Airbnb has launched a $5 million political campaign in New York City, starting with $1 million in digital attack ads targeting three mayoral candidates who oppose short-term rentals. These ads are being paid for by a SuperPAC—Affordable New York—funded entirely by Airbnb, making the company the largest political spender in the city’s 2025 election cycle so far.

But this isn’t a one-off move. It’s the latest in a multi-pronged, intensifying strategy to defend Airbnb’s place in urban markets where regulations have tightened, listings have been delisted, and enforcement has become more aggressive. The company is moving on several fronts at once: funding legislation, producing economic impact studies, and now taking aim directly at local elections.

Airbnb Is Backing a SuperPAC—But What Does That Actually Mean?

To non-U.S. readers, this kind of political spending may seem extraordinary. Under U.S. law, companies like Airbnb cannot donate large sums directly to candidates. But they can fund independent expenditure committees, or SuperPACs, which are allowed to spend unlimited amounts on political advertising, so long as they do not coordinate with a candidate’s campaign.

Affordable New York is one such entity. It has received $5 million in funding from Airbnb alone and is legally permitted to use that money to run ads, send mailers, or promote candidates that align with Airbnb’s interests. This explains how Airbnb has become deeply involved in NYC’s elections without appearing on a single campaign donation report.

The $1 Million Question: Who Is Being Targeted—and Why?

Affordable New York’s first major public move was a $1 million digital ad campaign targeting three Democratic mayoral candidates:

- Zohran Mamdani

- Scott Stringer

- Brad Lander

These candidates have all taken strong stances against Airbnb, particularly in response to a 2023 City Council bill that would have allowed one- and two-family homeowners to legally list their properties for short-term rentals without being present. That bill was significantly watered down in early 2024, under pressure from tenant advocates and the powerful hotel workers union. Still, Mamdani, Lander, and Stringer remain some of the most vocal critics of Airbnb’s business model.

Who Does The Ad Benefit?

Interestingly, Airbnb’s spending indirectly boosts Andrew Cuomo, the former New York governor and current frontrunner in the mayoral race. By targeting three of Cuomo’s strongest progressive opponents, the campaign may indirectly strengthen his position, without endorsing him or mentioning him in the ad.

Cuomo has not received Airbnb’s direct endorsement and has historically opposed short-term rentals during his time as governor. He is also supported by the Hotel and Gaming Trades Council (HTC), a consistent opponent of Airbnb’s expansion efforts. This raises the question: Why would Airbnb help someone who has opposed them before?

Strategic Motives: Why Airbnb Is Spending Big in NYC

There’s no single explanation, but several overlapping motives may help make sense of Airbnb’s approach:

1. Remove Ideological Opposition

Mamdani, Stringer, and Lander are among the most ideologically committed opponents of short-term rentals. Even if Cuomo has opposed STRs in the past, Airbnb may see him as less entrenched, more transactional, or simply the “least bad” option in a field of difficult choices.

2. Revive the One- and Two-Family Home Exemption

The bill Airbnb supported in late 2023 offered a way to partially legalize STRs again in NYC. That bill was watered down, but with different political actors, it could re-emerge.

3. Strengthen Council-Level Support

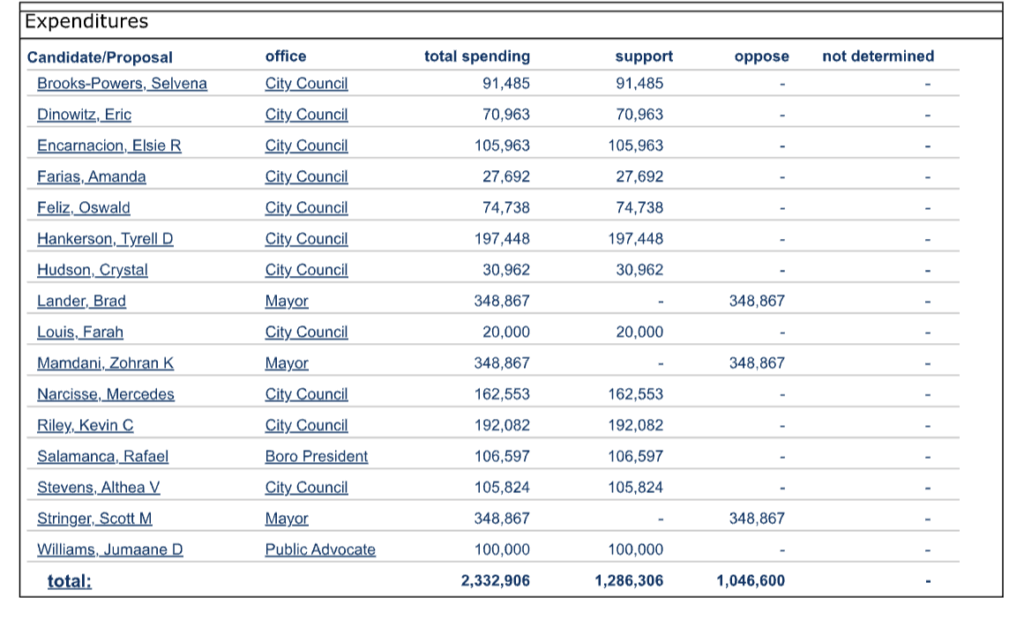

Most of the campaign’s early money, roughly $600,000, has gone toward supporting City Council and borough-level candidates who backed Airbnb-friendly legislation. These races are less costly but more critical for shaping policy coalitions.

4. Reframe the Narrative

Airbnb’s campaign is not just about legal battles, it’s also about messaging. The SuperPAC is called Affordable New York, and its ads don’t mention Airbnb or short-term rentals. Instead, they frame the issue as one of everyday affordability, arguing that candidates like Mamdani, Lander, and Stringer support policies that would make the city even more expensive.

By omitting direct references to Airbnb, the ad appeals to a wider audience of New Yorkers struggling with rising costs, while still reinforcing a narrative that aligns with Airbnb’s interests.

5. Send a Message Beyond NYC

Airbnb’s political engagement isn’t isolated. It comes just weeks after it published a $90 billion economic impact study, prepared by Charles River Associates, which models how much tax revenue and guest spending cities like New York, Boston, and Philadelphia are losing under strict regulation. The study makes a clear case: hotels—not residents—are benefiting most from short-term rental restrictions.

Context: The NYC Regulatory Landscape

Short-term rentals are effectively banned in most of New York City due to a state law that prohibits rentals of less than 30 days unless the host is present. The city began strict enforcement in 2023 through a host registration law, removing thousands of listings from platforms like Airbnb.

The 2023 bill, introduced by Councilmember Farah Louis, aimed to loosen these restrictions, but was amended before gaining traction. Airbnb’s current push appears focused on revisiting and reviving that bill or introducing similar legislation with broader support.

A Pattern of Intensifying Action

Airbnb’s NYC campaign should be seen as one part of a broader, intensifying regulatory strategy:

- In May, the company released its U.S. economic impact report, a detailed, city-by-city breakdown of lost guest nights and tax revenue due to STR restrictions.

- In British Columbia, Airbnb and Vrbo are currently removing listings in response to the province’s Short-Term Rental Accommodations Act, which forces delisting of non-compliant properties and mandates public license displays.

- In Europe, Airbnb has similarly released impact studies, aligned with its lobbying for lighter-touch, harmonized regulation.

These moves reflect a larger shift: platforms are no longer just lobbying behind the scenes, they are participating directly in public policy and public opinion.

Why This Matters to STR Managers Beyond NYC

Cities may no longer represent the majority of Airbnb’s bookings, but they remain essential to brand visibility, guest acquisition, and long-term profitability, especially in legacy urban markets like New York.

While the politics are local, the implications are global. Airbnb’s campaign demonstrates:

- A tactical shift: From reactive lobbying to proactive political spending

- A messaging shift: From abstract economic impact to “affordability” and “common-sense solutions”

- A market reality: That bookings in major cities still matter, and STR restrictions in those cities can reshape platform dynamics for everyone.

If you’re managing short-term rentals in a city that’s debating new laws, watching platforms spend millions to sway local elections signals what may come next. Whether it’s delisting (as in BC), court battles (as in France), or full-scale political campaigns (as in NYC), regulatory change is no longer theoretical—it’s operationally urgent.

Final Thought: Will the Strategy Work?

With $4 million left to spend, Airbnb is still early in its political campaign. Whether its candidates win, or whether legislation changes, remains to be seen. But the direction is clear: Airbnb is no longer just a platform. It’s now a political actor, too.

For professional short-term rental managers, that means regulatory change won’t only come from city councils or planning commissions. It may increasingly arrive through campaign ads, PACs, and ballot boxes.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.