To attract new hosts and keep current hosts happy, Airbnb innovated 10 years ago with the launch of its $1,000,000 Host Guarantee. Yet, this November, Airbnb killed the Host Guarantee name and replaced it with AirCover, an umbrella name for the set of free host protections the company offers. Why such a drastic move? We’ll see that the emergence of rival offers (e.g. both Vrbo and Vacase offer a $1,000,000 liability insurance) and the need for Airbnb to make new and old hosts more aware of the protections it offers can explain this rebranding. Airbnb wants hosts to know that this series of free protections are “only on Airbnb’”.

We’ll also see what is new and different with AirCover. For instance, the program now features enhanced support for deep cleaning costs and pet damage. For an online booking platform such as Airbnb, it is crucial to get hosts to lower excessive cleaning and pet fees. High fees hinder booking conversion and revenue growth. We’ll also see that something fundamental is not changing: Any host who wants to make a claim with AirCover must first use the dreaded Resolution Center. There, the host communicates with their guests and must try to convince them to pay for the damage. Airbnb only steps in after a while and decides on its own how much AirCover money, if any, the host will get.

Key takeaways:

- Airbnb has launched AirCover, a free protection offer for Airbnb hosts.

- Airbnb’s goal is to attract new hosts and keep the hosts it already has. However, the most significant barrier for new hosts to list is the fear of damage. As for existing hosts, Airbnb may need to make them more aware of the protections they already benefit from and get reassurance every time they get a booking.

- AirCover bundles together previously existing offers, such as Airbnb’s $1,000,000 Host Guarantee (no insurance) and its $1,000,000 Host Liability Protection (insurance).

- Killing the name of the 10-year old Airbnb Host Guarantee was a pretty bold move. Yet, putting everything under one single name helps Airbnb easier communicate about all the facets of the protection it offers, as even seasoned hosts may not be aware of some existing features, such as the $1,000,000 Host Liability Insurance. The rebranding also helps Airbnb get people to talk about its protections again after Vrbo and Vacasa have rolled out free and paid insurance products that hosts may think are just the same as what Airbnb offers.

- What has not changed is the core of the claim process, which relies first on hosts trying to convince guests to pay for the damage. AirCover requests transit through Airbnb’s Resolution Center. They first go the guests. Next, Airbnb’s team gets involved if the guests do not want to pay. Then, it is up to them to decide whether hosts can benefit from damage protection and liability insurance.

- AirCover seems to be adding new features such as pet damage protection and deep cleaning. Airbnb may have singled out these protection to convince its hosts to lower excessive pet fees and cleaning fees, which are common guest gripes. Lower fees also create better conversion and more revenues for Airbnb.

- Another addition to the AirCover offer is income loss: Airbnb reimburses lost income if hosts cancel confirmed bookings due to damage. Income loss coverage was one of the main advantages of the paid insurance offer that competitor Vrbo had created with the help of vacation insurance company Proper. Airbnb now offers it for free.

- Successful Airbnb hosts with back-to-back bookings are also treated a bit better. Previously, they had to make a claim before the next guest had checked in. Now, hosts have up to 14 days.

The AirCover launch: Airbnb Host Protection V2

AirCover, a single name that is easy to market to raise awareness about Airbnb’s host protections

AirCover is a single simple name for a series of existing and new host protections.

For instance:

- Host Protection Insurance is now Host Liability Insurance (HLI)

- Host Guarantee is now Host Damage Protection (HDP)

The rebranding effort is so important to Airbnb that the company has published a video about AirCover:

AirCover is just one word to cover a long list of things. Having just one word / brand to call it makes it easy to mention it in more places. For instance, it shows up in reservation details, on the host side. It provides reassurance (this booking is protected-. It makes the invisible visible, this showing value where it is the most needed, i.e. when an inquiry comes and in the booking details.

For instance, Airbnb shows a “protected by AirCover” mention to hosts who are looking at the details of a specific reservation:

The Host Guarantee had been around for 10 years. For some hosts, the difference between the $1M host guarantee and the $1M host liability insurance was probably not super clear. Instead of explaining the differences, merging both under a common name is easier.

What is AirCover on Airbnb?

Airbnb summarises AirCover by calling it a “top-to-bottom protection”. It does not bill it as insurance. Most of what it replaces used to be a “guarantee”. Now, AirCover is a “protection”. In its FAQ, Airbnb acknowledges so:

Does AirCover replace the need for additional liability insurance?

While AirCover protects you while you’re hosting an Airbnb stay or Experience, it is not a substitute for personal insurance. Since everyone’s situation is different, you should talk to your insurer to see how, or if, your policy overlaps with AirCover.

Then Airbnb says that AirCover is

- Free for every Host.

- Only on Airbnb.

It is to mark the contrast with competitors who may have some paid insurance offers.

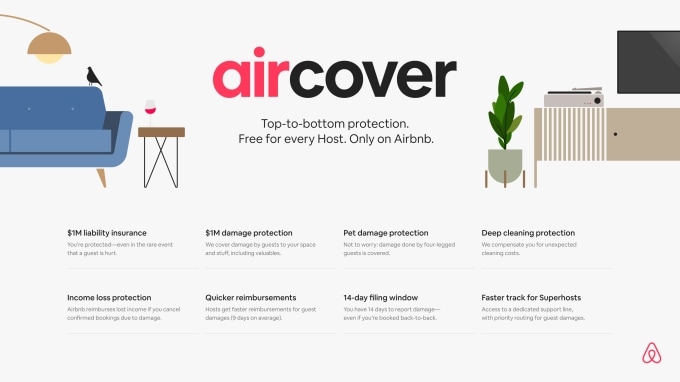

- $1M liability insurance: You’re protected—even in the rare event that a guest is hurt.

- $1M damage protection: We cover damage by guests to your space and belongings, including valuables.

- Pet damage protection: Not to worry: unexpected damage done by four-legged guests is covered.

- Deep cleaning protection: We compensate you for unexpected cleaning costs.

- Income loss protection: Airbnb reimburses lost income if you cancel confirmed bookings due to damage.

- 14-day filing window: You have 14 days to report damage—even if you’re booked back-to-back.

- Quicker reimbursements: Hosts get faster reimbursements for guest damages (9 days on average).

- Faster track for Superhosts: Superhosts get access to a dedicated support line with priority routing.

Complex, not always clear that to hosts what the Host Guarantee and Liability Protection entailed

Airbnb calls it a “top-to-bottom” protection: It covers a lot of stuff behind this simple name.

Airbnb needed to make its offer easier to read. For instance, it wanted to make clear that the host liability insurance covers not only the owners but their co-hosts and cleaners. And that the $1 million host damage now also includes reimbursement for lost income

Airbnb says that its former set of host protections had some gaps:

You’ve told us in listening sessions, during workshops, on the Community Center, and through the Host Advisory Board that you needed more protection: What if a guest smokes in your space without permission, and you need special cleaning? What if a guest’s dog makes a snack of your sofa, and you need to repair it?

You’ve also told us that the reimbursement process isn’t always straightforward, and it was stressful to get your reimbursement requests submitted before your next guest checked in.

Competitors’ insurance offers made Airbnb’s promise less unique

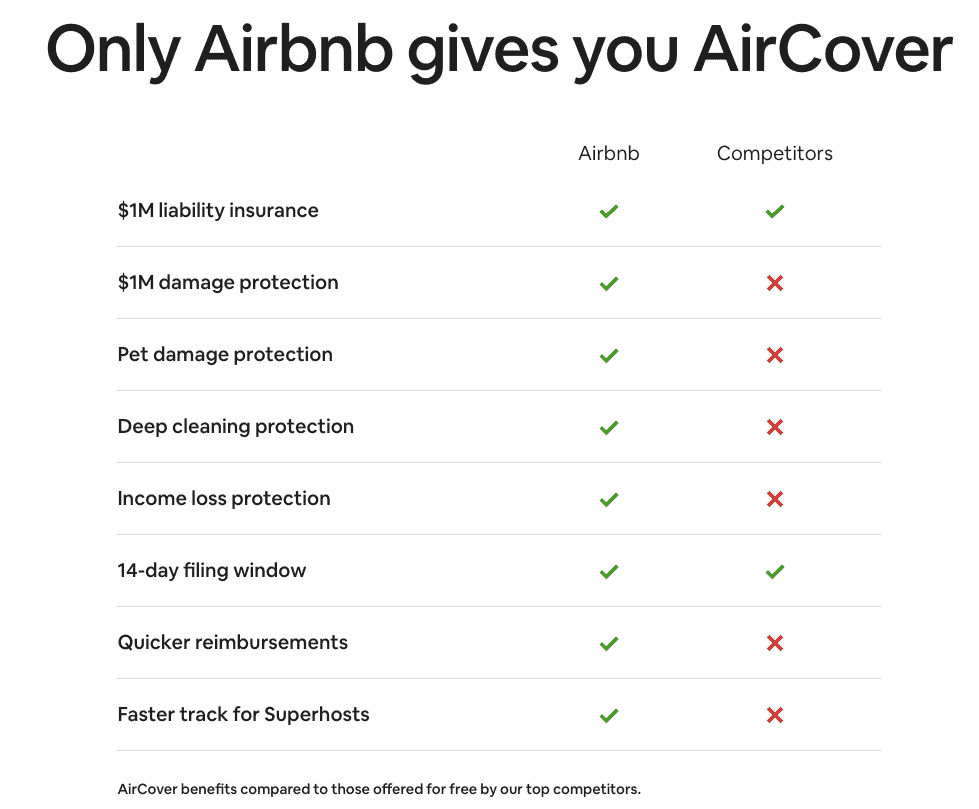

So, both Vrbo and Vacasa offer insurance products, sometimes for a fee. In the chart below, Airbnb compares its free coverage with that of its competitors. Note that, on the damage protection side, Airbnb is comparing its “protection”, which is not insurance, with actual paying insurance products. This is not completely fair, but this is marketing.

Vrbo has a free $1M Liability Insurance. It also sells damage insurance and loss of income insurance through vacation rental insurance company Proper.

Vacasa homeowners are charged $8.54 per night for supplemental insurance through Assurant $1 million in liability coverage due to owner negligence. Examples of owner negligence include broken stairs, defective railings, warped or broken flooring, etc.

Why pet damage and deep cleaning protections feature so high in the list of protections

Airbnb wants to make its pricing more transparent. It wants hosts to be clear about their fees and to set them up properly. But Airbnb also knows that any fee mentioned lower conversion on its platform. Excessive fees can kill the conversion of a property with high potential.

Airbnb has also been pushing its hosts to welcome pets. With remote working, more people are taking their pets with them. “The longer you’re traveling, the longer you’re actually living somewhere, the more you want to bring the whole family — and usually your entire family includes your dogs or cats,” says Brian Chesky.

Programs like AirCover also help dissuade Airbnb hosts from setting a high security deposit, cleaning fee, and pet fee

Airbnb’s copy mentions AirCover to moderate hosts’ appetite for high fees that hinder conversion and booking growth. For instance:

On the cleaning fee page:

“The cleaning fees pays for the housekeeping you expect to do after hosting guests. For unexpected cleaning costs, such as removing smoke odors, AirCover offers your cleaning fee, for up to $1 million in damage protection.“

So, why charge ridiculous cleaning fees when AirCover is here?

On the pet fee page:

For those unexpected damages caused by guest pets, you’re protected by AirCover, which offers $1 million in damage protection

So, why charge a high pet fee when AirCover is here?

On the security deposit page:

(Reminder: Hosts can indicate a security deposit on their listing, but Airbnb never takes from guests pre-stay or even pre-authorizes them)

Even if there’s no security deposit, you’re still protected by AirCover, which includes Host damage protection. All AirCover requests for damage, missing items, and unexpected cleaning are subject to the Host Damage Protection Terms.

So, why ask for a security deposit at all when AirCover is here?

Vrbo offers income loss insurance as a paid product, now Airbnb makes it part of its no-cost Host damage protection

In its terms and conditions, this is how Airbnb defines “Booking Income Loss”:

The loss of booking income from the booked portion of a Covered Accommodation (according to bona fide Airbnb confirmed bookings, contracts or agreements in force prior to the established time of loss) by you, as a Host, resulting from a Covered Loss.

What’s different from Vrbo’s product (sold by Proper)?

- Airbnb’s version is free (“at no cost”)

- Airbnb’s version is not insurance, but a “protection” (Airbnb will decide whether to pay or not)

- Airbnb’s version seems to cover only the loss of Airbnb booking revenues, not booking from other platforms. Vrbo’s Proper insurance covers them all.

Some hosts may think that the booking income loss protection is good enough and a nice-to-have. Property managers will most certainly look into real insurance products to get covered.

Successful Airbnb hosts with back-to-back bookings are also treated a bit better. Previously, they had to make a claim before the next guest had checked in. Now, hosts have up to 14 days.

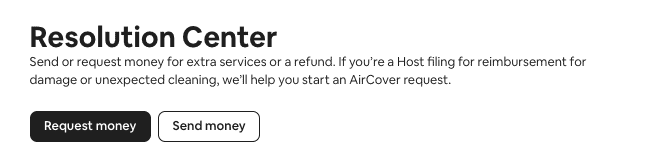

The Resolution Center remains the first step for any AirCover claim

Trying to get money from AirCover is not like filing a claim with an insurance company.

First, hosts have to go to the Resolution Center to create an AirCover request. They are asked to send a message to the guests to ask them to pay for the documented damage.

Some guests may pay the damage through the Resolution Center. Oftentimes, some hosts will believe that it AirCover (formerly the Host Guarantee) that paid them some money, while it is the guests doing so.

If it does not work out, then the claim is escalated to an Airbnb caseworker. Quite often, Airbnb sides with the guests and there is not much room for appeal.

So, we can estimate that very few hosts claim actually make it to the point where they can benefit from some of the $1,000,0000 of the damage protection.

This how Airbnb explains who the AirCover dispute goes first to the guest and only covers what others have not paid for:

Airbnb agrees to pay you, as a Host, whenever the Responsible Guest fails to do so, to repair or replace your Covered Property (as defined below) damaged or destroyed as a result of a Covered Loss (as defined below), subject to the exclusions, limitations, and other terms and conditions of these Host Damage Protection Terms.

If you need to request reimbursement, just start an AirCover request at our Resolution Center. Once you submit your request, we’ll notify your guest about what’s damaged or missing. Your guest then has 72 hours to pay the amount you’re requesting. If they decline to pay the full amount or don’t respond, you’ll be able to involve Airbnb Support.

10 years of Airbnb host protection, from the Host Guarantee to AirCover

When Airbnb introduced its Host Guarantee in 2011, it was considered a bold move: The company promised to cover its US hosts for up to $50,000 in guest damage, at no cost to the host. This was never seen before and got the company a lot of press. In 2012, Airbnb upped the ante by increasing the guarantee to $1,000,000 and rolling out to 16 countries. The Host Guarantee would gradually go global.

For almost ten years, the Host Guarantee was central to any landing page, sales materials, or advertising Airbnb showed to its hosts. The page http://www.airbnb.com/guarantee was abundantly mentioned on Airbnb’s website and ads.

The Host Guarantee was crucial to help the company grow its number of listings. For a lot of would-be hosts, the fear of damage was stronger than the hopes of financial rewards. Additionally, for a new breed of short-term rental managers, Airbnb’s Host Guarantee was something they could also show to homeowners to create more trust and get them on board. The Guarantee was not an insurance product and did claim to be one, but some owners probably believed that it was.

It was an answer to the Airbnb horror stories that were starting to creep up into the press as its profile rose. The introduction of the Host Guarantee was one of the first storytelling exercises that Airbnb would come to master so successfully over the years.

On August 3rd, 2011, Airbnb hosts received an email from Brian Cheskly, Airbnb’s CEO, which said:

Last month, the home of a San Francisco host named EJ was tragically vandalized by a guest. The damage was so bad that her life was turned upside down. When we learned of this our hearts sank. We felt paralyzed, and over the last four weeks, we have really screwed things up. Earlier this week, I wrote a blog post trying to explain the situation, but it didn’t reflect my true feelings. (…)

We want to make it right. On August 15th, we will be implementing a $50,000 Airbnb Guarantee, protecting the property of hosts from damage by Airbnb guests who book reservations through our website. We will extend this program to EJ and any other hosts who may have reported such property damage while renting on Airbnb in the past.

Yet, the press kept covering terrible stories about properties being devastated and even about hosts being sued by guests for injuries. As Airbnb wanted to grow faster, it needed to give more reassurance to its hosts, as well as to local authorities. Large Airbnb investors were also in need of some reassurance that the company was not setting itself up for costly prosecution in the future.

So, in 2014, Airbnb introduced a real insurance product to cover hosts from liability claims. The page http://www.airbnb.com/host-protection-insurance was officially launched. The Airbnb Host Protection Insurance was a liability insurance program that provided up to $1 million worth of protection to Airbnb hosts for their listings in the U.S. If a guest was accidentally injured anywhere in a host’s building or property during a stay, the Host Protection Insurance program provided coverage for Airbnb hosts and, where applicable, their landlords.

On November 9, 2021, Brian Chesky detailed the new features of Airbnb’s 2021 Winter Release. Among them, he put a good emphasis on AirCover, the new umbrella name for all the company’s host protection programs.

FAQs about Airbnb’s AirCover protection for hosts:

How to make an AirCover claim?

Resolution Center

Send or request money for extra services or a refund. If you’re a Host filing for reimbursement for damage or unexpected cleaning, we’ll help you start an AirCover request.

Getting reimbursed for damage

If a guest causes damage during an Airbnb stay, you can file an AirCover request through our Resolution Center. Learn about the process.

This is the liability insurance intake form hosts can use for liability claims, instead of the Resolution Center

https://www.airbnb.com/insurance/form

How can I contact Airbnb?

If you’re an Airbnb host, then you can contact Airbnb by going to the Resolution Center. You can find the Resolution Center by logging into your Airbnb account and clicking on the Resolution Center tab. Once you are in the Resolution Center, you can file a dispute request.

How do I contact Airbnb about a complaint?

The Resolution Center is an easy-to-navigate site where disputes can be filed with Airbnb. A customer service representative will contact the host to work toward a resolution of the complaint. The Resolution Center provides a clear overview of how to use the Resolution Center, what information must be provided by Airbnb for AirBnB Resolution Center cases, and the timeline for Resolution Center disputes.

How do I file a dispute with Airbnb?

If a host has a problem with their listing, they can file a dispute with Airbnb. This is done through the Resolution Center, which is an online portal where hosts can contact Airbnb and make an AirCover request. AirCover is a program that helps hosts who have experienced property damage.

Hosts can claim money from Airbnb’s protection damage program by filing a report through the Resolution Center. If the damage is more than $1000, then the host can file an insurance claim. The Resolution Center also provides hosts with resources and support that can help them resolve any disputes they may have with Airbnb.

If you’re having trouble resolving a dispute with Airbnb, or if you need assistance filing a claim, the Resolution Center can help. The Resolution Center is staffed with experts who can help you navigate the Airbnb dispute resolution process. You can find more information on the Resolution Center website, or you can contact us by email or phone for assistance. We’re here to help, so don’t hesitate to reach out if you need our support.

Can an Airbnb host sue a guest?

In most cases, the host is not allowed to sue a guest. In some cases, the guest may have broken a law or Airbnb policy during their stay. In this case, both the guest and host can be sought after by authorities for criminal prosecution.

Is AirCover a great name?

On the Airbnb subreddit on Reddit, hosts say that AirCover ii “Spin, spin, spin” and “Same s…, different name.” At Rental Scale-Up, we actually think that it is more than just a new name. What matters is what is and how Airbnb uses it.

Note that AirCover.ai is also the name of a company not affiliated with Airbnb. They provide real-time, in-meeting sales tools. We hope that they’re not getting inundated with insurance claims! AirCover is also the name of a herbicide-related product, which has something to do with organosilicone chemistry.

We get the idea that AirCover = Airbnb + Coverage, but it is strange to see other product categories with a similar name.