There is no doubt that Covid-19 has created new travel trends, erasing the boundaries between working and traveling. Staycation has become a buzzword, and travelers’ preferences have even questioned the short-term rental industry’s name because long-term stays are becoming more and more popular. Even in 2021, according to Airbnb, “travel will be less about tourism and more about living, working and connecting safely away from home.”

Airbnb quickly adapted its business model to the new travel trends, showing that they have multiple resilient categories that were less influenced by the Coronavirus disruptions and demonstrated stronger recovery to tap into these trends. Will travelers continue to prefer entire private homes in 2021 after being isolated in 2020? Can we expect international travel to be back to normal? Will Airbnb guests continue to favor safe ways to reconnect with family and friends?

Pockets of resilience

Some parts of Airbnb’s business remained resilient throughout the pandemic and are expected to stay strong in winter, spring, and summer 2021. Airbnb booking data shows which travel trends are expected to remain in 2021 until things start slowly to get back to normal.

Most resilient property types

The most resilient Airbnb property types during the pandemic turned out to be whole properties. Feeling the agony brought by Covid-19, Airbnb hosts who want to advertise their listings as “Social Distancing Retreat” obviously have to be able to offer entire properties and not an Airbnb room. Home sharing and more affordable stays have become a less attractive travel option in the age of social distancing. Travelers who are likely to resort to long-term Airbnb rentals want to rent an “entire place” instead of a “private room” or a “shared room.”

According to Airbnb, entire homes have officially replaced apartments as the top space type among guests in 2021, providing controlled, private space for everyone. More off the beaten path stays like cabins and cottages are considered as the top five space types for 2021 travel, replacing villas and townhouses from 2020.

Safety and cleanliness are expected to remain on top of travelers’ minds, who in 2021 would prioritize private, entire homes over overcrowded hotels.

To grapple with the challenges brought by Covid-19, Airbnb worked closely with hosts and guests to sustain safe and responsible travel. The U.S. Centers for Disease Control and Prevention guidelines have listed homes shared with the same household members as safer than hotels during the pandemic, which supports the way guests travel on the Airbnb platform.

Most resilient types of stays

In the context of increasingly negative travel settings, there have been several areas of Airbnb’s business that have to remain more robust and stable:

Domestic travel

Domestic travel happens when guests travel to the same country where their origin is. Unlike air and cross-border international travel, which has been strongly influenced by the pandemic, domestic travel worldwide, according to Airbnb, has been highly resilient. Airbnb recommended that its hosts change their listing titles and mention that their spaces are terrific for a staycation or as a work-from-home alternative.

“Travel in this new world will look different, and we need to evolve Airbnb accordingly. People will want options that are closer to home, safer, and more affordable,” Airbnb CEO Brian Chesky wrote in a note to employees in May 2020.

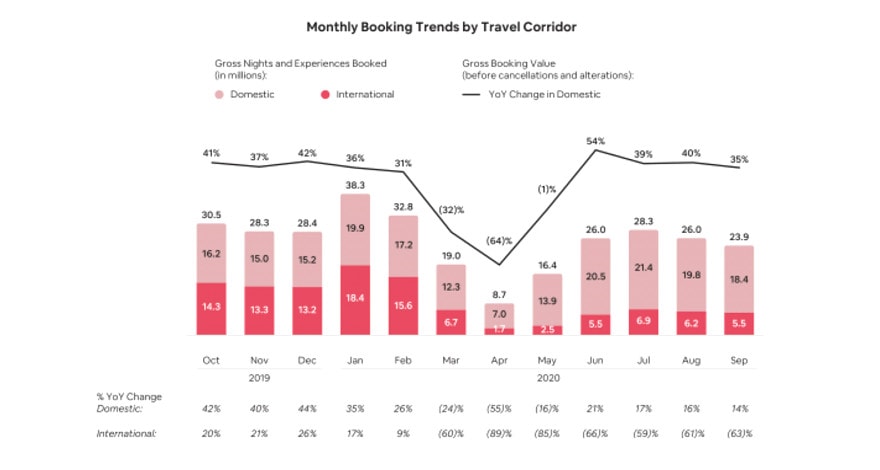

According to Airbnb, Gross Booking Value before cancellations and alterations grew 35% year over year in September 2020. The global domestic nights and experiences booked in September this year were 77% of Airbnb’s gross nights, and experiences booked compared to 52% in January 2020, and domestic nights and experiences rose 14% year-over-year.

Source: Airbnb’s IPO prospectus

In 2020, according to Airbnb, a variety of domestic locations in national parks, winter ski and beach towns are becoming the most popular, perhaps showing a departure from regular seasonal travel, and a taste for traditional vacation getaway destinations year-round. Among the top destination are:

- Great Smoky Mountains, Tennessee

- Breckenridge, Colorado

- Davenport, Florida

- Palm Springs, California

- Tulum, Mexico

Short-distance travel

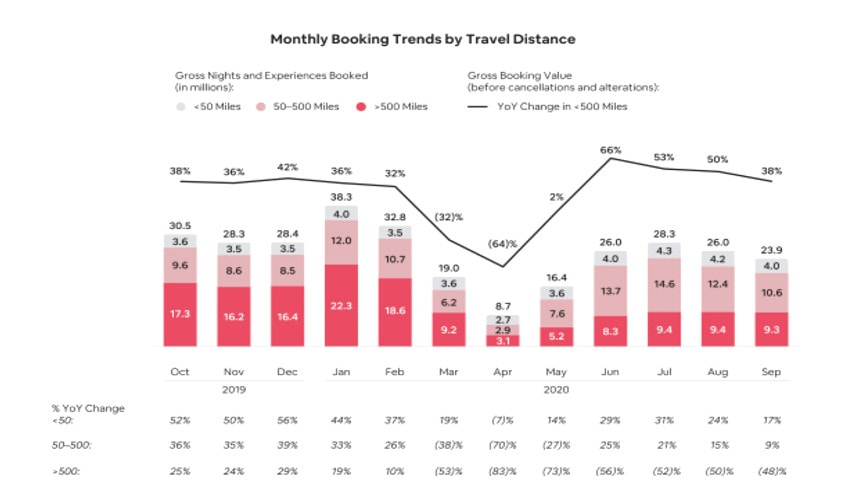

As explained by Airbnb, short-distance travel is considered to be travel within 50 miles of guest origin. This type of travel has been extremely resilient, even at the Corona disruption’s zenith in April 2020. According to Airbnb, short-distance travel is one of the rapidly growing categories prior to the COVID-19 pandemic.

Also, the popular short-term rental platform has seen stays between 50 miles and 500 miles from guest origin bounce back. The data shows that from May through September 2020, this category grew year over year. Gross Booking Value before cancellations and alterations for travel distance under 500 miles grew 38% year over year in September 2020.

Source: Airbnb’s IPO prospectus

Long-term stays

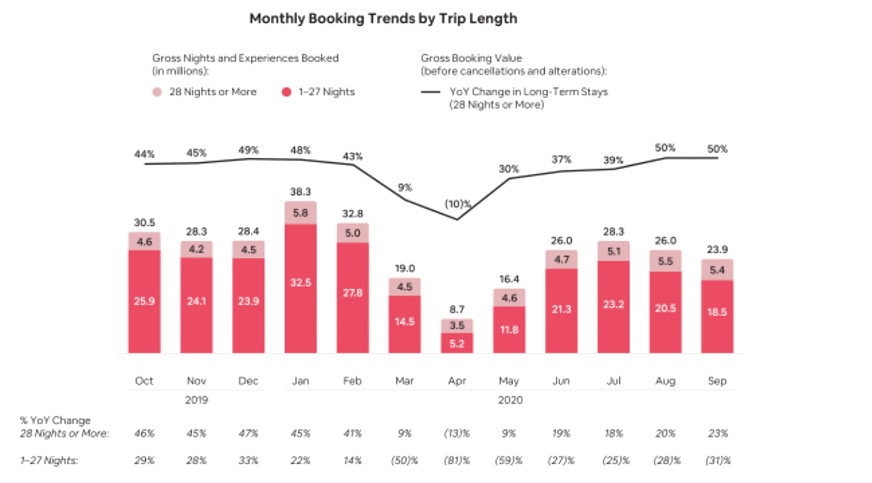

Bookings made on Airbnb’s platform for at least 28 nights are considered as long-term stays. According to Airbnb, the long-term stays category is different from leisure travel, and therefore, it was not as affected as much by the pandemic. Ass a growing trend, these types of stays were among Airbnb’s fastest-growing categories due to new travel needs imposed by Covid-19.

Trying to bypass the drop in bookings, a growing number of Airbnb hosts turned to ‘longer stays’ as a strategy to continue having guests. Compared to August 2019, the number of guests searching for longer stays in August this year increased by more than 50% and shows Airbnb’s data. A few months ago, after introducing a new dedicated “monthly stays” section for guests, the platform said that 80% of hosts accept longer-term stays and around 50% of its active listings are giving guests a discount on stays of one month or more.

The insights for monthly booking trends by the length of stay published in Airbnb’s IPO prospectus provide glimpses of the trends: the long-terms stays which were down just 13% year over year and demonstrated year-over-year growth in the period May-September 2020, whilst the short-term stays (1-27 nights) drop 81% year over year in April 2020. In September this year, Gross Booking Value before cancellations and alterations for long-term stays increased 50% year over year.

Source: Airbnb’s IPO prospectus

According to Airbnb’s estimates, in 2021, work from home could be working from any home because remote working will remain a reality for many people. The survey done by Airbnb showed that 83 percent of respondents support relocating as part of remote working. Analysis of guest reviews depicts that in the period from July to September 2020, there has been a 128% rise in reviews that mention “relocation”, “relocate”, “remote work” and “trying a new neighborhood” in comparison to the same time frame last year.

Most resilient countries and regions: travel outside of Airbnb’s top 20 cities

Airbnb published 20 trending destinations for 2020 based on year-over-year growth in bookings. Travel outside of Airbnb’s top 20 cities has been more resilient than those booked in the platform’s top 20 cities. On the top of the list are Milwaukee, WI, US, Bilbao, Spain, and Buriram, Thailand. The gross nights and experiences booked in Airbnb’s top 20 cities by 2019 GBV decreased by 52%.

But in September 2020, compared to September 2019, the gross nights and experiences outside of their top 20 cities based on 2019 GBV and decreased just 19%. As was to be expected, in Corona times, with periods of lockdowns and social distancing, smaller destinations became more attractive for travelers than the crowded urban environments.

However, when compared, the historical mix of gross nights and experiences booked by travel distance, corridor, and top 20 cities is alike to the historical mix of revenue by those categories. As long-term stays have lower GBV per night and lower service fees, the revenue by trip length is weighted more toward short-term stays.

Source: Airbnb’s IPO prospectus

The trend has been also evident through a survey done by Airbnb. Of travelers who have relocated since the pandemic was declared, 24 percent of them say they moved to a suburb and 21 percent to a rural area, both greater percentages than those who answered they moved to cities. Most popular destinations include Park City, Utah, Truckee, California, Steamboat Springs, Colorado, etc.