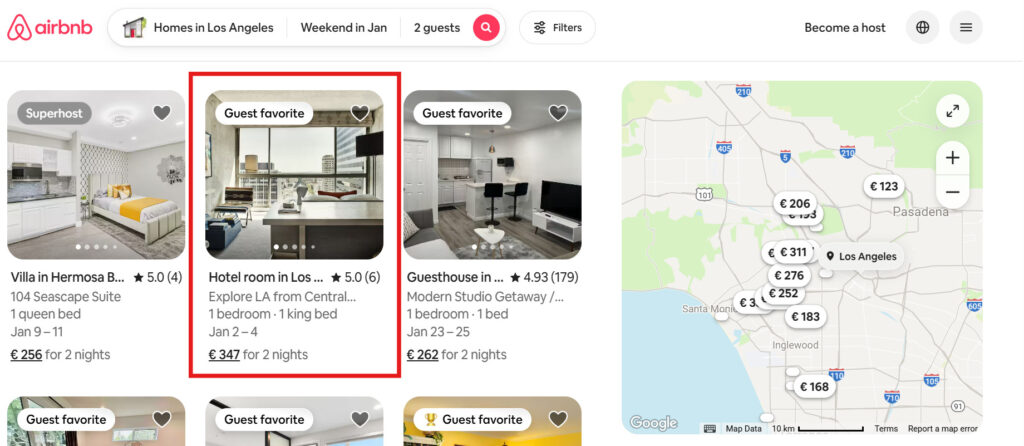

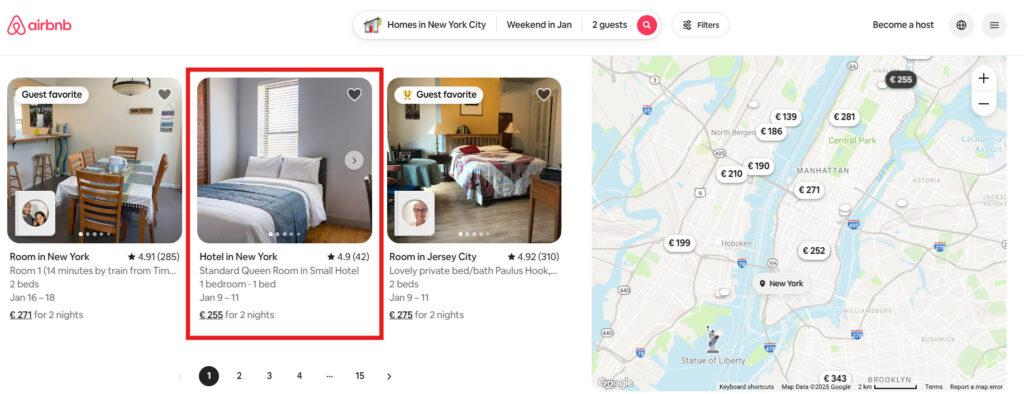

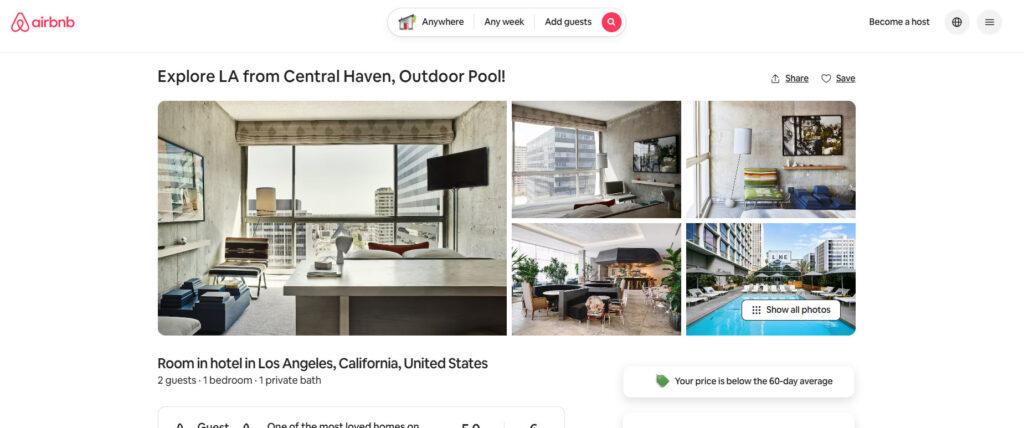

The pilot introduces a new, dedicated hotel experience inside the Airbnb app, designed to handle what typical home listings cannot:

- Room-based inventory: guests can select individual room types instead of entire listings.

- Night-based pricing: more typical of hotels than multi-day vacation stays.

- Refined filters: users can search by amenities like breakfast, front desk service, or parking.

- Updated property pages: with hotel photos, rate plans, and multi-room availability displays.

It’s a structural redesign, not just a reclassification of existing listings.

In other words, Airbnb isn’t simply allowing hotels — it’s rebuilding how they’re shown and sold.

🧩 Why Airbnb Is Testing Hotels Now

The timing isn’t random. Several forces are pushing Airbnb toward hotels again:

- Regulatory pressure in major cities: Cities like New York, Barcelona, and Amsterdam have sharply restricted short-term rentals. Offering hotels allows Airbnb to maintain presence and revenue in those markets.

- Guest expectations: Travelers want choice, especially last-minute bookers and business travelers who expect the reliability and amenities of hotels.

- Supply diversification: After focusing for years on “unique stays,” Airbnb is now quietly rebalancing toward coverage — ensuring that no guest leaves the platform because there were “no options left.”

- A lesson from Booking.com: Booking’s dominance in Europe comes from one simple truth: having every type of accommodation keeps users inside your ecosystem. Airbnb is taking notes.

But rather than scaling globally, Airbnb is piloting first; learning what guests want, how hosts (in this case, hotels) respond, and how the design impacts conversion rates.

🧠 What Makes This Pilot Different

Airbnb’s earlier attempts to include hotels — like “Airbnb for Work” and “Airbnb Plus” — fell flat.

This time, it’s different for three reasons:

- It’s deeply integrated: These hotel listings appear naturally in search results, using the same design language as homes and apartments. Guests don’t feel like they’ve left Airbnb.

- It’s data-led, not branding-led: Airbnb isn’t marketing this as a new program. It’s quietly gathering usage data and feedback.

- It’s a pilot, not a promise: If it doesn’t work, it will fade away without public embarrassment — a strategy Airbnb now applies across all new business lines (Hotels, Services, Experiences).

This cautious, iterative approach allows Airbnb to test new verticals without overextending.

🏙️ Where It’s Being Tested

The hotel pilot currently focuses on:

- Los Angeles: testing design integration and pricing logic.

- New York City: filling regulatory supply gaps with boutique hotels.

- Madrid: exploring cross-category booking behavior (homes + hotels).

While Airbnb hasn’t disclosed metrics, early signals from the call suggest it’s seeing healthy conversion rates and strong interest from independent hotels looking for alternatives to Booking.com’s commission-heavy model.

One telling line from Chesky during the Q3 call:

“We’re hearing from hotels in Europe that they want another channel to list on.”

That’s code for: Airbnb wants to attract hotels that feel overdependent on Booking.com.

🧭 Why It Matters

The hotel pilot is small in scale but big in implications. It signals that Airbnb’s next growth phase is about breadth, not reinvention.

It’s not abandoning its home-sharing roots — it’s ensuring that wherever a traveler searches, Airbnb has something to offer.

At the same time, this move raises new questions for the platform’s identity:

- Can Airbnb maintain its brand of “belonging” if hotels become part of the mix?

- Will hosts feel overshadowed by professional operators?

- How will search results balance private homes and commercial inventory?

These are the questions Airbnb seems eager to answer through real-world testing rather than theory.

👀 What to Watch in 2026

- Geographic expansion: If results are positive, expect rollouts to other supply-constrained cities like Paris, Amsterdam, Barcelona, and Tokyo.

- New search filters: As hotel inventory grows, Airbnb will likely introduce a “Hotels & Stays” toggle.

- Rate parity and pricing rules: Will Airbnb allow hotels to list at the same rates they offer on Booking.com — or push for exclusive discounts?

- Host sentiment: How individual hosts react will matter. If Airbnb appears to prioritize hotels in search results, backlash could follow.

For now, though, this is still a pilot — not a pivot.

It’s Airbnb experimenting with how to fill inventory gaps while preserving its identity as something more personal than a hotel booking site.

Thibault Masson is a leading expert in vacation rental revenue management and dynamic pricing strategies. As Head of Product Marketing at PriceLabs and founder of Rental Scale-Up, Thibault empowers hosts and property managers with actionable insights and data-driven solutions. With over a decade managing luxury rentals in Bali and St. Barths, he is a sought-after industry speaker and prolific content creator, making complex topics simple for global audiences.