This comprehensive article reflects on the European short-term rental market throughout 2022, revealing captivating insights from actual booking data provided by leading online platforms, such as Airbnb, Booking, Expedia Group, and TripAdvisor. As a short-term rental owner or manager, you’ll uncover the staggering changes and contrasting situations across countries compared to 2019, such as the impressive 33% increase in nights spent in Sweden and the notable 36% decrease in Czechia. This indicates that it’s not yet business as usual in Europe after the pandemic. Additionally, we explore the sustained popularity of traditional coastal holiday destinations like Croatia’s Jadranska Hrvatska, which topped the list with 20 million nights. This invaluable information will help you understand the market dynamics and make strategic decisions to navigate the constantly evolving European travel landscape.

Surge in Demand for Short-Term Rentals in Europe Noted in 2022

A new batch of data from the European Union’s Eurostat highlights a remarkable increase in demand for short-term rentals in 2022, as evidenced by the following key figures:

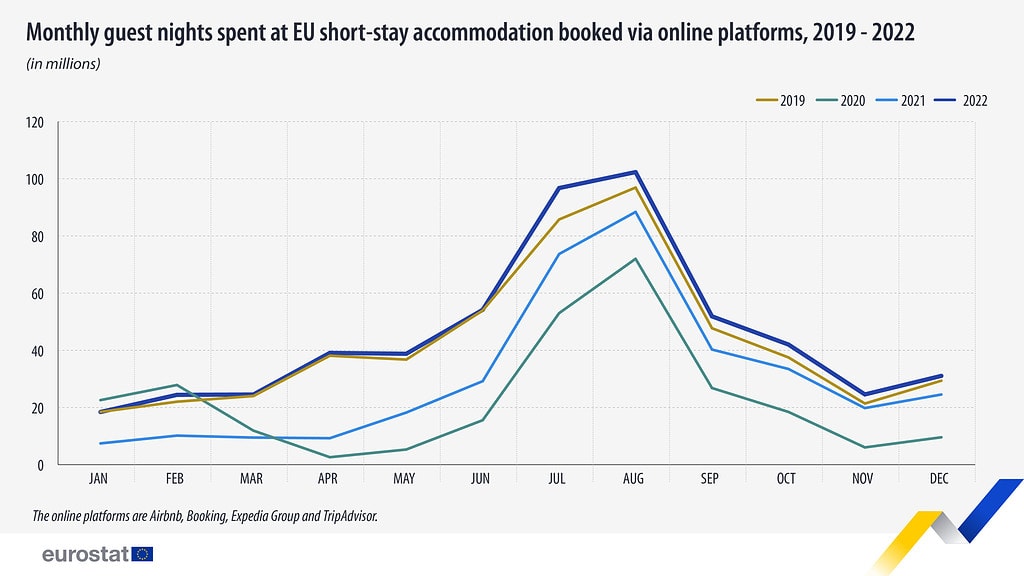

- Guests spent approximately 547 million nights in EU short-term rental accommodations booked through online platforms in 2022.

- This figure indicates a significant recovery compared to 2021, which recorded 364 million nights, representing a 50% increase in demand year-over-year.

- The demand for short-term rentals in 2022 not only surpassed 2021 levels but also exceeded those of the pre-pandemic year 2019, which registered 512 million nights. This demonstrates a 7% growth compared to 2019 figures.

These statistics underscore the remarkable resurgence in demand for short-term rentals in Europe, as the industry bounces back from the challenges posed by the pandemic.

Divergent Recovery Paths in European Short-Term Rental Market: Growth Leaders and Laggards in 2022

The Eurostat data highlights a notable contrast between two groups of European countries in terms of short-term rental demand recovery in 2022:

Countries with significant growth compared to 2019:

- Sweden: experienced a 33% increase in nights spent.

- France: saw a 31% growth in nights spent.

- Belgium: recorded a 23% rise in nights spent.

These countries demonstrated strong recovery in the short-term rental market, outpacing their 2019 performance.

Countries still lagging behind 2019 levels:

- Czechia: experienced a 36% decrease in nights spent.

- Hungary: recorded a 27% decline in nights spent.

- Ireland and Estonia: both saw a 23% drop in nights spent.

In contrast, these 14 EU member states have yet to reach 2019 levels in the short-term rental market, indicating a slower recovery. Tighter short-term rental regulations in countries like Czechia have significantly reduced the available supply on online platforms, subsequently impacting the number of nights sold.

This comparison underscores the varying degrees of recovery across European countries, with some experiencing substantial growth in their short-term rental markets. In contrast, others continue to struggle to regain their pre-pandemic performance.

Top Coastal Regions in Europe Continue to Attract Tourists in 2022

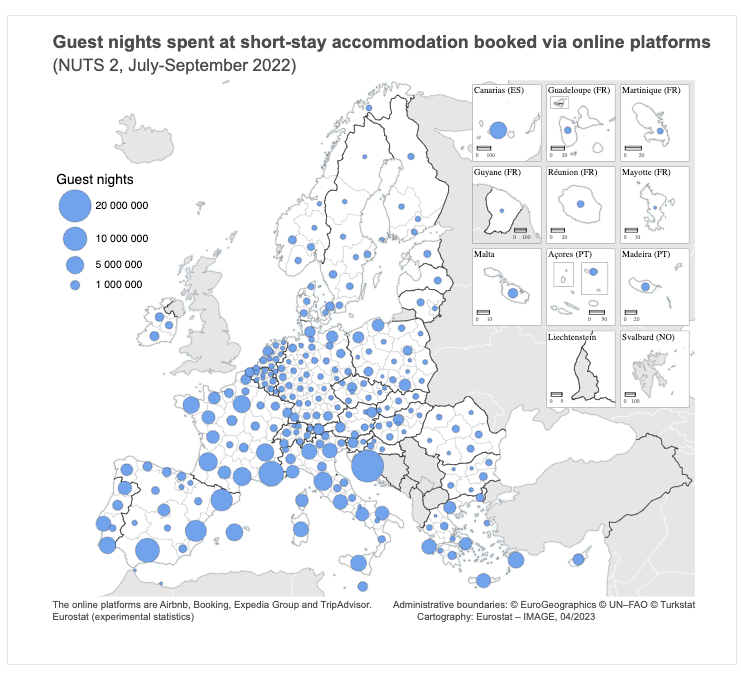

Q3 2022 data showcases the sustained popularity of traditional coastal holiday destinations for tourists seeking short-term rental accommodations. The following highlights emphasize the most sought-after regions and their respective appeal:

Top three coastal regions for short-term rentals in 2022:

- Jadranska Hrvatska, Croatia: topped the list with an impressive 20 million nights.

- Provence-Alpes-Côte d’Azur, France: followed closely with 11 million nights.

- Andalucía, Spain: remained popular, accounting for 10 million nights.

Distribution of top 20 coastal regions across countries:

- France: dominated with seven regions.

- Spain: held a strong presence with five regions.

- Italy: featured four regions in the top 20.

- Croatia, Portugal, Greece, and Romania: each contributed one region to the list.

These figures emphasize the enduring appeal of coastal regions and countries with well-established tourism infrastructure in 2022. Despite the ongoing challenges posed by the pandemic, tourists continue to be drawn to these picturesque and popular European destinations.

Exclusive access to booking data from top online platforms sheds light on the European short-term rental industry.

A landmark collaboration between Eurostat and leading online platforms, including Airbnb, Booking, Expedia Group, and TripAdvisor, has provided valuable insights into the European short-term rental market. This unique access to real booking data from these major industry players offers a captivating look into the travel landscape in Europe.

It’s important to acknowledge that this data only covers a portion of the market, as bookings made offline, through classified sites, or regional travel websites are not included. Nevertheless, the information obtained from these prominent platforms significantly contributes to understanding the European travel industry and helps policymakers and tourism businesses make informed decisions.

Conclusion

In conclusion, the European short-term rental market witnessed a remarkable resurgence in 2022, with data from leading online platforms such as Airbnb, Booking, Expedia Group, and TripAdvisor offering valuable insights into the industry’s recovery. However, it’s crucial to recognize that the path to recovery has not been uniform across countries, with some experiencing significant growth. In contrast, others continue to struggle to regain their pre-pandemic performance. Coastal regions and well-established tourist destinations have demonstrated enduring popularity, highlighting the resilience of these areas in attracting visitors.

As short-term rental owners and managers, staying informed of these market trends and leveraging this data to make strategic decisions that will help your business thrive in an ever-changing travel landscape is essential. Although the industry has made considerable strides in recovering from the pandemic, the contrasting situations across countries emphasize the importance of staying agile, adapting to new market dynamics, and seeking growth opportunities. By understanding these trends and embracing their challenges and opportunities, you’ll be better equipped to navigate the evolving European short-term rental market and position your business for success.