- The European Commission’s proposal clarifies definitively that the short-term rental of accommodation is not exempt from VAT (value-added tax) in the EU. Until then, many small hosts were either unaware of or even exempt from (in some countries) the obligation to collect VAT.

- The proposal should come into force in January 2025. It needs first to be discussed further and adopted.

- To make VAT collection easier, the EU is making short-term rental platforms such as Airbnb responsible for collecting and remitting VAT to tax authorities (unless the host is a company that already does so on its own).

- If the proposal is adopted, hosts will not have anything to do. Airbnb and others will automatically add VAT to the stays booked by travelers, for instance, 20% in France. Thus, short-term rental stay prices could increase dramatically across Europe. Will demand shift back to hotels? Will Europe become a less attractive destination for international travelers?

- To our understanding, the VAT rate on night stays will depend on where the property is located. Meanwhile, services fees and commissions collected by the likes of Booking, Airbnb, and Vrbo, which are already subject to VAT, will keep on being taxed based on the country from where the guest is booking.

- The EU finds that individual exemptions made sense before platforms started to scale across the continent. While a vacation rental owner advertising their property through a local newspaper was no threat to competing offers, such as hotels, the Commission thinks that the situation has drastically changed with the rise of platforms such as Airbnb and Booking.com. European authorities find that hotels, whose stays are taxed with VAT, now incur unfair competition from thousands of short-term rental listings that are exempt from VAT.

Plugging a hole in EU-wide VAT collection as many short-term rental stays do not comply with rules

The proposal also extends to transportation services, such as Uber. The Commission estimated that an additional €6.5bn a year would come from the requirement for platforms in the short-term accommodation and travel sectors, such as Airbnb and Uber, to collect and pay VAT on the full cost of all bookings. At a time when the budgets of EU Member States are tight, they will likely approve this proposal to plug a hole in VAT collection in 2023. The rules could kick in somewhere between 2023 and 2024.

The European Commission has published a series of proposed measures to modernize and make the EU’s Value-Added Tax (VAT) system work better for businesses and more resilient to fraud by embracing and promoting digitalization.

The proposal also aims to address challenges in the area of VAT raised by the development of the platform economy, such as with short-term rentals. This is the part that European Rental Scale-Up readers will care the most about.

According to the European Commission, a lack of clarity on how online short-term rental bookings should be treated for VAT purposes has led to an unfair playing field with the more traditional economy, such as hotels.

After extensive research, the Commission has established that European countries could collect around €6.5bn a year more in VAT. Indeed, the taxation of short-term rentals is a mess across the EU:

- There was no clarity on whether the EU considered that all short-term rental stays should be taxed with VAT.

- Some countries such as Italy were already forcing platforms such as Airbnb to collect VAT on all stays, while it is not the case in most other EU countries

- Most countries exempted small businesses and hosts from VAT duties, under revenue thresholds that vary widely from country to country.

- Many hosts were just unaware of the obligations.

- It was just too expensive and complicated for local governments to enforce such duties with small hosts.

The European Union is keen on regulating the short-term rental economy

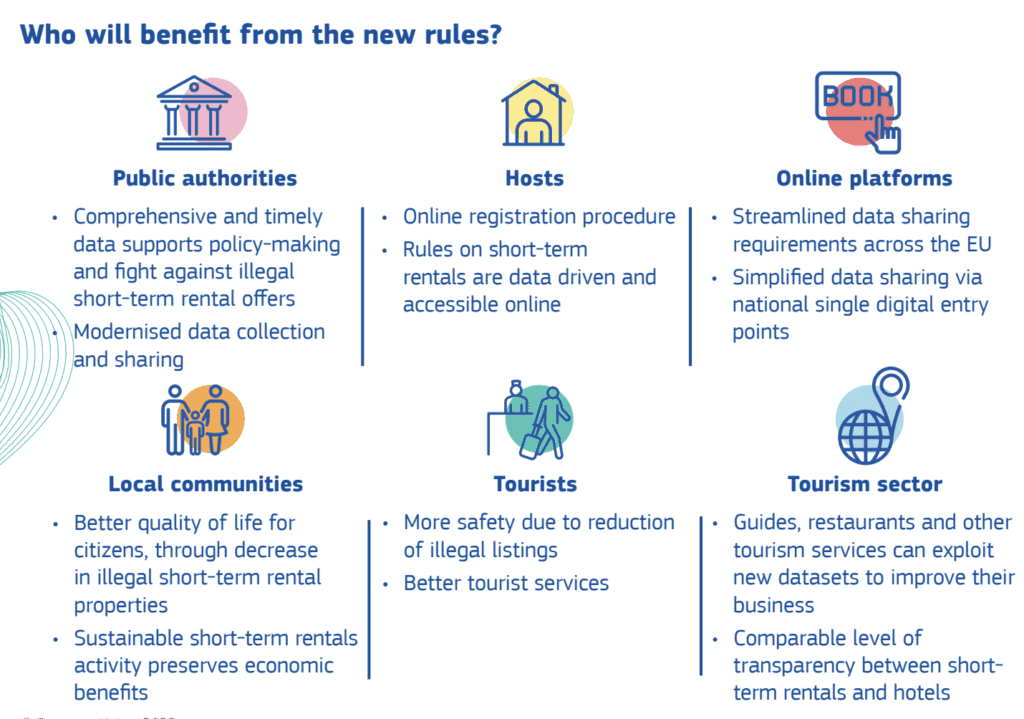

This proposal for new VAT rules joins other moves from the European Union to regulate the short-term rental market. The E.U. wants to ensure fair competition across the single market while clarifying and aligning rules.

In October 2021, we covered the EU’s Short-Term Rental Initiative for the first time. The EU acknowledged that “across the EU, short-term rental market players are subject to a wide variety of regulatory and often burdensome requirements, often adopted at a local level, which can create market access barriers and make it more difficult to provide short-term rental services, in particular for small and medium enterprises”.

The European Commission wants to make things simpler for platforms, hosts, and local authorities with its new proposal for a regulation, proposed on November 2, 2022. , The goal is to “enhance transparency in the field of short-term accommodation rentals and help public authorities ensure their balanced development as part of a sustainable tourism sector.

Summary of the updated VAT rules for short-term accommodation platforms such as Airbnb

Here’s how the European Commission presents the new VAT rules:

Under the new rules, platforms such as Airbnb, Vrbo, and Booking will become responsible for collecting and remitting VAT to tax authorities when hosts do not, for example, because they are small businesses or individual providers.

It will ensure a uniform approach across all Member States and contribute to a more level playing field between online and traditional short-term accommodation services, such as hotels. It will also make life easier for small companies who would otherwise need to understand and comply with the VAT rules in all Member States where they do business.

Under the new rules, short-term rental platforms will be deemed responsible for collecting VAT when hosts do not (because they are, for example, a small business not usually required to register for VAT) and for remitting this VAT to tax authorities.

How are short-term rental platforms currently treated for VAT purposes?

According to the European Commission, short-term rental platforms have boomed in recent years. They act as an intermediary between the suppliers of accommodations and travelers.

Under current VAT rules, it is the underlying providers of services, e.g., the person renting out an apartment, who is obliged to collect and remit VAT to the tax authorities.

But many hosts – whether an individual person or a small business – are unaware that they may be liable for VAT on the services they offer. Even when aware, it can be difficult to understand the VAT system and to comply with their VAT obligations

At the same time, the economies of scale and the sheer number of users of these platforms, such as Airbnb and Booking.com, mean that these hosts are now in direct competition with traditional VAT-registered suppliers such as hotels and private transport companies.

Under the current VAT rules, a hotel in a large European city faces competition from a platform like Airbnb that may facilitate thousands of listings in the same city, many of which are not taxed.

What will change for short-term rental hosts and operators?

The new rules announced clarify that short-term rental booking platforms must ensure VAT collection and remittance on the sales they facilitate when the listing owner has not done so. This will remove the current inequality in the area of VAT suffered by traditional operators such as hotels

In addition, estimates show that this simple change should bring in up to €6.6 billion per year in additional VAT revenues for Member States over the next ten years (when according for a similar obligation for transportation services such as Uber).

In parallel, and by standardizing the information that must be provided to authorities, the platforms themselves will collectively save €48 million per year over the same 10-year period.

Small companies that rent property in another Member State through an online platform and who may be required to register and charge VAT in that Member State will also benefit. Under the new rules, the platform will be able to account for this VAT on behalf of the small company.

Finally, the new proposal clarifies definitively that the short-term rental of accommodation is not exempt from VAT in the EU.

How will the new European VAT rules for short-term rentals work for hosts?

Under the new rules, Airbnb and the likes will charge VAT, when short-term accommodation hosts do not/ The platform will collect the VAT from the guest and remit it to the tax authorities. Day-to-day operations of underlying short-term rental suppliers are not affected: VAT is simply automatically added to the price shown on the platform.

How will short-term rental guests be affected by adding VAT to their stay costs?

For guests, it may mean short-term rental prices increasing by 20% in countries like France, for instance. This will be a very steep increase. One of the European Commission’s goals is to make sure that hotels and short-term rentals are competing fairly. Thus, the E.U. is ok with short-term rental prices increasing to hotel levels in some destinations.

For Airbnb and other booking platforms, it means that they may not be seen as a cheaper alternative to hotels anymore. Airbnb is already worried about entering a recession period with a reputation for high cleaning fees and non-transparent pricing. It’s been adding new sources of supply, for instance, private rooms, to ensure its average prices stay reasonable.

Conclusion: A sticker shock in 2025?

The proposal should become law in January 2025, to our understanding of the European Commission’s proposal. It means that short-term rental operators have two years to think about their pricing strategy: Should they absorb part of the new tax? Should they stay put, as the whole market sees its prices increase by 10% to 25%, depending on where their property is listed?

Will the new EU VAT rules for short-term rentals make Europe a more expensive and less attractive destination at a time when many international travelers prefer booking a home over a hotel room? Will demand shift back towards hotels?