If you want to understand how Vrbo is doing, you still have to read between the lines of Expedia Group’s earnings call. Expedia doesn’t publish a neat Vrbo-only scorecard. But Q3 2025 included a cluster of vacation-rental signals that all point in the same direction: Vrbo is benefiting more directly from Expedia’s core marketplace—its main shopping funnel, its loyalty pricing, and its push to sell a “full trip,” not just a stay.

That framing should sound familiar. Over the past couple of years, Expedia has been laying the groundwork to run Vrbo on the same rails as its other brands—after a rocky platform transition in 2023, followed by an ongoing effort to rebuild merchandising features and align Vrbo with Expedia’s loyalty and distribution muscle. Q3 is one of the clearer quarters where that long arc starts to show up as measurable traction.

Vrbo “improved sequentially” in Q3 and grew year over year

Expedia leadership said “Hotels and Vrbo both improved sequentially,” and that both grew year over year. They didn’t attach a Vrbo-specific growth rate, and they didn’t separate Vrbo’s revenue line from the rest of the business.

Still, this is a meaningful phrasing choice. In recent quarters, including the period when Vrbo was re-platforming and reintroducing key shopping features, Vrbo has often been discussed with caveats. Q3’s wording places Vrbo on the right side of the story: improving, not dragging.

The more actionable question is why, and that’s where Q3 gets unusually specific.

U.S. travel flows were steadier in Q3

Expedia also gave a useful window into what demand looked like—especially into the U.S., which remains central to Vrbo’s footprint.

In response to a question about travel “corridors,” Expedia described demand as “healthy across the board,” and added several U.S.-inbound signals: inbound travel to the U.S. was “nearly back” to last year’s levels; Europe-to-U.S. growth recovered from Q2; APAC-to-U.S. accelerated from Q2; and Canada-to-U.S. travel “remains pressured,” though it improved as the quarter progressed.

That corridor commentary doesn’t isolate Vrbo demand, but it sets the context: the quarter’s U.S. demand picture improved from Q2 in some important international flows, while Canada remained a weak spot. In the same quarter that Expedia says Vrbo improved sequentially, Expedia is also describing a more supportive inbound backdrop into the U.S. than the quarter before.

Expedia is selling more vacation rentals inside Expedia’s core shopping flow

In prepared remarks, Expedia said it launched “new design flows in the lodging search and post-booking paths,” and that these have led to “double-digit growth in vacation rentals,” alongside “record attach rates.”

In that, Expedia is effectively telling investors that it can now sell vacation rentals through the same kind of funnel engineering it applies to hotels: change how people browse, compare, and commit—then shape what happens next.

This matters for Vrbo because Vrbo is Expedia Group’s vacation-rental engine, and Expedia has been steadily pulling vacation rentals into the broader Expedia shopping environment (rather than treating them as something you only buy on Vrbo.com). The Q3 call is explicit that this approach is producing growth at the vacation-rental level.

Promotions are becoming part of the marketplace mechanics fast

Expedia also provided one of the clearest adoption signals we’ve seen for Vrbo’s newer discount tools. In Q&A, leadership said: “20% of our bookings last quarter were on a promotion suite that we only rolled out in the spring this year.”

Earlier RSU coverage already tracked Vrbo’s shift toward a more structured promotion toolkit: early booking, last-minute discounts, and the later rollout of mobile-only and member-only pricing. Q3 adds something new: not just that the toolkit exists, but that it is already shaping a meaningful share of bookings.

It’s also consistent with how Expedia described the quarter: healthy demand, but increasingly competitive shopping behavior. Promotions in that environment become less about “discounting to fill gaps” and more about how the platform chooses to package inventory in front of users.

Loyalty is being used as pricing, and Vrbo is part of that

On loyalty, Expedia said it launched “two important loyalty capabilities,” and then called out Vrbo specifically: “For Vrbo, we introduced member deals, giving our members access to better rates.”

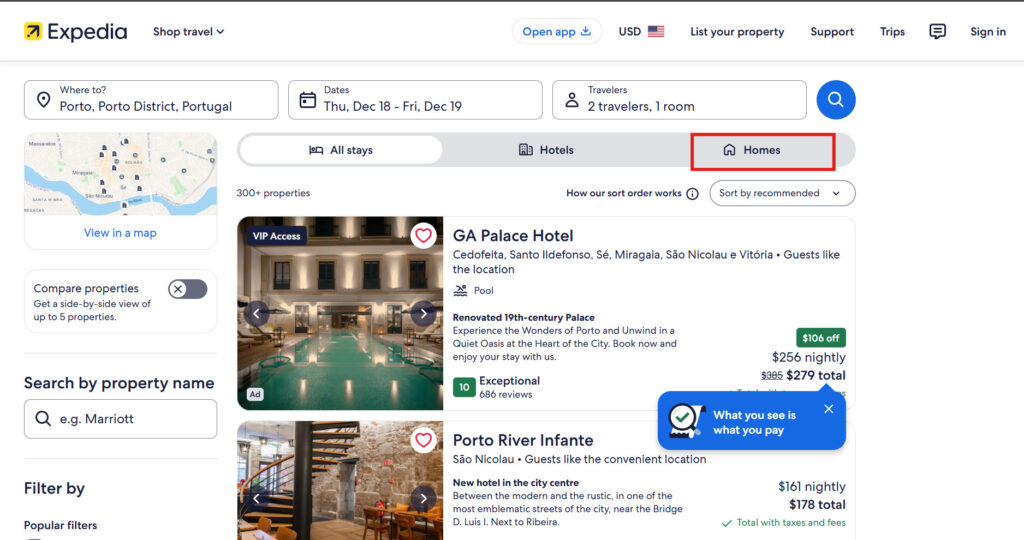

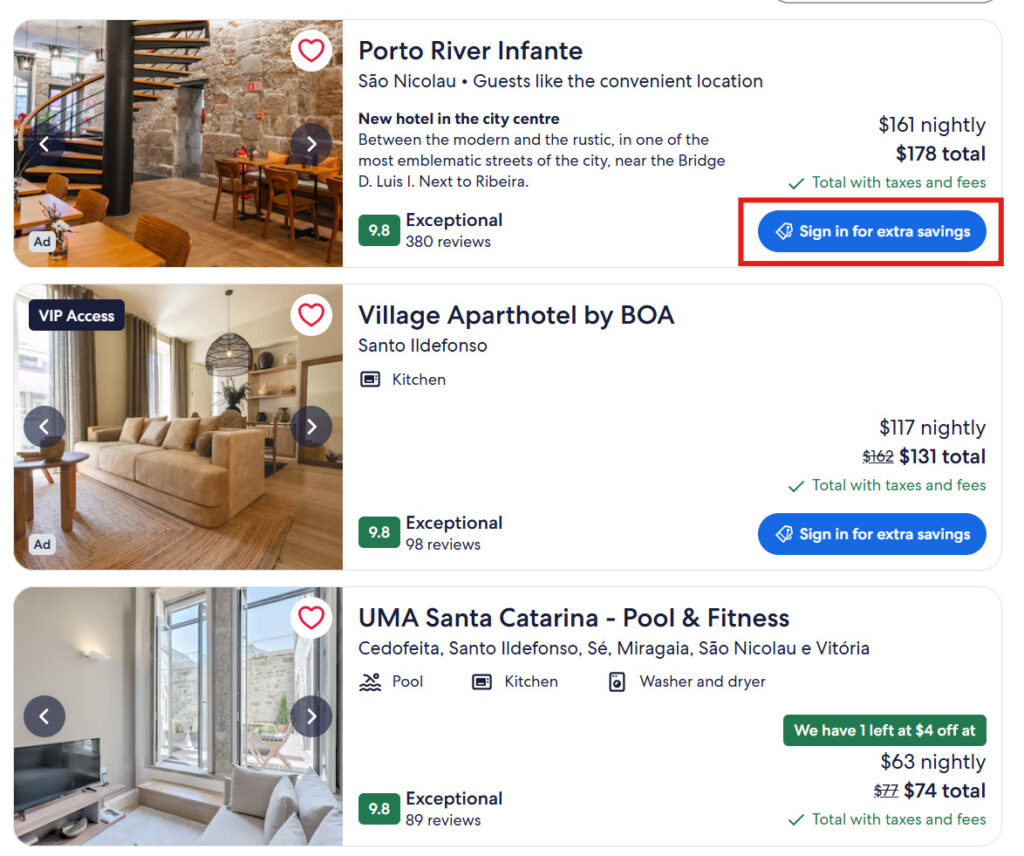

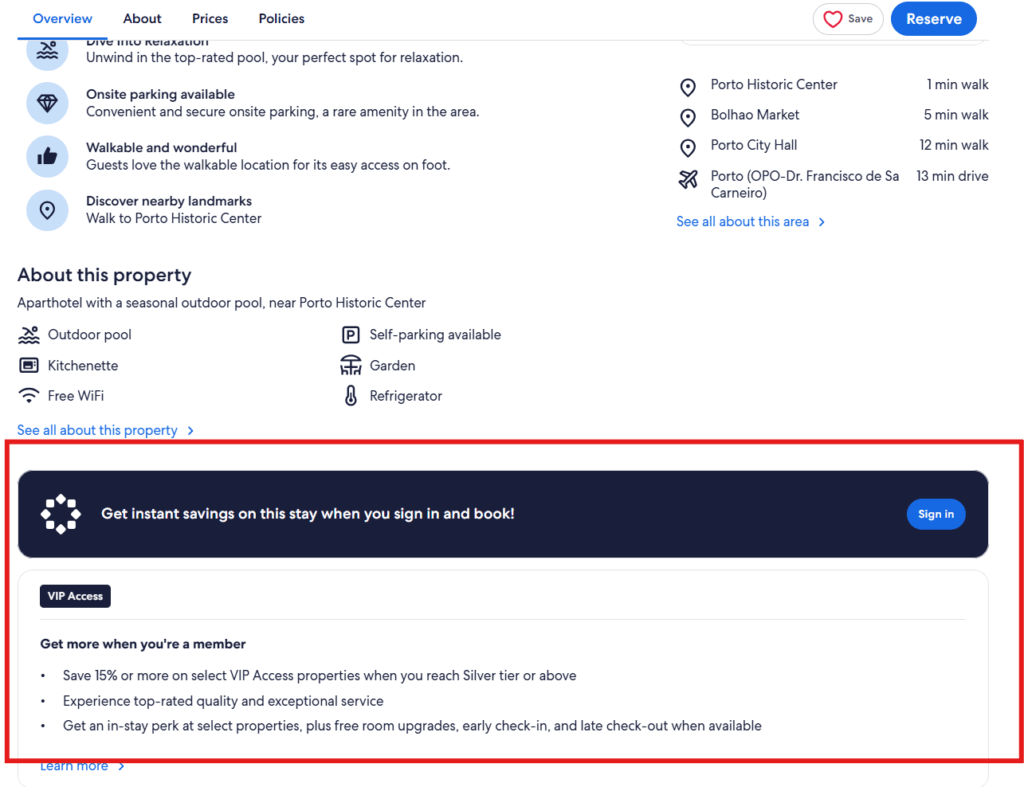

That might read like standard loyalty talk until you look at what’s actually happening on Expedia’s consumer surfaces. The deck and on-site experience increasingly frame value through sign-in gated discounts—“Member Price available,” “VIP Access,” and other cues that make loyalty feel immediate and transactional.

We have previously covered how Expedia has been tightening the One Key loop across its brands. Q3 reinforces that this is not a hotel-only strategy. Vacation rentals are being pulled into the same playbook: make members feel like they’re getting a better deal, drive login behavior, and reduce shopping leakage to competitors.

Multiple Vrbo property listings on Expedia with strike-through pricing and “Sign in for extra savings” callouts, highlighting loyalty-based discounts and VIP Access tags.

Record “attach rates” show Expedia’s vacation-rental bet is tied to bundling

In the same breath as “double-digit growth in vacation rentals,” Expedia said the redesign also produced “record attach rates.”

Attach rate is investor shorthand for “how often the traveler adds something else to the trip after booking lodging”—cars, trip protection, flights, activities. When attach rises, it usually signals that the platform is getting better at turning a stay booking into a broader trip purchase.

That’s important context because Expedia is competing in a market where OTAs are trying to own more of the traveler journey. Booking.com has been pushing the “connected trip” model; Airbnb is widening into additional verticals. Expedia’s Q3 language shows it is applying the same logic to vacation rentals: sell the stay, then build the trip around it.

For Vrbo operators, the takeaway isn’t that they suddenly need to sell cars. It’s that Expedia is prioritizing vacation rentals more when they help it win the larger prize: a higher-value, higher-retention traveler relationship.

Personalization is becoming the distribution layer, not just a feature

In Q&A, Expedia also signaled that ranking models will become more personalized. That matters because it connects multiple threads RSU has been tracking: Vrbo’s tightening of quality standards, its tiered recognition systems, and the platform’s, as well the industry’s broader effort to reduce friction and mismatches.

As personalization increases, the “winning” listings are less defined by a universal ordering and more by how confident the platform is that a property is the right fit for the traveler in front of it. That puts weight on the things platforms can measure consistently: structured content, clean attributes, reliable policies, strong guest feedback, and low cancellation problems.

This also fits the broader assimilation story: once vacation rentals are distributed more widely across Expedia surfaces and partners, quality signals become a business requirement, not a nice-to-have. A low-quality booking isn’t just a bad review; it’s a cost and a risk that undermines the broader marketplace.

The integration arc: Q3 looks like a “platform leverage” quarter

Vrbo’s 2023 switch onto Expedia Group’s platform was always pitched as a long-term project: unify the tech and unlock scale, even if the transition is painful. Q3 2025 reads like a quarter where Expedia can finally point to the upside in a concrete way:

- Expedia.com’s lodging funnel changes are driving vacation-rental growth.

- Promotions are quickly becoming a meaningful share of bookings.

- Loyalty is being deployed as rate advantage, including for Vrbo.

- Attach behavior is hitting records, reinforcing Expedia’s bundled-trip direction.

Bottom line

Vrbo’s performance in Q3 is a reminder that the competitive landscape is shifting away from single-product marketplaces. Expedia is explicitly optimizing vacation rentals as a core lodging offering and tying them to bundling economics. That doesn’t guarantee Vrbo will outperform other channels in every market, but it does suggest Vrbo is being positioned as a more strategic asset inside Expedia than it has been in some previous cycles.

In practical terms, a more “assimilated” Vrbo tends to reward the operators whose inventory fits the system Expedia is building: listings that are easy to shop, easy to compare, clearly priced, and operationally consistent, because those are the properties that survive value-based merchandising, loyalty gating, and increasingly personalized ranking.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.