Every year, it is interesting to sit at Booking.com’s VRMA presentation to learn what the Amsterdam-based OTA wants to tell to the U.S. market, and especially to vacation rental managers. While in Europe the company is seen as a gatekeeper for the online travel industry, it has an underdog status in the US when it comes to vacation rentals.

Signaling a major shift in the U.S. in an almost-empty room

While the early morning presentation did not attract big crowds at VRMA, it signaled a potentially major shift in Booking.com’s fortunes in the U.S.: The company showed that it had finally fixed some of the worst flaws in its value proposition for vacation rental managers (e.g., Booking.com now offers a decent payment solution that works and does not cause hair-rising cancellation rates anymore). It also shared that it was ready to target individual hosts in the US, with features aimed at reassuring them, such as Booking.com’s first-ever request-to-book option.

Yet, as the low attendance to the session showed, Booking.com has an awareness issue in the US. How will it ensure that guests, small hosts, and large property managers know about it? The brand is far from being a household name in the US. Booking.com’s branding efforts in the US have fallen flat for the moment. For vacation rental managers and hosts who were disappointed in the past when using Booking as a channel, what is the plan to win them back?

Booking.com was eager to show what it had delivered over the last months:

Attract more U.S. vacation rental managers thanks to a new payment solution

Property management company Casiola shared that it saw dramatic improvement when it started using Booking.com’s new payment solution. The company went from a disastrous situation, with a cancellation rate of Booking guests up to 70%, to a state where only a few guests cancel, fraud is gone, and chargebacks are almost inexistent.

Property managers get paid on the day of check-in via a bank transfer, which is faster than with some competitors.

It took 20 years for Booking to propose a decent payment solution to US vacation rental managers, but it could be a game-changer for the company. Its growth in the US may not be impeded anymore by this issue.

Attract more U.S. individual hosts and reduce their fears the Request-to-book feature, the Damage policy, and the $1,000,000 Partner Liability Insurance

As we reported in September, Booking.com is offering to a sample of new properties in 3 countries (Australia, France, and the U.S.) the possibility to be available on a request-to-book basis. It is a big test for Booking.com, as the company has only offered instantly-bookable properties for the last 20 years.

What is striking here is that Booking.com wants to attract individual hosts, not just property managers. This is the first time Booking.com has said it wants to go after individual hosts in the US. Historically, Booking.com has attracted very large connected property managers, such as Vacasa. It recently focused on large and medium property managers in the US Southeast.

How can Booking.com go after small hosts? Booking.com knows that it needs to help hosts feel more confident about listing their place on the platform. This is what the request-to-book feature and the newly launched $1,000,000 Partner Liability Insurance come in.

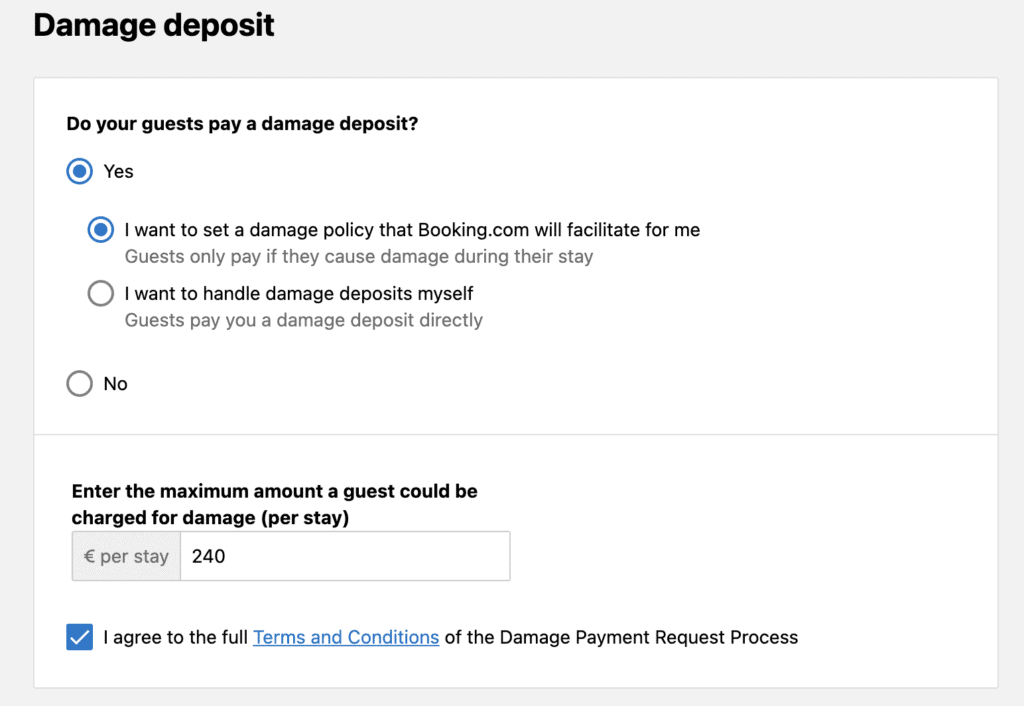

This is also the goal of Booking.com’s new damage policy, which is inspired by the way that Airbnb handles damage deposits.

Cleaning fee waiver: At last, Booking.com adapts Genius, its massive loyalty program, to vacation rental hosts and guests

The Genius loyalty program is one of Booking.com’s most successful tools to get travelers to stick to its platform. It offers perks to travelers, such as room upgrades and free breakfast. In exchange for these concessions, property owners get more visibility and promotion on the platform. By being part of Genius, properties can also attract what Booking.com calls its “best” customers, i.e. its frequent users.

Yet, until recently, vacation rental managers and hosts could not leverage the Genius program: Most of its perks for guests, such as room upgrades and free breakfast, made sense in a hotel context, but not with self-catering entire homes.

Now, Booking.com has introduced a new kind of perk that sounds interesting in our context: A cleaning fee waiver. Vacation rental operators that are members of the Genius program can activate a cleaning fee waiver. Booking.com will then show Genius Level 2 and 3 travelers your property rate with the cleaning fee waived from the total amount. Level 2 Genius members are ravelers with 5 or more completed stays in two years, while Level 3 Genius members are travelers with 15 or more completed stays in two years. This offer won’t be visible to other travelers.

Given the sheer size of Booking.com’s loyalty program and how unpopular cleaning fees are, this move can have a lot of impact for vacation rental hosts in terms of conversion. Yet, owners and managers need to think carefully about the discounts involved. For instance, to target Level 2 Genius members, the property also needs to give at least a 15% discount on the regular unit price to the traveler. While it can be easy for a hotel or an aparthotel operator to discount a few rooms or units to attract travelers in the hope of upgrading them to something more expensive, a vacation rental owner has only one unit at a time on which to offer such discounts.

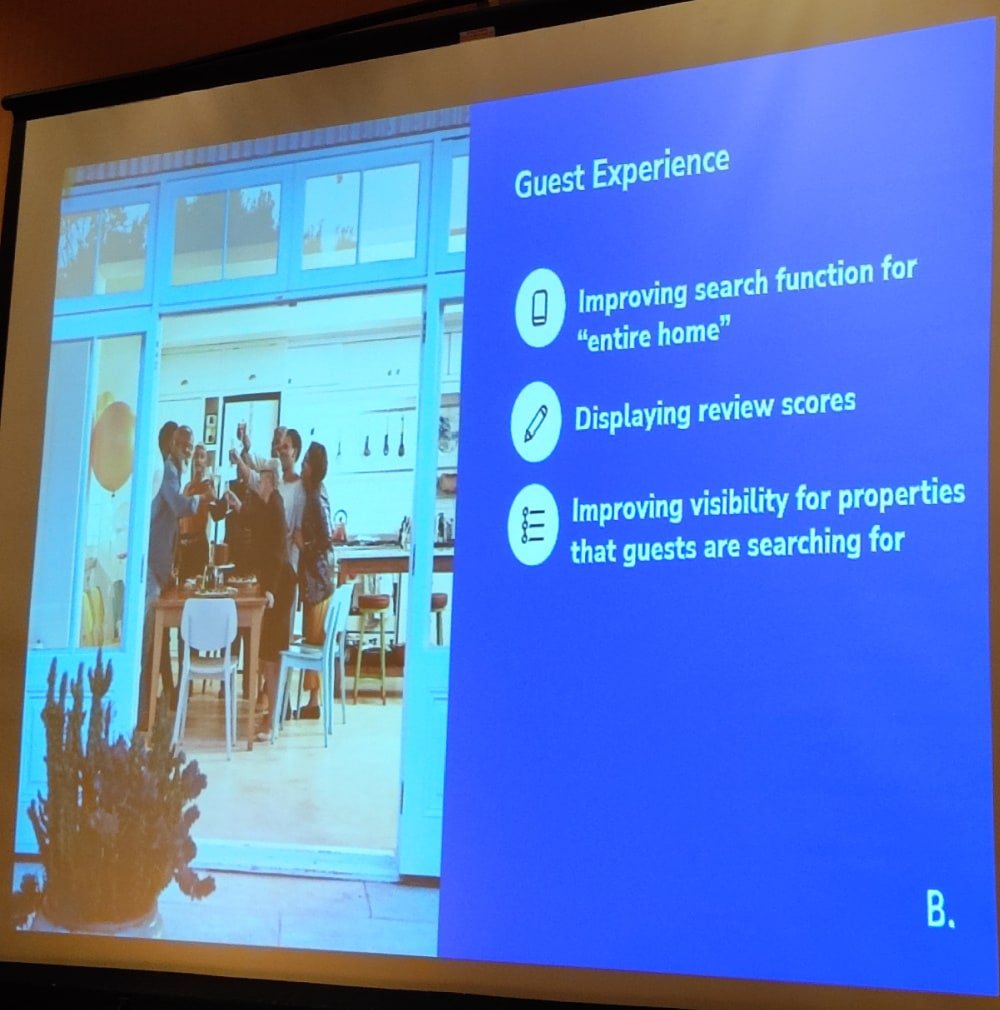

Give more visibility to vacation rentals on the Booking.com website and in the app

This is not specific to the US, but over the last 12 months, Booking.com has given visibility to vacation rentals in multiple ways. To a casual observer, these changes may look drastic. Yet, they seem to have been carefully designed and experimented upon to subtly introduce a dose of vacation rentals into the journey of a Booking.com user.

The idea is to make users aware of the existence of vacation rental supply on Booking.com as the traveler is looking at their option. Many people may come to Booking.com looking for a hotel, but showing them the possibility of booking a vacation rental home or apartment may interest them. Also, as hotel supply tend to dominate the rankings on Booking.com, these filters help surface the vacation rental offers.

Here are a few that we’ve noticed:

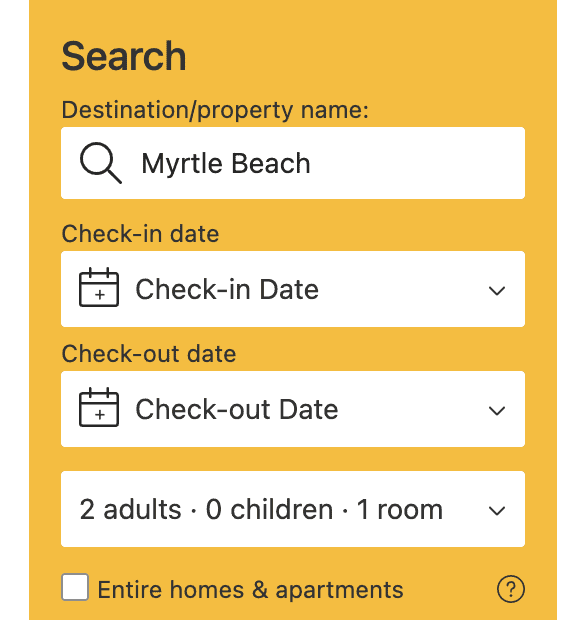

“Entire homes & apartments” tick box on the search box visible on the results pages

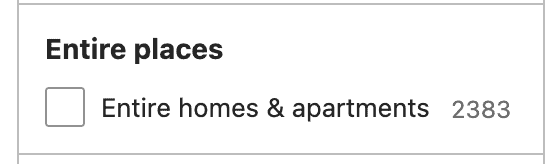

“Entire places” search filter among the dozens of available search results filters

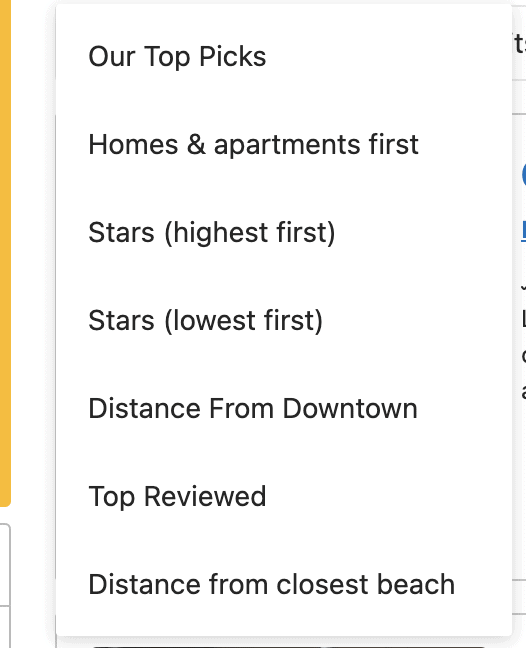

A “Homes & apartments first” sorting filter in search results

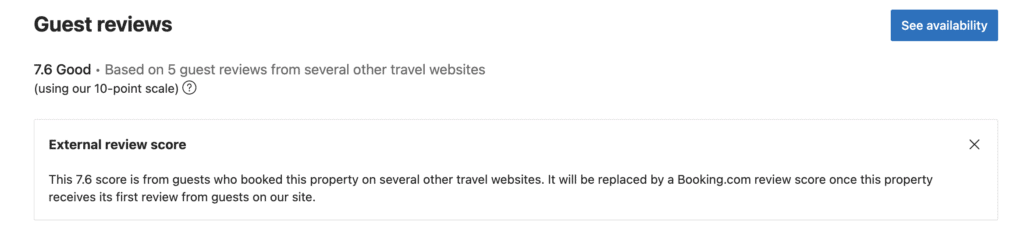

Booking.com is also helping vacation rentals that are new to its platform get more bookings: Instead of waiting for them to get their first review, it imports their review scores from other platforms such as Airbnb and Vrbo. Once the property gets its first review, it gets its own Booking-made review score.

Solving the branding and marketing issues in the US

To attract smaller hosts and generate demand from travelers, Booking.com still needs to solve the lack of awareness around its brand in the US.

During the presentation at VRMA, the company insisted that it was investing a lot of in performance marketing. It also showed the Booking.yeah TV commercial it ran during this 2022 Superbowl (a commercial that we did not find very convincing when it comes to resonating with US travelers).

While it seems that Booking.com has addressed the biggest flaws of its product offering (e.g., a new payment solution for vacation rental managers), the biggest unknown is how it will raise awareness and consideration around its brand in the US.