Thibault Masson

What the Largest Vacation Rental Companies in the U.S. Really Look Like

TL;DR- Most vacation rental operators in the U.S. with 250+ listings fall into one of five archetypes: legacy regional players, multi-market aggregators, tech-driven platforms, luxury specialists, or urban hybrids. Based on the 2025 Comparent 100, scale spans from 250 to 37,000+ listings, but size alone doesn’t ensure success. Organizational discipline, operational DNA, and owner communication matter more than portfolio count. The industry is shifting again, with big players like Casago reshaping the map post-acquisition and Sonder’s downfall warning against over-centralization.

You’re Probably Comparing Your Performance to the Wrong Market

📌TL;DR- Many short-term rental managers rely on flawed comp sets when comparing performance. This article breaks down how physical, qualitative, performance, and strategic comparisons give a more accurate view of where you stand — and how better definitions lead to smarter decisions.

Which Airbnb Service Fee Am I Paying? (How to Check Your Host Fee in 2025)

📌TL;DR- In 2025, not all Airbnb hosts were moved to the 15.5% host-only fee—only those using a property management system (PMS) were automatically switched. If you manage your listing directly on Airbnb, you may still be on the 3% split-fee model. To confirm, go to Account → Payments → Service fee and look for the “CURRENT SETTING,” or check a recent payout to see whether ~3% or ~15.5% was deducted. This quick guide helps hosts identify which fee model they’re on and how to verify it in seconds.

How Steve Schwab’s Relationship Philosophy Helped Casago Outperform Vacasa

📌TL;DR- Steve Schwab, founder and CEO of Casago, grew his company through discipline, humility, and relationship-driven leadership. While competitors like Vacasa leaned on tech hype and rapid scaling, Schwab prioritized local trust, owner loyalty, and cultural alignment—proving that people-first business strategies are more resilient than investor-driven growth stories.

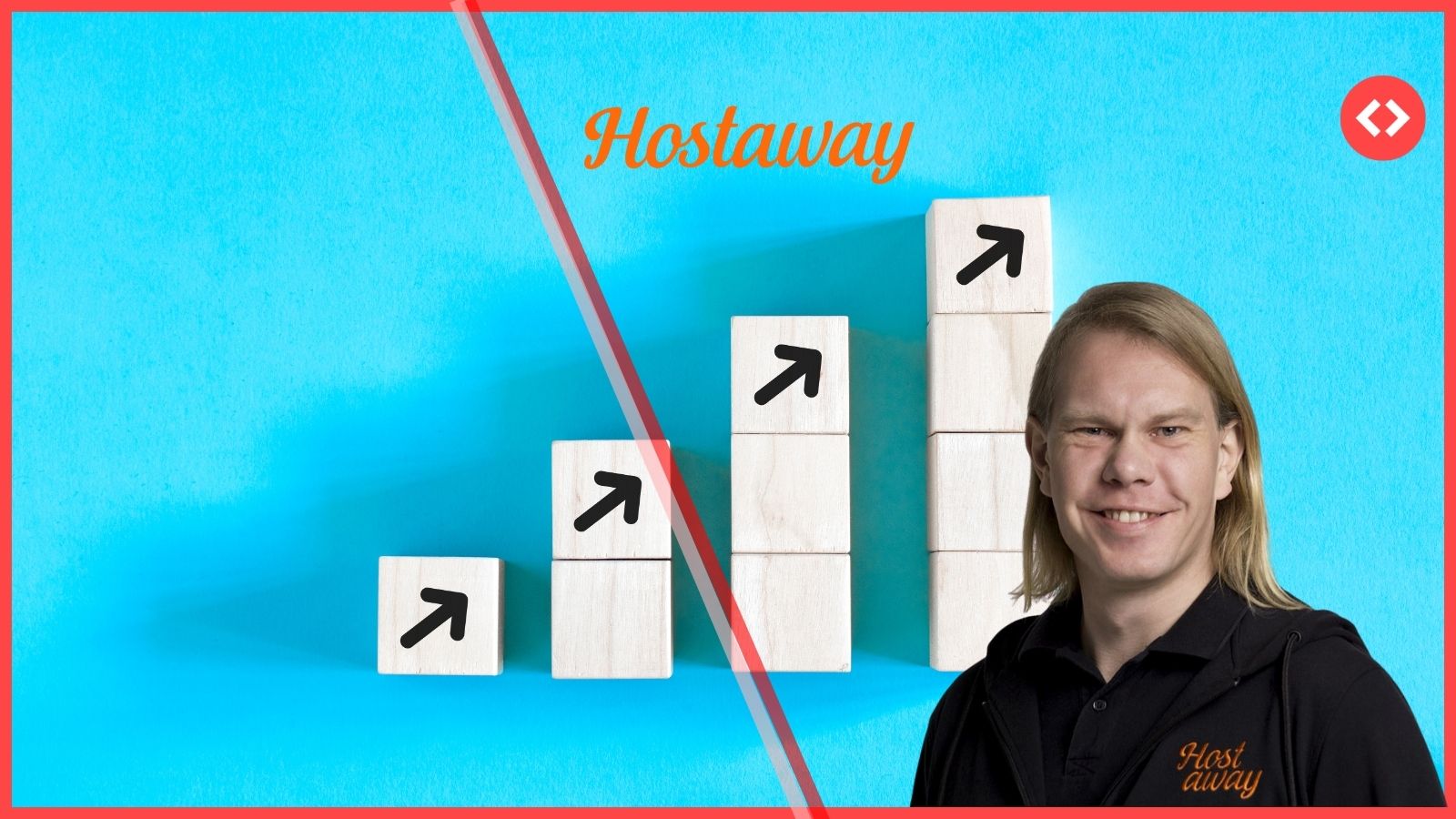

Hostaway CEO Marcus Rader on Becoming the First Short-Term-Rental PMS Unicorn—and What Comes Next

📌TL;DR: Hostaway has become the first short-term rental PMS unicorn. CEO Marcus Rader credits its global mindset, U.S. growth during COVID, and renewed focus on Europe for the milestone. Looking ahead, he sees AI as the next major disruptor for travel discovery and property management. With new funding, Hostaway is expanding product, engineering, and support for larger property managers across key European markets.

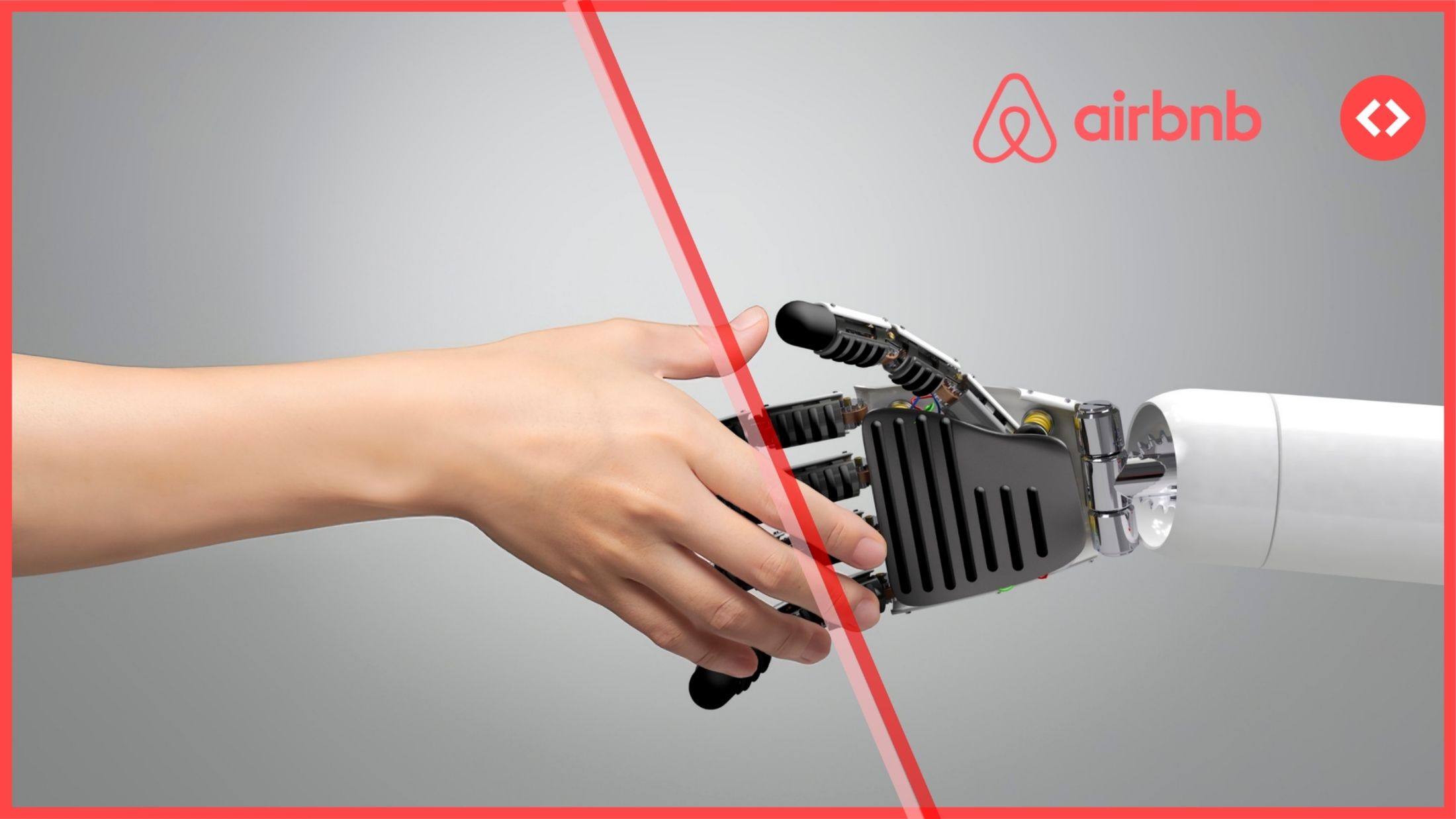

Airbnb Is Borrowing from Booking.com’s Playbook, but Only Where It Fits

📌TL;DR- Airbnb and Booking.com are looking more alike in 2025, but only on the surface. Airbnb is copying Booking where it boosts conversions (cancellations, payments, discovery), while rejecting the loyalty programs and corporate tone that define Booking’s DNA. The big takeaway: Airbnb is becoming an OTA with personality, and that hybrid strategy may give it a long-term edge.

Airbnb’s Fourth Pillar: How AI Became a Strategic Defense Against an AI Future

📌TL;DR- Airbnb’s “fourth pillar” is here, and it’s powered by AI. Moving beyond operational efficiency, Airbnb now treats artificial intelligence as a strategic moat against the rise of general-purpose AI platforms. CEO Brian Chesky’s vision centers on using AI to deepen personalization, protect its marketplace, and ensure Airbnb remains the platform where human connection meets machine intelligence.

Will Airbnb Hosts See a Rise in Cancellations in 2026?

📌TL;DR: Airbnb now gives every booking a 24-hour grace period and has introduced more flexible refund options for guests. While this change aims to increase traveler confidence and conversions, it could also lead to more last-minute cancellations in 2026. For hosts, that means adapting pricing and cancellation settings to balance flexibility with revenue protection — especially as Reserve Now, Pay Later expands and Airbnb tests Dynamic Cancellation Policies.

Airbnb’s Hotel Pilot Explained: What It Is, Why It Matters, and What to Watch

📌TL;DR: Airbnb is quietly expanding into hotels, adding boutique and independent properties in select cities. The Airbnb hotels pilot reflects the company’s strategy to diversify supply, balance regulatory pressures, and keep travelers within its ecosystem. It’s a pivotal step toward making Airbnb a full travel marketplace, not just a home-sharing platform.

Airbnb’s 15.5% Host-Only Fee: Why It Feels Like a Tax Hike (But Isn’t One)

📌TL;DR- Airbnb fee changes in 2025 have some hosts worried about higher taxes. But despite the new 15.5% host-only commission, this shift is tax-neutral for most U.S. operators. Here’s why it feels like a tax hike, and how income, gross receipts, and occupancy taxes are actually affected.

2025 Airbnb Professional Host Summit: Why Property Managers Should Care

Where & when: Early October 2025, Airbnb headquarters, San FranciscoWho: ~150 invited professional hosts/property managers (per attendee reports)Why this was ...

How to Rank Higher on Airbnb: Booking Probability and Guest Satisfaction Now Drive VisibilitY

📌TL;DR- At the 2025 Airbnb Professional Host Summit, the company revealed that listings now rank based on two key signals: how likely a guest is to book, and how likely they are to leave a 5-star review. This marks a major shift toward guest satisfaction as a core ranking factor. Airbnb’s algorithm now uses over 800 signals—including listing accuracy, cleanliness, communication, and even the likelihood of support issues, to predict the outcome of a stay before it happens. For property managers, this means maintaining visual quality, consistent operations, and perceived value is more important than ever, as these elements now directly impact visibility and bookings.

EU Signals Short-Term Rental Regulation as Part of Housing Crisis Response

European Commission President Ursula von der Leyen briefly mentioned short-term rentals (STRs) in her 2025 State of the Union address, ...

Airbnb Host-Only Fee at 15.5%: What It Means for Property Managers

Airbnb is ending its split-fee model for PMS-connected hosts and standardizing a 15.5% host-only fee worldwide (16% in Brazil). For property managers, this raises distribution costs — but margins can stay intact by adjusting rates and increasing PMS markups to about 18.34% to fully offset Airbnb’s new fee.

Airbnb’s “Reserve Now, Pay Later”: More Bookings, But Who Carries the Risk?

In August 2025, Airbnb introduced Reserve Now, Pay Later for US travelers. Guests booking eligible listings can now reserve with ...

Airbnb Talks Up Hotels Again — And This Time, It’s Strategic

During its Q2 2025 earnings call, Airbnb announced it expects moderate growth in Q3 and especially Q4. Alongside the cautious ...

Forget Airbnb’s Flashy New Services Expansion — It’s Time to Put the B&B Back in Airbnb

Airbnb has been talking up new services, experiences, and hotels — but there’s a quieter, more strategic growth lever hiding ...

Airbnb’s Platform Activity: What Vacation Rental Managers Need to Know for Q2, Q3, and Q4 2025

If you’re managing vacation rentals and rely on Airbnb, it’s key to understand how many bookings are happening on the ...

Airbnb’s Long-Term Bet on Experiences & Services Faces Short-Term Skepticism

Airbnb is making one of its boldest strategic moves yet: expanding beyond homes to become a lifestyle brand. With its ...