While waiting for the “biggest change to Airbnb in a decade” (see our expectations for Airbnb’s 2022 Summer release), let’s have a look at Airbnb’s Q1 2022 quarterly results. In short, the company is doing well and 2022 should be a great year, as demand for cross-border travel and urban travel stays (Airbnb’s “bread and butter” according to its CEO) is coming back.

- Airbnb exceeded 100 million booked nights and experiences for the first time ever.

- Gross booking value was $17 billion, a 73% increase compared with Q1 2019.

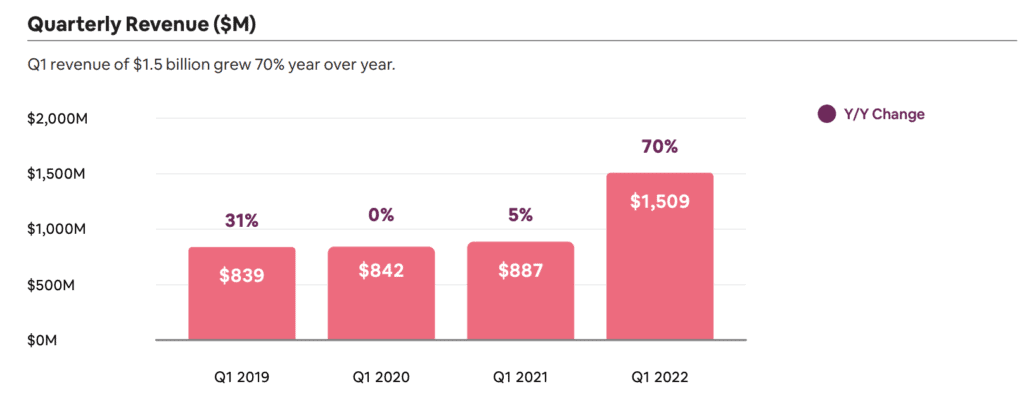

- Revenue was $1.5 billion, exceeding Q1 2019 by 80%.

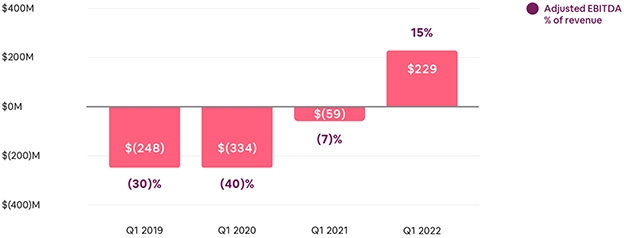

- Q1 Adjusted EBITDA of $229 million was Airbnb’s first profitable Q1, with an adjusted EBITDA margin of a positive 15%

- In Q1 2022, long-term stays of 28 days or more accounted for 21% of gross nights booked in Q1 2022, up from 13% in Q1 2019. Long-term stays are at an all-time high, more than doubling in size from Q1 2019.

Airbnb’s leadership team gave a positive outlook for the year 2022, noting that the return of demand for urban stays will benefit the company proportionally more than its competitors (e.g. Vrbo and Booking) as big cities have traditionally been the company’s core strength.

Airbnb quarterly results: Key financial data

Here’s our selection of quotes from Airbnb’s shareholder letter and earnings call for Q1 2022:

The first quarter of 2022 was another record quarter for Airbnb. Guests are continuing to travel domestically and to rural destinations, and now, guests are also returning to cities and crossing borders at or above pre-pandemic levels. Airbnb is stronger than ever before.

Nights and Experiences Booked surpassed pre-pandemic levels and exceeded 100 million for the first time ever, demonstrating strong global demand for travel.

Q1 revenue of $1.5 billion grew 70% year over year. It also exceeded pre-pandemic Q1 2019 revenue by 80%. The strong revenue growth was driven by the combination of growth in Nights and Experiences Booked, and continued strength in ADR.

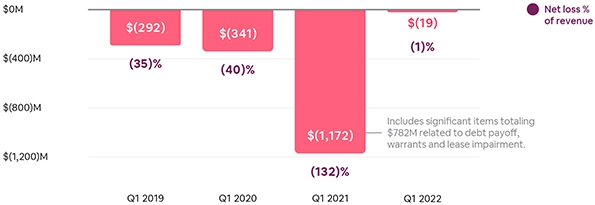

Q1 net loss of $19 million significantly improved from both Q1 2019 and Q1 2021. Net loss in Q1 2022 improved by $273 million compared to Q1 2019 primarily due to our revenue growth and cost management.

Q1 Adjusted EBITDA of $229 million was our first profitable Q1; Adjusted EBITDA for Q1 2022 was $229 million, our first positive Q1 Adjusted EBITDA, which was substantially improved compared to Adjusted EBITDA in Q1 2021 of $(59) million and Q1 2019 of $(248) million. This substantial improvement in Adjusted EBITDA demonstrates the strength of our revenue recovery and the benefit of strong ADRs, coupled with our disciplined spending.

Q1 free cash flow exceeded $1 billion. Q1 2022 net cash provided by operating activities was $1.2 billion, up from $618 million in Q1 20212. Free cash flow of $1.2 billion was an all-time high, up from $611 million in Q1 2021. The year-over-year increase in free cash flow was driven by revenue growth and margin expansion, as well as seasonal bookings growth driving increased unearned fees. Due to seasonality, Q1 2022 cash flow typically benefits from unearned fees that are generated by bookings made in Q1 for stays in Q2 and Q3.

Airbnb 2022 booking trends

Biggest number of booked nights ever. Lead times longer than in 2019. Booking pace for summer 2022 up 30% compared with 2019.

In Q1 2022, gross nights booked grew 32% compared to Q1 2019 despite ongoing pandemic concerns, the war in Ukraine, and macroeconomic headwinds. People are becoming increasingly confident in booking travel further in advance, with lead times even surpassing 2019 levels by the end of Q1.

Looking ahead, we see strong sustained pent-up demand. As of the end of April 2022, we had 30% more nights booked for the summer travel season than at this time in 2019, and the growth from 2019 is higher the further we look out this year.

Return of demand to cities and crossing borders playing to Airbnb’s traditional strength

Urban vs non-urban: Stays in big urban areas have been Airbnb’s core strength. In Q1 2019, they made up 58% of the company’s gross booked nights. In Q1 2021, they were down to 41% and in Q1 2022, they bounced back to 46%. Yet, as Airbnb’s overall number of booked nights has increased so much, it means that the absolute number of gross nights booked to high-density urban destinations is exceeding pre-pandemic Q1 2019 levels. So, there’s more room for Airbnb to grow, as the number and share of urban stays should keeping on growing in 2022.

At the beginning of the pandemic, guests preferred to travel to non-urban destinations close to home. We continue to see this trend persist with Q1 2022 non-urban gross nights booked increasing 80% compared to Q1 2019. Domestic gross nights booked also increased 65% compared to Q1 2019.

Long-term stay nights = Double the Q1 2019 figure

While short-term stays rebounded strongly in Q1 2022, long-term stays of 28 days or more continue to be our fastest-growing category by trip length compared to 2019. Long-term stays are at an all-time high, more than doubling in size from Q1 2019.

Long-term stays accounted for 21% of gross nights booked in Q1 2022, up from 13% in Q1 2019 and down from 24% in Q1 2021. While the percentage of long-term stays varies depending on short-term stays, the number of long-term stays were at an all-time high in Q1 2022.

87% of all available listings on Airbnb except long-term stays. 52% of hosts offer a monthly discount, and these discounts are 85% of our long-term stays.

Overall, 48% of gross nights booked were from stays of at least seven nights in Q1 2022

ADR (Average Daily Rate) should stabilize or go down

ADR increased by only 5% compared with Q1 2019: The 5% year over year increase from Q1 2021 was entirely driven by price appreciation, which more than offset some negative impact from mix as urban destinations and other bookings that tend to have lower ADR rebounded.

As the share of bookings in urban markets and outside of the US grows back, the average nightly rate is going down as these markets have a lower ADR than traditional US vacation rental markets. Yet, inflation is also pushing prices up, helping support ADR levels.

Non-urban supply still growing

Destinations with the strongest demand are showing the most supply growth, with non-urban active listings growing 21% in North America and 15% globally, compared to Q1 2021. Dave Stephenson, the company’s Chief Financial Officer, said:

We just have more supply than we’ve ever had in our history. (…) The fact that we grow more supply in the areas that we have the greatest demand, like nonurban active listings grew 21% in North America and 15% globally.

Airbnb results throughout the world

North America

North America remained strong, with Nights and Experiences Booked showing compounding growth on top of the recovery experienced in 2021. Specifically, Nights and Experiences Booked in Q1 increased nearly 55% above the level achieved in the same quarter of 2019, and 25% above Q1 2021, primarily driven by the U.S.

Europe, Middle East, and Africa

In EMEA, Nights and Experiences Booked were above Q1 2019 levels for the first time since the pandemic began. Despite COVID variants and the war in Ukraine, Nights and Experiences Booked were up by approximately 20% compared to Q1 2019.

Latin America

In Latin America, Nights and Experiences Booked were about 65% higher than Q1 2019 with continued resilience in certain countries, such as Brazil and Mexico, where both domestic and inbound cross-border travel continued to strengthen.

Asia-Pacific

In Asia Pacific, Nights and Experiences Booked remained depressed compared to Q1 2019 as the region has historically been more reliant on cross-border travel than other regions. In Q1 2022, we did see sequential recovery relative to Q4 in the region, excluding China where record levels of COVID cases were confirmed and severe lockdowns began. As borders continue to open and pent-up demand in the region is realized, we expect a similar rebound in APAC as we have seen in other regions. We will be ready for this rebound, and expect APAC to represent a significant growth opportunity for Airbnb over the long-term

Ukraine update

The company also gave a quick update on its Airbnb helps Ukraine initiative:

To date, more than 34,000 people have signed up to offer their homes to refugees through Airbnb.org, including more than 20,000 across Europe and more than 7,000 in the U.S. More than 14,000 people have now received temporary accommodations through Airbnb.org in Europe.

Guests were able to choose the Hosts they wanted to support and in certain cases, communicate with the Hosts. We waived all guest and Host fees on these bookings to ensure that all earnings went directly to Hosts. For the quarter ended March 31, 2022, approximately 600,000 nights were booked in Ukraine with a total GBV of about $20 million.

2022 outlook for Airbnb

Specifically, in Europe and Latin America, we saw the number of nights stayed for the Easter holiday in April eclipse 2019 levels. Heading into peak travel season in Q3 2022, we are seeing substantial demand for summer travel months in EMEA and North America. We are also seeing higher than historical demand for Q4.

Airbnb is very positive about the US, both for domestic and international demands. “U.S. domestic demand this year has so far outpaced our internal expectations and we are encouraged by U.S. international bookings exceeding 2019 levels”

On May 11, 2022, Airbnb will detail its Summer 2022 release. You can read here what we anticipate in terms if new search capabilities and guest travel insurance.