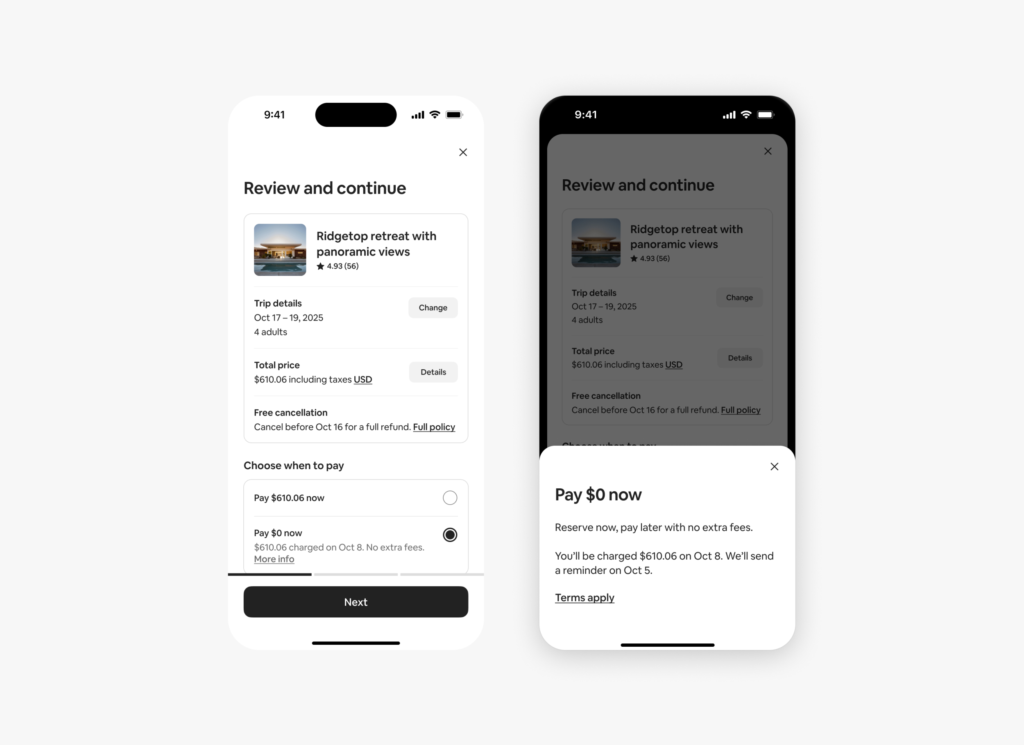

In August 2025, Airbnb introduced Reserve Now, Pay Later for US travelers. Guests booking eligible listings can now reserve with $0 upfront and pay later—specifically, before the free cancellation deadline ends.

This move closes a long-standing gap between Airbnb and Booking.com, which built much of its European dominance on “book now, pay at property.” But Airbnb’s version works differently, because it still operates under a merchant model (Airbnb processes payments on behalf of hosts).

For vacation rental managers, the feature is less about financial innovation and more about operational impact.

Reserve Now, Pay Later is only available with Flexible or Moderate policies.

As of October 2025, Airbnb’s cancellation policies look like this (Strict is being retired):

| Policy | Guest gets full refund until… | Host payout if canceled later | Rebooking window |

|---|---|---|---|

| Flexible | 24 hours before check-in (plus 24h grace) | Nights stayed + 1 night | ❌ Very short |

| Moderate | 5 days before check-in (plus 24h grace) | Nights stayed + 1 night + 50% of remaining nights | ✅ Reasonable |

| Limited | 14 days before check-in (plus 24h grace) | 7–14 days: 50%; <7 days: 100% | 🚀 Strong |

| Firm (replacing Strict) | 30 days before check-in (plus 24h grace) | 7–30 days: 50%; <7 days: 100% | 🔒 Very long |

👉 Reserve Now, Pay Later is only available with Flexible or Moderate policies.

What Airbnb Is Really Offering

- Pay Part Now, Part Later → Guests split payments into deposit + balance. Simple scheduling.

- Pay Over Time (Klarna, Affirm) → Genuine Buy Now, Pay Later. Guests borrow, the BNPL provider takes credit risk, Airbnb gets paid upfront.

- Reserve Now, Pay Later → $0 at booking. Airbnb charges the guest’s card before free cancellation ends. No lending, no credit check—just a shift in timing.

So while the branding feels “fintech-y,” Reserve Now, Pay Later is not a financial product. It’s an operational tweak to reduce checkout friction and boost conversion.

What Hosts and Managers Are Saying

Concerns

- Cancellations closer to arrival: If payment fails, Airbnb cancels the booking—sometimes just 1–5 days before check-in. Rebooking a villa that fast is nearly impossible.

- Weaker cancellation policies in practice: Guests can sidestep penalties by simply not paying, effectively bypassing late-cancel fees.

- Dependence on Airbnb: Hosts have no control over collection. If a card fails, Airbnb must resolve it.

Perceived Benefits

- More bookings: Lower upfront cost encourages guests to commit, especially groups and budget-conscious travelers.

- No payout change: Hosts still receive funds 24h after check-in, as usual.

- Competitive necessity: Competing OTAs already offer similar flexibility.

Marketplace Logic: Why Airbnb Is Doing This

Marketplaces like Airbnb rest on three pillars:

- Supply & Demand → Payment flexibility widens the funnel. More guests book, more supply is used.

- Trust → Guests trust they can cancel; hosts trust Airbnb will cancel unpaid bookings before the deadline.

- Finance → Airbnb strengthens its role as a payment platform, controlling not only money flow but also when commitments are enforced.

Airbnb isn’t offering credit. It’s streamlining checkout to compete with Booking.com’s flexibility while keeping more control than a full “pay at property” model.

The Real Lever: Cancellation Policy

The key insight for managers is this:

- It’s not just payment that matters—it’s the cancellation policy window.

- Flexible (1 day) may drive more bookings, but leaves almost no chance to rebook.

- Moderate (5 days) offers a balance between guest appeal and host protection.

- Limited (14 days) would be even better, but isn’t currently eligible for Reserve Now, Pay Later.

So while Airbnb says this makes it “easier for groups to book,” the bigger story is that the rebooking window shrinks for managers if guests cancel late.

Key Takeaway for Managers

- Expect higher conversion rates with Flexible or Moderate policies, especially for group and high-ticket properties.

- Be ready for operational strain: cancellations may now cluster closer to check-in.

- The true trade-off is not about “fintech vs. operations”—it’s about flexibility vs. control.

👉 Reserve Now, Pay Later is not a FinTech revolution. It’s an operational tweak to increase bookings—but managers pay the price in calendar uncertainty. The winners will be those with pricing tools and distribution channels agile enough to rebook late cancellations quickly.

Thibault Masson is a leading expert in vacation rental revenue management and dynamic pricing strategies. As Head of Product Marketing at PriceLabs and founder of Rental Scale-Up, Thibault empowers hosts and property managers with actionable insights and data-driven solutions. With over a decade managing luxury rentals in Bali and St. Barths, he is a sought-after industry speaker and prolific content creator, making complex topics simple for global audiences.