Our vacation rental data partner AirDNA has just shared with us its review of the European market for February 2022.

AirDNA review of the European market – Takeaways

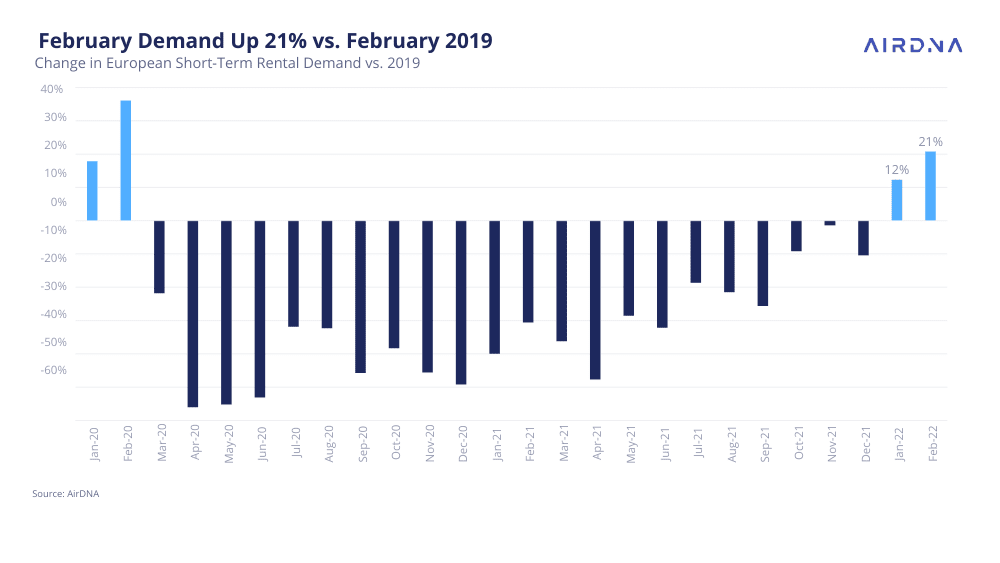

- February 2022 hit a post-pandemic high in demand (+20.8% vs 2019), ADRs (+28.9% vs 2019) , and revenue (+77.3% vs 2021), although the future remains uncertain because of the Ukraine/Russia conflict.

- Spring booking pace for 2022 is +113.5% vs 2021, and +3.4% vs 2019.

- ADR pacing for spring is decelerating from all-high 2021 (-4.8%) but remains (+24.6%) above 2019

- Summer vacations are pacing high: +74% more summer (June-September) nights booked than in 2021

- Supply continues to recover throughout the continent, (+4.1%) vs 2021 although lower than in 2019 (-7.5%)

- Occupancy for Feb 22 was 47.8%, still below Feb 19 (48.9%) but above Feb 21 (44.1%)

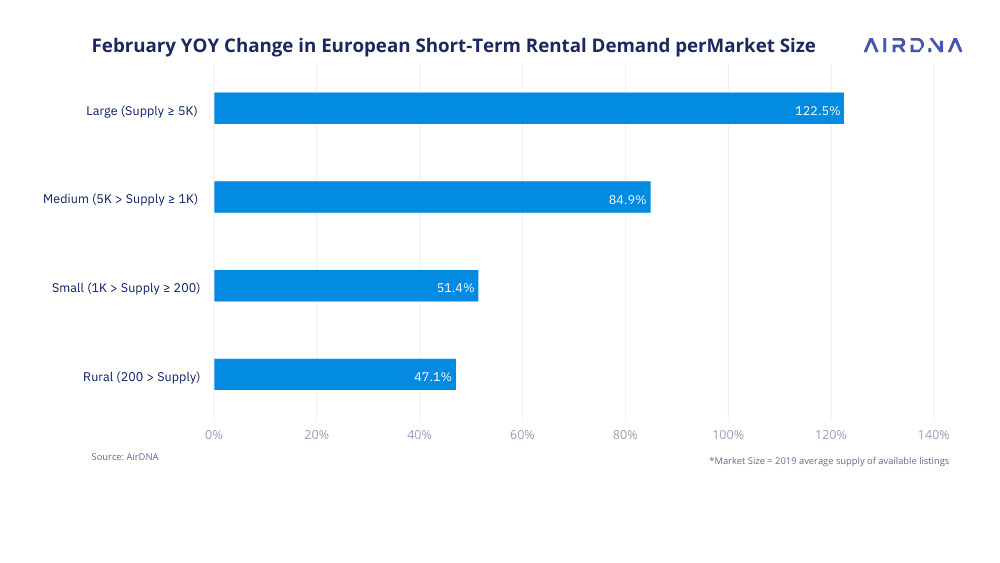

- Strongest year-on-tear growth for Feb is for properties located in large markets – with at least 5,000 available listings – (+122.5%) and medium markets (+84.9%).

Impact of the Ukraine – Russia war on through Airbnb data

The dataset examined by AirDNA went from February 1 to February 28, 2022. As Russia invaded Ukraine on 24, the impact, if any, was probably barely felt in the data of the month. While Ukraine and Russia do not represent Yet, AirDNA was able to measure the impact of the war in 2 ways when looking at Airbnb data:

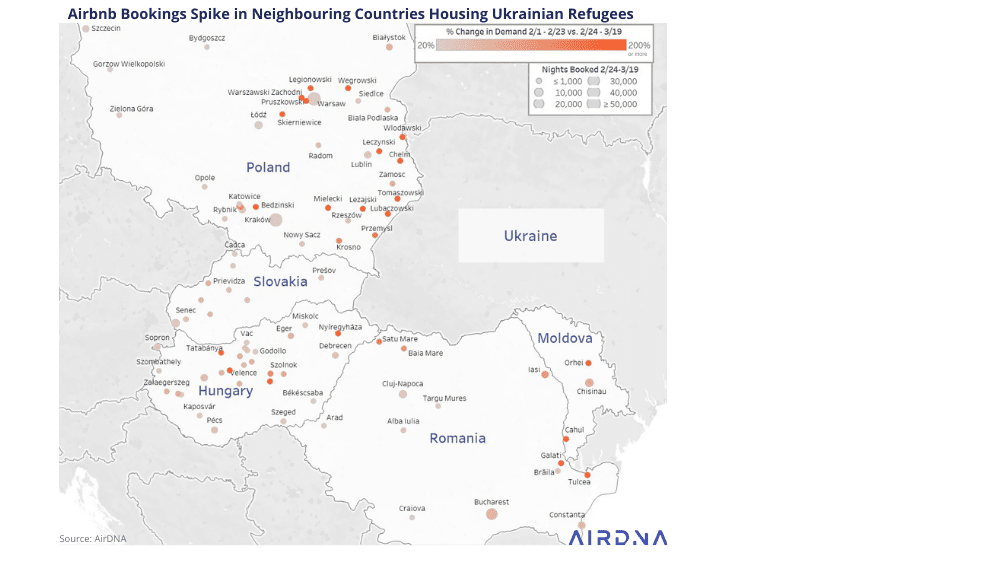

Spike in Airbnbs booked in countries and cities neighboring Ukraine

The chart below reports the number of Airbnb bookings in countries located near Ukraine. It compares two periods of time: The first 3 weeks of February with the first weeks following March 24, when the Russian invasion started.

Along the border with Ukraine, you can see a clear increase in Airbnbs booked. It is hard to know exactly what happened, but it can be a mix of:

- Ukrainian booking short-term rentals as they are fleeing their country

- Local hosts lowering their prices or even hosting people for free through Airbnb.org’s Help Ukraine scheme

- Europeans booking places by the border to fetch families and friends or to bring some relief

- Donators booking airbnbs to then offer the nights to refugees

Spike in bookings in Ukraine from Airbnb users using the platform to send money donations to Ukrainian hosts

Armed with their Airbnb account, travelers used the company’s payment platform to send around $5 million in revenue in 4 days, according to AirDNA. These bookings, usually for the same night and for a few days, represented over 140,000 nights booked in war-torn Ukraine.

You can see on the graph below that people started bookings stays in Ukraine as soon as March 24, when Russia invaded the country. As the news spread on social media that using Airbnb’s payment platform to support Ukrainians was easy to do, the number of booked nights started to increase in early March.

February had much good news in store for the Europen short-term rental market

February 2022 hit a post-pandemic high in demand (+20.8% vs 2019), ADRs (+28.9% vs 2019) , and revenue (+77.3% vs 2021).

In the US, demand figures started turning positive in January and February 2021. In Europe, it took 12 more months, until January and February 2022, for demand figures to finally surpass 2019 levels.

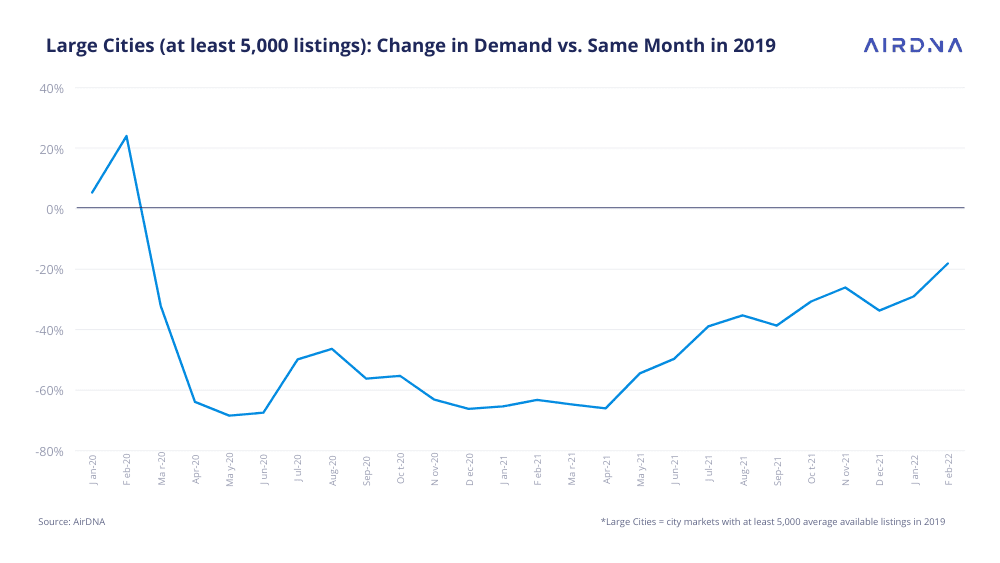

Demand and Supply are finally rebounding in large cities

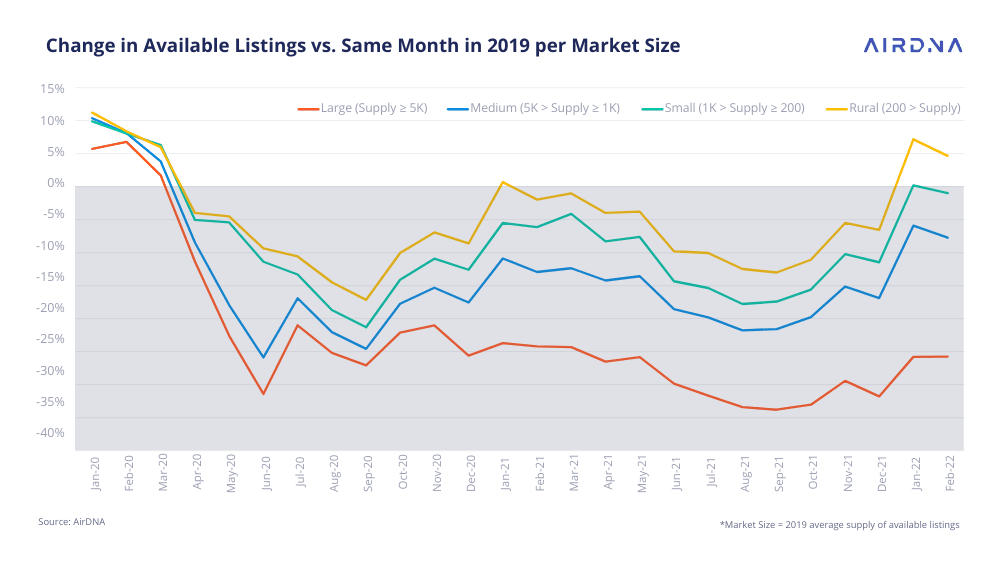

Here’s how AirDNA segments the market

- LARGE = Large cities: at least 5,000 average available listings (24.7% of total share)

- MEDIUM = Medium cities: at least 1,000 average available listings but less than 5,000 (28.7% of total)

- SMALL = Small towns and cities: at least 200 average available listings but less than 1,000 (24% of total)

- RURAL = Rural areas: less than 200 average available listings (22.6% of total)

As you can see below, the demand in large cities is still 19% under 2019 levels, but it’s been creeping up since April 2021.

The graph below compares 2021 vs 2022 demand data for short-term rentals in large cities, medium cities, small cities, and rural markets.

As mentioned above, demand is back from 2020 and 2021. Compared with February 2021, demand for large cities is up 122.5%. As we’ve seen, this is still very much under pre-pandemic 2019 levels, but this is a marked and positive change from the situation one year ago.

Rural markets did well in 2021 and are still growing in demand by 47%, which is remarkable.

Now, in 2021, several European countries were still under lockdowns and travel restrictions, so positive trends were expected.

In terms of supply, large European cities are 30% lower than in 2019, while rural markets are up 5%. Supply data is inching back up across all markets but seems to follow demand with some delay.

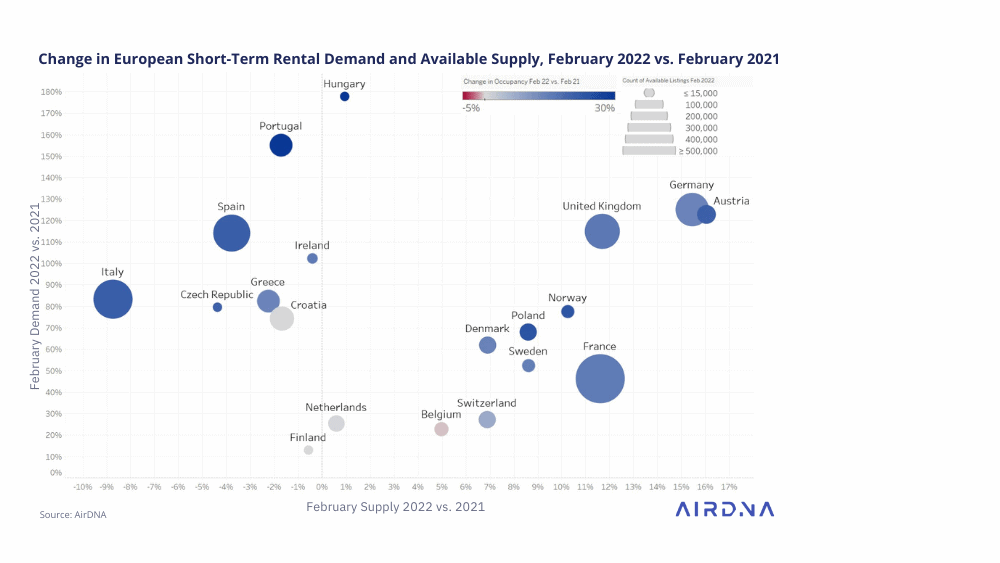

If you look at demand by country, with the chart below, you can see huge increases from February 2021 in markets such as Germany and the United Kingdom (+120 to 130%) where travel restrictions were severe. Spain, Portugal, and Italy are also progressing as cross-border travel is not an issue in 2022 (+ 80% to +160%).

Now, France is not increasing as much (+45%) as it actually had a great month of February 2021, so the relative increase is less spectacular.

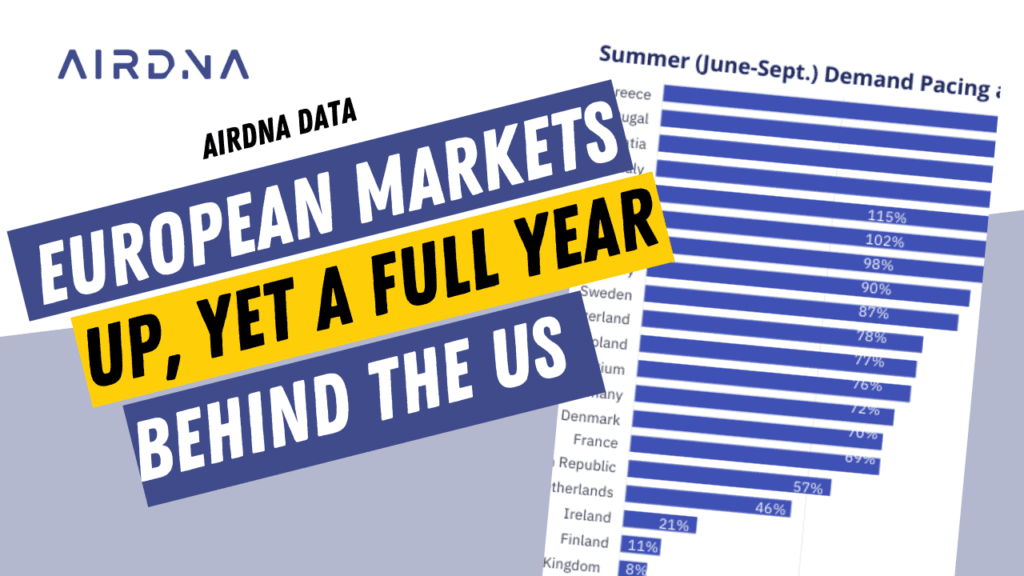

Summer 2022 predictions

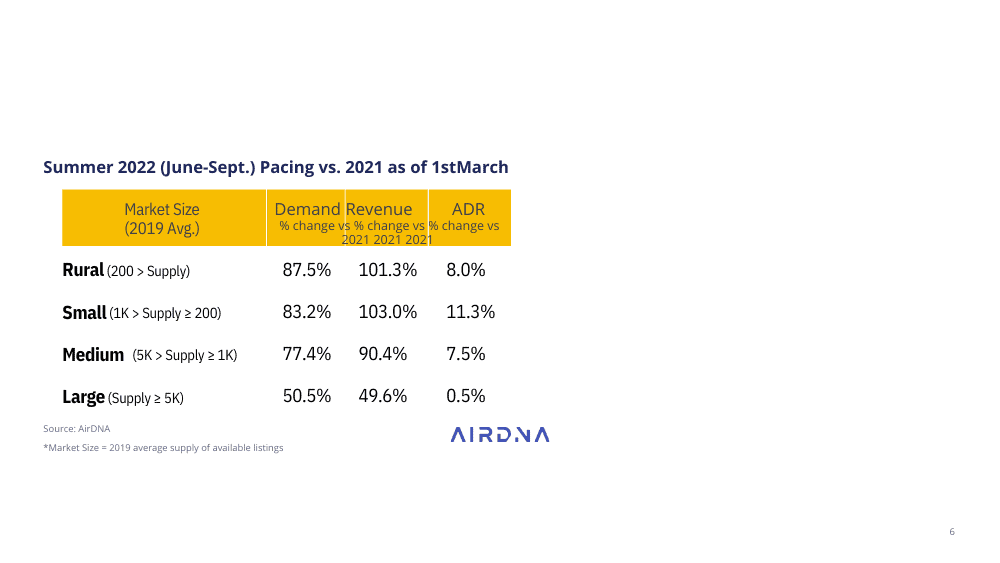

Here, AirDNA is looking at booking pace data, i.e. data from bookings for stays in the upcoming months. It helps see whether people are booking more for summer 2022 then for summer 2021, at the same period of the year.

As of March 1st, 2022, demand for Summer 2022 was up 87.5% for rural markets compared with the situation on March 1st, 2021. Even large cities are at +50.5% in demand, yet starting from a lower point.

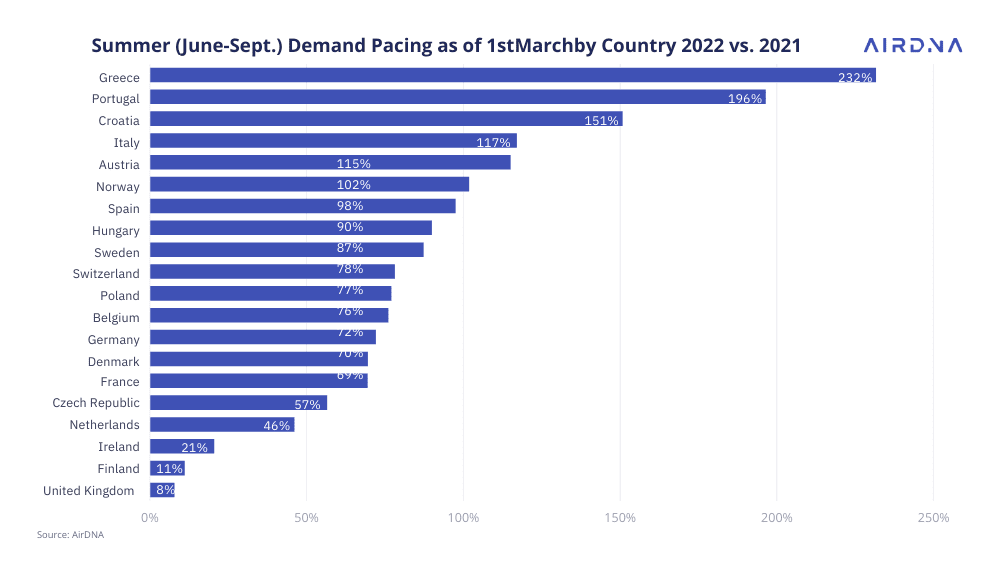

The return of cross-border travel and fewer uncertainties of travel restrictions are benefiting Mediterranean markets, as Nothern Europe feel confident that they can travel south for Summer 2022.

For instance, booked nights recorded for summer, as of March 1st 2022, were up:

- +232% in Greece

- +196% in Portugal

- +151% in Croatia

- +117% in Italy

It may not mean that bookings will end up being +232% higher in Greece in 2022 compared with 2021. It may just mean that travelers are booking earlier in 2021 than in 2022.

Countries that did well in 2021, for instance thanks to domestic demand, such as the UK and France, are progressing, but not as much.