The battle for vacation rental supply growth is heating up among the big platforms. We’ve already covered how Airbnb was focusing on individual hosts through its Made possible by Hosts campaign and its Airbnb Ambassadors host recruitment program. Now, Vrbo wants to attract the best of Airbnb hosts and superhosts. The Vrbo Fast Start program wants to lower the switching cost barrier by solving the cold start problem: A successful host on one platform is a newbie with no status or reviews on a new platform. So, it can take a lot of time to get successful on a new platform. Some hosts may leave after a couple of months of seeing no results.

The Vrbo Fast Start program brings more visibility and trust factors to the new properties so that they get more views, bookings, and revenues faster. The program increases the visibility of new properties during the first 90 days on Vrbo and displays a review score based on reviews from other travel sites (e.g., Airbnb). This is probably an acquisition campaign that has a lot of human and operational work behind the scenes. Going after high-grossing properties may be the only way to make the campaign profitable. So, it may be that it is the acquisition costs that led Vrbo to target money-making hosts, instead of Vrbo wanting first to go after Superhosts.

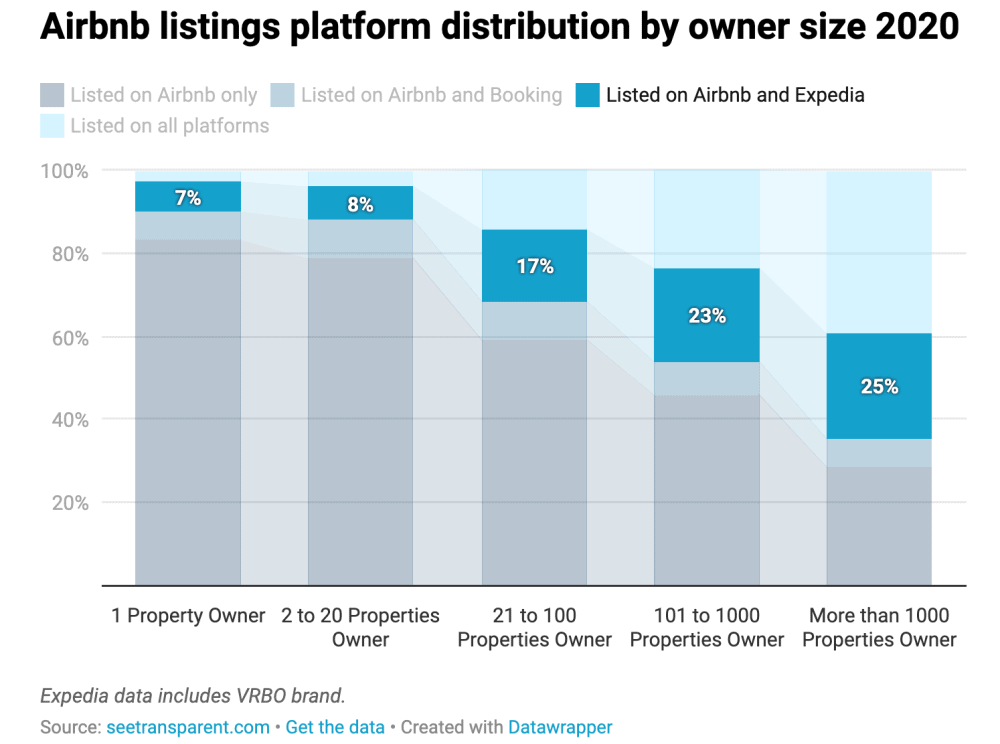

Individual Airbnb hosts tend to be loyal to the platforms.

Airbnb loves small hosts, who tend to be loyal to the platform and to use conversion-friendly tools such as SmartPricing. Larger property managers tend to list their places across any platform that is easy to integrate, is not too expensive, and generates demand.

A lot of small Airbnb hosts are not listed on Vrbo. When Airbnb was getting ready for its December 2020 IPO, Transparent released a study on Airbnb hosts’ loyalty. The short-term rental data company looked at listings across Airbnb, Booking.com, and Expedia/Vrbo. According to their findings, 83% of Airbnb hosts with 1 property were listed on Airbnb only. Only 7% of them were listed on both Airbnb and Expedia/Vrbo, 7% on both Airbnb and Booking.com, and a tiny 3% on all of these platforms.

Cold start effect: Successful hosts can be reluctant to try out another platform

Vacation rental owners and managers listing a new property on an OTA dread the cold start effect:

- Lower trust: With no review, the property inspires less trust from OTA users. They do not know what to expect. These new properties do not benefit from the trust granted by a review score badge. On Airbnb and Booking.com, a listing needs to get at least 3 reviews to get a review rating badge. As not all bookings turn into a review, it means that a new listing may need 5 to 7 guest stays to get the minimum 3 reviews needed to get a publicly-displayed review rating badge.

- Lower visibility: A review rating score is a badge that is visible in search results. It contributes to attracting more users to click on a listing. Ranking and sorting algorithms also tend to favor properties with a rating score, and the higher the score, the better.

- Vicious circle: So, new properties rank lower and inspire less trust. To create more trust, they need reviews. But to get reviews, they need bookings, which is hard to come by as these properties are not visible on the platform.

- Long time to see results: It may take months before a small host can break this vicious circle. As a result, the new host may leave the platform and choose to double down on the platforms where she/he is already successful.

- Necessary discount: A common tip for new properties is to lower their rates by 20% until they get the 3 reviews they need to display a review rating badge. Airbnb, Booking.com, and Vrbo all encourage new properties to do so, to attract their first bookings and break this vicious circle.

If you are a successful Airbnb host, you’ve got a rating badge with a high score and may even get a SuperHost badge. It means that you get more visibility and potentially more bookings and revenues than the same property without similar badges. You may even be able to charge more than your competition.

When listing on a new platform, it may take you a lot of time before you can get the same visibility, conversion rate, and prices as on Airbnb. There is also a learning curve with the different hosting tools, websites, and apps that the competing platform offers.

I’ve looked further at the correlation between guest review scores and occupancy in a guest post for vacation rental data company Transparent.

Vrbo Fast Start: Solving part of the low visibility and trust issue

Who can qualify for the Vrbo Fast Start program?

Any Superhost or host with a 4.5+ review rating and who has earned more than US$3,000 in the last year is eligible for Fast Start.

How can you tell that the program is aimed at Airbnb hosts?

Vrbo’s program used the word Superhost, which is only used by Airbnb. Vrbo has Premier Hosts and Booking.com has Prefered Partners, for instance.

The review rating scale is another clue: The program mentions a minimum rating of 4.5, which indicates a 0 to 5.0 rating scale. This is what Airbnb uses, while Booking.com has a 0 to 10.0 rating scale.

The press release also alludes to March 2020, when Airbnb hosts were forced to refund guests, while Vrbo enforced the existing cancellation policies. It may be a subtle signal to Airbnb hosts who are still feeling unhappy about Airbnb’s decision at the time.

What does the Vrbo Fast Start program offer?

- A ‘New to Vrbo’ badge displayed for 90 days -> More visibility in search results and an additional trust factor on the list page

- A review score based on reviews from other travel sites -> No need to wait to get bookings and reviews to get a public score

- An elevated position in sort -> Upranking in search results

- New hosts will receive dedicated, personal support. => We guess from Vrbo employees, a bit like what Airbnb Ambassadors provide to their new hosts they refer

- The program begins with a virtual kick-off call from a Vrbo expert for seamless onboarding

- No exclusivity: The host can stay on Airbnb. This is about getting hosts to try out Vrbo.

What results can be expected from this program?

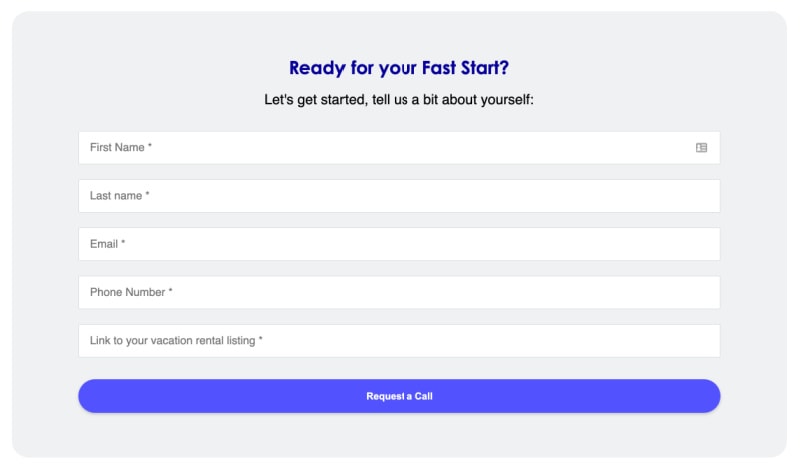

Vrbo has shared data from its pilot program. At Rental Scale-Up, we had noticed that, on its sign-up page, Vrbo was telling people who were “Already a host on another travel site” that it had “a dedicated team standing by to help you build your listing”.

Vrbo piloted the program with 1,600 U.S.-based hosts who recently came from other sites and wanted a quick way to ramp up their bookings. The impact of the Fast Start program for each property was positive, including:

- 25% increase in bookings

- 50% increase in booked nights

- 140% increase in gross booking value.

Vrbo does not claim that this was an A/B testing. It was a pilot. It means that results should be taken with a grain of salt. For instance, the properties included in the test may have been more desirable and larger than the other new properties that were not in the test. This would explain why the value of gross bookings was 140% higher than for the properties not in the program. Another factor would be that the Vrbo experts just know how to pick the right settings so that the property is set up for rapid success. Who knows.

A non-automated way to make it easier for Airbnb hosts to try out a new platform

When considering the program, the Rental Scale-Up team voiced diverging opinions:

- The program does answer the Cold Start issue (hence the name Fast Start, we guessed)

- What is the cost of an onboarding process (“kick-off call”) done through a call with a Vrbo expert?

- Vrbo can only offer this cost if the properties joining are sure to make money. This is one of the reasons for Vrbo to require properties to have generated at least US$3,000.

- Let’s say that Vrbo takes a 15% commission on bookings (guest + host) and that the property can generate US$1,500 in bookings for the first year. It would bring back $225 in commission to Vrbo the first year. If Vrbo’s marketing costs are 40% of the commission, then it leaves $135 of profit to Vrbo. This should cover a first onboarding call, especially of the property.

- So, maybe it is the cost of the acquisition funnel to led Vrbo to target high-grossing properties. The whole story about targeting SuperHosts may actually be a consequence of the costs involved. It also makes a good PR story that the travel industry trade would pick up 😉

- Yet, it must be tough to automate some parts of the process:

- Who is checking the eligibility of the hosts for the program?

- Who is checking their review score on Airbnb?

- How does Vrbo know that a host generated at least US$3,000 in booking revenues last year?

When entering markets, Airbnb did a lot of non-scalable things. Vrbo seems to be willing to do the same things. If the Vrbo experts are a cheap resource, then this non-automated program may be more scalable than it looks at first sight. Airbnb is using independent entrepreneurs, its Ambassadors, to do that. It will be interesting to compare the tactics.

A scalable way to help Airbnb hosts try out a new platform at Booking.com

Booking.com is traditionally keener on only doing things that are scalable. It may make it move slower and less boldly than others, but it can also result in interesting innovation.

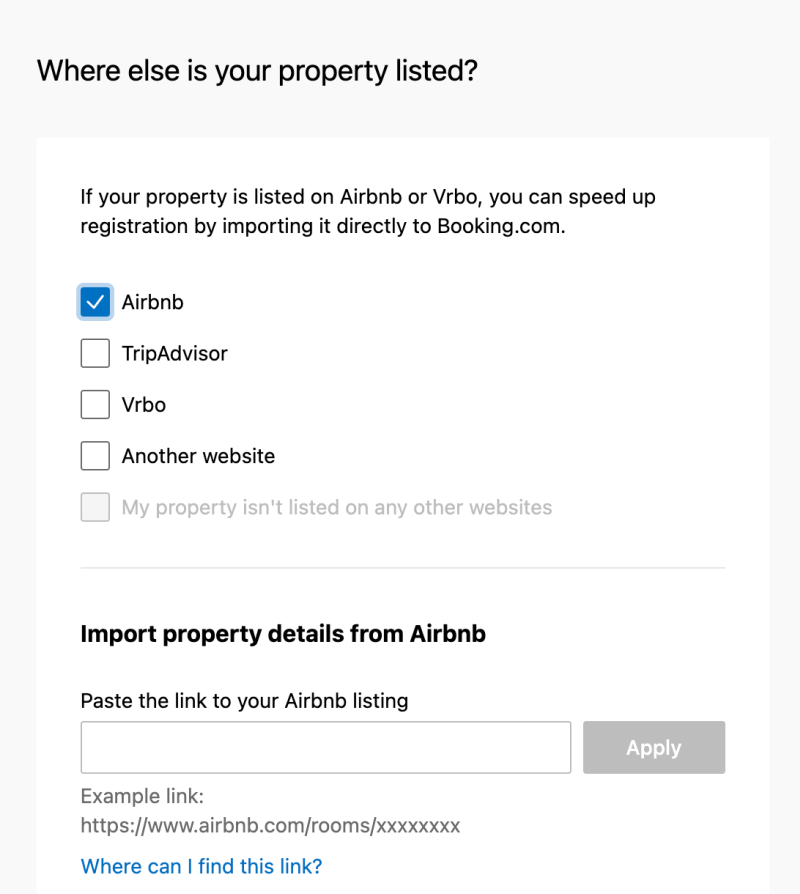

Can you transfer an Airbnb listing?

For instance, someone who wants to list an apartment on Booking.com will be asked whether the property is already listed on Airbnb or Vrbo. If so, Booking.com is able to import part of the listing features from its competitor websites, such as the photos. It can greatly speed up the signup process.

Vrbo Fast Start, when Vrbo adopts an underdog tactic

Vacation rental growth comes with adding more supply. This is what property managers, Airbnb, Booking.com, and Vrbo are busy doing in 2021. It is interesting here that Vrbo and Booking are adopting challenger strategies: While the leader, Airbnb, is busy spending money on TV ads to evangelize the market about becoming hosts, Vrbo and Booking.com are devising ways for existing to diversify their bets and list their property beyond the sole Airbnb.