Vacation rental data provider Transparent and vacation rental channel manager Rentals United have joined forces to publish a Global Vacation Rental Report. You can download it for free here. We’ll cover some of its insights (without revealing everything), from which vacation rental tech products are used by property managers, the proportion of direct bookings vs OTA bookings, and differences between small and large property managers, as well as between North America in Europe. But, first, we’ll start with a look at the potential biases in the data collected. When looking at averages and trends, it is important to understand who is responding, so that you know how accurately you can compare your own property management company with what is depicted in a survey.

Most respondents are probably tech-savvy property managers in Europe and in North America, so usage of tech solutions may be overestimated

This survey may be more a reflection of the traits and behaviors of the client and prospect bases of Rentals United and Transparent, all things considered.

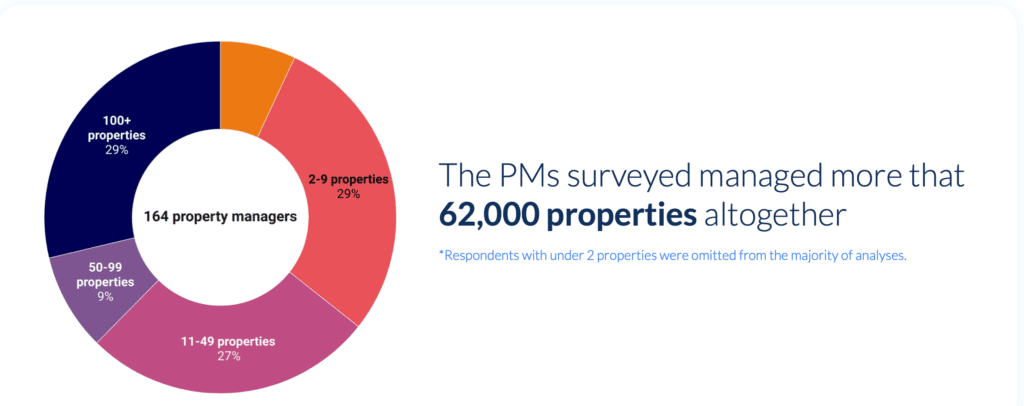

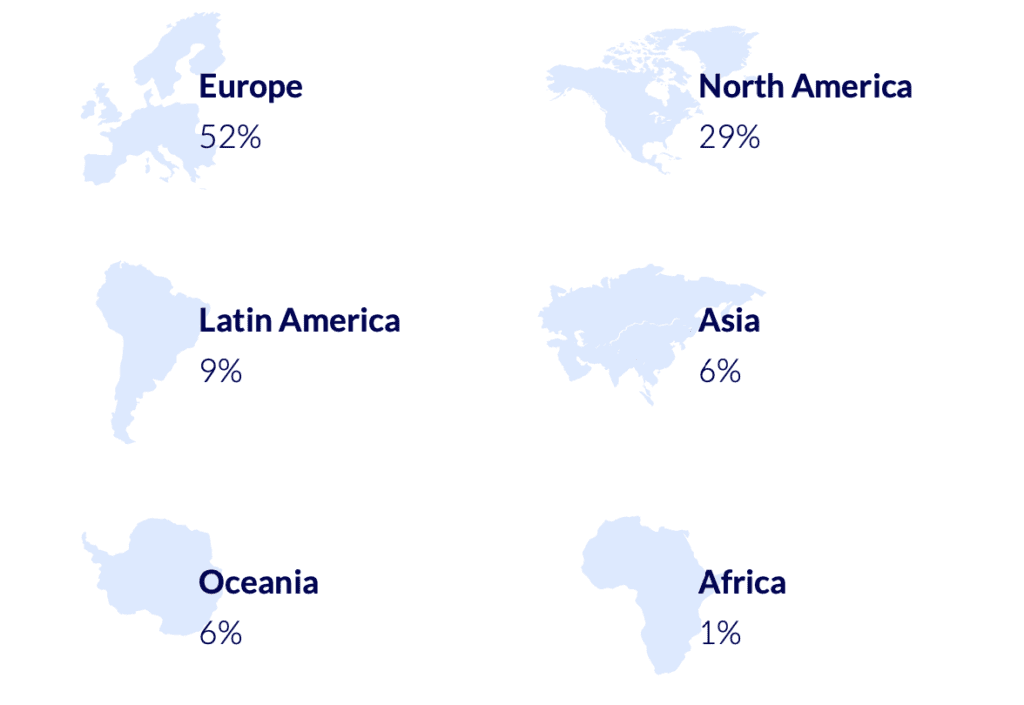

For instance, these two companies have roots in Europe, so it is normal that more respondents should be from Europe (52% of the 164 respondents) than from North America (29%). When looking at the data for Asia, have in mind that it comes from 6% of the respondents, i.e. in Asia about only 10 property managers for a continent that spans from Indonesia to India, and from Japan to China.

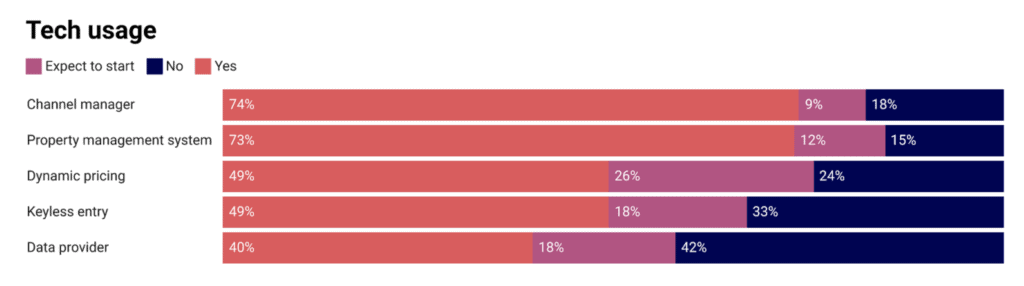

We can assume that the respondents were contacted by Rentals United and Transparent. For instance, the survey may have been emailed to their current clients, prospects, and newsletter subscribers. This may explain why so property managers in the survey declare using:

- a channel manager (such as Rentals United): 74% of respondents

- a data provider (such as Transparent): 40% of respondents

If our assumption is true about the distribution of survey respondents, it does not make the survey false. It means that the results are more skewed towards the share of property managers who use Rentals United and Transparent. If you are going to compare your short-term rental management company with what you see in the survey, you may want to keep this in mind.

Interesting insights from the Global Vacation Rental report

Direct bookings vs OTA bookings

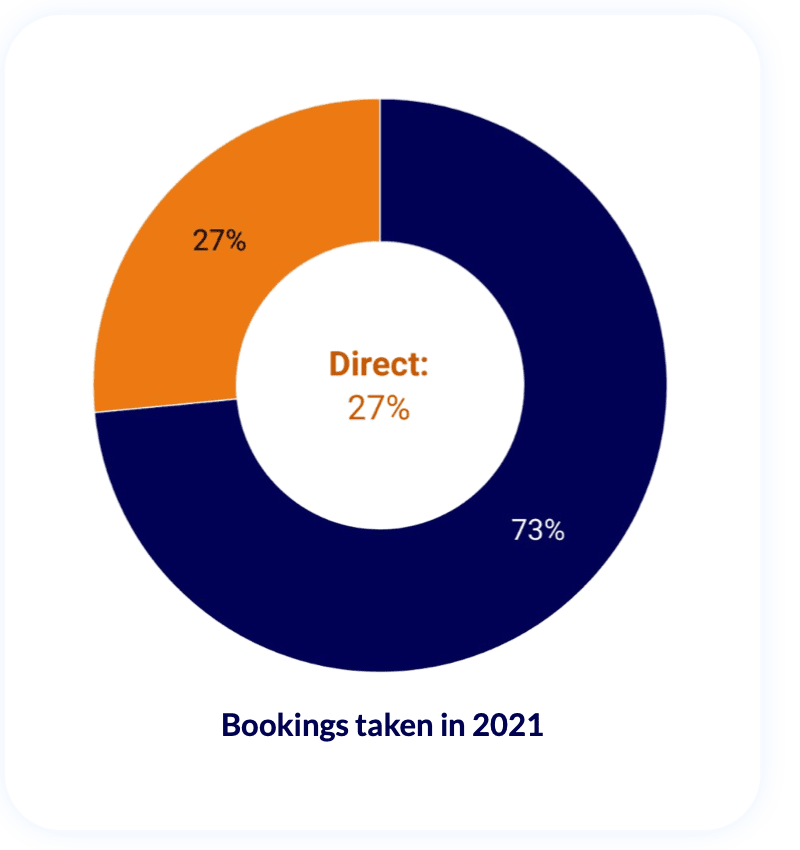

The #BookDirect movement has become more vocal over the last few years. According to this report, the share of direct bookings has increased to 27% and property managers expect this number to grow in 2022. The report also shows that large property managers tend to have a bigger share of direct bookings, and thus to depend less on OTAs, than smaller property managers.

Vacation rental software and tech adoption

We talked earlier about the potential bias in the survey results due to the possible over-representation of current Rentals United (a channel manager) and Transparent (a data provider) clients and prospects. With this in mind, let’s have a look at this graph about vacation rental tech adoption:

- Vacation rental channel manager: 74%

- Property management system for vacation rentals: 73%

- Vacation rental dynamic pricing: 49%

- Vacation rental keyless entry: 49%

- Vacation rental data provider: 40%

When looking at various data available from Airbnb, Vrbo, and Booking users, the share of software-connected hosts is probably much lower than the 74% of channel managers and PMS buyers of vacation rental software reported here.

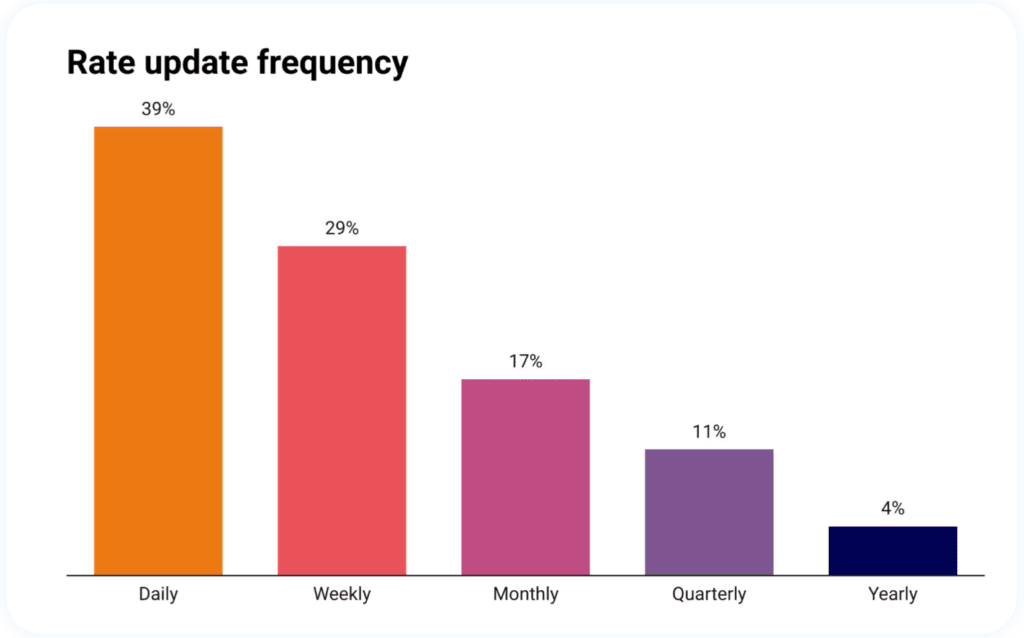

Vacation rental pricing: How often are rates updated?

32% of property managers update their prices once a month or even less frequently. When you consider that an individual Airbnb host using Airbnb’s Smart Pricing technology probably sees their price updated every 2 to 3 days, it is shocking to see that a large chunk of the vacation rental industry is not more in sync with demand changes.

Now, if you are a property manager who has committed to once-a-year agreed-upon rates with owners and who only used seasonal rates (e.g. low, high, and shoulder rated), you have little reason to changes your vacation rental pricing daily.

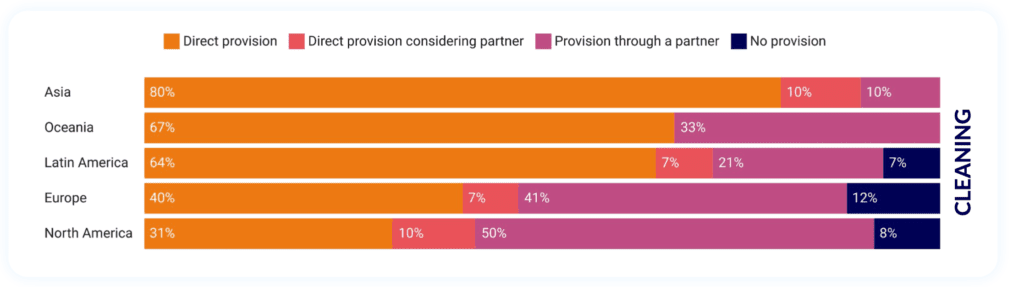

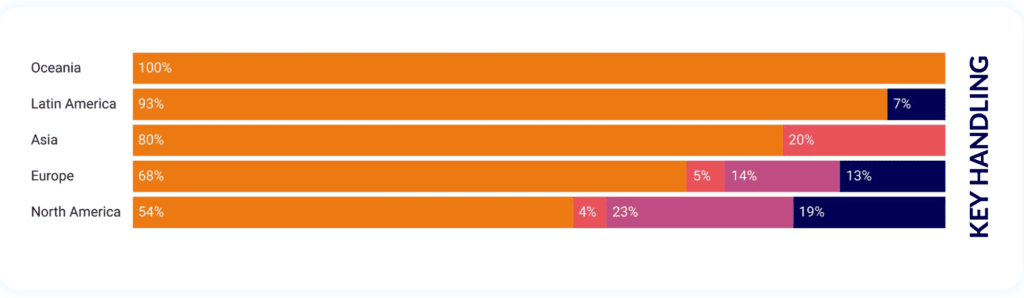

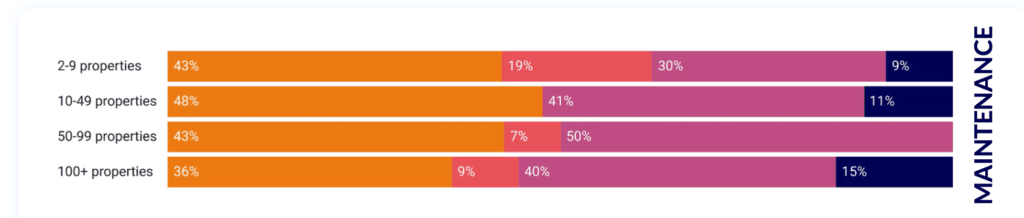

Vacation rental cleaning and operations: Cleaning and key handling are insourced, but large property managers outsource more maintenance

The Global Vacation Rental Report looked into the operational side of the business and tried to see which tasks were outsourced or insourced.

40% of European property managers and 31% of US ones handle cleaning internally, while respectively 41% and 50% of them get it done through a partner.

Key handling is handled directly by 68% of European and 54% of US property managers. Now, we are not sure whether automated entry access, for instance via a code, is considered “direct provision” here.

Unsurprisingly, maintenance is the service that is the most outsourced. Note that a fair share of large property managers does not even offer the service or outsource it.

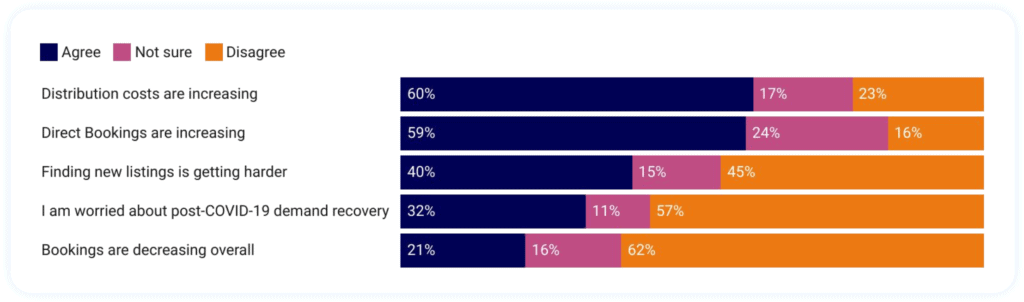

How do property managers see big industry trends?

Most property managers things that distribution costs are increasing but that the share of direct bookings is also going up. A fair share (40%) also thinks that finding new listings is getting harder.

If you want full access to this report, head to this link.