Each month, Rental Scale-Up organises a conference, bringing together industry experts to share recent short-term rental trends and insights on what property managers and hosts should do to keep up with them. Our very first conference in January was created exclusively for European property managers, to help them prepare for a more profitable year, and have them bulletproof their 2022 plans. Scalers Network Plus members get a complimentary speaker spot – apply to become a member here.

Here are some key findings and insights to get you started:

- Markets with strong domestic demands such as France, Germany, Russia, and the UK did well in 2021 and are poised for more of the same in 2022

- Summer 2022 booking pace looking better than same time in 2021 and even 2022 (pre-Covid)

- Guests demand flexibility: fully refundable cancellation policies a driving force

- Inflation and labor shortages to impact revenues and operations – automation will be key

- Email privacy changes may hamper guest communications

Let’s meet the speakers first:

ANDREW MARTYN, CEO, YOUR.RENTALS

Sharing insights based on exclusive data from thousands of European property managers

Andrew Martyn is the CEO of Your.Rentals, a company whose goal is to make the daily life of property managers all over the world simpler, easier and more profitable. Your.Rentals works with property managers in hundreds of locations across Europe in multiple languages. This gives Andrew access to exclusive data from European property managers just like you. In this conference he will share key insights based on this data to share with you how other property managers like you are preparing to deal with the uncertainty brought on by rising Covid-19 cases and new travel restrictions.

HENRY BENNETT, CO-FOUNDER, PROPERTYCARE.COM

Cleaning and guest experience will remain top guest priority: How to meet changing expectations fast?

Since 2020, the focus of the short-term rental industry has moved towards cleanliness, sanitation, and guest experience more than ever. This is not changing anytime soon, as is clear from emerging 2022 trends. Vacation rental businesses that keep up with rising guest expectations and provide consistent service will be the only ones who thrive. Propertycare.com (powered by YourWelcome) Co-Founder Henry Bennett highlights exactly how important these factors will be, and how you can build a resilient property management business that responds fast to changing needs.

TALIA LOCKARD, DIRECTOR OF BUSINESS DEVELOPMENT, RENTED

Performance metrics you should be tracking and what they signal

Taking Rented’s dynamic analytics that predict consumer behavior at the micro-market levels, Talia Lockard will highlight how various European markets might perform in 2022. She will clarify what different metrics signal about your business, and how to track and understand them to get visibility of ongoing performance & future trends.

THIBAULT MASSON, CEO AND FOUNDER, RENTAL SCALE-UP

Providing context with a look back at 2021 and how it connects with 2022

Through Rental Scale-Up Thibault publishes industry reports, analyses, and news that help short-term rental professionals grow their business and become more profitable. With Scalers Network, Thibault has created a private network for these professionals to take action, find peer support, network, and get oppurtinities to become a voice in the industry. Taking 2021 short-term rental trends data, Thibault will help clarify how 2022 stacks up versus 2021, and whether it compares positively.

Uvika Wahi, Rental Scale-Up:

Thank you everyone for joining us today. This is the first conference by Rental Scale-Up in 2022, so I’m very glad to see you here. My name is Uvika Wahi, I’m the head of content and community at Rental Scale-Up, and today we are going to talk about bulletproofing your 2022 plans. We put together key insights and data for you to help you make better decisions as property managers in Europe in 2022, and help your business grow. So, not only will we be sharing key data, but also actionable advice in terms of what you can do to keep up with these trends that we are sharing with you. So, we are going to start with an introduction referring to what 2021 was like in Europe, and then we’ll move on to talking about 2022 booking trends. We’ll be talking about how Q3 will be strong again, but how booking patterns are not the same as 2021, or even 2019.

Uvika Wahi, Rental Scale-Up:

The second topic we’re going to talk about today is profitability under threat. So, with inflation and labor shortages, property managers are facing new challenges, or perhaps older challenges that are resurfacing. We are going to talk about how you can meet those head-on, and how you can overcome these issues, as well. And the third topic for today is guest communications at risk. So, changes happening to email channels, which is a channel that property managers use for guest communications primarily, and for marketing, there are changes happening to regulations around that, as well. So, what is it that you can do in order to continue leveraging these channels, or perhaps do it in a different way.

Uvika Wahi, Rental Scale-Up:

Joining us today are industry experts, starting with Andrew Martyn, who is the CEO of Your.Rentals. Your.Rentals is a short rental business management tool that is used by property managers globally. In Europe, it’s trusted by property managers in hundreds of locations in multiple languages, he’ll be sharing his expertise with us. Welcome, Andrew.

Andrew Martyn, Your.Rentals:

Thank you.

Uvika Wahi, Rental Scale-Up:

Next up is Henry Bennett, he’s the co-founder of PropertyCare.com, and YourWelcome. YourWelcome helps property managers drive revenue by adding a service layer to their business through their tablet, and their advanced service, and PropertyCare.com is the most recent offering. It is a housekeeping and maintenance platform that also makes guest management easier. Hello, Henry.

Henry Bennett, PropertyCare.com:

Hey, guys. Thank you.

Uvika Wahi, Rental Scale-Up:

And next up is Talia Lockard, she’s the director of business development at Rented, a vacation rental revenue management platform. Their automated rate tool or ART provides dynamic pricing with powerful tools in an easy to use platform. Hello, Talia.

Talia Lockard, Rented:

Hi, everybody.

Uvika Wahi, Rental Scale-Up:

And last, but obviously not the least, is Thibault Masson. He’s the CEO and founder of Rental Scale-Up, and he’s here to give you a little more context for the data that we are sharing today, and also moderating this conference for you. Thibault, please take it away.

Thibault Masson, Rental Scale-Up:

All right. Thank you so much, Uvika, and thank you, everyone, for attending, watching here today. Thank you to Your.Rentals, PropertyCare, and Rented for also being speakers today, and we hope to provide you value and actionable insights. My goal here is to give a quick introduction with some charts and then just let our speakers speak.

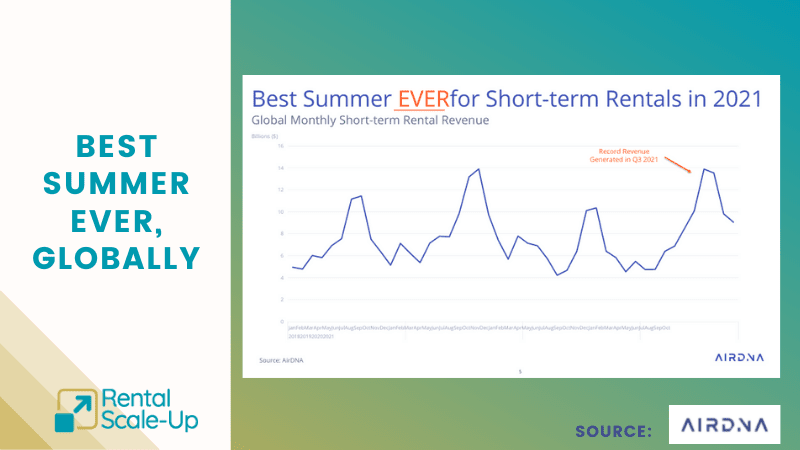

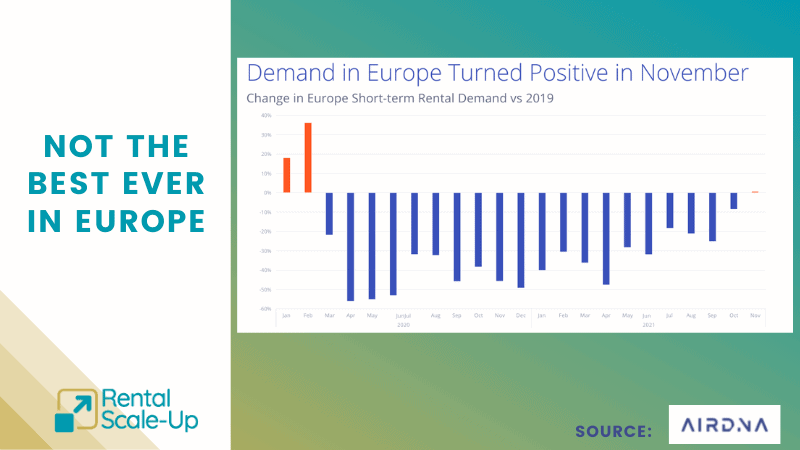

So, for context, first up for our conference today, I have two slides quickly to look at last year, right? Globally last year was the best year ever for short-term rentals, especially for the summer, right? If you put together summer 2021, especially, for example, in the US and Europe together, it was the best year ever. But it was really true for the US for the whole year, actually. Whereas in Europe, Europe was a different story, really.

Thibault Masson, Rental Scale-Up:

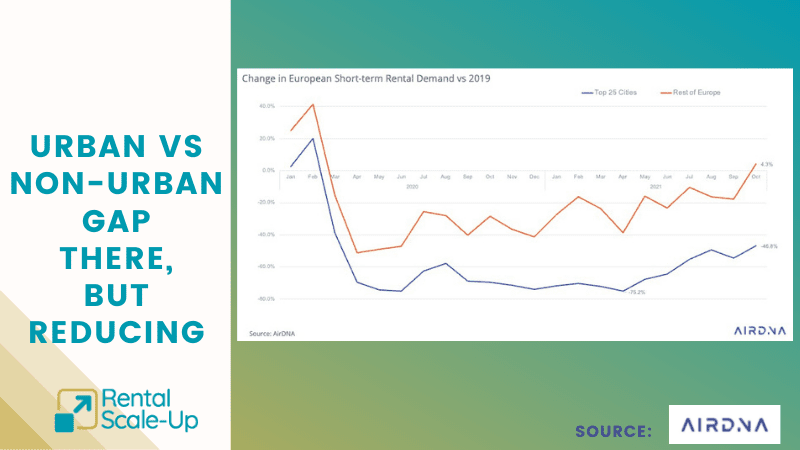

If you look at the data here shared by AirDNA, in March 2020, you see the bars going down, going negative. It means, basically, the demand turned negative in March 2020, of course, when the pandemic broke out. And demand didn’t turn positive, meaning became stronger than in 2019, not before November of 2021, right? Whereas, in the US since January 2020 demand has been at record-breaking months after month. In Europe, it took until November overall to find some positive demand, bigger than 2019. And that was, of course, right before Omicron struck at the industry. So, where are we standing now, this year?

Oh, yes. The last point I wanted to make here is that, even this situation getting better was really driven by, let’s say, non-urban markets. Obviously in Europe’s top cities, the demand was still depressed, but it was coming back, again, until Omicron struck.

Thibault Masson, Rental Scale-Up:

So, where are we standing now? So, Uvika told us, there will be three topics today. The first topic is 2022 booking trends. And I will, on my side, just show two graphs, actually giving some context about last year. What we saw last year… And you’ll get a PDF after this session.

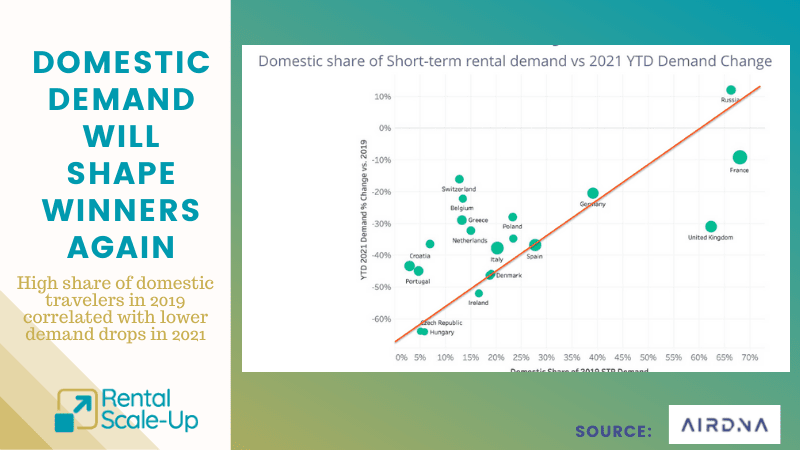

I’m going quickly here, but what we just learned last year, basically, is that the markets that did really, really well, like Russia, France, the United Kingdom, and Germany, were markets where there was a very strong component of domestic demand that was able to balance out the local supply. Obviously, markets like Portugal also had domestic demand, but there was way more supply. So, it means, compared with 2019, there was a big drop in terms of overall the demand. Markets that were depending on international travel didn’t do well. So, we’ll talk about that.

Thibault Masson, Rental Scale-Up:

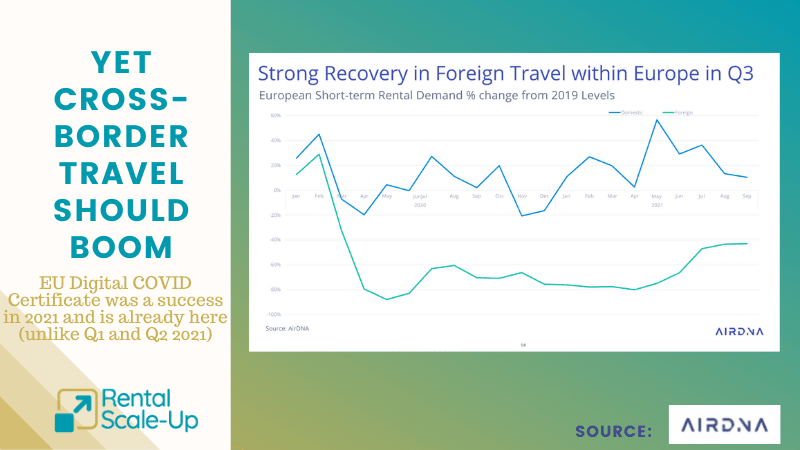

What was important to see last year is that, again, basically starting May, June, cross-border travel in Europe… Which is important to us Europeans. Cross-border travel was starting to come back. The share of foreign travelers was trying to come back. And again, that was until Omicron struck. So, let’s see how this is going to fare this year. And to do that, we’ll start with data from Your.Rentals, and Andrew, CEO of Your.Rentals, will take us through this data, and I will debate.

Andrew Martyn, Your.Rentals:

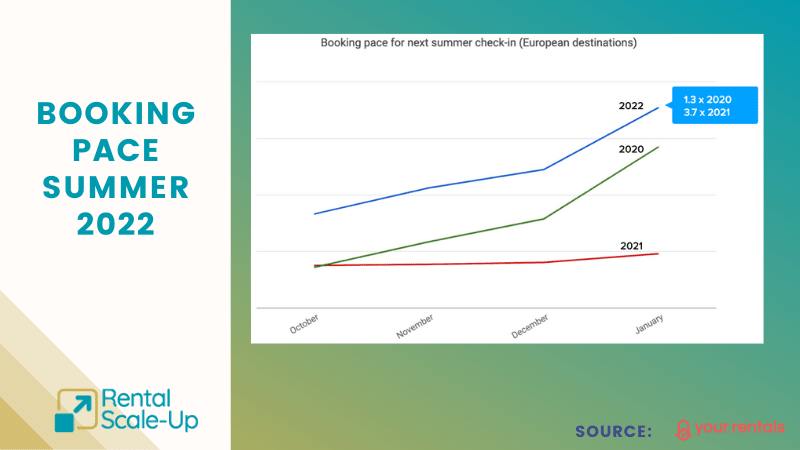

Thanks, Thibault. Yes, it was a year last year that really had some promising signs, but didn’t quite make it through the whole year, which I think all of us felt. So, what we’re trying to do to understand how does 2022 look, we’re using a measure called booking pace. For those of you who don’t know what it means, it’s quite simple. So, we take this point in time today, and we look at how many bookings we have for a certain period in the future, and then we can compare that to the same point in time in previous years.

Andrew Martyn, Your.Rentals:

So, one of the things that makes us very optimistic about how 2022 might play out is the fact you can see on the chart there, the blue line at the top is actually the booking pace for summer check-ins coming in 2022, this year. And you can see that that is higher than the red line down the bottom, which was at the same point in time, the middle of January in 2021, it was extremely flat. People were not booking their summer holidays in advance. And in fact, if you compare it to the middle of January 2020, which is right before COVID started to impact new bookings being created, then you can see that we’re actually 1.3 times higher than we were even then. So, this gives us quite a good optimism for the summer coming ahead.

Andrew Martyn, Your.Rentals:

In order to understand why that might be, well, we think it’s two things at play here. The first one is, the confidence of guests to be making bookings in advance. And normally, in January we see a lot of bookings for the summer coming ahead. So, the confidence of guests has definitely rebounded. A lot of people did travel in Europe last summer, so they know that it was possible, and in fact, it was not too different an experience than before. We’ve got the QR codes and the COVID passes that the EU launched right in time for summer last year, and people have gotten used to those, and know how they work, and are using them in their home countries, as well as for travel, as well. So, that guest confidence, we’re seeing a rebound of people booking their summer earlier.

Andrew Martyn, Your.Rentals:

And then, the second main factor driving this… And you’ll see some data on the next slide in a second, is that the whole short-term rentals industry has really jumped on board and said, “How can we make the risk for guests booking much lower in case they can’t travel?”

So, one thing that we’ve helped to implement is a wider spread of fully refundable cancellation policies. This means that the guests will have a full refund if they cancel a certain number of days before check-in. I think most of the property managers here have a love-hate relationship with this. So, one of the things that we’re asked quite a lot by our customers and property managers all around Europe is, “Should I be using fully refundable? They get canceled at a higher rate, how should I weave that into my strategy?” And this is one of the takeaways we’d like to give for this session.

Andrew Martyn, Your.Rentals:

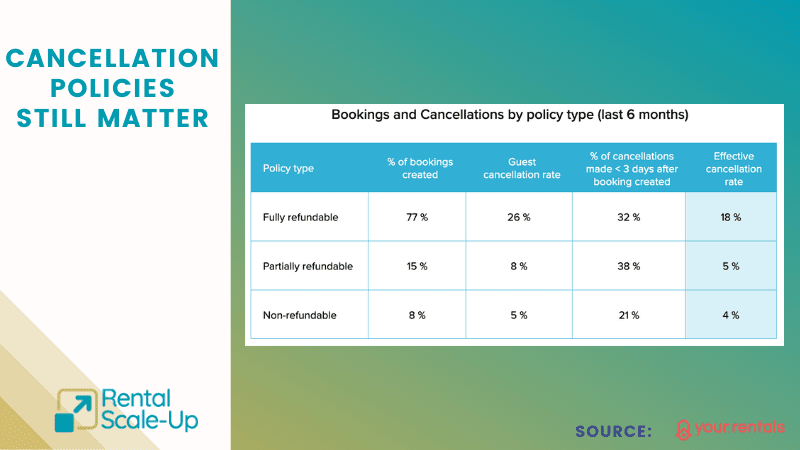

What you can see here is, we’ve separated the bookings that we’ve seen over the last six months into the three types of cancellation policy. Fully refundable at the top, partially refundable, usually a 50 percent refund upon cancellation, and then non-refundable, no refund after the booking’s been confirmed. And you’ll see that, what’s driving the bookings over the last six months, and still here in January, is a fully refundable cancellation policy. It far outweighs bookings under any other policy.

Andrew Martyn, Your.Rentals:

An interesting layer on that is, how do cancellations look if you’re offering fully refundable. So, over the last six months, fully refundable bookings have been canceled at a rate of 26 percent versus partially refundable 8 percent, and non-refundable at five percent. And that… That’s changed quite a lot over time. So, if you align it with Omicron check-ins around Christmas and New Year, there was a far higher cancellation rate, because people were not going ahead with their travel plans, whereas in other times of the year, it’s a lower rate.

Andrew Martyn, Your.Rentals:

One very important thing is that many bookings are actually canceled very shortly after they’ve been created. So, if you look at the third column there, this is the percentage of cancellations made less than three days after the booking was created. You can basically take those out of the equation unless it’s a very late check-in booking, giving an effective cancellation rate of 18 percent for fully refundable, five and four for the other two types of policies. Why is this important? Well, it should guide you in terms of how you set your pricing. So, we allow our customers to set multiple offers for the same period, and for fully refundable, you should be pricing those somewhere between 20 to 30 percent higher than your normal rates, so that you’re covering that cancellation risk. And that is a strategy that we see as working quite well for our customers.

Thibault Masson, Rental Scale-Up:

So, what’s interesting here, Andrew… And my cat agrees, apparently. What’s very interesting, Andrew, here is that this is very different from what I heard last week Graham Donaghue say. So, I was interviewing Graham, he’s the CEO of Sykes holiday rentals, which is basically the number two largest property management company in the UK. He was seeing some bookings in Q1 happening, quite a few of them, but really in the near term, and not so much for summer yet. He was optimistic they would be happening, but they were not happening yet, which is different from what you just mentioned. So, how do you explain the difference?

Andrew Martyn, Your.Rentals:

Of course, this is going to be different market by market, and that’s one of the other things you need to consider. What am I seeing in my market? What sorts of restrictions are there? Et cetera. So, for Sykes, of course, they have a lot of inventory in the UK, of course, and it’s in more leisure destinations, meaning that it’s targeting a more domestic travel audience. And I agree with him, he will probably see quite a good summer this summer. But what I think we’re seeing is, where we have UK guests booking travel at the moment, they’re typically booking for holidays abroad. So, they’re planning ahead with destinations like Spain, Greece, and Portugal being at the top of the list. We don’t see much demand ourselves for UK guests booking UK destinations at this point, so I think that the data definitely aligns with what we’re seeing as well.

Thibault Masson, Rental Scale-Up:

Yes, and… Thank you, Andrew. I’m going to switch now to Talia from Rented, because pricing is very important as well, and a bridge I would have here is that also, what Graham was saying… And we talked about that as well, is that, they know they’re going to sell out this summer in the UK domestic destination-wise, so they’re not cheap at the moment. So, pricing is very important depending on your market. So, Talia, how do you see this? How about booking trends? What should people be doing in terms of pricing?

Talia Lockard, Rented:

Absolutely. Can y’all hear me okay?

Thibault Masson, Rental Scale-Up:

Perfect.

Talia Lockard, Rented:

Good. Had computer issues, but I’m here. I’m excited to be here. So yes, pricing is a really big part of this, and I’d like to piggyback off of something that Andrew was saying, right? We’ve heard so much in the past two years that having flexible cancellation policies is how vacation rentals are going to continue to compete with hotels as the pandemic goes. Vacation rentals are doing amazing, whether or not US or EU, but we have to look at this on other perspectives as well, urban versus non-urban, and how is your strategy looking out? So, one way of checking is, is the flexible cancellation policy working, as Andrew said, was looking at booking pace, right?

Talia Lockard, Rented:

So, when you’re looking at booking pace as the property manager, it gives you a great view on how the properties are doing. Well, what about the owner? So, an owner who is looking on the other side of it and saying, “Oh man, we’re not getting what we used to get, everything’s going down, my ADR is down, or my occupancy is down.” Are you actually giving those owners… Giving them the right KPI to be checking? So, one thing I’d really like to hone in on is RevPAR, revenue per available night, also, whenever you’re looking at your trends, because if you think you have a lot of cancellations but your RevPAR, meaning the value of each night, is going up, and you can show that to your owners, they’re able to see even more data points that can help them understand the cancellations in there.

Talia Lockard, Rented:

When it comes to pricing, I think that it’s very important to just be aware of that strategy. I think we’re seeing a lot of early bookings happening, right? And maybe we’re seeing more of a trend coming up in the late bookings, but we’re not seeing the middle bookings, right? It’s either, you’re booking early for your holidays, for your family vacation… Or I want to go on a spontaneous vacation in the next couple weeks that are there. So, when you look at it this way, always having your price set at a premium outside of your booking window, right? For those extended early bookings that people are making, and then making sure, if the cancellation was to come up, that you also have a pricing strategy as soon as those gap nights and those last-minute bookings are available in there.

Talia Lockard, Rented:

So, making sure as soon as the cancellation happens that you already have rates in your tool or your system that are going to recognize that you don’t want the price to drop all the way, that you’re still looking at supply and demand, because just because it’s a last-minute booking, it could be a higher rate than the booking you got before, right? Depending on if the demand is in the area.

Thibault Masson, Rental Scale-Up:

This is something we’ve seen a year earlier in the US and in Europe, is that, demand is also coming back to cities, to the big urban centers. So, obviously, the strategies are different from one place to another, and as we saw in the case of the UK where Sykes has, let’s say, non-urban properties, there’s a big chance they’re going to sell out, so why lower your prices far in advance, to your point. Whereas, maybe urban rentals will probably have to compete with, let’s say, hotels, for example, or maybe more supply will come in, right? So, what do you think for urban rentals? What would be your advice here, Talia?

Talia Lockard, Rented:

I think with urban rentals you do have to be a little bit more flexible, and not in only your cancellation policy and your strategy, but in what will be your minimum nights, or your minimum stays, that it may not be able to be the same as it was before, because business travel and urban travel is just coming back, right? So, if somebody’s coming back, or somebody’s going to an urban area, they may not be staying for a week if Omicron is high, right? They may stay for a couple days, because they don’t have as much exploring to do. So, I would be as flexible as you can, so allowing a lot of minimum stay logic, so filling gap nights in there, maybe a lower minimum night stay if your operations can handle it, or if the owner’s okay with it, and really just always checking your health scores.

Talia Lockard, Rented:

In our tool, you can check your 70, 30 and 90 day health scores. I would say, this is something you should be looking at multiple times a week on an urban standpoint. Because urban’s still last minute, so you don’t know when the demand’s going to just spike out of nowhere. So, being a little bit more cautious in it, where, rural, you can look a couple of times a week if you’re using dynamic pricing,

Thibault Masson, Rental Scale-Up:

Thank you, Talia. What I’d like to share now is another topic. Next topic is profitability, because here, we talk about booking trends, and we talk about differences between different markets, as well. But another issue we have for property management companies this year is that bookings are coming back, on the revenue side, the costs are rising.

Thibault Masson, Rental Scale-Up:

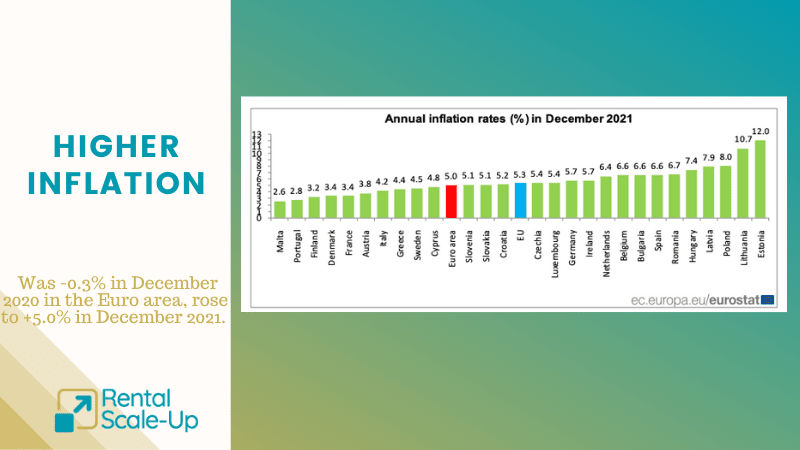

Let’s take inflation, for example. That’s inflation in Europe in December 2021. In December 2020, a year ago, inflation in the Euro area was minus point three percent. That was not inflation, basically. It was negative. Whereas it was plus five percent in December 2021. And Poland, for example, inflation was eight percent, so it means inflation is there, and it’s something new, and maybe some of the newest property management companies have never known inflation, quite frankly. So, how to handle that.

Thibault Masson, Rental Scale-Up:

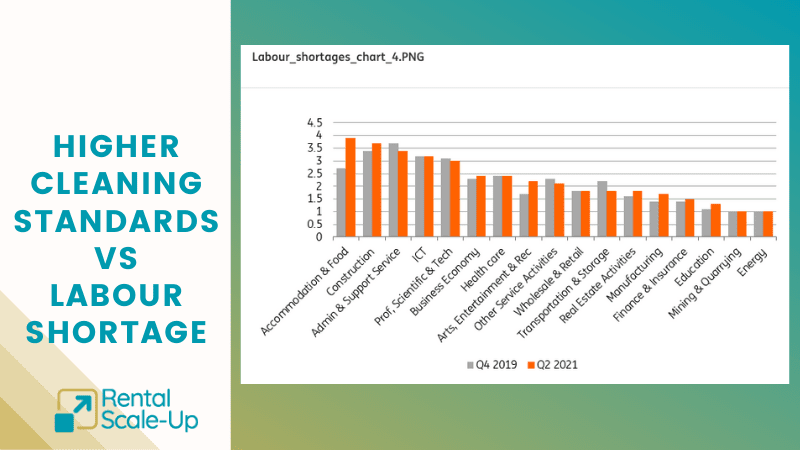

This graph is the shortage in labor per sector in Europe. So, the highest bar, the biggest shortage in labor in this sector. And no surprise, right? The sector with the biggest shortage is hospitality, right? Accommodation and food. And think about that. That was in Q2 2021. That’s the most recent data we have from Eurostat, but that was a time when a lot of places were closed, in Q2 2021. So, it means, again, we are at a time where, for example, cleaning standards are higher, but it’s very hard to find a cleaner. So, we’ll talk about that with our guests. Talia?

Talia Lockard, Rented:

So, the labor shortage and inflation is obviously a real thing. And I know, as property managers, vendors… Or even outside of our industry, right? We’re all feeling it, no matter where you are with that. So, one thing I wanted to really touch on with this is, how using automation in all different areas can help you with the labor shortage, help you to basically reach operational excellence without having those operational hands, and really… It’s the automation to help your team thrive, right? We’re all burnt out, we’re going to continue to be burnt out as markets are opening, so giving everyone the right tools.

Talia Lockard, Rented:

So, one thing, thinking keyless entry, right? So, automation. Just as simple as that. Keyless entry, codes for guests to be able to get in the houses. How does that help with labor shortage? So, you have a guest in the middle of the night who just drove an hour or three hours to a remote destination, and you don’t have anyone around, and they just can’t find the key. You maybe thought you put the key in a place that would be easy for them, but they can’t find it, and then, you would have to wake up a cleaning person, a maintenance person or yourself to go drive and give them the key.

Talia Lockard, Rented:

With keyless entry, it’s as simple as resetting the code, getting on a FaceTime, and showing them how to actually get in there. So, less having to get up and get your people to get out in the middle of the night, and also more guest satisfaction, right? Because if you have a guest that has to wait outside in the cold for a few hours, which I have been that guest before, it’s not that fun to do, and you’re very excited to get inside. Other apps, PropertyCare, and different apps that help you with your operational cleaning can easily tell you… Say, “Hey, a cleaner’s in the house,” and as soon as the cleaner is done, they can go into the app, tell everything that’s done so it pings the property manager or the reservationist right away that the new guest can check in or the property is open.

Talia Lockard, Rented:

Also, dynamic pricing, which is the tool that we have in revenue management. And one thing I was explaining earlier is saying, “Hey, if you’re going to do flexible cancellation policies, right? Make sure that you’re looking at your rates all the time to ensure that your cancellation rates are in there correctly.” That’s a lot of work if you don’t have a qualified revenue manager, or a revenue management team, or you have one revenue manager managing 1000 properties. It’s hard to do all of those things. So, using tools that are going to allow you to put in these rules to automatically do this as soon as a guest cancels, or automatically fills a gap as soon as your five night booking’s available, now you have a four-night booking available. These are just basically tools to really empower your teams to make better decisions quicker and faster.

Thibault Masson, Rental Scale-Up:

Yes, enabling teams to make quicker decisions faster is important when the team can’t be grown. And again, talking with Graham, for example, from Sykes, right? And I was looking at his job openings. Not that I’m interested, but he has plenty of job openings. We were talking about that in the UK. And the labor shortage, it’s not just the cleaners. It’s all over the map. We’re talking about labor shortage for revenue managers, or marketers. That’s why automation is really important for things. And maybe I could ask the question now to Henry from YourWelcome and PropertyCare.com, because Henry, you’ve obviously yourself talked with property managers in the UK about this labor shortage, and what they’re doing to solve the issue.

Henry Bennett, PropertyCare.com:

Thanks everyone for having us. Actually, to pick up on a point earlier, I think not only have some property managers not experienced inflation, it’s fair to say that a lot of underlying owners of the properties haven’t either. They’ve never seen mortgages, rates sometimes above one point five percent. So, I think the pressure will come twofold. One from the owners suddenly becoming potentially more financial pressure upon their portfolio, and therefore pushed upon the property managers. But I think the other thing that we’re seeing, and for those of us that possibly are a bit older is, we’ll know that inflation is likely to hit your operations side of your business before your booking flow.

Henry Bennett, PropertyCare.com:

Now, the reason why that is obvious is that, at a time when it’s difficult to recruit cleaning staff, maintenance staff, and some of the lower paid outside of your business, that has a real material impact on your business. And this is coming just at a time, when to be honest, I don’t think guests ever ask what cleaning protocols are prior to booking a vacation rental. Whereas now, obviously, in the COVID-19 world, your guests have pretty good eyes as well on what your cleaning protocols are. So, I think there’s a lot of pressure that’s going to be put on property managers, directly result of inflation, which isn’t necessarily something that anyone that’s set a property management company up or raised money to do so probably has ever put in their threats to their business. So, it’ll be interesting to see.

Henry Bennett, PropertyCare.com:

And I think from our side, we’ve been running YourWelcome, which is a tablet for vacation rentals, now, for nearly six years, and we do an annual survey of what priorities are for property managers leading into new years. And yes, it’s been quite interesting. You can imagine 2019, the world is a very different place. Things are going very well, the number one priority for all property… Or the vast majority that responded was property acquisition. They just wanted to grow, grow, grow. That’s pretty inevitable. And then, it was followed by guest experience and direct booking, but very much second and third to that.

Henry Bennett, PropertyCare.com:

And then, when we come into 2020, it was very much moved towards property retention, which again, is no surprises. Most of us know that, particularly as the pandemic started to hit, really, all you could focus on is trying to maintain the profitable parts of your portfolio. And then, occupancy obviously became the second one as revenues were drying up. But what’s really interesting for the first time in 2021… We’ve never had a response of anyone mentioning cleaning staff. That’s now number one. So, cleaning staff recruitment is the number one priority of the response from YourWelcome. Second of that is property acquisition, which I think is quite a fairly good summary of how everyone’s seeing this right now, is that we all know that with no cleaners, you have no property management business, you have no guests, and you’ve got awful reviews. It’s so key.

Henry Bennett, PropertyCare.com:

And then, the second thing that we’re seeing that inflation is having a big hit on property managers is, when we’re onboarding PropertyCare.com clients, which is a task management tool, you typically have to onboard all of your team members. Now, what we’re seeing is over 60 percent property managers that have signed up have some level of external cleaning resource. Which is quite interesting, because, a traditionally property manager would either go for everyone in-house, everyone outsourced, or maybe some emergency outsourced, but we’re now seeing a very mixed model, which is, I think, something we’re going to see going forwards, where I don’t think you can no longer rely just on employing a set number of people. And broadly, we’re seeing everyone managing the same amount if not more properties with the same amount or less cleaners, which puts huge pressure on your operations, which is a direct result of inflation, because everyone would like more cleaners, given a choice.

Henry Bennett, PropertyCare.com:

And then, I saw this first-hand myself. One of my colleagues was down in Cornwall, premium UK area, demoing PropertyCare.com, and everywhere you drove, you saw hotels, and bars and restaurants with signs up saying, “We no longer open Mondays, Tuesdays or Wednesdays,” purely because they can’t get the staff. I would imagine that cleaning resources are competing with bars for this temporary resource that is not there all year round, for obvious reasons.

Henry Bennett, PropertyCare.com:

And then, the last thing that we’re seeing, excuse me, is… Talia’s succinctly put it before, is automation. There’s always been, we all know, a huge disparity between what we call internally is Airbnb management companies, and by that, I mean traditionally venture-backed businesses that have raised capital. They see their businesses as very much just automating everything and outsourcing everything, as opposed to traditional VR companies. But really, within our discovery calls talking to property managers everywhere, it’s quite interesting, because pretty much everyone has some level of email communication automation, whether it’s just a very top-line automated response, but we see very, very little cleaner automation in the markets which we’re entering. So, with PropertyCare.com, that’s a completely new market.

Henry Bennett, PropertyCare.com:

It’s interesting that we’re seeing one of the other things in automation, which plays into what we’re talking about, as well, is that, for the first time, we’re seeing automation of how they can grow their inventory. So, they want that to play this automation into how they market and outreach to new owners. So, I think that’s going to become a key thing, as well.

Thibault Masson, Rental Scale-Up:

Thank you, Henry. It’s very clear, and I think it’s a great bridge that we’re talking about. Obviously, in terms of marketing or outbound outreach to get more supply, more guests, email, for example, is very important. And it’s a great segue to a topic that I think you know a lot about, but let me share just two slides again to share this last topic, which is the drastic change that’s threatening a lot of property managers. You may not know that. I know you actually taught me a few things about this. ‘

So, guest communications are at risk. So, I don’t want to be over-dramatic, but we’ve known it’s been already messy already to try to make sense of messages you get through the booking app, the Airbnb, and your channel manager, and direct, and the rest. But here, it’s something different.

Thibault Masson, Rental Scale-Up:

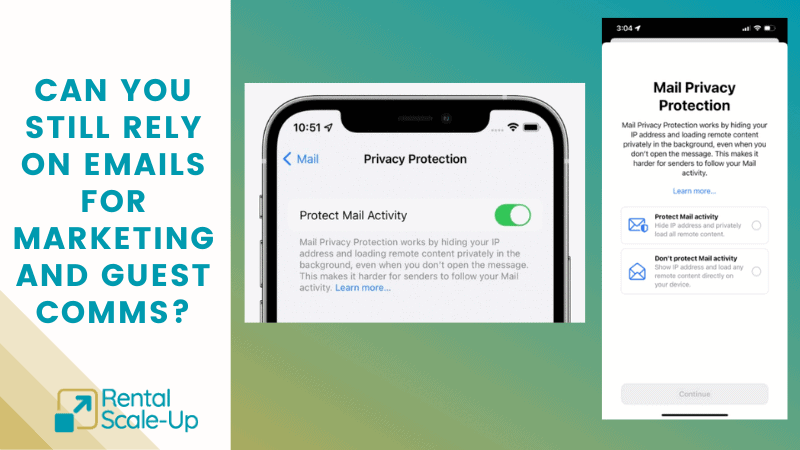

There’s been changes in the way Apple, for example, are now enabling its users to basically stop tracking, or make, let’s say… It’s harder for people tracking emails to have a clear idea of click rates. And it’s endangering, basically, communications to guests, and also in terms of marketing. And so, thank you, Henry, for actually explaining to us what I really mean by this. What’s the impact of what Apple did, and is it really important? Should we care as property managers?

Henry Bennett, PropertyCare.com:

Yes. Sadly, it will impact you, you should definitely care, I think is a summary. But I think broadly, there’s four types of guest communications, and they differ as you go through the guest journey. So, there’s obviously email, which everyone uses here, I would suspect. SMS, WhatsApp, and also the OTA direct messaging apps as we just covered. And really, when you’re in… If you look at a guest journey, when we started YourWelcome, which is obviously a physical tablet in property, one of the things that we identified very quickly is that email communication is really effective pre-arrival, because people are excited about their holiday, they’re worried about getting into the property, how the property’s going to work. So, they open all your emails, they look at them. Once they get into property, email is a poor form of communication to try and upsell, or to communicate with your guests, as they generally aren’t going to be checking their email. So, SMS or some sort of physical tablet is a lot more effective.

Henry Bennett, PropertyCare.com:

But one of the challenges which we are all going to face, and whether you’re a property manager, or a tech supplier in any industry, or tech supplier to the property management companies, is that Apple introduced their mail privacy protection, and anyone that’s updated their iPhone or Apple device would’ve had a popup that turned up, and the majority of people are pressing it, which essentially means that it’s going to reduce the ability for emails to land in people’s inboxes that you don’t know, and also, you won’t have any insight into the open rates. So, I think a survey in Adweek, which is a British publication tracking marketing emails, revealed that just over 50 percent of Apple users are now obscuring open rates and affecting their spam rates.

Henry Bennett, PropertyCare.com:

So, what does that mean for you guys? Well, one of the slight challenges that we all face is that there’s always been ambiguity in our industry about who owns the guest. So, the guest books through the OTA, so OTAs have always said that they own the guest, and that’s been a topic I’m sure you’ve discussed before at some point. And then, there’s the property managers, and then there’s the tech companies that provide the communications on behalf of the property managers. So, what does that mean? That basically means that the guest is potentially going to get an email from someone they don’t know, and what that could mean going forward, particularly with Apple’s changing with this, is that your guest might not see it, which is a material problem for property managers, as we know. If you’re sending door codes or key information, you need your guest to be seeing that.

Henry Bennett, PropertyCare.com:

And I think that one of the things that we’re seeing from this from discovery calls from PropertyCare.com is, particularly in Europe, people really, really want to start using WhatsApp because one, it’s got the red symbol on there, two, pretty much everyone has it on their phone and there’s a very, very quick response rate. And if you look at America, WhatsApp’s not so popular, SMS is the one to use. But unfortunately, it’s not as clear as just saying, “Move all your coms to WhatsApp or to SMS,” because both of these also come with challenges, as well. And the reason why we’re going to go into this little bit is PropertyCare.com is very, very focused on providing communications to your guests, as well, through these mediums.

Henry Bennett, PropertyCare.com:

So, the challenge with WhatsApp is, most of you will know, it’s owned by Facebook. Facebook are very protective over WhatsApp, and they don’t want it to become a marketing channel, because people will switch off. So, one of the things that has to happen, if you’re going to start communicating by WhatsApp, apart from ad hoc texting responses, but more on the automation side, is you need all your messages pre-approved by Facebook. So essentially, what you do is, you need to have a number of key messages that are outlined as a response to a booking inquiry, or how you’re going to send your door code, or how you’re going to try and upsell a late checkout. All those need to be pre-approved before you start selling on WhatsApp. Otherwise, you’ve got chances of being banned from the platform, which obviously would have a material impact going forward. This, by the way, is only if you’re automating, not if you’re just sending WhatsApp just with someone on their phone in the office. But as anyone knows, at this scale of business, that’s not a scalable way of communicating with guests.

Henry Bennett, PropertyCare.com:

And then, the same is true on SMS. So, SMS is one of these things where there’s a lot of automation. I’m sure all of us have had those in our phones. But one of the things that’s come in in the US is that they’re trying to regulate the automation of emails from computer to people’s handsets. And this is called application to person on 10 digit code (A2P on DLC), which is a catchy name, but essentially it means computer to phone. And this regulation’s going to have a huge impact in the US on how property managers communicate, and it is inevitable that it’ll come over here, as well. So, none of this is a necessary reason to be concerned imminently, but I think it’s something you should also be considering when you’re talking to PMSes or third party suppliers about what protocols they’re using, and how much they about this space if they’re going to be sending WhatsApp, email automation or SMS on your behalf.

Henry Bennett, PropertyCare.com:

That’s a very quick summary of where we’re going. And I think one of the things I would recommend, if you do use third-party suppliers, whether it is your PMS or a company like PropertyCare.com, try and make sure that you as the property manager are actually the SMS provider, i.e. you’re signing up with the end company that is delivering those emails as opposed to doing it as part of everyone that a company is sending. So say, for example, a tech company is sending out SMSes for hundreds of property managers. If there’s one bad actor that’s sending out marketing SMSes when they shouldn’t, you could also get banned. So, just look into how people are sending SMSes on your behalf.

Thibault Masson, Rental Scale-Up:

That’s really great advice for guest communications. As we said as well, right? It’s also threatening email marketing data in the sense that your open rates may be higher than ever, and you may think it’s great. But actually, what happens, basically, Apple preloads the data from each email. It’s as if it had been opened in a lot of cases. So, they will count as open, so you’ll think, “Oh, my open rate is going up.” Actually, people didn’t open. So, if you have a follow-up sequence, if you’re emailing a newsletter, for example, in my case when I’m writing to guests, I have a MailChimp, I have an email sequence where, if they did not open the email where I ask them to give me the time they arrive at the airport, I’ll send them a text. These sequences will not work anymore, because your system will think the email was open. It actually was not, just because of these new settings of Apple’s.

Thibault Masson, Rental Scale-Up:

That’s just a summary of how it may be affecting a lot of metrics that we have been relying on, and I think 40 percent of people are using Apple to read emails. Something like this, if I’m not mistaken. So, it’s big. Talia or Andrew, do you have… At that part, in terms of guest communications, what to do, what’s your take on it?

Andrew Martyn, Your.Rentals:

First, thanks Henry for bringing up such an interesting topic, I think, and challenging. But the main thing here, I think, is that you want to be talking to your guest through the channels that they prefer. Everybody prefers different channels. And at different times, as Henry pointed out, the email may be switched off once they’ve checked in. So, that becomes quite a complex technical challenge to be able to distribute and receive messages on different channels like WhatsApp, or SMS, or email, and have the replies come back into somewhere where you can see them all in one place. Something we’re working quite hard on at Your.Rentals, and it’s a little bit like building a telecom company inside the company, because it’s technically very challenging, a lot of use cases, and also changes like Henry’s talking about that are coming up, as well. So, probably something you’d want to have a good supplier, tech vendor, whether it’s a PMS or somebody else to help navigate that.

Thibault Masson, Rental Scale-Up:

Thank you, Andrew. Talia, anything else to add on the guest communication side?

Talia Lockard, Rented:

Sure, I definitely think Andrew and Henry really nailed down on exactly what’s happening, and what you can do on the tech side. What I would like to offer is, thinking outside of the tech, why automation and all this stuff is going to make it easier for you to do communications, and be diverse in your communications. Also, realizing there’s this level of making sure the guest knows your brand, picking up the phone if we really have a big problem with them answering, and now that the pandemic… We’ve gone through it, we don’t think we want to pick up the phone, because we want to do everything faster by automating it, and getting it to our guests. But also, everyone has been in their house at the same time, getting all these same text messages, all these same automated emails over and over again. It’s surprising how much I’ve noticed a lot more people want to build that on the phone relationship with you and remember you. So, don’t be afraid to have that communication.

Talia Lockard, Rented:

Now, that goes back to inflation, right? If you have a labor shortage, who’s going to be calling everybody, and doing all that? My last point there would be, thinking outside the box with this inflation. You may not have somebody on your staff right now who wants to call and check in with all your reservationists, but if you went somewhere and you saw an amazing server who gave you the best hospitality experience at a restaurant that night, maybe that’s a good person that would make some calls for you. Thinking outside the box on who can help you do these things that automation may not be able to get you to in terms of whether or not they’re not answering, or more rules and regulations.

Thibault Masson, Rental Scale-Up:

Thank you, Talia. So, in a nutshell, we talked today about the trends, what’s happening, and not just in terms of booking trends but alson changes happening to us in terms of profitability, or even connection channels. Uvika will tell us at the end what you’ll be getting out of this, but I think right now, we can only answer a few questions. There was actually a question, and Andrew, thanks for replying to this. I think you did, but I’m going to ask the question aloud, and you can answer the question as well. So, the question I think was from Marla, and she was asking, “Is there any way that the hosts can purchase cancellation insurance, and would it cover COVID?“

Andrew Martyn, Your.Rentals:

It’s a really good question, Marla, and I’ve been asked it so many times the last 18 months. We looked really in-depth into… We had talks with a lot of insurance underwriters, some specialized in vacation rentals, others more larger companies, and basically, it came to the same point every time, that the risk is so uncertain that they could not bring a product into the insurance market that would be priced where anyone would want to buy it. So, the challenge was insurmountable, you could say. So, that’s when we started to dig into, well, we have this thing called cancellation policies. Let the guests pay for the insurance of having their money back or not. That was basically where we came to in our thinking.

Andrew Martyn, Your.Rentals:

So, I know it’s maybe not the strategy that everyone likes to adhere to, but we recommend for our property managers to set prices at all three levels of cancellation. So, your regular partially refundable policy where the guests will have 50 percent refund if they cancel. That, you charge your normal rates for. For a free cancellation, then you mark up even 30 percent. People are paying this, guests are happy to have the option, and they’re prepared to pay for it. You can see by the conversion rate on those policies are so much higher than anything else right now. And then, for non-refundable as well, we see that as a great opportunity to lock in revenue at a slight discount to your normal rates. And when you’re able to present the guests with two or three options on many of the channels now, they will make the choice and decide whether they want to pay extra for the flexible policy that gives them a full refund. What we try to do is share the data so you can make good decisions about how you should price that.

Thibault Masson, Rental Scale-Up:

Thank you, Andrew, and I can see in the chat that Daniela and Mark had also suggestions about this, and Mark, a friend from Rentivo, who’s here, saying that, in terms of COVID coverage, they are discussing with Protect Group who offers some form of coverage integrated solutions. And Daniela, who’s got properties in Marbella, says that she’s maybe more addressing the confidence… She’s offering a 30 percent deposit by the 31st of March 2021 with free change of dates up until three days before arrival for health reasons, and balance on arrival. So again, what I like in this approach, as well, from Daniela is thinking… Which I also have my mind is, maybe right now we are in the middle of this craziness, and maybe after that, after Q1, we can be a bit stricter about this. So, we give convenience now, and if people are seeing this crazy time into Q1, we can do this, but still make sure to be stricter.

Thibault Masson, Rental Scale-Up:

And to that, I will address something Uvika noticed also today, and she was telling me earlier that… As you may know, Airbnb, Booking, all the others have changed their cancellation policies to extenuating circumstances in 2020. COVID is not a reason anymore to get a cancellation. For Airbnb, it’s only a reason if you are actually sick. If there’s travel restrictions, that doesn’t count. And yet, Airbnb has a new system now, just issued that, they’re going to give you travel credit if you can’t travel because of Omicron. Why? Because there’s been a wave of cancellations of people not sure whether they want to book, but Airbnb can’t force us property managers and owners anymore. They can’t force us to massively cancel things. So, what they have to do, they’re offering to travelers travel credits if they have to cancel.

Thibault Masson, Rental Scale-Up:

So, it is interesting, but to me, they’re only doing this because they think it’s temporary. They think this Omicron thing will end, so they have this temporary solution, but let’s see what it is. Any other question we have on the topic, or any other reflections from our speakers, maybe?

Andrew Martyn, Your.Rentals:

Thibault, the credits from Airbnb is that for any other property, or the same property, or same post?

Thibault Masson, Rental Scale-Up:

Obviously, an OTA would do this for their platform, not for various…

Andrew Martyn, Your.Rentals:

Yes, and that’s exactly one of the pushbacks, we got to that. So, we actually provide the… That’s the same feature, it works on any OTA channel we can support, but only for the same property manager’s property for re-booking.

Henry Bennett, PropertyCare.com:

Yes. I think also, the other thing to add, as well, is that, particularly the UK government was very guilty of this, is that they decided quite early on not to bail out the airlines, but in return, what they didn’t do is go after them for refunds when planes were canceled. So, one of the things that that’s done is no fault of property managers, but I think there’s also a consumer confidence crisis with believing that an airline is going to give your money back. Now, obviously there’s reasons why the government did that, but I think that the knock-on effect of that is going to be that people will book their flights later, as well, because they have no confidence that these bigger airlines will hold onto their money for months, and months, and months, and try and give them a credit to somewhere they don’t want to go in winter, which I think is always going to be a challenge going forward, as well.

Thibault Masson, Rental Scale-Up:

So, I think it’s a point we had, as well, and I’m going to close on that one. So, I shared at the beginning, this whole cross-border travel. So, we’re also guessing, right? That… I think Andrew touched upon that with the people… A lot of people did travel across borders. It was a bit complicated, there was lots of back and forth, but they did last summer across borders. Numbers were going up, the QR code, now, in Europe is… Again, no small feat. 27 countries getting together, I think even Switzerland. I think the UK is aligned or not, I’m never sure, but I think they aligned. But at least, this thing, they managed to get at least 27 countries to agree on a format for a QR code, it’s working. And now, everybody has their eyes on their phone, right?

Thibault Masson, Rental Scale-Up:

Last year, stays were soft until June, but stays probably will be happening earlier around Easter, for example. So, Easter should be good, right? This is also what you think that… Because we talked a lot about right now, we talked a lot about summer, and Australia was saying this in between this soft belly, but I think Easter looks pretty good. Or does anybody have trends, or data, or some analytical evidence around this, or people watching? Do you have an idea that you can share around your Easter data?

Uvika Wahi, Rental Scale-Up:

I think I have something to share here, I’m so excited. Well, I think the attitude towards COVID is changing in Europe overall, because for example, in Spain, there is a demand to have COVID be treated as endemic, so as the flu, basically. What that would mean is, that would change the rules around quarantine, et cetera, and obviously that’ll impact travel, and it will impact booking windows as well. You can already tell that people are moving to downgrading it in terms of what its impact is. They’re already demanding that in Europe. In Spain, it’s actually a movement right now, so that’s something to keep an eye on as well, because that’s going to change how people travel as well.

Talia Lockard, Rented:

Sorry, I was going to add to that. I am in the US, but that was what I was going to add to that, is what we’ve seen in the US… And obviously, it’s a lot easier, it was a lot easier early on for us to travel and stuff in the US is that, as I’m talking to everyone in the past couple months and really into the industry, everyone last year who was very dead set on staying in the US, and going to drive-to market locations, they don’t want to do that. A lot of the US people I talk to now, they are planning their European, get out of US vacation this year, and the thought of even saying Omicron or COVID are not coming out of people’s mouths, because they’re like, “Oh, this is here,” right? But they’re downgrading it, and they’re still thinking of their future plans, and how to change it from what it’s been the past two years.

Thibault Masson, Rental Scale-Up:

It’s a fair point, as well, for people who depend on the overseas market, like the US. Obviously, as we talked about, but the attitude… And again, the baby agrees with me. The attitude towards COVID, also, is a bit different, obviously, in Europe. I think we talked about this with Henry, we were referring this, is that, in Europe, you have to repeat a lot about protocols, COVID-19 protocols, right? Guest communications are very important. Within the US, I think Henry is telling me, his teams are like, “Well, you guys in Europe are still talking about COVID?”

Henry Bennett, PropertyCare.com:

For us as a company, because we have offices both in London and also in Florida, it’s been a recurring theme of the pandemic, where London, who’s had probably one of the worst COVID cases and also restrictions alongside Europe, where completely polar opposite in Florida where seemingly, there’s been virtually no restrictions, I’m not sure about the cases. But yes, it’s been interesting running a tech company that runs between both sides, where one seemingly has no… Not interest, but it’s not the top priority, where the other side, no one talks about anything else other than COVID. It’s interesting.

Talia Lockard, Rented:

It is, and that’s exactly right. When you were saying London versus Florida, our company, we’re all virtual. We have Bermuda, we have some in EU, all over. And even in different parts of the country, the west coast versus the east coast of the US, in general. It is very different in everywhere that we’re looking, right? And juggling that.

Thibault Masson, Rental Scale-Up:

All right. Thank you so much for your time, everybody. Uvika, please take it away, because I think there’s things that people will be getting after this call, so you take us through this, please.

Uvika Wahi, Rental Scale-Up:

Will do. Thank you, Thibault. And thank you, everybody else, for your insights, for working together with us on this, and thank you everyone for joining us and attending. Please keep an eye out in the coming week for an email from us with the session recording of this conference so you can watch it later, even perhaps share it with your friends who you think this might interest. And also, in that email, you can expect a report, an exclusive report that we’re creating that has all the data that we shared today in the report, as well as the main talking points from today, and main insights. So, you will have that handy. And finally, you will also get access to exclusive discounts and offers from all our partners today, from Your.Rentals, from PropertyCare.com, from Rented. So, keep an eye out for that, so you can make better decisions for your business.

Thibault Masson, Rental Scale-Up:

All right. That’s it. Well, okay. Thank you everyone. Thank you, Uvika, for organizing, and Andrew, Henry, Talia for being here today.

Talia Lockard, Rented:

Thanks for inviting us.

Henry Bennett, PropertyCare.com:

Thanks, Thibault.

Thibault Masson, Rental Scale-Up:

Bye, everyone.

Andrew Martyn, Your.Rentals:

See you later.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.