It turns out that property managers with 100+ listings are often marching to a different beat than the rest of the market: lower occupancy, harsher reviews in some cases, yet consistently higher revenue.

In the latest RevLabs × RSU by PriceLabs session, we dug into real 2025 market data by PriceLabs from five key regions, the US, UK, France, Spain, and Italy, to understand what’s really happening beneath the surface, and what it means for planning decisions heading into 2026.

Below are the key takeaways every large operator should be aware of heading into the new year.

1. Bookings Are Coming Later, and Demand Is Becoming More Compressed Around Events

One of the clearest themes from the webinar was that demand hasn’t disappeared; it has shifted.

Guests are booking later, and a growing share of demand is concentrating around specific dates and events, rather than being spread evenly across the calendar.

1.1 Booking Windows Are Shortening and Last-Minute Demand Is Growing

A booking window refers to the number of days between when a guest makes a reservation and their check-in date.

Shorter booking windows mean guests are deciding and committing closer to arrival.

Using aggregated PriceLabs market data, the webinar highlighted two reference months to illustrate this shift across seasons:

- January (typically a lower season in many markets)

- July (peak summer demand)

What the data showed

In the United States:

- January booking windows shortened from ~19 days (2022) to ~15 days (2025)

→ Guests are now comfortable booking much closer to arrival, even in lower-season periods. - July booking windows shortened from ~34 days to ~29 days

→ Even peak-season demand is materializing later than it used to.

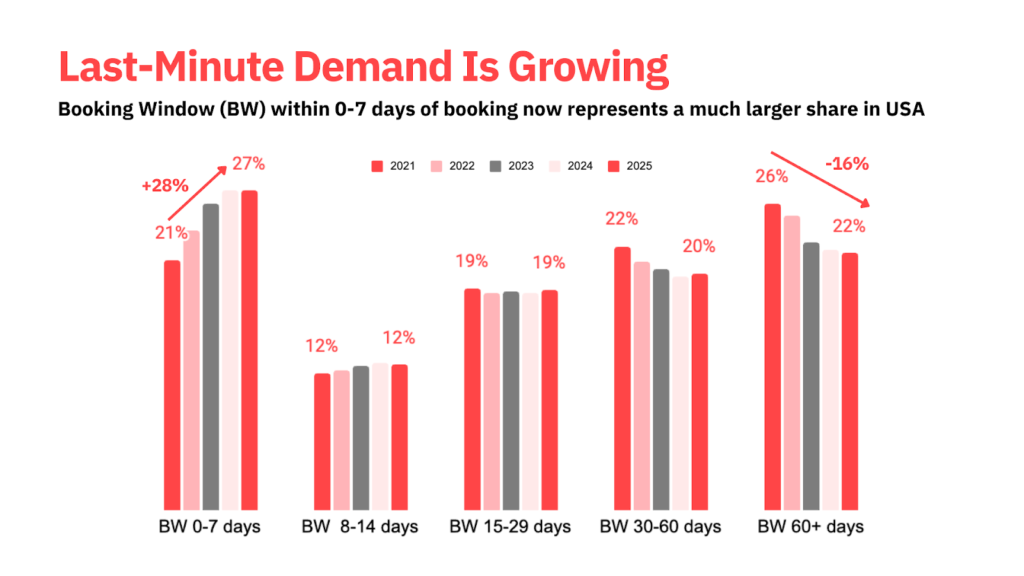

At the same time, the share of last-minute bookings increased:

- Last-minute bookings (defined as 0–7 days before check-in) rose from 21% to 27% of all bookings

→ A larger share of total revenue now depends on how operators handle truly short-lead demand. - Bookings made 60+ days in advance declined over the same period.

The US market shows a similar pattern: a growing reliance on last-minute demand and fewer bookings far in advance, underscoring why reacting too early can lead to unnecessary price drops.

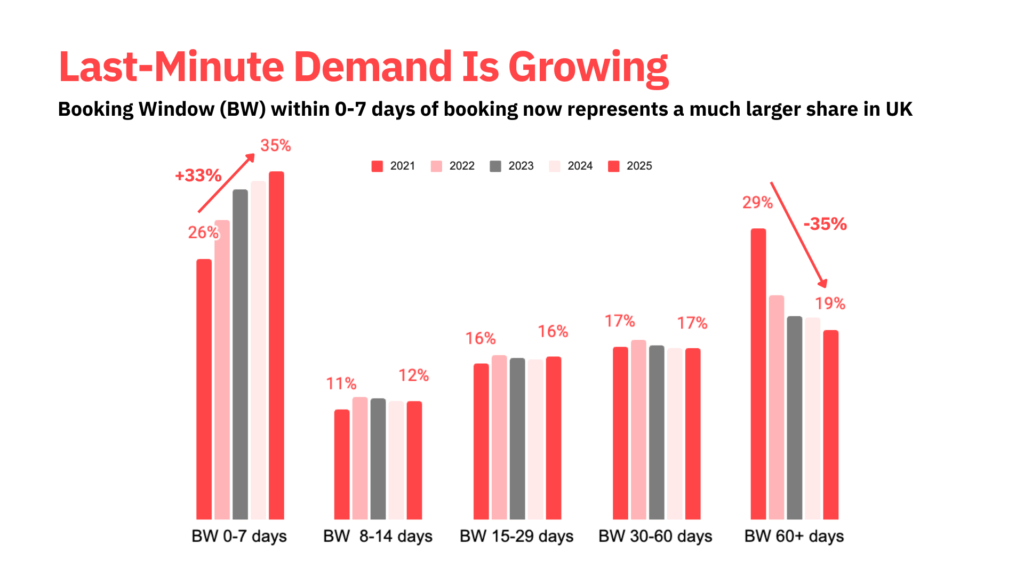

In the UK, last-minute bookings now represent a much larger share of total demand, confirming that booking windows are compressing and revenue is increasingly decided closer to arrival.

This pattern is most pronounced in the US and UK. In parts of Europe, the signal exists but is noisier due to one-off disruptions such as the Paris Olympics.

1.2 Events Are Pulling Demand Forward, and Concentrating It

The second half of this shift is event-driven demand compression.

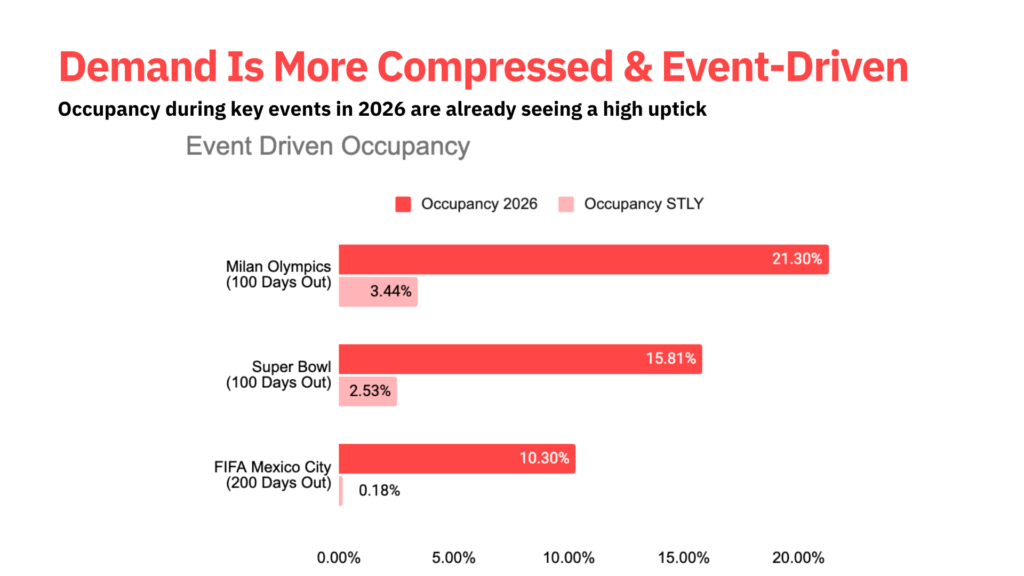

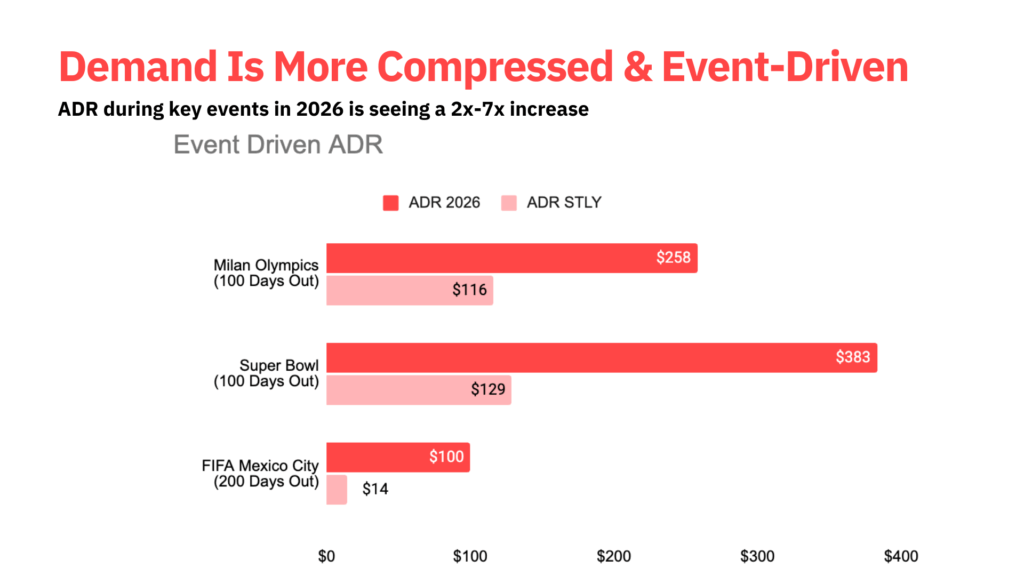

PriceLabs compared current booking data for major 2026 events with STLY (Same Time Last Year), meaning how booked the market was at the same point on the calendar one year earlier.

What stood out

- Milan Winter Olympics (2026)

Occupancy roughly 100 days out jumped from ~3% (STLY) to ~21% - Super Bowl (Santa Clara)

Occupancy increased from ~2% to ~15% at the same lead time. - FIFA World Cup 2026 (US, Mexico, Canada)

Early demand already exceeds last year’s levels, even before team allocations were finalized

Early booking data shows that demand for major 2026 events is already several times higher than at the same point last year, highlighting how travel demand is increasingly concentrated around key event dates.

It’s important to note that this reflects booked prices, not just list prices.

- ADR (Average Daily Rate), the average nightly price guests actually pay, is already materially higher for these dates.

Early booking data shows that demand around major 2026 events is not just higher than last year — it is multiple times stronger at the same lead time, with guests already paying significantly higher nightly rates.

Why this matters

Events are accounting for a disproportionate share of annual revenue.

Richie emphasized that a relatively small number of event dates often generate a large portion of yearly revenue. Getting event pricing wrong can undo months of strong performance elsewhere.

What large operators should do for 2026

- Identify major events early, including secondary and regional events

- Track occupancy pacing before adjusting prices aggressively

Avoid two common mistakes:- Underpricing too early

- Holding inflated prices too long as supply flexes

2. Supply Growth Is Slowing, But Professional Operators Keep Gaining Share.

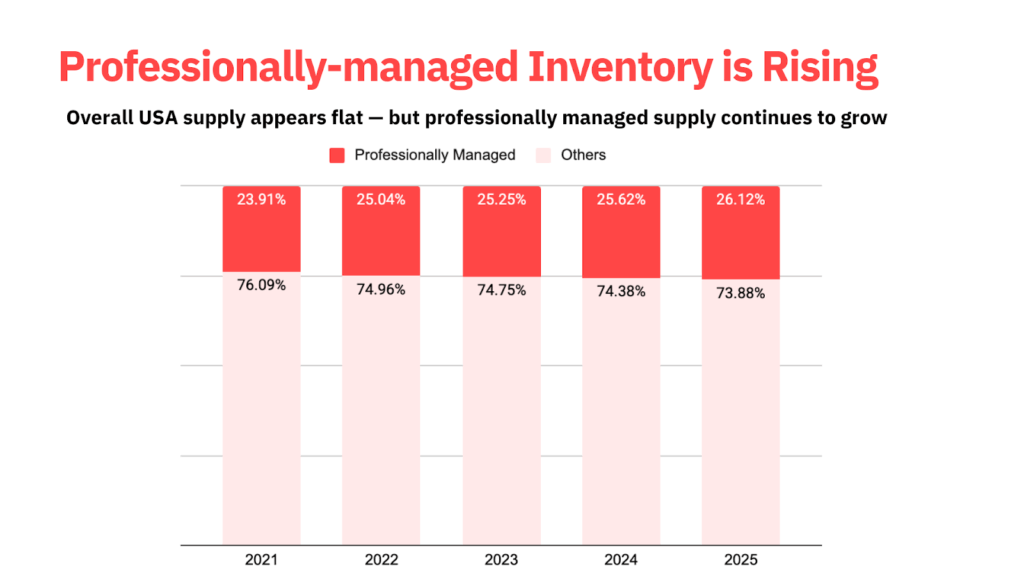

A recurring industry narrative has been that short-term rental supply is “skyrocketing.” The data tells a more nuanced story.

What the data showed

- In mature markets (US, UK, Western Europe), total short-term rental supply has largely flattened

- However, professionally managed inventory continues to grow

- The market is consolidating rather than expanding indiscriminately

This reflects both institutional investment and smaller operators exiting or being absorbed.

Overall short-term rental supply in the US appears flat, but the share of professionally managed inventory continues to grow year over year.

Why this matters

For large property managers, the real competition is increasingly with other professional operators, not individual hosts.

Richie highlighted that benchmarking only against your own past performance can be misleading:

- You may feel “down” while outperforming the market

- Or feel “stable” while falling behind peers

What large operators should do for 2026

- Benchmark against local peers and competitive sets, not just last year

- Track market movement alongside portfolio performance

- Reassess assumptions when the broader market shifts

Relative performance matters more than absolute comfort.

3. Large Property Managers Run Lower Occupancy — and Still Make More Money

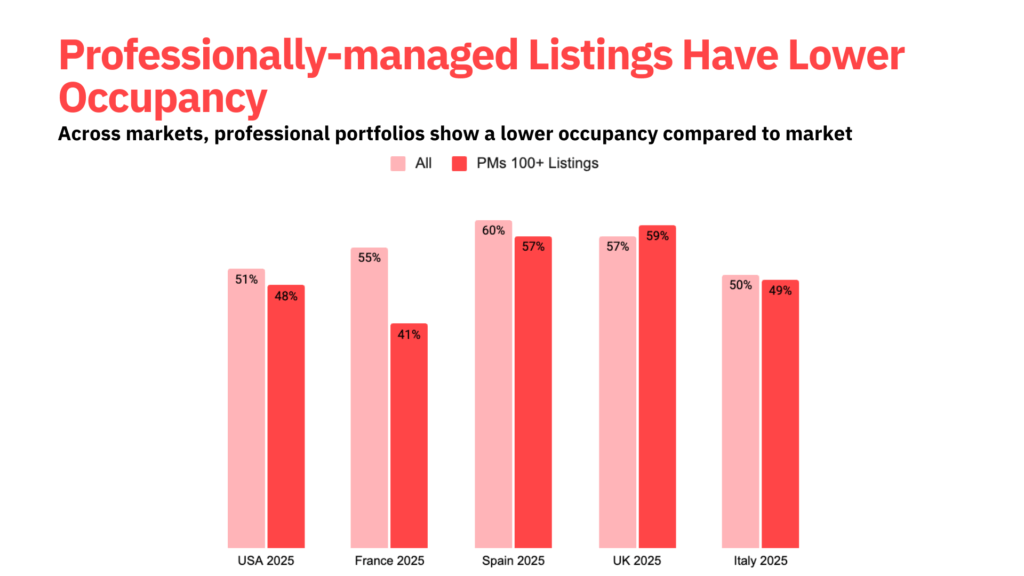

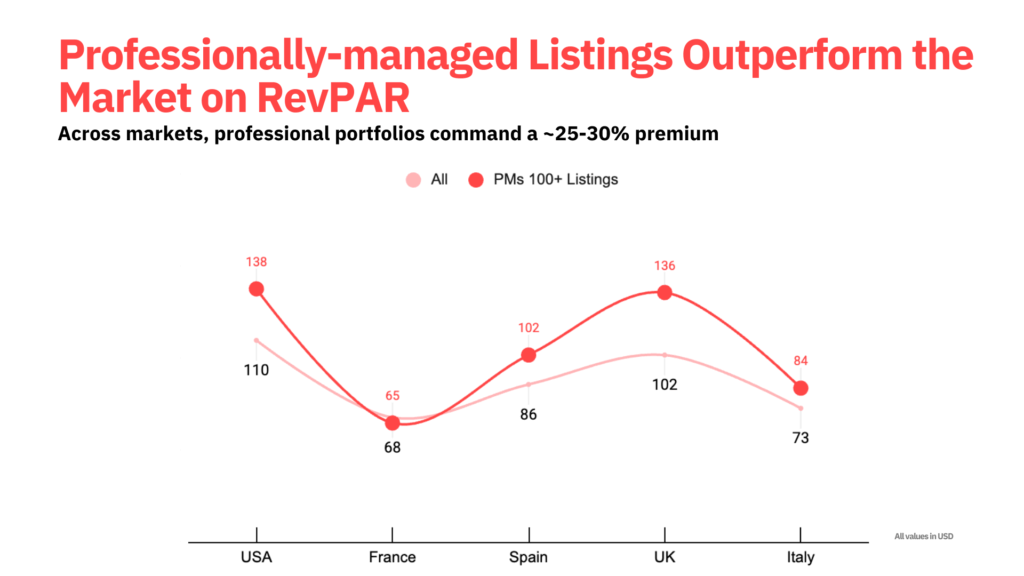

Across all five markets analyzed, large property managers consistently run lower occupancy than the overall market, yet still achieve higher ADR and higher RevPAR.

This is one of the most counterintuitive findings from the webinar, and one that often clashes with how performance is discussed internally and with owners.

The charts below show how lower occupancy and higher RevPAR coexist in the same portfolios.

Across major markets, large professional portfolios run lower occupancy than the market average — a deliberate trade-off rather than a performance gap.

Despite lower occupancy, professionally managed portfolios achieve higher RevPAR across all markets, reflecting stronger pricing discipline and revenue strategy.

Why this happens

Several structural factors explain why large operators look different from the broader market:

- Rate discipline

Professional operators are more likely to protect rates rather than chase every possible booking, especially far in advance. - Minimum stay rules

Minimum stay requirements reduce low-value, high-friction bookings that can hurt overall revenue efficiency. - Owner constraints and operational consistency

At scale, changes to pricing, cancellation policies, or stay rules often require owner buy-in, which naturally limits hyper-reactive behavior. - Event strategy

Large portfolios tend to be more deliberate about holding rates around peak demand periods and major events, even if that means lower occupancy outside those windows.

The result is a portfolio that may look “underfilled” on the surface, but performs better financially over time.

Thibault highlighted that this dynamic often creates tension in owner conversations: occupancy is the most visible metric, even when it’s not the most meaningful one.

Why this matters

At scale, chasing occupancy alone is rarely optimal.

Higher revenue more often comes from:

- Maintaining pricing discipline

- Capturing event-driven demand effectively

- Being selective about which demand is worth filling

What large operators should recalibrate for 2026

- Shift internal and owner-facing reporting toward RevPAR, not occupancy in isolation

- Be intentional about when to push for fill versus when to protect rates

- Frame performance discussions around revenue outcomes, not booking volume

- Use data to explain why lower occupancy can still mean stronger performance

4. Listing Quality Is Now a Direct, Measurable Revenue Driver

One of the most actionable sections focused on listing quality.

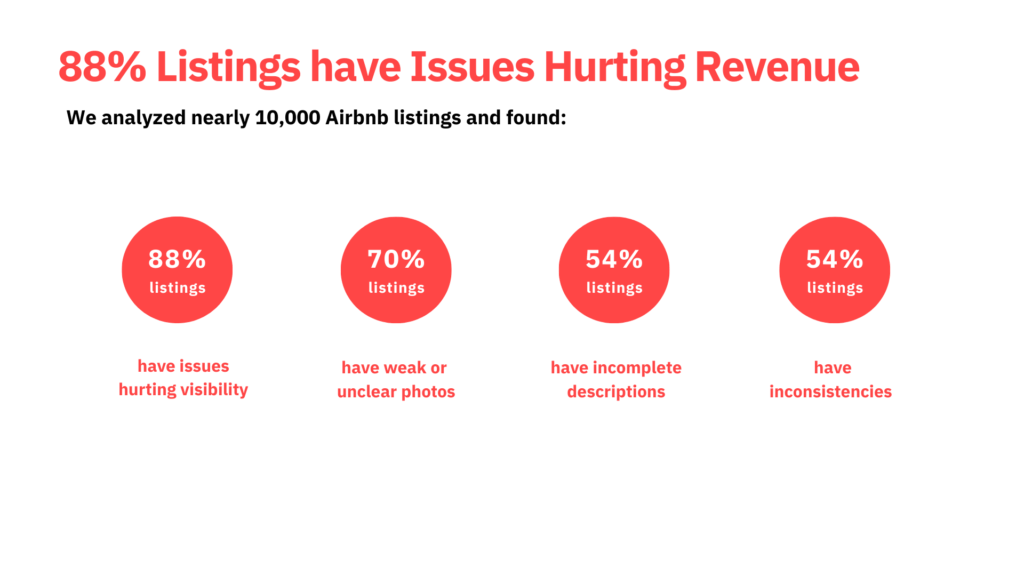

PriceLabs analyzed 10,000+ Airbnb listings globally to identify patterns among listings that consistently outperform their market.

What the analysis revealed

Among underperforming listings:

- 70% had weak or unclear photos

- 40% had incomplete descriptions

- 40% had inconsistencies across photos, titles, and amenities

- Only 12% of listings showed consistently “money-making” content.

An analysis of nearly 10,000 Airbnb listings shows that the vast majority suffer from content issues that quietly reduce visibility and bookings, even in professionally managed portfolios.

At the same time:

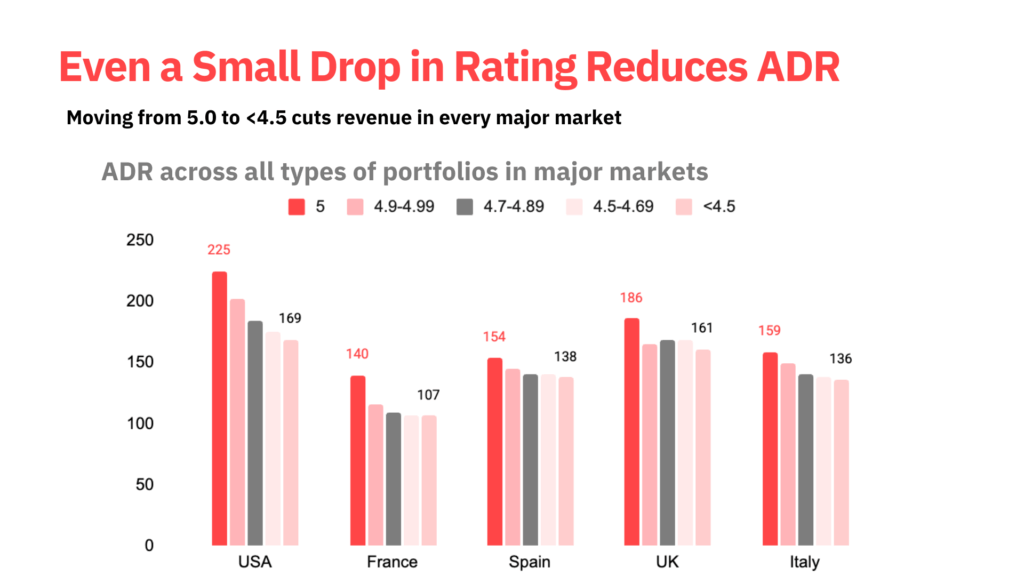

- Higher review scores consistently correlate with higher ADR

- “Guest Favorite” badges are now common

- ~30% of US listings have them

- Among large property managers, only ~10% of listings carry that badge

Across every major market analyzed, even a small decline in guest rating translates into a meaningful drop in Average Daily Rate — reinforcing why listing quality is now a direct revenue driver.

Why this matters

Quality is no longer a differentiator; it’s a baseline requirement.

At scale, small issues compound:

- Guests filter aggressively by amenities

- Inaccurate listings lose trust and clicks

- Even perfect pricing cannot fix a listing that guests never choose

Richie shared a personal example from Paris, where filtering for air conditioning reduced thousands of listings to just six, not due to lack of supply, but poor listing accuracy.

Thibault highlighted that for large portfolios, listing quality problems often go unnoticed because they don’t fail loudly.

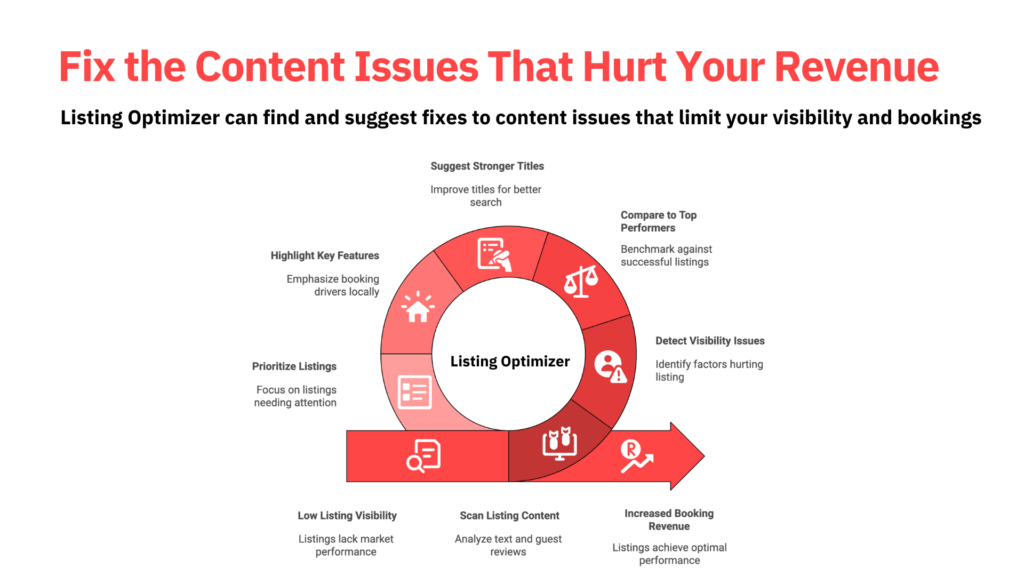

This is where PriceLabs’ all-new tool, Listing Optimizer, was introduced in the session.

Listing Optimizer was introduced during the session as a way for large operators to systematically identify and prioritize listing content issues at scale, turning quality from a blind spot into a measurable lever.

The tool is designed to:

- Scan listing content and guest reviews at scale

- Identify where listings are losing visibility or trust

- Highlight inconsistencies across photos, descriptions, and amenities

- Compare listings against top-performing competitors in the same market

- Help prioritize which listings need attention first, instead of fixing everything blindly

As platforms lean more on AI-driven recommendation and personalization, how cleanly and accurately your listing is structured becomes even more important; the algorithm can’t surface what it can’t ‘understand’.

What large operators should do for 2026

- Treat listing content as a revenue lever, not a cosmetic task

- Prioritize fixes based on impact, not instinct

- Address quality issues portfolio-wide, not one listing at a time

5. 2026 Requires a Reset, Not a Rollover

The closing message was clear: do not carry 2025 assumptions into 2026 unchanged.

Markets have shifted in:

- Booking behavior

- Event pacing

- Competitive dynamics

- Guest expectations around clarity and quality

The data points to a clear takeaway for 2026: operators who adapt faster to changing demand patterns, benchmark correctly, and fix listing quality issues will be best positioned to outperform.

Richie and Thibault emphasized that the end of the year is the right moment to:

- Revisit pricing rules

- Re-evaluate benchmarks

- Question long-held assumptions

- Let data, not fear, guide change

The signals are already there. The advantage belongs to those who act on them first.

If you want to see the charts and full discussion behind these takeaways, you can watch the webinar recording or listen to the podcast version.

More detailed, market-specific breakdowns for the US, UK, France, Spain, and Italy will follow. Subscribe to our free weekly newsletter to stay informed.

Snigdha Parghan is a Content Marketer at RSU by PriceLabs, where she creates articles, manages daily social media, and repurposes news and analysis into podcasts and video content for short-term rental professionals. With a focus on technology, operations, and marketing, Snigdha helps property managers stay informed and adapt to industry shifts.