Hostfully, a provider of property management software and guest guidebooks for the short-term rental industry, has released the 2022 edition of its “Hospitality trends in the vacation rental industry” report. Note that most of the respondents are individual hosts and small property managers based in North America, so the survey findings are skewed toward their experience. Also, as the survey is sent out to PMS users and other more advanced users, the survey probably captures more independent-minded small hosts with a multi-channel approach, rather than the ones who are 100% exclusive to Airbnb.

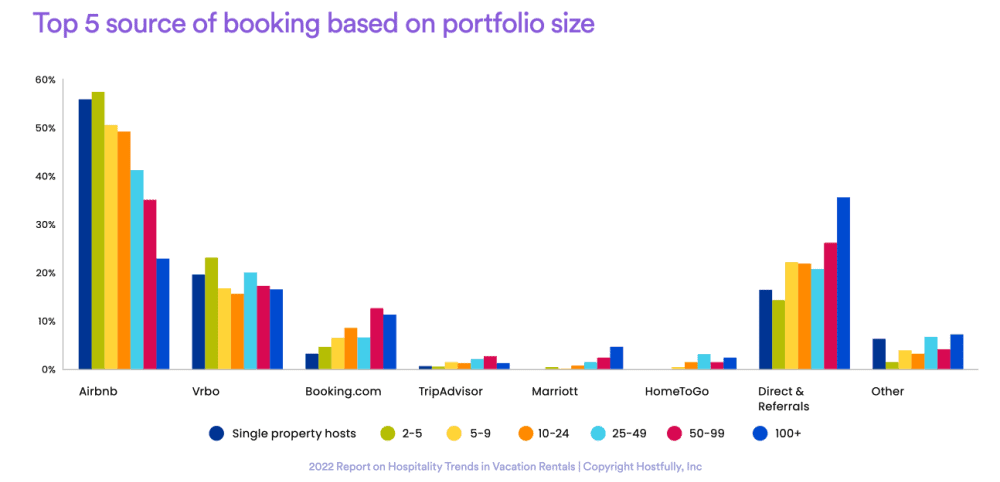

However, Hostfully makes some insightful breakdowns to show how results vary as the property management company grows. For instance, Airbnb generates 55% of the bookings of the single property hosts surveyed but only 22% of those of property managers with 100+ properties. As for direct bookings, they make up 15% of a single host’s bookings, but 34% of those of the largest managers.

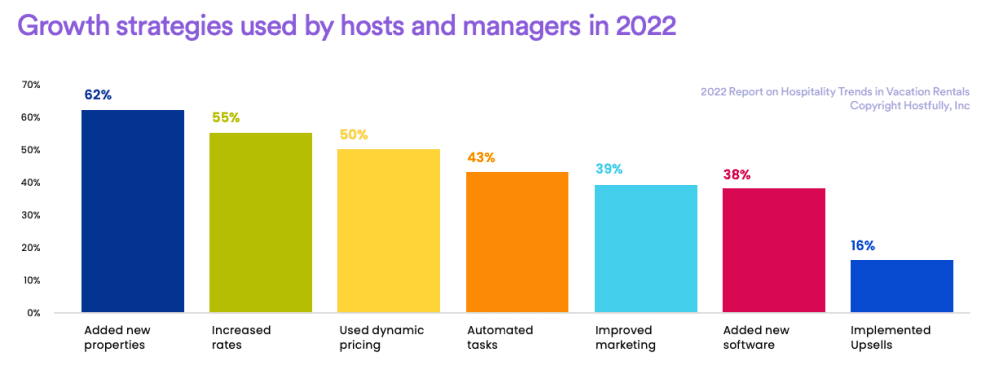

The report also shows that, in 2022, the two main sources of growth were adding more properties to the portfolio and improving revenue management strategies (by increasing rates and/or using dynamic pricing software).

Important caveat: Data skews towards small and medium North American hosts

If you want to understand the graphs and lessons from Hostfully’s survey, it is crucial to look at who the respondents are:

- 375 vacation rental operators

- 75% from North America (probably most of them from the US)

- 51% of respondents with 5 properties or less, 82% with 24 properties or less

As a consequence, when you look at these survey results, keep in mind that you are mostly comparing yourself with an individual host or small US property management company

Second caveat: This is a survey by a PMS company, so many of the questions are about … PMSs

Hostfully has included questions about strategy, marketing, and overall business performance. Yet, many of the questions have to do with property management software (PMS), what they do well or what they do not. Most of the rest of the insights are also around tech solutions, from dynamic pricing to guest communication.

2022 revenue performance: How did you do?

Almost 50% of bookings from Airbnb and only 19% direct … on average for this sample skewed towards small US hosts and managers.

When looking at these graphs, we can see that the data was largely collected from small US short-term rental hosts and managers:

- Booking.com, which is strong in Europe, but specifically weak with US individual hosts and small property managers, ranks very low

- Vrbo ranks well here. Indeed, it does well in the US and a few international markets, such as France, Germany, and Australia. Yet, it’s only present in 27 countries in the world.

- Airbnb, which does very well with individual hosts, many of which are exclusive to the platform, takes the lion’s share of the bookings, according to this graph.

However, Hostfully helps us get further insights by splitting the results along the portfolio size of the respondents:

- Airbnb is by far the top booking source for small hosts (almost 60% of the bookings of hosts with 2 to 5 properties come from Airbnb). However, Airbnb’s share drops to 20% for property managers with more than 100 properties.

- Vrbo’s showing is stable across the sample.

- Other channels, such as Booking.com and Marriott do much better as the portfolio grows. For instance, Booking generates almost 10% of the bookings of companies with 50 properties and more. One of the explanations could be that, in the US, Booking.com is not a household brand known to small hosts, but is used as an additional channel by more professional hosts.

Growth sources: More properties and better revenue management (higher rates + dynamic pricing)

The most widely used growth strategies were adding new properties, increasing rates, and using dynamic pricing.

Adding supply as the best strategy for growth … until oversupply strikes?

As D. Brooke Pfautz, the CEO of supply acquisition specialist Vintory, says: “ 1 new property is worth 100 new bookings”. This has been the strategy pursued by most vacation rental pros in 2021 and 2022, as demand was exploding.

Yet, in 2022, in the US, the first signs of oversupply in key markets have shown. After 2 years of bringing more properties to the market, supply seems to have caught up with demand. Some Airbnb hosts are even talking about the #AirbnBust, whereby they are getting way fewer bookings than in 2021. Airbnb itself is doing all it can to add more properties, from private rooms to Airbnb-friendly buildings.

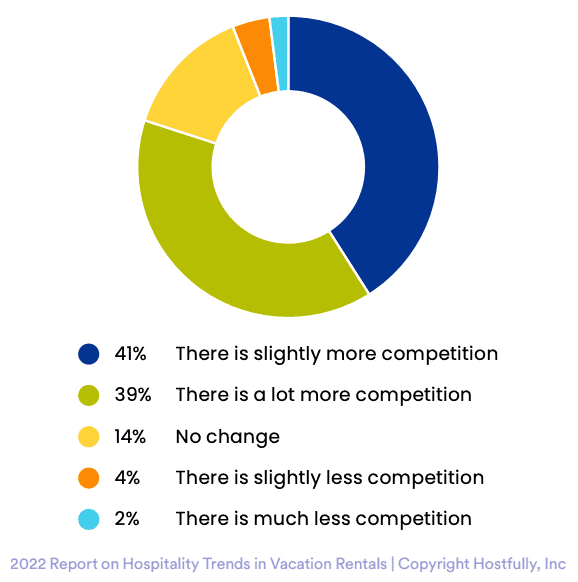

As a result, 80% of respondents to Hostfully’s survey say that competition around them has increased: 41% say “slightly more” while 39% say “a lot more”

The key role of Dynamic Pricing in the vacation rental industry

As I also work as Head of Product Marketing for PriceLabs, my job may drive me to see everything through a pricing angle. Yet, it is striking that issues around revenue management rank very high across various answers in the survey, from finding the right price to using dynamic pricing software.

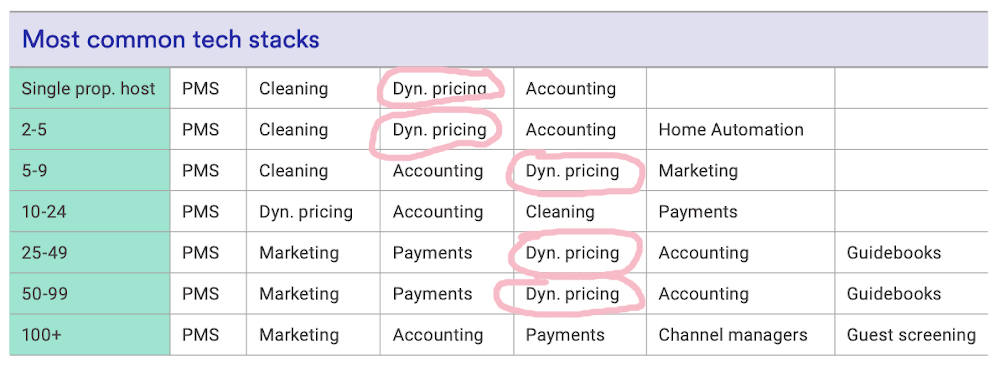

When looking at the tech stack of vacation rental companies, dynamic pricing software shows up as a must-have, almost on par with a PMS. When looking at the table below, remember that many respondents, even small ones, use a PMS. This is not the most common situation for most single hosts. As the survey has been sent to people who are probably using PMSs and other tech providers, the results may skew towards the most tech-advanced side of the industry.

Again, when looking at the answers about the most pressing tech challenges met by vacation rental pros, pricing comes second, after automation and before calendar sync and booking management.

Vacation rental pros’ long list of challenges and jobs-to-be-done

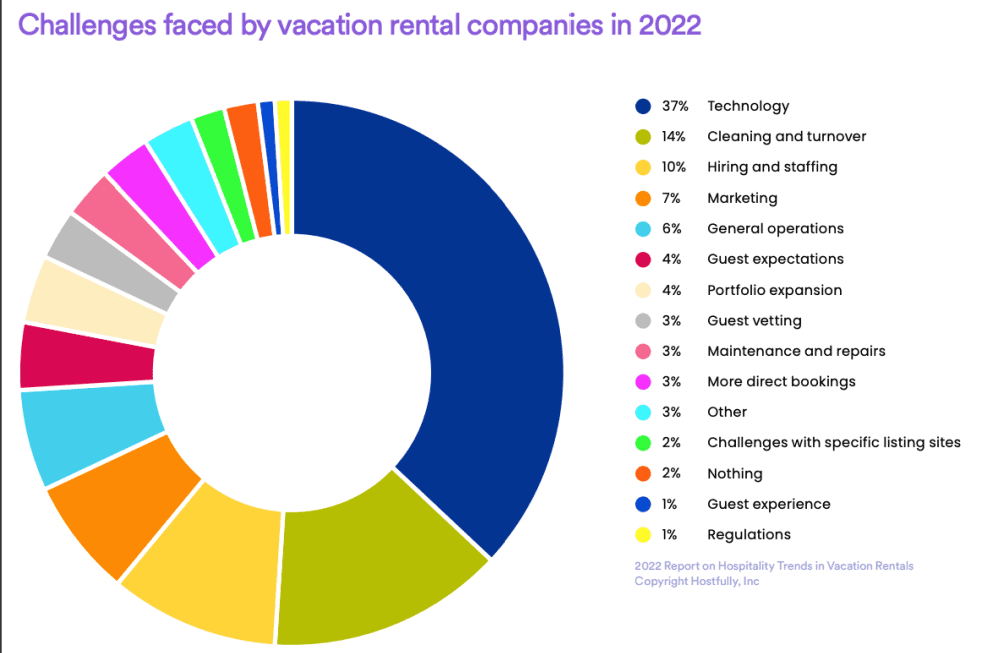

Nobody has ever said that being a vacation rental pro was easy. Look at this long list of challenges!

The top 5 are:

- Technology

- Cleaning and turnover

- Hiring and staffing

- Marketing

- General Operations

Issues with cleaning, hiring, and general operations are tightly intertwined. Staff shortage is as acute in North America as in Europe. It is not clear that a possible recession would immediately help with the issue, as unemployment rates remain low everywhere.

Conclusion

The Hospitality trends in the vacation rental industry report for 2022 is now available from Hostfully. The report contains interesting insights into how results vary as the property management company grows. Airbnb generates 55% of the bookings of the single property hosts surveyed but only 22% of those of property managers with 100+ properties. As for direct bookings, they make up 15% of a single host’s bookings, but 34% of those of the largest managers. The report also shows that, in 2022, the two main sources of growth were adding more properties to the portfolio and improving revenue management strategies (by increasing rates and/or using dynamic pricing). To learn more, read the full report.