Vacasa, the leading property management company in North America, representing 30,000 properties, is to go public in Q4 2021 through a merger with a public company. We’ve already looked at Sonder’s investors’ deck and the HomeToGo presentation, both vacation rental businesses going through the SPAC merger path. While IPOs can take a long time and focus investors’ attention too much on actual profits, the SPAC route is supposed to be faster.

Today, let’s have a look at the Vacasa SPAC presentation. We’ll first compare some data with what Airbnb, Sonder, and HomeToGo shared. Then, we will focus on what makes the company unique: It is an acquisition machine that has gobbled up over 160 property management companies, among which big names such as Wyndham and Turnkey. The deck does a great job talking up Vasaca’s “portfolio strategy”, which analyzes data to decide which markets to enter and then assess which existing local property management companies to acquire. Instead of going after properties one by one, Vacasa wants to enter markets where it can offer a wide choice of properties fast.

It is a chicken-and-egg story: It does not make sense to start spending money on marketing a destination if you do not have enough properties there to satisfy demand and have a positive ROI. So to go faster, Vacasa tries to build a solid local presence in key markets where it sees potential. For instance, Vacasa says it manages 47% of Airbnb’s listings in the popular Destin, Florida market.

Caveat: While Vacasa is an exciting case for studying a growth strategy and looking at the metrics a company chooses to use to reflect it, we cannot ignore the elephant in the room: The ultimate success of the company will come from mastering its operational costs and making profits.

A $4.5bn valuation for 30,000 properties (and no profits so far)

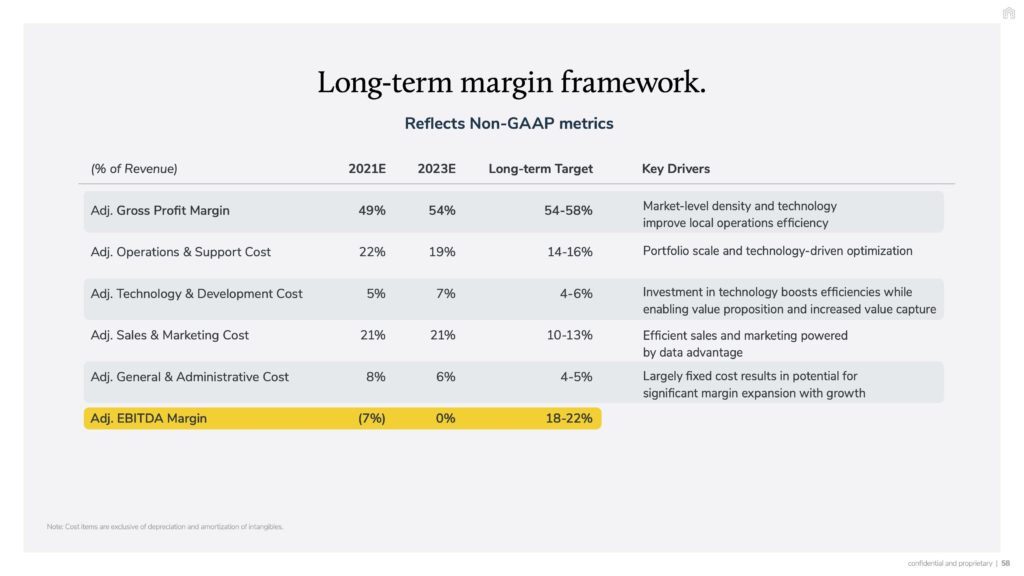

Vacasa is not profitable yet. The company bets that it will grow enough to dominate local markets and increase its rates while saving more money thanks to its tech and operations economies of scale.

Yet, to achieve profitability, Vacasa also needs to reduce costs (e.g. in tech, sales, and operations). It is where the deck falls a bit short. Unlike Airbnb, Booking.com, or Etsy, Vacasa has to run complex offline operations. Just think about having to coordinate housecleaning and maintenance across so many markets. Are there really economics of scale here?

Sonder, in its own investors’ deck, makes a point about having hotel-like properties, where multiple listings are located within one building. Vacation rentals are usually spread out throughout a local market, so running cleaning operations is just more time-consuming. Outsourcing cleaning to local companies is a way to solve the issue, but then you need to make sure that the local cleaner (or the owner coordinating the cleaning) respect standard that meet the brand’s expectations.

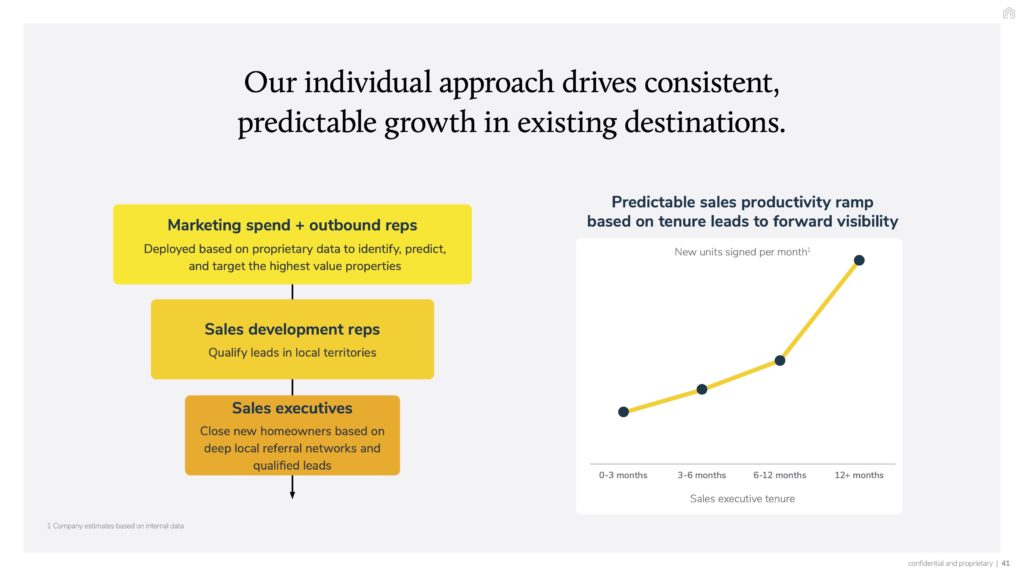

Similar, Vacasa needs to employ a large number of sales associates across various markets. The deck does address the fact that the more seasoned a sales associate is, the more properties the bring.

Looking at Vacasa’s current job openings, you will see the high number of housekeeping, maintenance, and sales positions currently open.

Let’s have fun and compare apples and pears. Here’s the valuation of some vacation rental businesses against the number of listings of units they have. It does not fair to compare Vacasa, which owns the exclusive contracts with a homeowner, with Hometogo, where the link between a homeowner and the platform can be tenuous. For instance, a property manager may list a property on an OTA which in turn may list the said property on HomeToGo. There is value in being closer to the homeowner and in supply exclusivity.

| Valuation in $bn | Number of units/listings | Unit value | |

| Airbnb | 90 | 7,000,000 | $12,857 |

| Vacasa | 4.5 | 30,000 | $150,000 |

| Sonder | 2.2 | 12,000 | $183,333 |

| HomeToGo | 1 | 14,000,000 | $71 |

Note that Homes & Villas by Marriott International, or HVMI, has around 35,000 whole-home listings.

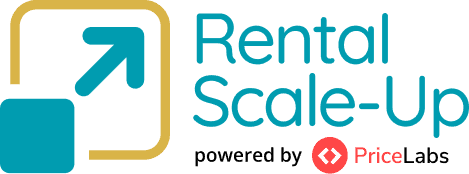

Vacasa uses external and proprietary data to identify promising opportunities in new and existing markets

In its investor deck, Sonder made a point of showing how savvy the company is at picking the right markets to enter and the right building to lease. The company put forward its propertiary tech that allows it to map mapping real-estate opportunities and potential RevPar.

Similarly, Vacasa wants investors to know about its “proprietary data and AI engine” that drive “intelligent supply acquisition”. This is about saying that the company makes smart decisions and that its processes can be hard to replicate, which is a reason to believe that it has a competitive advantage.

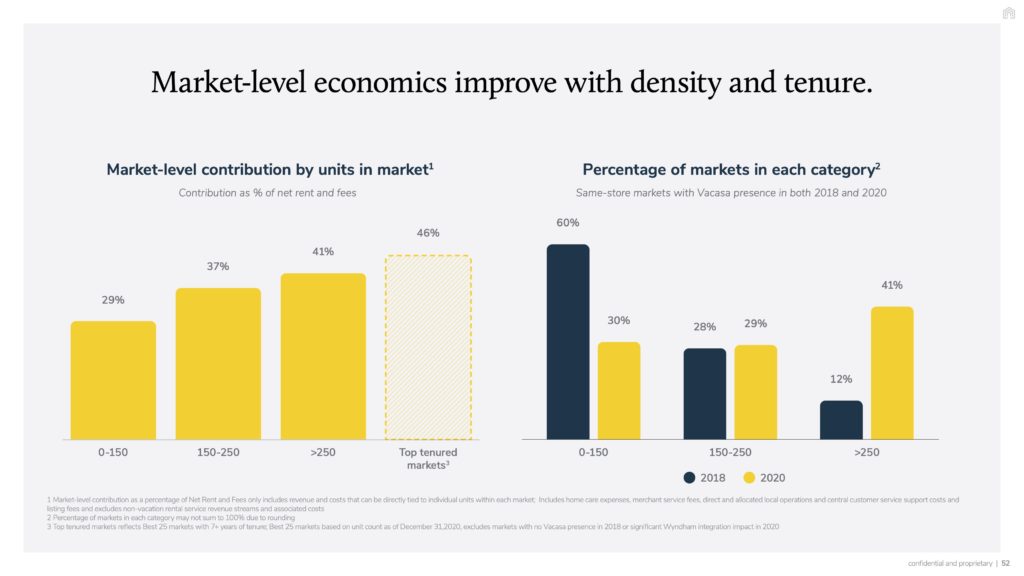

Vacasa wants to dominate markets fast to exert market pricing power and to achieve economies of scale for its operations: The more vacation rental properties the company manages in a market, the better it can justify the expenses to market the destination and to recruit and train housekeeping teams. Vacasa’s dynamic pricing tools can also better respond to market trends and even help influence average prices in the area.

The slide below shows that the more properties Vacasa manages in one specific market, the higher the revenues (in host and guest fees) it makes.

Market domination can also help Vacasa negotiate better commission terms with OTAs

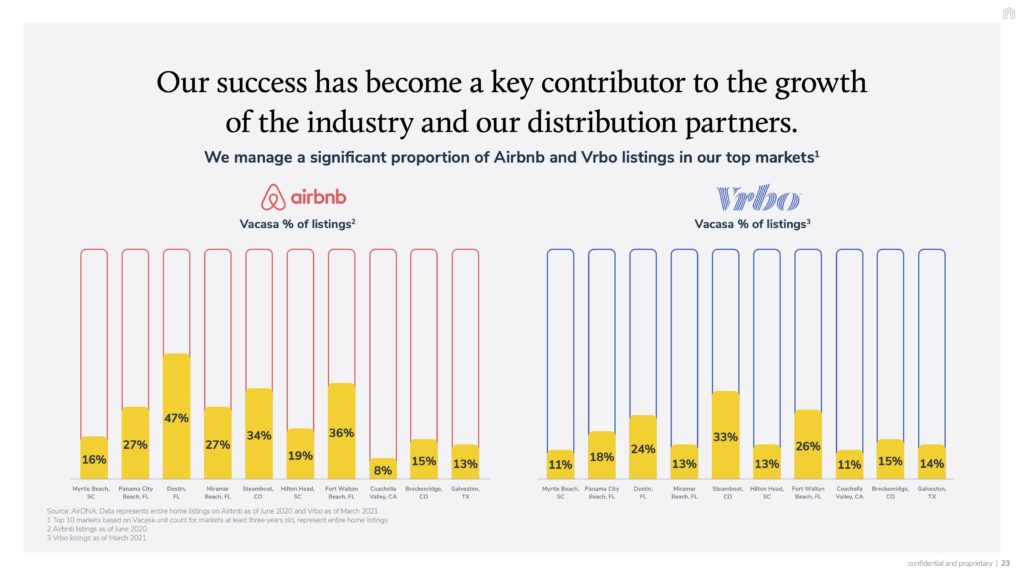

In some key vacation rental markets, Vacasa represents a big part of the supply offered on Airbnb and Vrbo. For instance, Vacasa listings make up:

- 47% of Airbnb listings and 24% of Vrbo listings in Destin, Florida

- 36% of Airbnb listings and 26% of Vrbo listings in Fort Walton Beach, Florida

- 34% of Airbnb listings and 33% of Vrbo lisitings in Steamboat, Colorado

A big actor like Vacasa can not only dramatically influence rates when it enters a market. It is also big enough to ask for lower commission rates from the likes of Vrbo, Booking.com, and Airbnb. As a result, with lower costs, it can lower its prices more easily.

New markets are entered through the acquisition of local property management companies (“Portfolio Strategy”), while the supply in existing markets is increased by attracting homeowners (“Individual Strategy”).

Vacasa is known for growing through dozens of acquisitions of property management companies each year. The company’s acquisition pipeline comprises companies with 20+ properties up to the likes of Wyndham Vacation Rentals and Turnkey with thousands of properties.

Yet, it is very interesting to see that Vacasa wants to projects another growth story. According to the slide below, Vacasa has two main paths to supply growth:

- Individual, i.e. going after homeowners, which is “modeling as 3/4 of new supply“

- Portfolio, i.e. acquiring local property managers, which is “modeling as 1/4 of new supply”.

So, this is not a reflection of Vacasa’s existing growth strategy and of the share of individual supply vs portfolio supply. The slide helpfully explains that the word modeling “reflects general forecast expectations through projection period, excluding opportunistic action”.

Is it an indication of a new direction for Vacasa’s supply efforts? Will it be competing head-to-head with Airbnb to capture the attention of Superhosts, as Vrbo is trying to do? Does it mean that, now that big competitors such as Wyndham Vacation Rentals and Turnkey have been absorbed, the focus can only be on getting smaller targets, even individuals, one by one?

Hard to tell how much “individual strategy” has contributed to Vacasa’s supply growth so far, as opposed to property management acquisitions

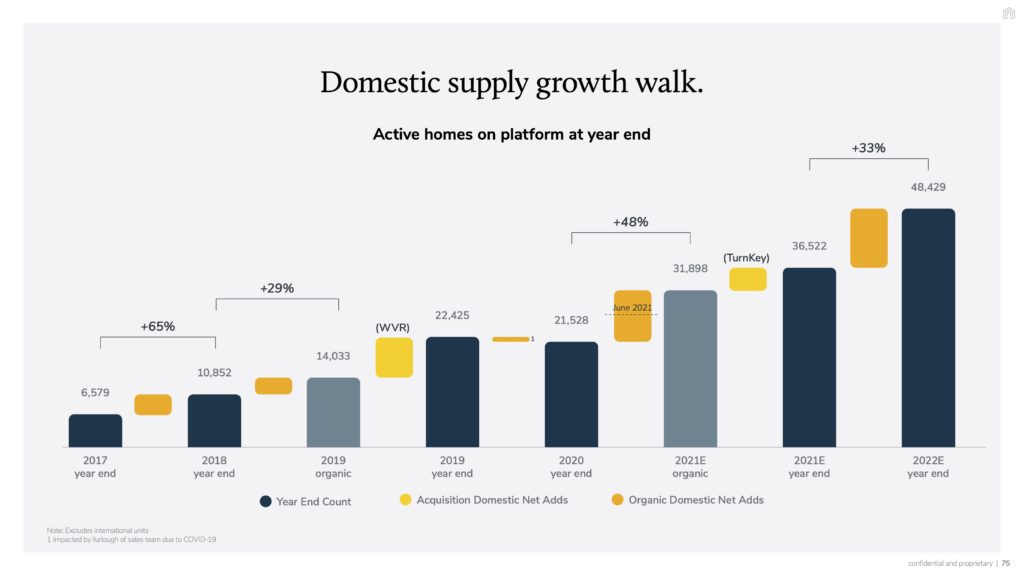

The graph below shows the growth in supply at Vacasa, for the US. You can see two colors that illustrate growth sources:

- In orange: “organic domestic ned adds”

- In yellow: “acquisition domestic net adds”.

Looking at the graph, we can see that acquisitions stand for Vasaca’s two biggest acquisition deals: Wyndham Vacation Rentals (WVR), representing about 9,000 homes worldwide, and TurnKey, representing around 6,000 homes.

Yet, Vacasa has been busy making many other acquisitions from 2017 to 2021. So, we guess that they are included as part of the “organic” adds. This leaves us with little information to appreciate what the effort to add individual homeowners represented in the past. It was probably under 3/4 of the growth.

Beyond “Individual” and “Portfolio”: The “buy the big ones” strategy

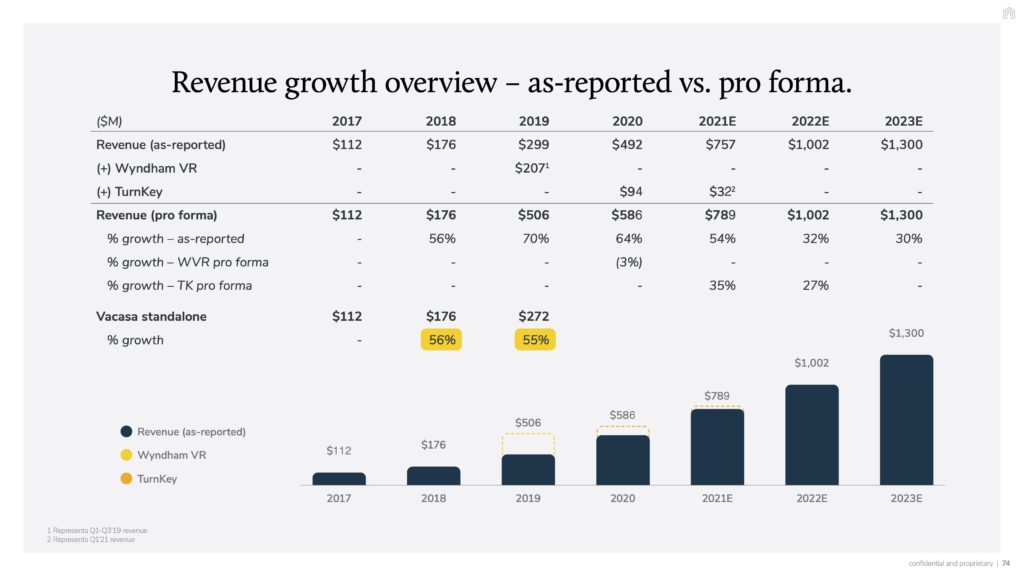

The Wyndham and Turnkey acquistions have been transformative for Vacasa, as you can see in the property count above and in the revenue report below. For instance, in 2019, Vacasa’s revenues were $299 million, while Wyndham was reporting $207 million.

However, in the US, there are not that many Wyndhams or Turnkeys left. Nothing is impossible, though, as the exit strategy for many property managers, even large ones, often takes the M&A route.

Existing markets: Vacasa employs a large team of sales and marketing reps to qualify and close individual homeowner leads

Part of Vacasa’s deck explains how the company goes about wining over new individual homeowner contracts:

- Marketing campaings (e.g. postcards) and sales reps who call the target homeowners

- Sales developement reps who further qualify leads

- Sales executives who develop referral networks with real estate agents and other potential sources within the vacation rental industry, draft customized letters to potential clients, cold call prospective leads, meet with prospective clients, and close deals.

This is a much more on-the-ground effort than what most OTAs are doing. It is more thorough, and probably also expensive.

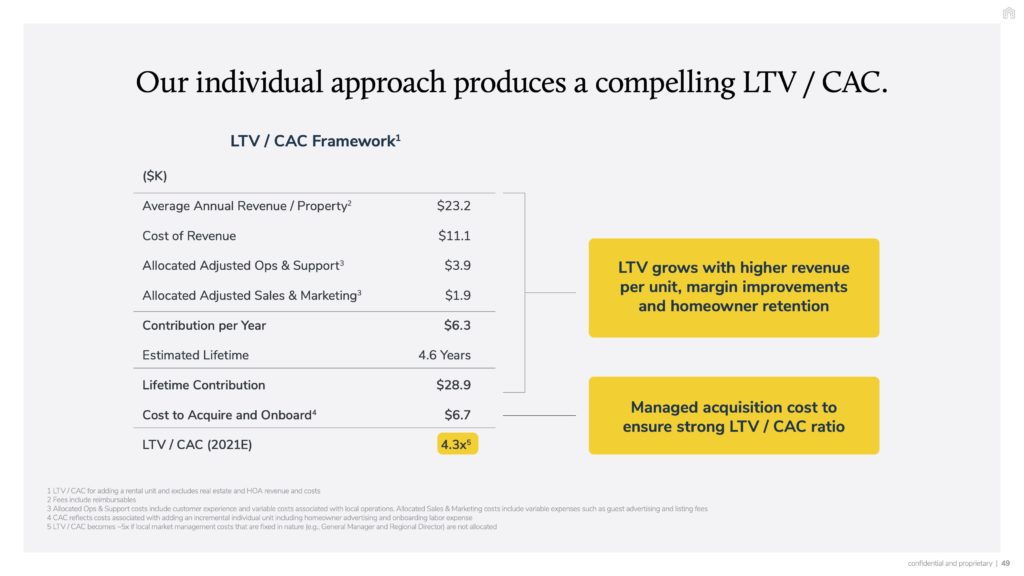

This next slide shows the cost of acquisition for an individual home: It is around $6,700. How long with the homeowner stay with Vacasa? The company estimate the lifetime of the relationship to 4.6 years.

Yet, Vacasa estimates that the $6,700 spent on acquiring one property yields $28,900 over the lifetime of the client relationship.

New and existing markets: Vacasa has an eye on 4,500 local property managers as potential acquisition targets

Vacasa has a playbook to acquire local property managers. It even has a landing page where people can go to sell their vacation rental business (Vacasa pledges to care for your homeowners, grow your team, and honor your legacy.)

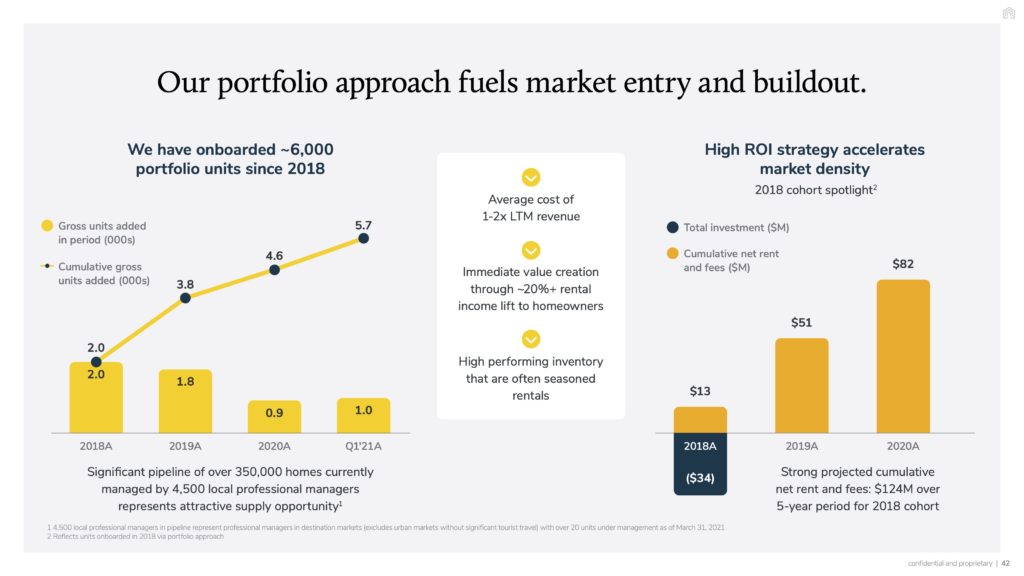

The following slide is interesting as well: Since 2018, Vacasa has onboarded 6,000 “portfolio units”, i.e. units that belonged to independent property management companies. From the data, we can guess that it is excluding properties from the Wyndham and Turnkey deals.

What’s next? Vacasa is basically aiming for any U.S. property manager with more than 20 units. It says that it has identified 4,500 local professional managers representing over 350,000 homes. Now, we are not sure what being in the pipeline means: Is it just a list? Are they already qualified as a good target? Have the owners been contacted yet?

Here again, we get an idea of the cost of acquisition: In 2018, Vacasa has spent $34M to acquire 2,000 units, at a cost of $17,000 / unit.

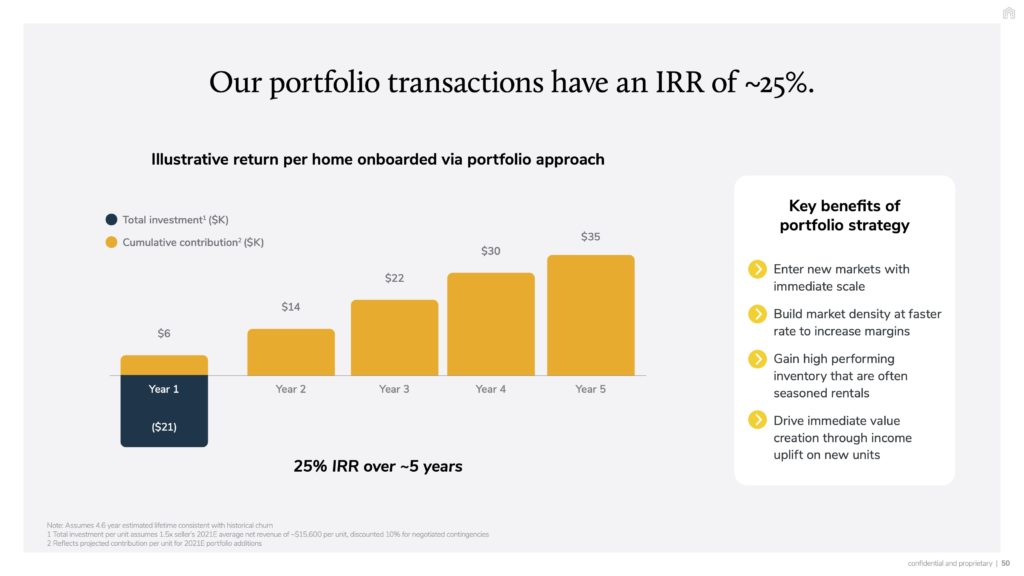

The slide below gives another cost of acquisition of $21,060 for the portfolio strategy. Here’s Vacasa’s calculation:

Total investment per unit assumes 1.5x seller’s 2021E average net revenue of ~$15,600 per unit, discounted 10% for negotiated contingencies

Looking at discounted cash-flows, it comes down to an internal revenue rate of 25%.

Path to growth supply is clear. Path to savings on operational costs, less so.

Is Vacasa really an asset-lite company similar to Airbnb? How about all these housekeeping and maintenance tasks that any property management companies like Vacasa has to solve?

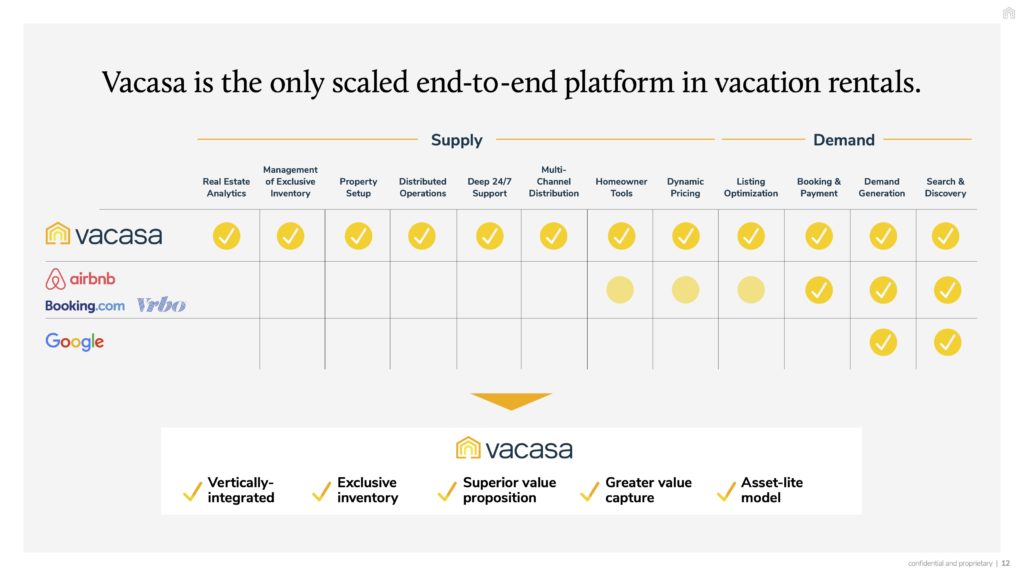

On one hand, Vacasa portrays itself as a vacation rental platform that delivers more than Airbnb, Booking.com, Google, and Vrbo. For instance, it has exclusive contracts and has “distributed operations”.

Vacasa is a property management company, with (some) feet on-the-ground, such as housekpeers, whether directly or through outsourcing. Online Travel Agents (OTAs) usually do not, except Airbnb in some markets through its Luckey property management service in Canada, France, and Spain.

While a lot of people think of Vacasa as a property management company, the company sees itself as a platform. When we looked at the HomeToGo investor deck, we discussed why platform was such a magic word.

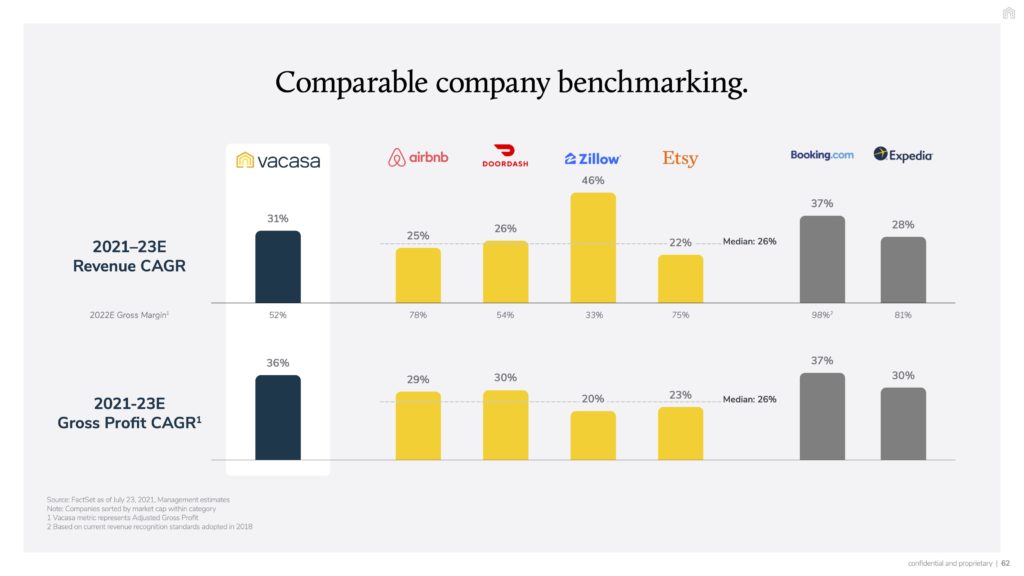

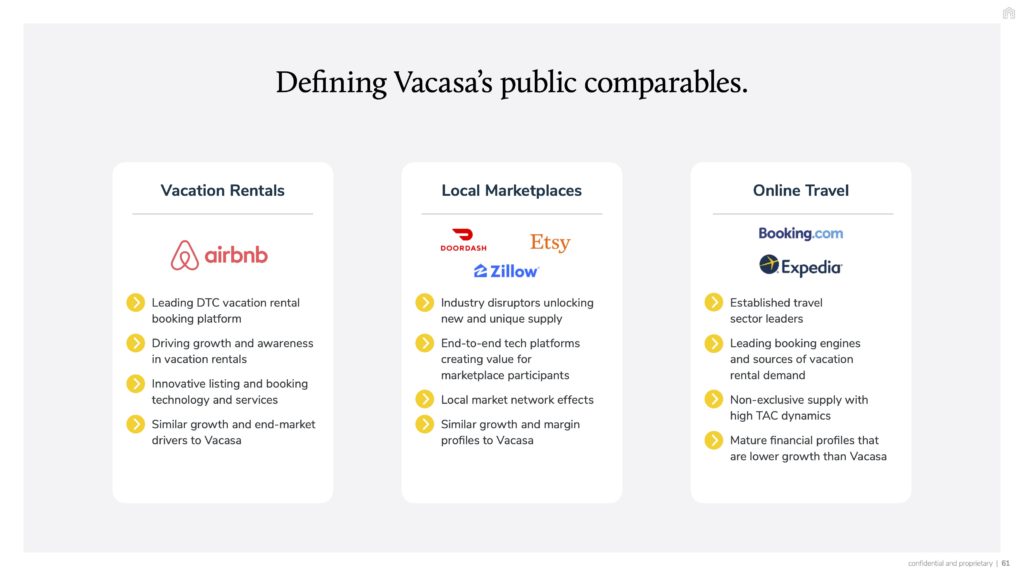

While HomeToGo was comparing itself not only to Airbnb and Booking, but also to Shopify because of its SAAS revenues, Vacasa has chosen to add local marketplaces such as Doordash, Zillow, and Etsy as comparables. Why? Because it sees them as also having a local market domination approach. Only Doordash has on-the-ground logistical issues to solve as Vacasa does, though.

Last observation, on the estimated 2022 gross margin. Look at the differences:

- Vacasa: 52%

- Airbnb: 78%

- Booking.com: 98%

First, Booking.com may not be the coolest kid on the block, but its margins are industry-leading. Second, this is gross margin, before operational costs, where Vacasa’s model is heavier than those of Airbnb or Booking, for instance.