For years, Airbnb and Booking.com have been positioned as opposites. One built its brand on human connection and trust between strangers. The other mastered scale, standardization, and instant transactions.

But as Airbnb grows up, it’s increasingly adopting parts of Booking.com’s playbook, while deliberately rejecting others. The result is a hybrid strategy: part OTA, part lifestyle brand, part social platform.

And 2025 has been the clearest sign yet that Airbnb is learning from Booking, but on its own terms.

🧩 Where Airbnb Is Copying the Booking.com Playbook

1. Easier Cancellations = More Bookings

For years, Airbnb was the predictable platform: bookings were firmer, guests less flaky. That’s changing fast.

Airbnb’s 2025 Winter Release and updated policies look strikingly familiar to anyone who’s listed on Booking.com:

- The Strict cancellation policy is gone for new hosts.

- Every guest now gets a 24-hour grace period to cancel for free.

- Dynamic cancellation policies coming in 2026 will let hosts set different rules by season — just like Booking.

- And Reserve Now, Pay Later (with $0 upfront) is spreading globally.

Booking.com learned long ago that the easier it is for guests to cancel, the more they book. Some of those bookings vanish, yes, but total completed stays rise.

Airbnb is betting the same dynamic holds true.

It’s a trade-off: less predictability for hosts, more momentum for the platform.

2. Hotels Are Back — But as a Controlled Pilot

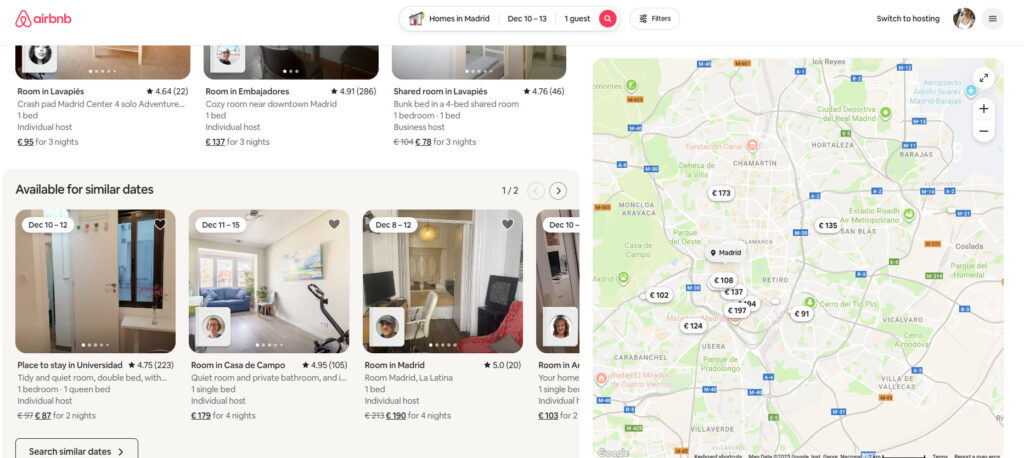

Booking.com dominates hotels; Airbnb historically avoided them. Now, Airbnb is running hotel pilots in Los Angeles, New York, and Madrid.

The difference is subtle but important: Airbnb isn’t trying to out-Booking Booking.

It’s filling gaps, especially in cities where local regulations or supply shortages limit home listings (think New York post–Local Law 18).

Airbnb redesigned its interface for hotels, allowing:

- Room-type selection

- Night-based pricing

- Revised filters and categories

But it’s a limited rollout — a deliberate pilot, not a full expansion. Airbnb is studying how hotels can complement its core business, not replace it. Where Booking.com built its identity around hotels, Airbnb is using them to stabilize coverage.

3. A More Elastic Search Experience

Booking.com’s engineering teams have spent years perfecting its discovery logic — surfacing listings outside the user’s exact criteria to maximize conversions.

Airbnb’s new Flexible Carousels and Improved Maps mimic this idea:

- Showing homes “just outside” your search area, price range, or amenity list.

- Recommending nearby destinations at slightly lower prices.

This is a direct nod to Booking’s “elastic search philosophy”: never let a user see zero results. If Airbnb can keep guests browsing instead of bouncing, booking probability rises.

🚫 Airbnb and Booking.com: Where Airbnb Refuses to Follow Booking

1. No Loyalty Program, No Points Economy

Booking.com and Expedia are doubling down on loyalty, with Genius tiers, discounts, and perks designed to retain repeat users.

Airbnb, on the other hand, remains firmly against it.

Chesky has repeatedly said that Airbnb’s brand itself is the loyalty program. The company prefers to focus on unique supply and user experience rather than transactional discounts.

Airbnb wants users to come back because the experience feels personal, not because they’re chasing 10% off their fifth stay.

2. Fewer Corporate Layers, More Personality

Booking.com’s communication style is highly corporate: investor-driven, data-heavy, low-emotion.

Airbnb continues to humanize itself — through Chesky’s personal tone, narrative-driven launches, and branding rooted in “belonging.”

Even as it adopts Booking’s performance tactics, Airbnb’s storytelling remains very un-Booking.

Every new release — whether it’s “Airbnb Rooms,” “Winter Release,” or “AI-powered travel” — comes wrapped in design language and optimism that Booking would never use.

That’s not accidental. Airbnb’s edge is emotional, not just operational.

3. AI Strategy: Personalization, Not Price Automation

Booking.com and Expedia are using AI primarily for search efficiency and marketing optimization.

Airbnb’s AI narrative is different: it’s about making the product feel smarter and more human. Instead of algorithmic pricing or points-based recommendations, Airbnb’s AI focuses on:

- Personalized search conversations (“Find me a cabin near Lisbon for under $400.”)

- Smarter customer support that can act on requests instantly

- Host-side assistance (drafting listings, offering pricing tips)

It’s not just automation. It’s personalization.

That’s a philosophical split: Booking wants AI to scale operations; Airbnb wants AI to shape experience.

🧭 The Hybrid Strategy: OTA Precision, Airbnb Personality

By late 2025, Airbnb is neither the scrappy home-sharing platform of its early years nor a pure OTA like Booking.com.

It’s something in between: an OTA with identity.

It’s adopting Booking’s precision in data, pricing, and conversion, but applying it to a product that’s still emotional, design-led, and story-driven.

In short:

- Airbnb is copying Booking.com’s efficiency,

- But keeping its brand soul.

That’s what makes its evolution fascinating, and harder to replicate.

🔍 The Bottom Line

Airbnb is learning from Booking.com — but selectively. It’s taking the proven OTA mechanics (flexibility, search elasticity, payments) and combining them with the Airbnb difference (brand trust, design, and community).

That blend could define the next decade of travel tech. Because in a world of pure algorithms and AI assistants, Airbnb’s long game isn’t just about bookings — it’s about belonging, at scale.

Thibault Masson is a leading expert in vacation rental revenue management and dynamic pricing strategies. As Head of Product Marketing at PriceLabs and founder of Rental Scale-Up, Thibault empowers hosts and property managers with actionable insights and data-driven solutions. With over a decade managing luxury rentals in Bali and St. Barths, he is a sought-after industry speaker and prolific content creator, making complex topics simple for global audiences.