The summer rush is over, and for property managers, that usually means one thing: the shoulder season slowdown. But in 2025, it’s not business as usual.

Guests are booking later, cutting trips shorter, and watching their budgets more closely. Combine that with the natural dip after summer, and managers are facing a double squeeze: thinner calendars and tighter revenue.

To help professional short-term rental managers overcome this dual challenge, in our latest webinar presented in partnership with RevLabs by PriceLabs, we brought together:

- Eduardo Mandri, Founder & CEO, Angel Host, brings the perspective of a global operator, with Angel Host managing 1,500+ listings across 15 countries. His team helps property managers and owners worldwide with pricing strategy and listing optimization.

- Jessica Mollard, Revenue Manager, OVO Network, brought the perspective of managing luxury self-catered chalets in the French Alps. OVO Network, a top-rated European rental platform, has grown to oversee a portfolio of 200+ properties.

- Kyle Driskell, Senior Solutions Consultant, PriceLabs, shared market data trends to help managers spot pacing shifts early and adapt strategies

Here are the key takeaways from the session, along with practical actions you can take now.

1. Shoulder Season Isn’t the Same Everywhere, Know Your Market

Eduardo explained that in coastal markets like Miami or the Caribbean, September and October remain some of the hardest months to fill, while cities like Madrid or Mexico City show stable year-round occupancy. Jessica added that in the French Alps, too, occupancy dips to around 20% versus 70%+ in August.

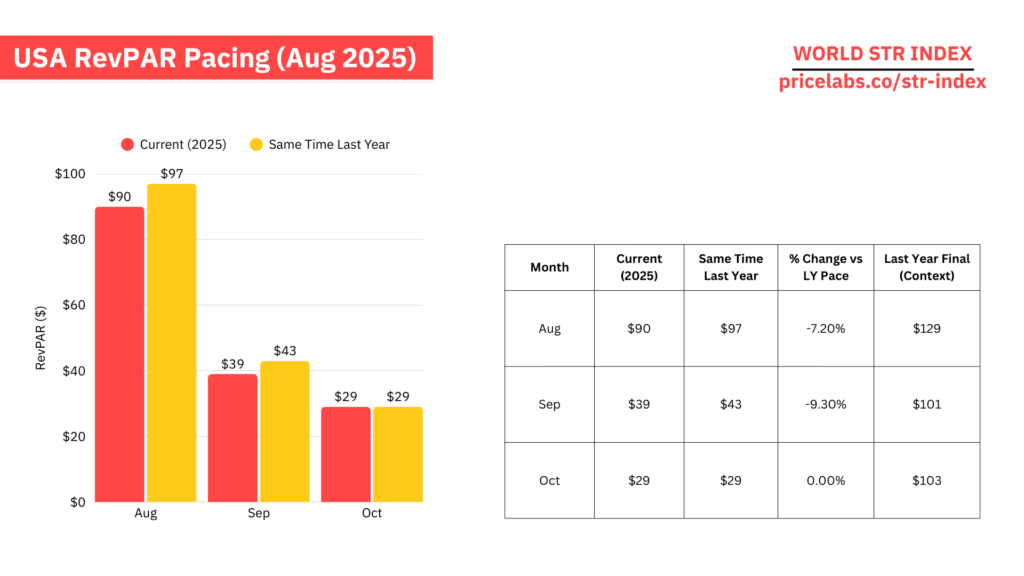

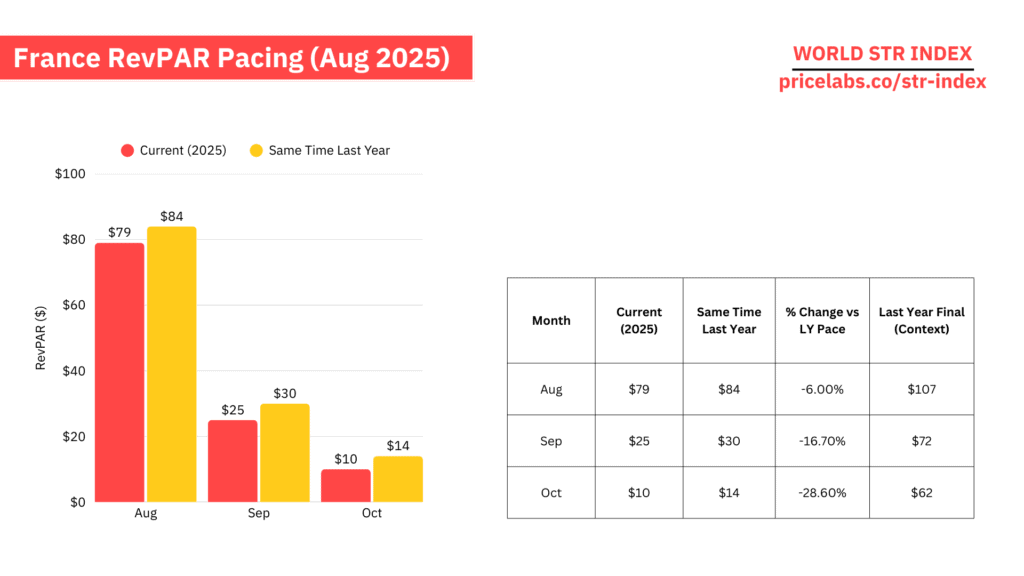

Kyle Driskell reviewed market data using PriceLabs’ STR Index, a free and comprehensive data tool for vacation rental markets worldwide. Managers can access up-to-date insights, with historical trends dating back to 2020 and forward projections for the year ahead.

Forward RevPAR Pacing (as of Aug 2025) shows sharp post-summer drops across the U.S., UK, and France, but the size of the dip isn’t the same everywhere. Some markets are experiencing steep declines, while others see only mild slowdowns. By using these benchmarks, property managers can identify whether their pacing is genuinely falling behind or simply reflecting normal seasonal patterns.

The U.S. shows a milder dip, with RevPAR only -7.2% in August and flat in October, suggesting resilience compared to Europe but still softer than 2024.

UK RevPAR is tracking slightly behind last year, down -9.8% in September and -11.5% in October, signaling a sharper autumn slowdown than 2024.

France faces the steepest drop, with RevPAR down -16.7% in September and plunging -28.6% in October, highlighting the toughest shoulder-season challenge.

What Property Managers Can Do: Don’t just compare your pacing to last year’s numbers; they only tell you where you’ve been. Market benchmarks show where you stand today. If your bookings are down but the whole market is down more, you may actually be ahead. But if the market is climbing and you’re flat, it’s a warning sign to adjust pricing or distribution early. Benchmarks give you the context to know whether you’re truly underperforming or simply seeing a normal seasonal dip.

2. Flexibility Beats Rigidity in Pricing & Stay Rules

Jessica highlighted the importance of relaxing arrival and departure rules, dropping rigid minimum stays, and allowing ultra last-minute bookings to capture demand.

Eduardo shared that his team introduces strategic early discounts five to six months out to avoid panic-cutting later. They also lean on weekly and monthly discounts to secure longer stays.

Kyle confirmed the trend: PriceLabs data shows shorter lead times across nearly all markets, meaning managers need to adapt minimum-stay and lead-time settings proactively instead of waiting until calendars are already empty.

What Property Managers Can Do: Reduce rigid minimum stays, enable last-minute booking windows, and offer length-of-stay discounts well ahead of time. In the shoulder season, prioritize occupancy over ADR.

One smart way to do this is by moving away from static stay rules and using tools like PriceLabs Dynamic Min Stay, which automatically adjusts minimum stay requirements based on demand and booking patterns. Instead of leaving gaps or scrambling to drop rules manually, Dynamic Min Stay lowers barriers when you need to fill empty nights and raises them when you want to protect high-value bookings.

3. Owners Play a Critical Role in Low-Season Success

Both Eduardo and Jessica pointed out that owner negotiations are often the hardest part of adapting. Owners may cling to high minimum prices even when the market won’t support them.

Eduardo recommended using data to show owners the cost of vacancies versus the benefit of covering variable costs. Jessica added that when owners won’t budge on price, managers need to push for added value, like amenities or flexibility, to remain competitive.

What Property Managers Can Do: Come armed with data when speaking to owners. Show the cost of vacancies, and propose realistic options, either lower minimum rates or invest in added amenities that justify higher prices.

4. Listings and Marketing Must Do More Heavy Lifting

Eduardo emphasized listing optimization: simple misses like forgetting to tag “ocean view” or “jacuzzi” in OTA filters can bury a property in search results. His team even uses AI to analyze titles and photos against best-performing baselines.

Jessica shared that in the French Alps, their best-performing chalets in the shoulder season are the ones with strong, year-round appeal. Properties with hot tubs, saunas, or indoor pools consistently outperform others because they provide an attractive experience regardless of the weather or season. Families, in particular, see these amenities as added value when traveling in slower months. To capture that demand, her team tailors campaigns to nearby drive-to markets (France, Switzerland) and highlights kid-friendly features during school holidays.

Kyle added that data on traveler origin shifts can help managers retarget marketing spend. For example, if more locals are booking in the low season, shift your ads and OTA strategy to target nearby travelers.

What Property Managers Can Do: Audit your OTA listings for missing tags and outdated photos, highlight off-season-friendly amenities, and adjust marketing campaigns to target nearby drive-to markets and families.

5. Think Long-Term: Reviews, Repeat Guests, and Resilience

Eduardo called the shoulder season “review harvesting season”, when guests paying lower rates are more likely to leave glowing reviews, building credibility before the next high season.

Jessica reinforced the importance of engaging past guests, especially repeat bookers who are more likely to return in off-peak months.

Kyle closed with the data angle: shoulder season patterns don’t just impact today’s revenue, they reveal booking behaviors that carry into the next year. By analyzing pacing now, managers can see whether demand is shifting earlier or later and adjust pricing and marketing for 2026 before the same gaps repeat.

What Property Managers Can Do: Use the low season to collect strong reviews, engage past guests with email campaigns, and study pacing data to prepare next year’s strategy early.

The Bottom Line

2025’s shoulder season isn’t business as usual. Between shifting guest behavior and seasonal dips, property managers need to act early and act smart.

The webinar panelists left us with a clear playbook:

- Benchmark with data (Kyle)

Use market pacing to understand whether you’re truly behind or simply experiencing the seasonal norm. Data context helps you act early instead of reacting late. - Secure occupancy first (Eduardo)

Protect revenue by prioritizing occupancy. Offer targeted LOS discounts, accept last-minute bookings, and focus on covering costs to keep properties profitable and owners confident. - Differentiate with amenities and marketing (Jessica)

Properties with standout features, hot tubs, pools, and kid-friendly extras perform better in slow months. Match this with targeted campaigns that focus on drive-to and family travelers. - Engage and educate owners (All)

Owners often resist rate cuts, but showing them the cost of empty nights can shift the conversation. Where pricing flexibility isn’t possible, add value through amenities or policy adjustments.

Handled well, the shoulder season becomes more than a survival exercise; it’s a chance to harvest reviews, strengthen guest loyalty, and refine strategy before peak season returns.

Managers who treat the slowdown as a strategic opportunity, not a setback, will be the ones entering the next high season strongest.

Snigdha Parghan is a Content Marketer at RSU by PriceLabs, where she creates articles, manages daily social media, and repurposes news and analysis into podcasts and video content for short-term rental professionals. With a focus on technology, operations, and marketing, Snigdha helps property managers stay informed and adapt to industry shifts.