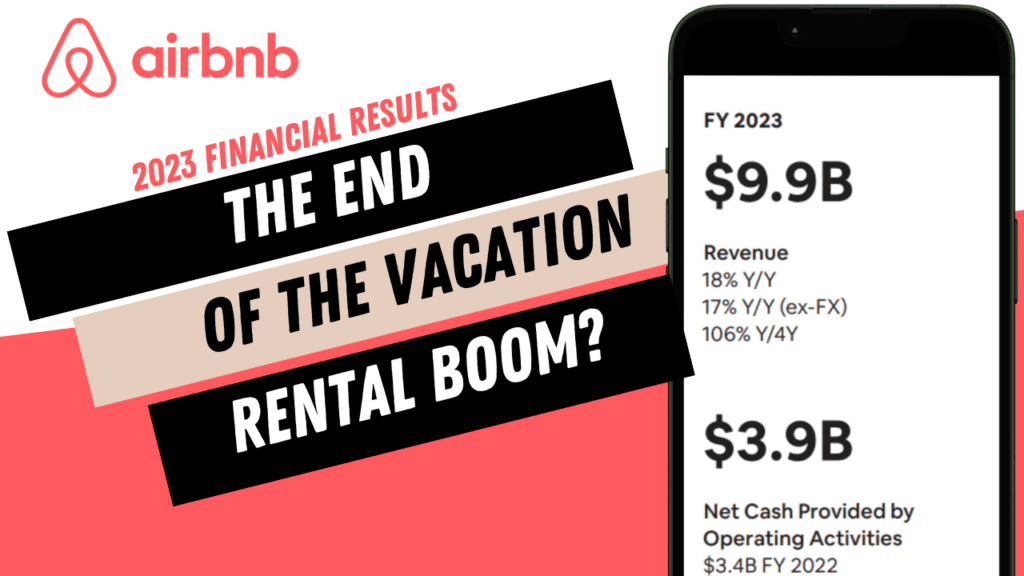

Airbnb’s 2023 financial snapshot offers a compelling glimpse into the evolving dynamics of the vacation rental market, crucial for every vacation rental manager to grasp:

- Steady Market Growth: With a 14% increase in booked nights and a 16% rise in Gross Booking Value (GBV), the market continues its upward trajectory, albeit at a more controlled pace.

- Pricing Stability: The Average Daily Rate (ADR) increased by less than 1% compared to the previous year, pointing towards a stabilization in pricing after the highs of the post-pandemic surge.

- Significant Supply Increase: The end of 2023 saw Airbnb’s host community grow beyond 5 million, with active listings reaching over 7.7 million — an 18% jump from the year before, indicating a robust expansion in supply to meet the demand.

This blend of demand-side growth with a substantial increase in supply marks 2023 as a year of maturation for the vacation rental industry. For vacation rental managers, these insights are vital for strategic alignment and optimization in a market that is balancing out from its previous growth spurts.

Key Business metrics

Demand: The end of vacation rental boom?

Airbnb’s data reveals the vacation rental market’s significant growth following the COVID-19 pandemic, particularly noticeable in 2021 and 2022. This period witnessed notable increases in booked nights and Gross Booking Value (GBV), alongside rises in Average Daily Rates (ADR). However, 2023’s figures point to a steadying of market growth. Booked nights and GBV still grew by 14% and 16% year-over-year, respectively, indicating a shift towards slower but more sustainable growth after the initial surge.

In 2023, the cooling trend was most evident in ADR, which saw an increase of less than 1% from the previous year, indicating minimal growth in pricing. In contrast, Nights and Experiences Booked saw a healthier 12% increase, suggesting a stronger demand for bookings relative to the modest adjustments in rates.

This trend suggests that after a period of intense growth fueled by pent-up demand post-pandemic, the vacation rental market is entering a phase of steady and sustainable growth by 2023. This shift is indicative of the market’s resilience and continued attractiveness but also signals a natural maturation after a phase of dynamic expansion. For vacation rental managers, understanding this transition is crucial for strategic planning and positioning in a stabilizing market.

Here’s a breakdown of Airbnb’s demand data since 2019:

- 2019 vs. 2023 Growth:

- Booked nights jumped by 37% over four years, showcasing a strong demand for vacation rentals.

- GBV nearly doubled, increasing by 94%, indicating a significant rise in revenue, partly due to higher ADR.

- 2023’s Market Behavior:

- The growth rate in booked nights and GBV shows a healthy but more measured expansion compared to the explosive growth seen right after COVID-19.

- Quarterly Data from Q4 2023:

- Nights and Experiences Booked saw a 12% year-over-year increase in Q4 2023, with GBV growing 15% in the same period, driven by both a rise in bookings and a modest increase in ADR (+1%).

What explains the moderation in ADR in 2023? Oversupply or Airbnb’s effort to convince hosts that their listings are too expensive?

In 2023, Airbnb’s prices started to stabilize, and there’s a debate about why this is happening. Is it because there are too many Airbnb listings, or is it because Airbnb is trying to make its stays cheaper? Let’s look into this:

- Supply Increase: By the end of 2023, Airbnb had over 5 million hosts and 7.7 million listings, up by 18% from the year before. This big jump means there are a lot more places to stay available on Airbnb.

- Making Stays Cheaper: Airbnb says it’s been working to make stays less expensive. They’ve introduced tools that let hosts compare their prices with others nearby and have encouraged hosts to lower or remove cleaning fees. Since these changes, 1.4 million hosts have checked their prices against others using the Similar Listings feature, and nearly 300,000 listings have cut down or dropped their cleaning fees.

Here’s the thing: Airbnb talks a lot about how these efforts are making stays more affordable. It is hard to say that these tools have the direct cause of this price moderation, although they must have helped. But with so many new listings added, we at Rental Scale-Up think it’s also important to consider how having more options than ever could be affecting prices.