1. 2024: A Record-Breaking Year

Europe welcomed 854 million guest nights via Airbnb, Booking, Expedia, and Tripadvisor — a 19% jump from 2023. That’s 2.34 million short-term rental guests per night. Paris topped city rankings, while Andalucía overtook Croatia as Europe’s #1 region.

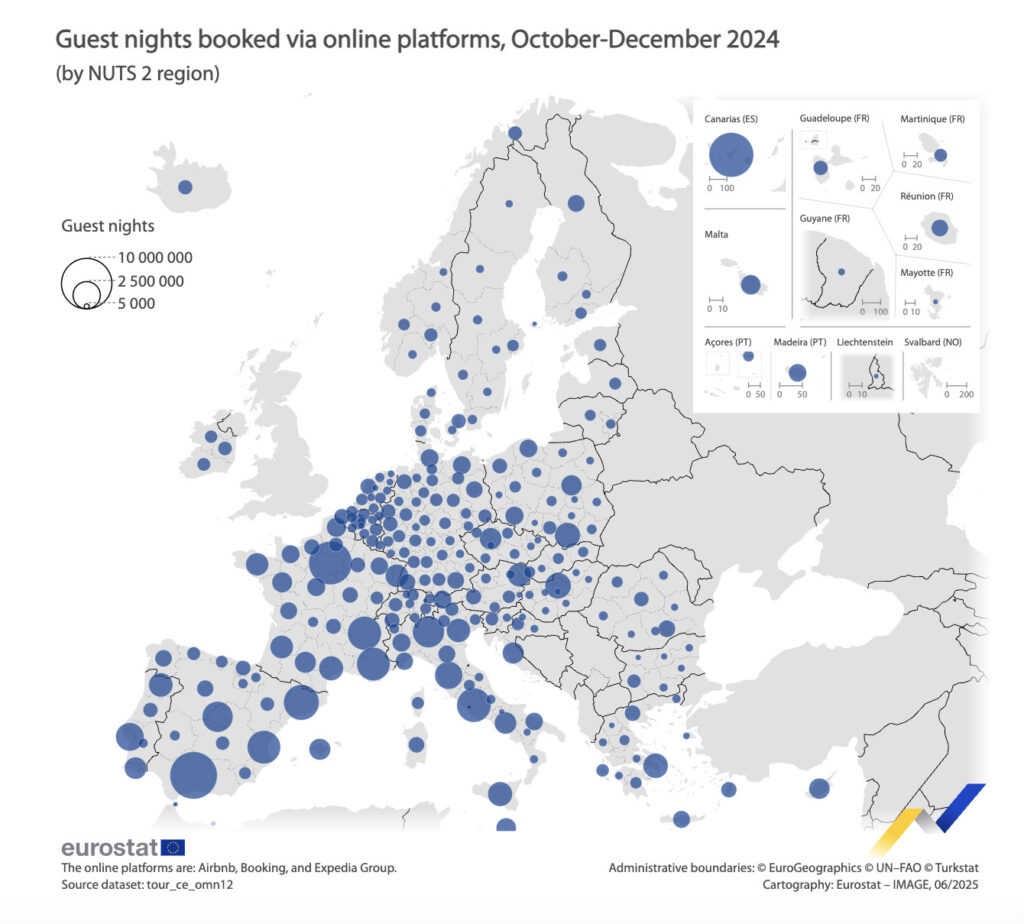

Eurostat map of Q4 2024 guest nights booked online shows Andalucía as the most visited EU region, followed by strong demand in parts of France, Italy, and island destinations.

2. The Power of Regional Data

Just five regions accounted for nearly 1 in 5 guest nights across Europe. From Cataluña to Provence-Alpes-Côte d’Azur, understanding the regional battleground is now key to smart expansion and pricing strategy.

3. 2025 Starts Slower — But Not Weak

Q1 2025 bookings dipped in parts of the Netherlands (-8.1%), Croatia (-5.8%), and Denmark (-3.8%) — but don’t panic. Much of the decline is explained by Easter’s shift to Q2, distorting YoY comparisons. Some countries — like Malta (+33.5%) and Poland (+11.2%) — are still gaining momentum.

4. Regulations & Price Sensitivity Are Real

Amsterdam, Berlin, and parts of France are tightening short-term rental rules. Meanwhile, travelers are more price-sensitive, booking later and spending less. Flexibility is your friend in 2025.

5. Summer Still Reigns, but Seasonality Varies Widely

In 2024, 33.6% of all guest nights were booked in July and August, but in seasonal hotspots like Croatia, that share surged to 58%. Meanwhile, countries like Germany and Luxembourg showed steadier, year-round demand. Understanding your market’s seasonality profile is critical for pricing, staffing, and pacing strategies.

2024 marked a historic milestone for short-term rentals in Europe, with 854 million guest nights booked through major online platforms — an all-time high and a 19% increase compared to 2023. The platforms covered — Airbnb, Booking, Expedia, and Tripadvisor — shared harmonized data with Eurostat under a landmark agreement with the European Commission. This partnership has made it possible to accurately chart the growth and geographical nuances of the short-term rental sector at both national and regional levels. For property managers, this isn’t just another dataset — it’s a powerful window into market evolution, demand shifts, and where competition is heating up.

But the first signs of a cool-down are emerging in 2025. The early months have brought a slower pace, due in part to a shift in seasonality: in 2024, Easter — one of the most travel-heavy weekends in Europe — fell in Q1, while in 2025 it landed in Q2. That timing skew alone explains part of the softer start. But it doesn’t explain it all. Regulatory tightening in cities like Amsterdam, cooling consumer demand amid inflationary pressure, have raised important questions about what comes next.

2024: A Year of Peaks, Records, and Rankings for European Short-Term Rentals

Across the EU and EFTA, 854 million guest nights were booked in 2024 via Airbnb, Booking, Expedia, and Tripadvisor. This means, on average, 2.34 million tourists stayed in a short-term rental each night. Paris retained its crown as the most popular destination, with 23.5 million guest nights — roughly 65,000 guests per night. Rome, Barcelona, Madrid, and Lisbon rounded out the top five.

But what truly defines this market is its regional nature. National numbers tell one story, but NUTS 2-level regions reveal the market’s true heartbeat:

Top 5 Regions in 2024 (Guest Nights):

- Andalucía, Spain – 44 million (now Europe’s #1)

- Jadranska Hrvatska (Adriatic Croatia) – 35 million (fell to #2)

- Provence-Alpes-Côte d’Azur, France – 31 million

- Cataluña, Spain – 29 million

- Île-de-France (Paris region) – 28 million

These top five regions alone accounted for over 19% of all guest nights in Europe. Andalucía’s rise past Croatia is a headline shift: a combination of stronger domestic tourism, year-round appeal, and local incentives has helped it claim the lead.

Meanwhile, 20 regions across Europe recorded more than 10 million guest nights each — together representing nearly 47% of all platform bookings. That concentration should be of particular interest to property managers: the battle for market share is increasingly a regional one.

Domestic vs. International: Who’s Traveling?

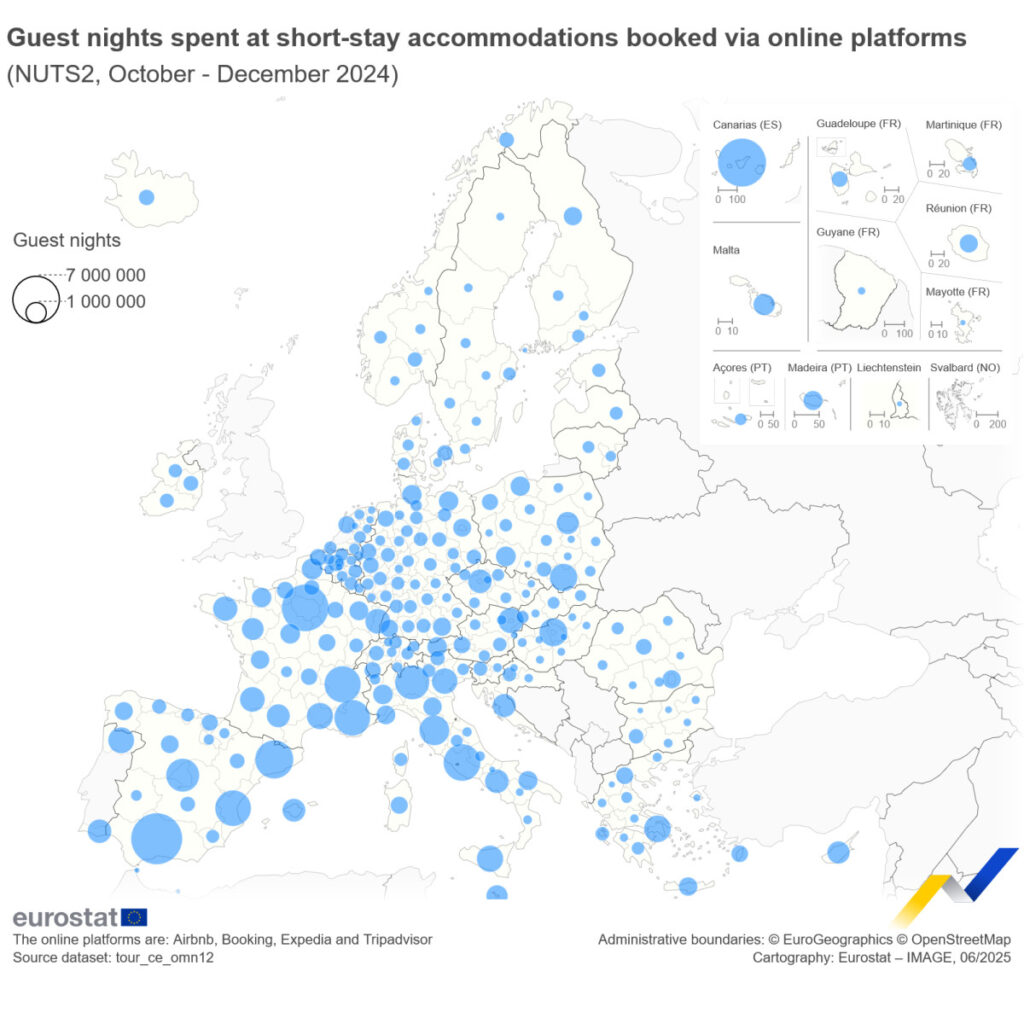

International guests continued to dominate the market, accounting for 62% of all guest nights. But the share has not yet returned to the pre-pandemic high of 67% in 2019. In seven countries — including Malta, Iceland, and Liechtenstein — international guests made up over 90% of all stays.

At the other end of the spectrum, large countries like Germany and France still see a significant share of domestic travel, driven by intra-country tourism and short weekend trips.

Top 5 Countries in 2024 (Guest Nights):

- France – 192 million

- Spain – 171 million

- Italy – 127 million

- Germany – 60 million

- Greece – 45 million

These five countries accounted for 70% of all EU guest nights.

Eurostat map showing Q4 2024 guest nights in EU short-stay rentals, with highest demand in France, Spain, Italy, and key islands.

A Closer Look at Length of Stay

Guest nights per stay averaged 11 nights across the EU, with Malta (20), Cyprus (18), and Croatia (14) leading the pack. Shorter durations were seen in the Baltics, with Lithuania and Estonia averaging just 6 guest nights per stay — a reflection of shorter booking lengths or smaller travel parties.

These numbers are not the same as average stay duration (i.e. number of nights per booking), but they’re useful for estimating guest volume and portfolio occupancy across different market types.

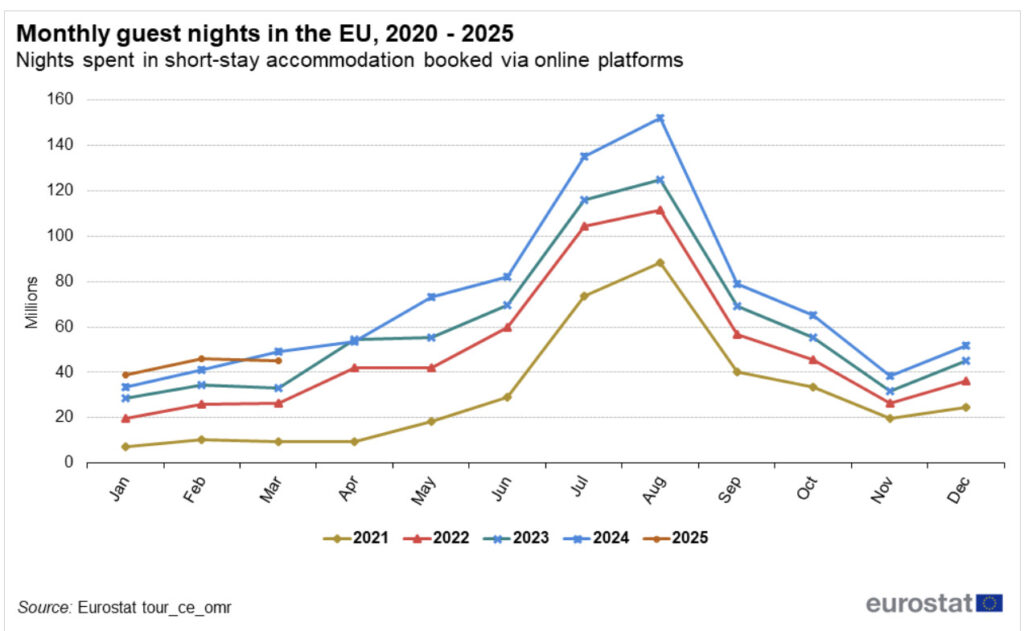

The Summer Squeeze and Seasonality

The summer months remain dominant. In 2024, 33.6% of all guest nights were recorded in July and August. In highly seasonal markets like Croatia, that figure rose to 58%, followed by Slovenia (45%), Sweden (44%), and Greece (44%). Meanwhile, countries like Luxembourg and Germany saw a more balanced distribution, with summer representing just a quarter of total guest nights.

What About Cities?

Paris remains Europe’s top city destination, followed by:

- Rome – 15.7 million guest nights

- Barcelona – 12.5 million

- Madrid – 11.8 million

- Lisbon – 11.3 million

These five cities made up nearly 9% of all platform nights in Europe, despite their geographic size.

2025: Slower Start, but Watch the Fundamentals

Looking at Q1 2025, several warning signs appear. Booking volume appears down in a number of large markets — but Easter’s shift from Q1 in 2024 to Q2 in 2025 significantly distorts the comparison. For countries like France, Spain, Germany, and Italy, Easter week is a cornerstone of early spring demand. Its absence from Q1 this year explains much of the drop.

But not all.

- In the Netherlands, heavy-handed regulatory changes have pushed listings off the platforms. The country saw an 8.1% year-over-year drop in Q1 guest nights.

- Denmark recorded a 3.8% decline, and Croatia dropped by 5.8% — indicating broader regional softness.

- In urban markets, caps on licenses and noise ordinances are tightening the rules, particularly in high-density destinations like Amsterdam, Berlin, and parts of southern France.

- And in general, consumer price sensitivity is higher, especially for international trips. Booking windows are shortening and average booking values are trending lower in more price-sensitive markets.

Still, it’s not all pessimistic. Q1 2025 still saw 129.6 million guest nights, a 4.8% increase over Q1 2024, even without the Easter bump. Countries like Malta (+33.5%), Finland (+23.6%), Bulgaria (+22.3%), and Poland (+11.2%)bucked the trend with double-digit gains — suggesting strength in off-the-beaten-path or domestic-heavy markets.

Eurostat chart showing monthly EU guest nights in short-stay rentals (2020–2025). Peaks in summer; 2025 slightly below 2023–2024 highs.

Final Thoughts for Rental Managers

This Eurostat dataset is a goldmine for short-term rental professionals. It offers:

- A trusted, platform-sourced benchmark of guest night demand by region and city.

- Clear indicators of where the action is shifting — from Croatia to Andalucía, from summer peaks to year-round cities.

- A way to compare market positioning across European regions and gauge the resilience of your destination.

Understanding where your region stands — and how your local market fits within broader European patterns — can inform pricing, marketing, and operational decisions.

As we move further into 2025, market normalization may continue. But as 2024 proved, the short-term rental sector remains remarkably resilient — and as the data shows, success lies in understanding the regional details, not just the headlines.

Thibault Masson is a leading expert in vacation rental revenue management and dynamic pricing strategies. As Head of Product Marketing at PriceLabs and founder of Rental Scale-Up, Thibault empowers hosts and property managers with actionable insights and data-driven solutions. With over a decade managing luxury rentals in Bali and St. Barths, he is a sought-after industry speaker and prolific content creator, making complex topics simple for global audiences.