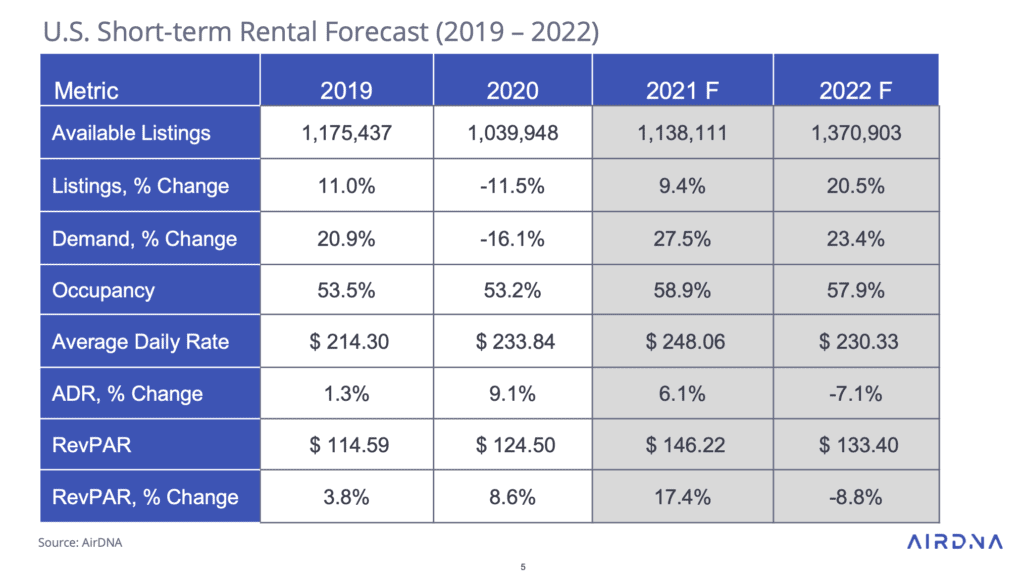

Short-term rental data provider AirDNA has boldly gone where no industry analyst has gone before by publishing a forecast report for 2021 to 2023. Using current booking trends, GDP and employment forecasts, as well as historic short-term rental and hotel booking patterns, AirDNA has made thought-provoking predictions about the U.S. vacation rental and urban markets. We summarize and comment on the most striking parts of this outlook, from the rebound in demand for urban short-term rentals to an increase in extended stays. Yet, as more supply comes back online and travelers start booking smaller city apartments again, overall average daily rates (ADRs) will go down in 2022 but remain 7.5% higher than in 2019.

US short-term rental market to be back to 2019 not before 2023

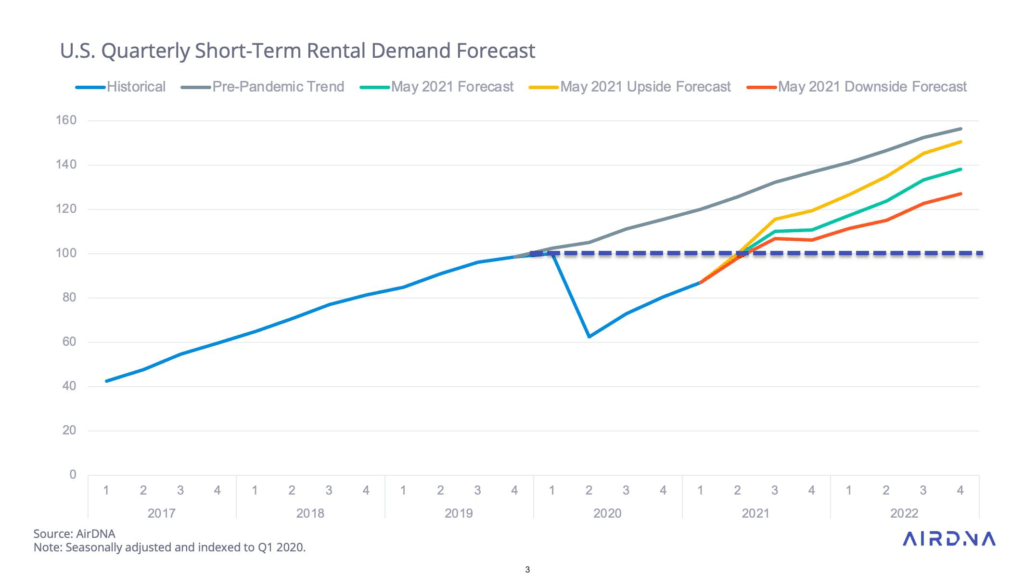

Here’s AirDNA’s forecast for the U.S. short-term rental market demand, with actual 2019 and 2020 figures and projected 2021 and 2022 numbers.

ADR has built 3 hypotheses from now to the end of 2022: Medium, Upside (Optimistic), and Downside (Pessimistic).

Only in 2022 will the number of available listings surpass the 2019 number

While the demand for non-urban rentals has given incentives for owners in these markets to open their properties, the loss in the number of available listings has been huge in cities.

Overall, the number of available listings decreased by 11.5% compared with 2019.

Available supply is both more elastic and less flexible than you can think at first sight:

- Very elastic: It is very easy to close a property calendar on Airbnb, Vrbo, or Booking. The listing is still there, but it is not an “available listing” anymore.

- Elastic: In seasonal markets (e.g., ski), vacation rentals close off for months on end. It is less true for urban short-term rentals.

- Elastic: Owners can choose to turn from short-term to long-term stays. The overall supply has gone down in cities as apartments were removed from the short-term rental listing sites.

- Less elastic than usual: When demand rises, owners usually find ways to add supply. While they cannot immediately build more properties, they can open up their secondary homes (see more here about the lack of supply in key markets). During COVID, many owners chose to keep their second homes for their use as they were moving away from cities. As a result, supply has been tight in 2020 and 2021 in traditional vacation rental markets.

ADR will go down in 2022 … not because rates will go down, but because smaller urban units will be booked again and drive down the average values

AirDNA’s Medium hypothesis states that rates will go up. Yet, it also says that the Average Daily Rate will go down in 2022 compared with 2021. There is no contradiction here.

In 2020 and 2021, a lot of small urban apartments sat empty, while people were booking large family-friendly vacation rentals in rural and coastal markets. These large, in-demand places have a higher ADR than urban rentals.

This is what Airbnb is seeing for summer 2021 in its data: Larger accommodations that can cater to 5 guests or more accounted for 35% of summer nights stayed in 2019 and now account for 54% of summer nights booked in 2021.

Yet, as demand flows back to cities in 2021, smaller places in cities will be booked again, driving down the overall average of the market.

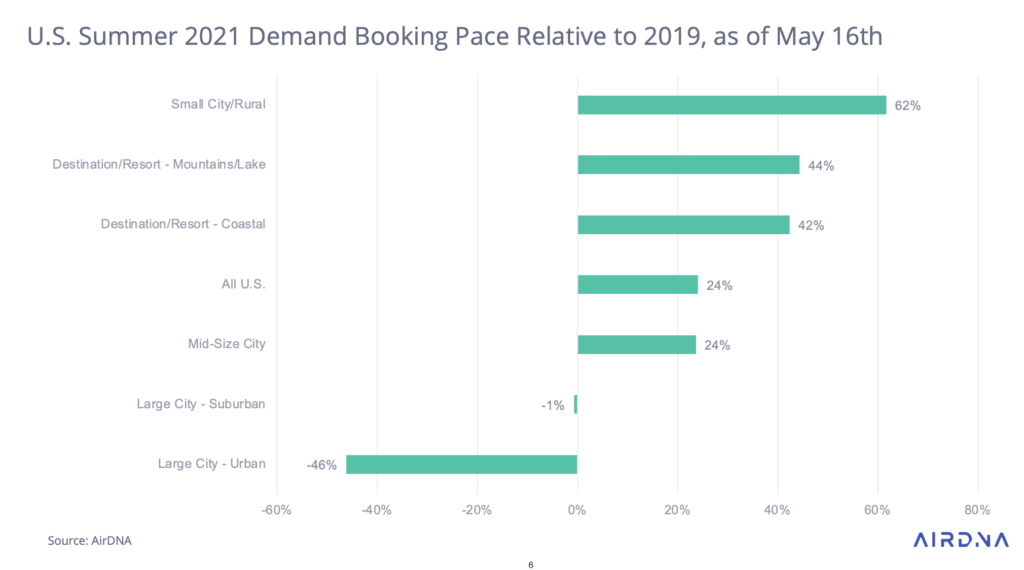

2020 and 2021 were great for traditional vacation rental markets (rural, coastal, and mountain) but cities are coming back. Urban demand to be back to 2019 levels in 2023.

In the first half of 2021, the whole US market was booming, with demand at +24% compared with 2019. The situation was very contrasted across markets. For instance:

- Small city and rural markets were growing at +62%

- Large cities and urban markets were decreasing by -46%.

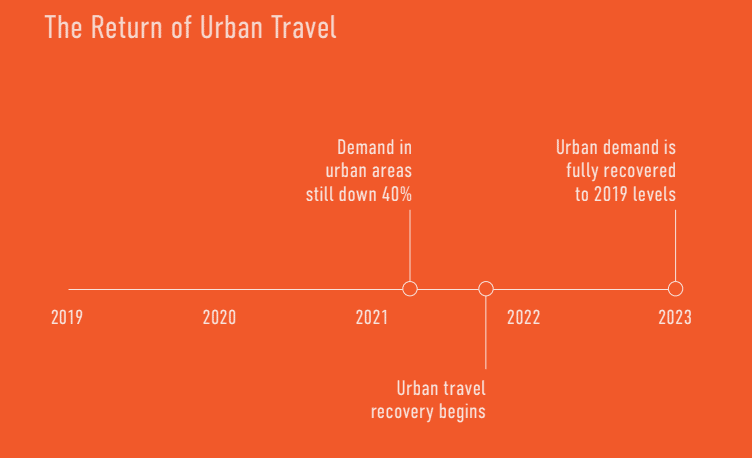

AirDNA sees urban markets starting to revive in late 2021. The company thinks that urban demand will fully recover to 2019 levels in late 2023. A key factor for the recovery of urban markets like New York City and Los Angeles is the return of international travelers, who represent up to 30% of the demand in these cities.

Note that some major coastal cities such as Miami are doing pretty well. As we discussed with HomeToGo, there are many differences in the impact of COVID in urban short-term rentals if you compare Chicago and San Diego, for instance.

AirDNA’s report is focused on the US. How do we think that Europe compares? When looking at our summer 2021 European trend report, we can see that:

- Just as in the US, non-urban destinations are doing well this summer

- While AirDNA thinks that US cities will start recovering in the second half of 2021, it is is harder to say in Europe. First, vaccination rates are still lagging behind the US. Second, the threat of new variants and the return of colder weather may impose new restrictions in European cities after September.

- European data seem to be the same in the US in terms of supply trends, with big supply losses in major tourist markets such as Paris and Barcelona.